HJBC

Introduction

Amundi S.A. (OTCPK:AMDUF) recently reported its Q4 2023 results, which I will discuss below. I will also compare the company relative to one of its largest stock-exchange-listed European peers, DWS Group.

In brief, I think that Amundi has little room for operational improvement (which is already superb). This coupled with its sizable tangible book premium and slow organic growth makes the company more of an income play via covered calls and cash-secured puts, rather than a growth/rerating story. Hence, I rate the shares a hold.

Company Overview

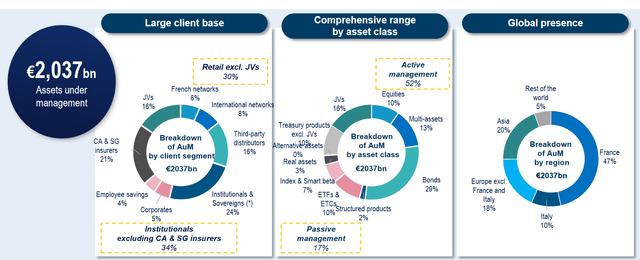

You can access Amundi’s financial results here. The company is majority owned by Crédit Agricole (OTCPK:CRARF) which holds a 68.93% stake in the asset manager. Amundi manages €2,037 billion in assets, primarily in Europe (75%) and Asia (20%):

Asset under management breakdown (Amundi Q4 2023 Results Presentation)

As you can see from the slide above, Amundi specializes in active asset management, with 52% of all assets under management (AuM) allocated under active asset management strategies, while passive strategies account for only 17% of AUM.

Operational Overview

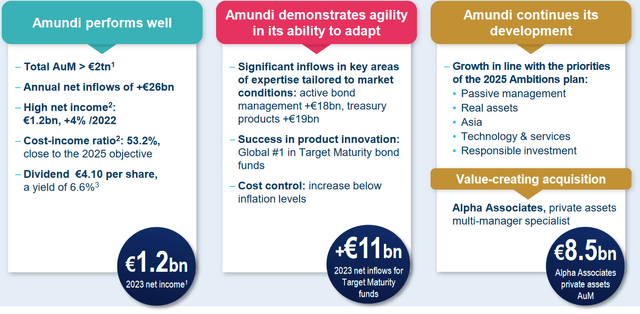

In 2023, Amundi recorded new flows of €26 billion (2022: €7 billion), which together with positive market developments brought AUM to over €2 trillion. The cost/income ratio stood at 53.2%, flat Y/Y (2022: 53.3%). The management fee margin was also little changed in the year, at 17.7 basis points of AUM (2022: 17.8). All in all, these developments resulted in a 2.1% revenue growth in 2023 and a 3.9% increase in adjusted net income to €1.2 billion. Adjusted EPS was €6/share in 2023, up 3.6% Y/Y (2022:5.79).

Amundi also announced the acquisition of Zurich-based asset manager Alpha Associates, which will boost AUM by €8.5 billion, strengthening expertise in private markets in Europe. The deal is expected to return 13% ROE after synergies, resulting in 2% EPS accretion.

2023 Financial Highlights (Amundi Q4 2023 Results Presentation)

Capital structure

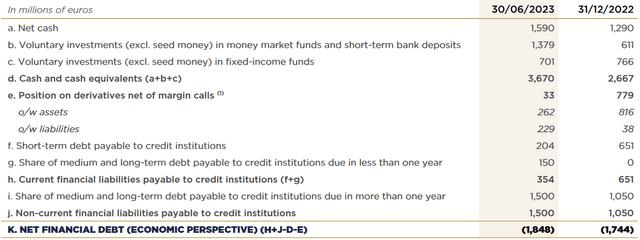

Tangible shareholders’ equity was €4.3 billion at the end of 2023, well below the current €12.4 billion market capitalization. Amundi runs a debt-free capital structure, with a net lending position of €1.8 billion as per the H1 2023 financial report:

Net financing position breakdown (Amundi H1 2023 Financial Report)

Amundi also employs a very conservative dividend policy, with the dividend set at €4.10 a share in 2023, unchanged from 2022 and 2021 (per the 2025 strategic plan, the payout ratio is set at over 65%). Relative to the circa €60.7 share price, the yield stands at 6.8%.

Comparison with DWS

Below, I will compare the performance of Amundi relative to DWS, which is majority-owned by Deutsche Bank (DB).

| Metric 2023\Company | Amundi | DWS |

| Assets under management, € billion | 2,037 | 896 |

| Net AUM flows, € billion | 26 | 28.3 |

| Management fee, basis points | 17.7 | 27.1 |

| Cost/income ratio, % | 53 | 64 |

| Price/tangible book | 2.9 | 1.8 |

| P/E | 10.1 | 13.4 |

Source: Author calculations based on company disclosures

As you can tell from the table above, the comparison is not one-sided. On the one hand, Amundi is growing AUM at half the pace of DWS, taking into account it manages more than double DWS’s assets but attracted lower absolute AUM flows in 2023. Furthermore, Amundi trades at a higher price/tangible book value of 2.9.

On the other hand, Amundi runs the business more efficiently, with a cost-income ratio 11% lower than DWS. Furthermore, Amundi is more attractively priced on a P/E basis, at only 10.1 times 2023 earnings.

All in all, I would say Amundi is a well-run but slow-growing business with little room for operational improvement, while DWS is more of a turnaround asset manager growing much faster.

Last but not least, Amundi is performing much better than AXA’s asset management unit, with a much lower cost/income ratio and positive net flows. You can read more in my AXA article here.

Conclusion

Amundi delivered a robust operational performance in 2023. The company is set to continue growing in 2024, with weak organic growth complemented by acquisitions such as the one for Alpha Associates. The company’s balance sheet is very conservative, which makes the P/E of 10 highly attractive. However, given the tangible book premium of 2.9 times, I think that investors are likely to only receive a high single-digit return going forward. As such, I am neutral on Amundi, with the company presenting a good opportunity to generate options income via covered calls and cash-secured puts, in light of its muted growth prospects but solid operational performance.

Buying shares directly in Credit Agricole could be an alternative way to gain exposure to Amundi, notwithstanding the different risk profile offered by the parent French bank. However, I reckon Credit Agricole is the most expensive French bank on the market, compared to BNP Paribas (OTCQX:BNPQF) and Societe Generale (OTCPK:SCGLF). As such, there appears to be no cheap way to get a stake in Amundi’s operational excellence.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.