Mario Tama/Getty Images News

Anheuser-Busch InBev SA/NV or AB InBev (BUD) investors haven’t had much respite since the consumer staples (XLP) sector fell from its August highs toward its recent October lows. The sector weakness has also affected BUD’s initial recovery from its “go woke meltdown,” which saw BUD re-tested the $51 level in early October.

However, I assessed buyers have returned over the past four weeks, attempting to fend off a further slide, which could lead to a collapse toward its October 2022 lows at the $45 level. With AB InBev scheduled to report its third-quarter of FQ3 earnings release on October 31, investors will be keen to see a further market share normalization in its North American business.

Management presented in an insightful Investor Day in September 2023, as it updated investors about its global organic growth strategies. Accordingly, the company remains focused on “continued growth opportunities in developing and emerging markets, along with the potential for margin expansion.”

As such, I urge investors to pay close attention to its ex-US market momentum, which is critical to justify its valuation. Notwithstanding the furor over its failed marketing campaign involving transgender influencer Dylan Mulvaney earlier this year, the North American segment accounts for only about 25% of its sum-of-the-parts valuation.

Therefore, I assessed the company wants to remind investors about the growing importance of its Middle Americas segment “as a developing market opportunity.” The segment has accounted for “over 50% of EBITDA and has been a top revenue and profit driver for the company over the past five years.”

Analysts’ estimates suggest that AB InBev’s adjusted EBITDA margin is projected to bottom out in FY23. Accordingly, the company is expected to post a marked improvement in its adjusted EBITDA margin by FY25, reaching 35.1%, up from this year’s 33.4% estimates. While it’s nowhere close to its pre-COVID margins near the 40% mark, BUD’s price action remains nearly 50% below its 2019 highs. In other words, I believe BUD’s valuation has likely reflected significant headwinds.

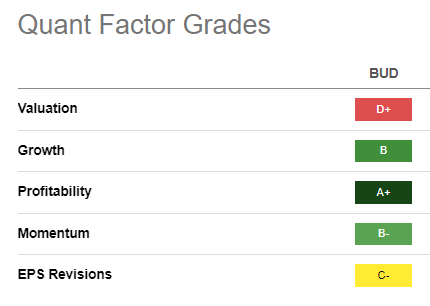

BUD Quant Grades (Seeking Alpha)

Seeking Alpha Quant rates BUD with a “D+” valuation grade, suggesting a premium valuation relative to its sector peers. However, the wide-moat brewer boasts a best-in-class “A+” profitability grade, underpinned by a solid “B” growth grade. The recent controversies haven’t impacted the company’s robust business model, as it picks up the pieces toward margin recovery.

Based on management’s commentary on its recent Investor Day, the ex-US opportunities would likely underpin the company’s growth drivers over the medium term. Bolstered by a further push toward premiumization trends, it’s expected to boost its ability to meet Wall Street’s medium-term margin projections.

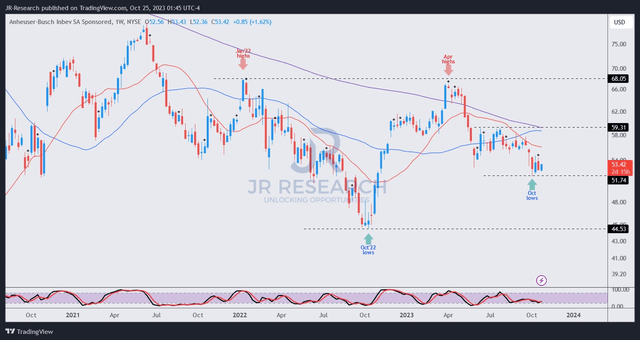

BUD price chart (weekly) (TradingView)

Notwithstanding my optimism, I must highlight that BUD’s mean-reversion thesis remains a work in progress. The dominant medium-term trend bias points to the downside. Moreover, the inability of dip buyers to sustain a decisive recovery of the $60 level suggests caution is necessary.

In other words, buying sentiments on BUD remain highly uncertain, with the bearish bias reinstating recently after it bottomed out in early June. As such, while the expected bottoming of the XLP could help provide some respite for BUD, I see the risk/reward as less attractive now.

As such, while the company is confident of improving its profitability margins, the market doesn’t seem convinced. With that in mind, I believe moving back to the sidelines and assessing how the consolidation occurs from here is appropriate.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.