Jay Yuno

Why Anta?

Global sportswear leaders like Nike (NKE) and Adidas (OTCQX:ADDYY) have been able to generate high ROICs (>20%) in their peak years. I decided to analyse the Chinese footwear market to see if a similar trend could play out there and I found that ANTA Sports Products Limited (OTCPK:ANPDY) is the best positioned to be a long term compounder given its strong execution track record and multi-brand strategy. Macro-wise, this is also an industry I view favourably in China given that it has huge growth potential (USD 40 per capita consumption in China vs sub 100 in other developed Asian countries), is propelled by nationalism and is also supported by governmental policies – a very important factor in investing in China.

Introduction

Anta is a designer and manufacturer of sportwear fashion with 99% of revenue from China. The company’s product line includes running, cross-training, basketball, hiking, athleisure shoes and apparel which are offered through its multi-branded strategy.

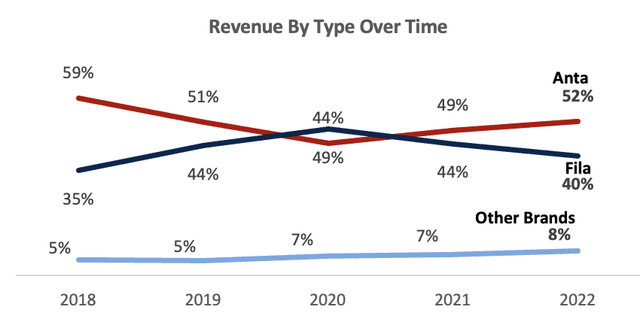

Revenues are split into three main segments (1) Core Anta Brand – Established in 1991, the largest revenue driver is its namesake Anta brand, which produces sports shoes and apparel and is positioned towards the Chinese mass market (2) Fila Brands – Acquired in 2009, Fila brands is Anta’s 2nd largest source of revenue. Brands here include Fila, Fila Fusion and Fila Kids. Fila brands offer athleisure products and are positioned towards young, affluent and trendy individuals. (3) Other Brands – These brands have been acquired by Anta over time and mainly target the premium market for outdoor sports. Brands include Descente, Kolon Sports as well as the recently acquired Amer Sports of brands which includes Arc’teryx and Salomon.

Anta Revenue Split Over Time (Annual Reports)

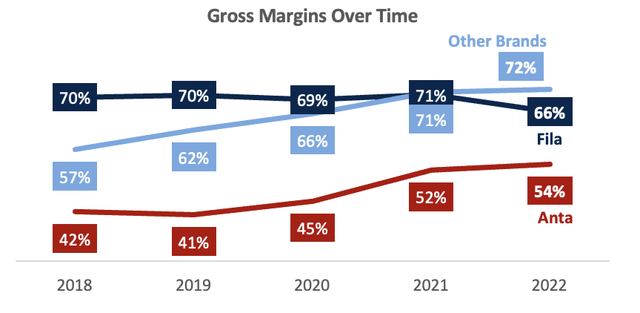

In ascending order of gross margins, we have Anta brand at 54% in FY22, Fila at 66% and other brands at 72%. The higher margin of acquired brands are testament of Anta’s multi brand strategy – main brand remains mass market while other brands will have higher ASPs and target more premium segments.

Anta Gross Margins Over Time (Annual Reports)

Industry Overview

According to Euromonitor, China’s domestic sportwear industry will grow at a 9% CAGR from CNY363 bn in 2022 to CNY 551bn in 2027. This growth is facilitated by (1) economic growth, (2) growing public awareness of fitness & health and (3) supportive government policies. To illustrate China’s commitment towards sports, the Chinese government has laid down sports-related goals in their 14th Five Year Plan (2021 – 2025). For example, it sets the objective of having 38.5% of the population engaging in regular physical activity by 2025, up from 37.2% in 2020. There are also aggressive targets in sports area per capita, sports instructors per 1000 people and the country has been rapidly adding sports facilities to support this growth.

