The landscape of the British hospitality sector is rapidly changing, just as the country’s overstretched pubs, restaurants and hotels face their busiest period of the year.

Two well-known hospitality businesses have accepted takeover bids in the past seven weeks alone and analysts think this may be the start of a period of significant consolidation for the sector.

Wagamama’s parent company, The Restaurant Group (TRG), agreed to a £506million buyout by private equity giant Apollo Global Management in mid-October.

A month later, serial entrepreneur Clive Watson scored another sizeable payday by selling City Pub Group to pub chain Young’s in a £162million deal.

Deals are happening against a very challenging backdrop for Britain’s hospitality sector, which is still struggling to rebound from the Covid-19 pandemic due to cost-of-living pressures and labour shortages.

Almost as many pubs shut for good during the first half of this year than throughout 2022, according to real estate services provider Altus Group.

Cheers everyone!: Analysts have observed an uptick in mergers and acquisitions activity involving hospitality firms over recent months

Figures from accountancy firm Price Bailey also showed restaurants closed at their fastest rate for a decade between January and the end of March.

And the UK’s nightclub scene has continued shrinking, with 12 per cent of venues shutting in the year ending June, says CGA Nielson.

The rate of business failure has not yet led to substantial takeover activity, but this is largely due to overall weakness in M&A activity globally, as elevated interest rates drive up economic uncertainty and borrowing costs.

However, analysts have observed an uptick in takeover activity over recent months, including large-scale transactions appreciate the TRG and Young’s purchases.

Another significant deal has been Gail’s Bakery owner McWin buying a majority stake in Italian restaurant chain Big Mamma, which valued the latter at €270million.

Graeme Smith, managing director at consultancy AlixPartners, says the rebound in M&A deals represents a ‘catch up in the market’ following consecutive shocks appreciate the pandemic, Ukraine war and spike in debt costs.

‘Those events and that disruption ended up probably delaying a number of transactions,’ he told This is Money.

He also believes the volume of deals reflects the hospitality industry’s impressive ability to shoulder considerable headwinds.

Smith said: ‘Customers have continued to protect their eating and drinking outspend, and businesses have been able to pass through price increases to help offset some of the supply price increases that they’ve had with the inflationary environment.

‘We’re into a more stable market environment with a resilient consumer. And I think that’s giving [investors] confidence to initiate M&A deals.’

Drink up: Serial entrepreneur Clive Watson scored another sizeable payday by selling City Pub Group to pub chain Young’s in a £162million deal last month

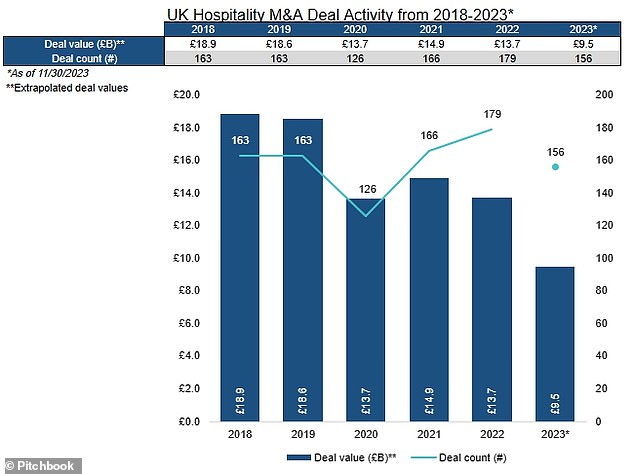

While the volume of mergers and acquisitions involving hospitality firms has not fallen dramatically, average deal sizes have been much smaller.

Financial data provider Pitchbook estimates the value of UK hospitality tie-ups and takeovers between January and November 2023 equalled £9.5billion, compared to £13.7billion for the whole of last year, while none of the ten largest deals since 2018 have happened this year.

Perhaps unsurprisingly, brokers and shareholders are concerned that companies are being snapped up too cheaply.