Breaking down sportswear, athleisure & winter sports are two rapidly growing segments, especially among higher tier cities. Athleisure has grown around 10 percentage points higher than the broader market the past three years, as evident by Lululemon (LULU) & Fila, and is driven by the growing acceptance of athleisure as everyday wear and a society which starts to prioritize daily fitness. According to BCG, luxury athleisure is growing more widespread in China with top 3 reasons being athleisure is socially accepted in more occasions (48%), can replace formalwear (31%), and is more comfortable (21%).

On the other hand, the growth of winter sports has been accelerated by the 2022 Winter Olympics as it brought about attention and new facilities which used to be the limiting factor. In 2022 alone, China already exceeded their 2025 300mn visitor target to winter sports locations, with most visitors being young, affluent urbanites. The winter sports market is expected to be worth $150 mn by 2025, representing a stunning 46% CAGR from $48 mn in 2022, with apparel being one of the main beneficiaries, according to China Briefing.

Competitive Positioning

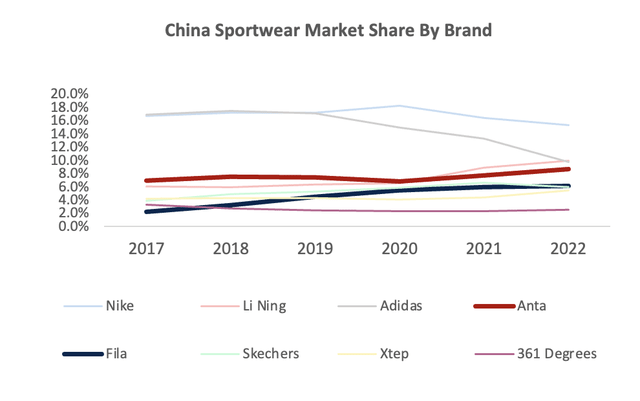

Compared to global markets, China sportswear is more consolidated with a company CR5 of 69%, vs CR5 of 36% in US and CR5 of 49% in Japan. The market is dominated by global peers like Nike, Adidas as well as local brands like Anta, Li Ning (OTCPK:LNNGF), Xtep (OTCPK:XTEPY) and 361 Degrees (OTCPK:TSIOF). While Nike & Adidas used to be the market leaders, the improving quality of domestic options fueled by nationalism has allowed domestic brands like Anta and Li Ning to gain market share from foreign leaders and propel into 2nd and 4th (by company) respectively in 2022. Notably, Nike & Adidas market share have fallen since 2020 due to their stance on the Xinjiang cotton controversy and has not recovered since. According to the Economist, this nationalistic sentiment is here to stay, which continue propelling Chinese brands forward in the long term. Specifically for Anta, part of their market share growth came from post 2020 gains of their namesake Anta, a widely popular domestic brand, as well as the tripling of Fila’s share in the athleisure market. Today, Anta owned brands combined have 18.6% market share, where core Anta brand is 4th, slightly behind Nike, Adidas & Li Ning, while Fila ranks 5th.

China Sportswear Market Share By Brand, 2022 (Euromonitor)

Investment Thesis

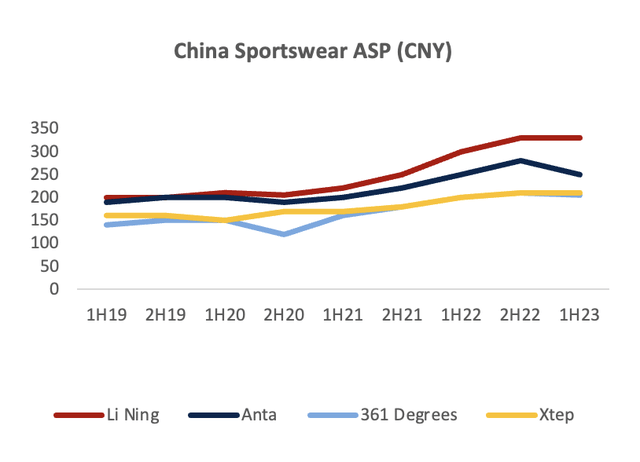

#1: Market Is Overlooking Anta’s Successful Improvements In Brand Equity Which Will Support More Premium Products In Top Tier Cities, Leading To ASP Expansion

Following the 2012 excess inventory saga of Chinese sportswear, Anta’s image was known as a “lower quality”, mass market shoe whereas Li Ning is commonly regarded as the best quality domestic brand which commands a premium. Over the past decade, Anta has doubled down on R&D & marketing to make higher quality shoes that consumers would resonate with. In FY22, Anta spent 12.7% of revenue on marketing (10.3%) and R&D (2.4%) combined, similar to peers on a relative basis but 1.4x higher than the next closest peer on an absolute basis, showcasing its dedication to brand building. I believe this draws some parallels to Li Ning’s brand building efforts in the early 2010, where they constantly outspend peers by almost 2x on marketing, and this move had successfully given Li Ning a branding premium in China.

Likewise, I believe that Anta’s investments will start to bear fruits in the coming years. First, Anta’s online marketing strategies have focused on celebrity ambassadors and sponsoring the national team for Olympics, which they have done so every edition since 2010. On Weibo, user engagement for Anta’s brand collaborations far exceeds that of Li Ning, with Anta topping 3 mn posts and 2.4 bn views per topic, compared to Li Ning’s 1mn posts and 85mn views. Online consumers have seem to shifted their brand preference towards Anta, with Anta overtaking Li Ning and Nike’s Weibo followers in 2022. Additionally, web scraping from 8 online forums show that consumers have an overwhelmingly positive opinion on Anta, with top two keywords associated being “value for money” and “quality”, whereas Li Ning was dominated by negative opinions on pricing and quality.

|

Keyword |

Hits |

Keyword |

Hits |

|

Anta |

52 |

Li Ning |

28 |

|

Value For Money |

11 |

-ve View on Price Hikes |

8 |

|

Quality |

10 |

Poor Qlty |

5 |

|

Good Design |

5 |

Strong Brand |

6 |

Source: Analyst Estimates

Anta’s positive brand image is also reflected in a 2023 online brand ranking survey by Maigoo which combines key metrics like votes, reviews and online store popularity. With over 150k votes, Anta tops the sportswear charts, ahead of Li Ning and foreign brands. Key social metrics such as likes & shares are also trending upwards for Anta, suggesting that Anta is successfully improving its brand imaging.

Top 5 Sports Shoe Brand Ranking In China (Maigoo)

As Anta aims to continue expanding in Tier 1 cities and add more premium products, I believe that Anta’s newfound strength in branding will support growing ASPs, and enable them to close the “perceived quality” and ASP gap to Li Ning in the medium term, something the market isn’t pricing in.

China Sportswear Shoes ASP (Market IDX)

#2: Anta’s Multi Brand Strategy Makes It Best Positioned For China’s K-Shaped Recovery Hence I Expect Higher Near Term Revenue Growth

China will likely experience a K-shaped consumption recovery in the near term. Higher-end consumption remained robust, with apparel like Nike & Lululemon reported double digit sales growth in 1H22, according to Jing Daily. On the other hand, broader consumption rebound is fizzling out, with China’s yoy retail sales growth missing expectations from May to July, reaching just 2.5% in July 2023, compared to a post lockdown high of 18.5% in April. As consumption appetite weakens, Chinese consumers are increasingly turning to quality and value for money products in their purchase, per McKinsey.

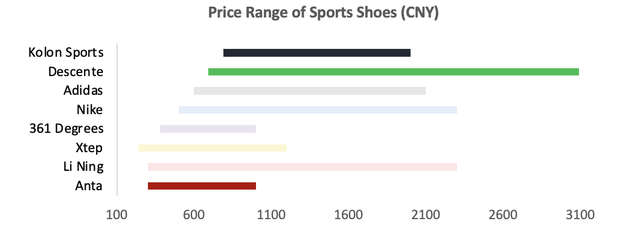

Among domestic China sportswear, Anta is the best positioned to benefit from divergent spending trends as it is the only company with a multi brand strategy. The core Anta brand targets the mass market and has shoes priced as low as RMB299 while Fila, Descente & Kolon are brands positioned towards the premium market.