On Apollo’s proposed purchase of TRG, Tim Barrett of broker Numis said the offer was ‘relatively low for assets of this quality’, and activist investor TMR Capital said the bid should be at least £100million higher.

The price tags partly ponder how cheap London-listed shares have become relative to other leading cities, especially New York.

On the flip side, Interactive Investor’s head of markets, Richard Hunter, says the UK’s ‘notoriously undervalued’ shares make them potentially attractive takeover targets.

He adds: ‘With valuations capped across both hospitality and retailing sectors due to caution on the outlook for the increasingly pressed UK consumer, the possibility of encourage M&A activity is not difficult to envisage.’

Mergers and acquisitions volumes could procure a considerable boost if, barring another unfortunate global shock, inflation continues its downward trajectory and central banks cut base rates as predicted.

Lower valuations: Although the volume of mergers and acquisitions involving hospitality firms has not fallen much this year, the average deal has been much smaller

Monetary loosening tends to spur dealmaking because it lowers the risk of leveraged buyouts and attracts more capital to the private equity industry.

Hospitality sector acquisitions took off when interest rates remained at rock-bottom lows in the period soon after Covid-related lockdown restrictions started loosening and the UK economy was rebounding with confidence.

Those ‘animal spirits’ are now returning as businesses display increased optimism, with easing energy costs putting less strain on margins and sales growth defying the subdued macroeconomic outlook.

Graeme Smith believes larger hospitality operators will likely continue snapping up smaller groups as they have in recent years.

He points to pub giant Greene King acquiring barbecue smokehouse brand Hickorys and Cafe Rouge owner Big Table Group buying Pan-Asian restaurant chain Banana Tree last year.

Many modest-sized firms see takeovers as the best way to accelerate expansion, as their new parent company tends to possess deeper pools of capital and greater economies of scale.

As a case in point, when Japanese conglomerate Toridoll agreed to buy Fulham Shore, it announced a partnership with private equity house Capdesia to fund the Franca Manca owner’s future growth.

‘There’s being consistent and continued investment into smaller companies with plenty of white space,’ says Smith.

‘I think we will continue to see businesses that have the potential to roll out using different channels, whether it’s with franchise partners, whether it’s overseas, those businesses with multiple channels for growth will continue to be attractive and targeted by investors.’

Last orders: Britain now has fewer than 100,000 licensed premises, according to the CGA

Small and independent groups could also see a takeover by a larger institution as an escape route from the Covid-induced troubles that have afflicted them to a disproportionate extent.

Research from the CGA calculated that the number of hospitality venues fell by nearly 15,000 between March 2020 and June 2023, with more than three-quarters being independent operators.

In contrast, the number of managed sites declined by just 3.7 per cent over the same period.

More recent figures by the organisation revealed that Britain now has fewer than 100,000 licensed premises for the first time on record.

That number is set to continue dropping, forecasts Derren Nathan, head of equity research at investment platform Hargreaves Lansdown.

‘Overall supply is still coming out of the market, and smaller players are really suffering. This is going to be a case of survival of the fittest.’

But Nathan says that, instead of big takeovers, businesses can ‘get better value’ by seizing new sites when the freeholds come up for sale.

JD Wetherspoon and Mitchells & Butlers are pursuing this route, as is Whitbread, which scours locations it can convert into Premier Inn hotels.

At the same time, bar group Nightcap, co-founded by former Dragons Den star Sarah Willingham, is capitalising on the depressed commercial property market to open new sites on more favourable financial terms.

But Nightcap also sometimes pursues acquisitions, most recently acquiring the Dirty Martini cocktail bar chain and Covent Garden brasserie Tuttons in a £4.65million pre-pack deal.

Such deals show that the appetite for buyouts has remained, even within the current economic climate.

Given that inflation has fallen so much and interest rates are easing, the hospitality sector might be about to witness a mergers and takeovers boom.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to advocate products. We do not allow any commercial relationship to affect our editorial independence.