Price Range of Sports Shoes In China (Tmall)

I believe Anta can win the “downshifting” mass market consumers due to their “value for money” and “quality” proposition, and at the same time have sizable exposure to the fast-growing premium market, a growth driver that peers lack. Hence, I forecast a higher FY23E revenue growth rate of 16.3% (vs street at 15.6%) and higher 23E-25E CAGR of 16.8% (vs street at 15%).

#3: Anta’s Tested & Proven New Brand Incubation Method Will Turn Amer Sports Into A Significant, Higher Margin Growth Engine, Which Is Underappreciated By The Market

With the market overly focused on China’s consumption trends and Fila’s recovery, I believe many have overlooked the growth and margin accretive potential that the Amer Sports acquisition brings in the medium-long term. Amer’s brands are in high growth markets like winter sports, while Anta is a proven executor in acquisitions, with a strong track record of success in turning around Fila and repositioning it as a top athleisure brand in China.

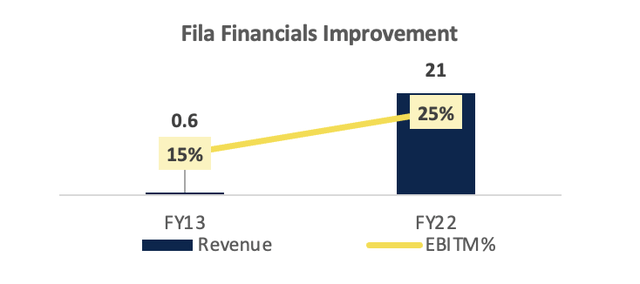

The Fila Turnaround: Anta acquired Fila in 2009 for CNY 332 mn, gaining trademark and operation rights in the Greater China region. Upon acquisition, Fila was loss making. Anta’s strategy was to use Fila to target the high-end sports market while Anta remained mass market, as they had always been unable to crack the former market. To turnaround the business, Anta did the following: (1) Collaboration with internationally renowned designers (2) Its own designers flew to Fila’s hometown in Italy where over 100,000 sketches and product samples were archived (3) Created designs bringing back Fila’s heritage while combining with Chinese elements and its sporting know how (4) Established new product line Fila Kids & Fila Fusion in 2015 and 2017 respectively to reposition and preimmunize the brand as a trendy, athleisure product for youths (5) Combining supply chains to streamline costs This turnaround was very successful, with Fila netting CNY 21 bn of revenue in FY22 (vs CNY 0.6 bn in FY13) and a 66% GPM, higher than core Anta. By preimmunizing Fila and streamlining operations EBIT margins rose from 15% in FY13 to 25% in FY22.

Turnaround In Fila’s Financials (Fashion Network)

Using The Same Tried & Tested Methods On Amer: Fila & Amer Sports brands share similar characteristics. They are both unprofitable upon acquisition but have a rich brand positioning and heritage, as well as overseas popularity, providing a turnaround runway. Fila has over 100 years of Italian cultural designs while Arc’teryx is well known for high quality waterproof & lightweight jackets. On the other hand, originating in the French Alps, Solomon has 70 years of history in producing high quality winter and hiking boots.

Therefore, Anta will be able and has been using similar methods to reposition Amer Sports’ brands. For example, it has (1) relocated stores from the roadside to strategic locations in central business districts on ground floors aside luxury brands to polish its image (2) included Chinese elements in apparel design (3) expanded its product line to target women & young – all of these having worked for Fila. As a testament to the success, Arc’teryx, one of Amer’s main brand saw revenue jump by 96% to CNY 829 mn the year after acquisition, compared to a 15% CAGR in the 7 years preceding. Anta was also able to reverse the flattish revenue trend of the brand since 2015. With premiumization & streamlining of supply chains, Amer Sports unprofitability has also been reversed in 2022, a testament to Anta’s successful execution.

Repositioning of Arc’teryx Storefronts (Baidu)

Financials

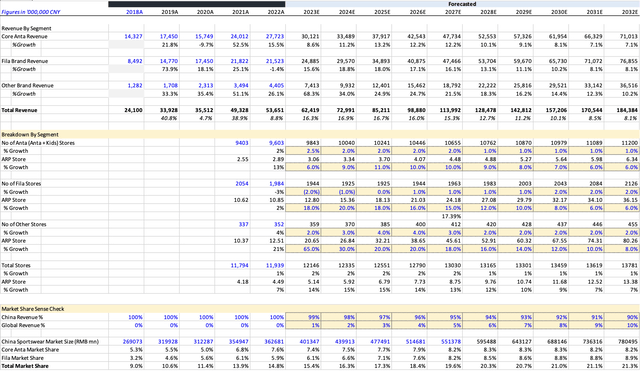

For retail, number of stores & average revenue per store are the two drivers of growth. Store count in 2023 are within the range of management forecasts. Following that, I expect core Anta store count growth to remain ~2% as they already have the most stores in China and are only targeting more expansion in some top tier cities. Fila store growth will remain flat as management continues to focus on store productivity while other brands will see slightly higher growth at 4% in FY25E and 26E to meet medium term expansion targets. For average revenue per store, I expect Anta to grow at a 10% CAGR through FY27E, slightly above market rate due to rising ASPs. Fila will grow faster at 17% CAGR due to a faster growing submarket and other brands will grow the fastest at 30% CAGR for a similar reason. I forecast store productivity for other brands to reach Canada Goose’s level by FY2032 (CNY 20mn in FY23 to CNY80mn in FY32), which seems conservative also given management’s CNY100mn goal.

Overall, store productivity will be the key driver of growth for Anta due to premiumization efforts of all brands while store count will remain low at ~2% of total growth.

Anta Revenue Model (Analyst Estimates, Annual Reports)

Gross margin wise, core Anta will continue to increase +550bps to 59.5% in terminal year due to DTC shift and higher ASP products. Fila & other brands will rise +700bps and +300bps to terminal year. Higher Fila increase is due to a one off fall in FY22. Consequently, profitability will be led by GPM expansion due to better product mix and ROCE will rise from 19% FY22 to 24% in FY27E. Anta does not have significant debt so financial health is robust.

Valuation

A 10 year Gordon Growth DCF was conducted for valuation. 10 years was used to allow for the high growth in Fila & other brands to normalize. Other assumptions include (a) SD&M % of revenue to stay elevated in next 3FY as Anta moves towards a DTC model, but fades to 33% in terminal year (vs 36% in FY22), (b) G&A % of revenue to come down 120bps through terminal year to 5.5%. (c) terminal growth rate of 3% was used (d) 12.5% hurdle rate was used for WACC.

A target price of HKD 122.62 was obtained, representing a 34% upside from closing price of HKD 91.55

Catalyst

One key catalyst would be the successful launch and take up of more premium Anta products. This would support the thesis that Anta has successfully rejuvenated their brand into one that can command higher ASPs, consequently supporting rising ASPs in the long term and higher store productivity. The market should also react positively by re-rating Anta with higher growth rates and be more confident of allocating a premium multiple.

Risks

A main risk would be prolonged negative consumer sentiment which may result in sportwear companies requiring to offer massive discounts to attract buyers. This would severely harm the top line & margins. However, this should be unlikely as core Anta growth remained robust at 6% yoy in 1H despite slowing consumer growth. There have also been no mentions of potential additional discounts per management calls among peers. Additionally, should the mass market suffer, Anta will remain the most robust among its peers as it has more than half of revenue supported from the more “luxury” market which remains strong.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.