William_Potter

Amtech Systems, Inc. (NASDAQ:ASYS) could experience significant net sales growth thanks to research, new products in the silicon carbide sector, and the semiconductors markets. I also believe that the implementation of the M&A strategy will most likely bring significant inorganic growth in the coming years if integration is successful. Yes, I do see some risks from large competitors, inadequate product development, or failed R&D, however Amtech Systems could be quite beneficial for long term shareholders.

Amtech Systems

Amtech Systems is a company that manufactures, designs, and markets various micro conductors and equipment pieces made of special materials for international distribution. In its portfolio, we find silicon carbide products, silicone-based generating products, LED lights, thermal, and polishing solutions for wafers among others.

Customers are semiconductor manufacturers mainly located in Asia, Europe, and North America. The company seeks to focus its strategy within the semiconductor industry globally and particularly in the development of sensors and analog devices.

The operations are divided into two segments, one of which covers the manufacturing, design, and marketing of semiconductors or parts for them, while the other segment includes the operations of special materials and substrates of different types.

The comparison between both segments shows that the semiconductor segment provides the company much greater activity since almost 80% of sales in 2022 were through this segment as compared to the remaining 17% that came from the materials segment.

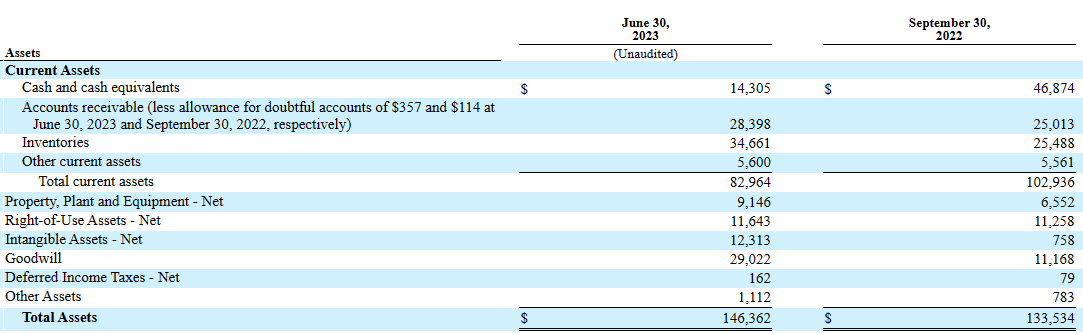

Balance Sheet

As of June 30, 2023, Amtech Systems reported cash of close to $14 million, accounts receivable of about $28 million, inventories close to $34 million, and total current assets of $82 million. The current ratio is way more significant than 2x, so I believe that liquidity does not seem a problem here.

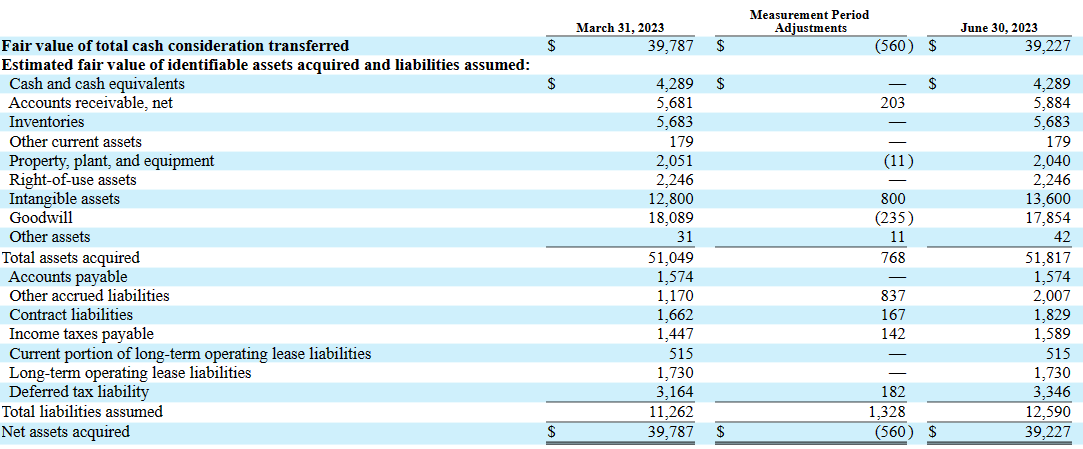

With property, plant, and equipment close to $9 million and right-of-use assets worth $11 million, Amtech Systems reported a significant amount of goodwill of $29 million. It is worth noting that the company acquired Entrepix, Inc. for $39.2 million in cash in 2023. With this information in mind, in my view, further acquisitions could lead to FCF growth in the coming years.

On January 17, 2023, the Company acquired 100% of the issued and outstanding shares of capital stock of Entrepix, Inc., an Arizona corporation (“Entrepix”), which primarily manufactures chemical mechanical polishing (“CMP”) technology. Entrepix’s CMP technology portfolio and water cleaning equipment will complement our existing substrate polishing and wet process chemical offerings. The total consideration for the acquisition was $39.2 million, consisting of $35.2 million cash consideration to the sellers and $4.0 million cash paid for debt and Entrepix transaction costs. Source: 10-Q

Source: 10-Q

Total assets were equal to $146 million, and the asset/liability ratio is more than 2x, so I would say that the balance sheet appears solid.

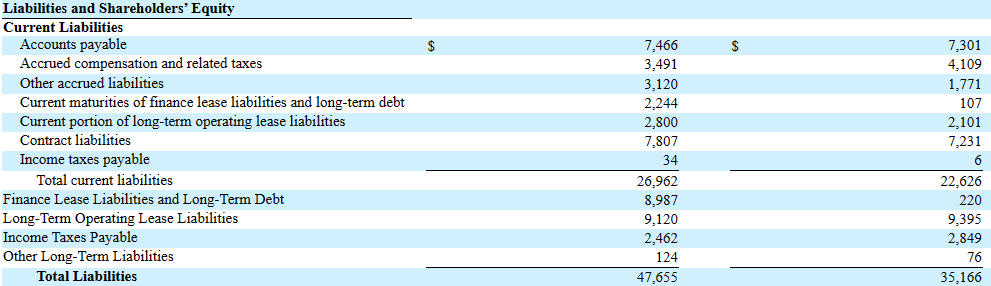

Source: 10-Q

The list of liabilities included accounts payable worth $7 million, current maturities of finance lease liabilities and long-term debt of $2 million, and total current liabilities close to $26 million. I do not think that the total amount of debt may scare most investors, however I did conduct some due diligence to assess the cost of debt and cost of capital in my DCF model.

Finally, long term liabilities included finance lease liabilities and long-term debt worth $8 million, with total liabilities of about $47 million.

Source: 10-Q

It is worth noting that Amtech Systems successfully received financing represented by a term loan, which has an interest rate of 6.38%. The fact that debt investors do believe in the business model of Amtech Systems is beneficial. The cost of debt could be lower, however given the size of Amtech, I think that the company did reach beneficial terms.

On January 17, 2023, we entered into a Loan and Security Agreement (the “LSA”) by and among Amtech, its U.S. based wholly owned subsidiaries Bruce Technologies, Inc., a Massachusetts corporation, BTU International, Inc., a Delaware corporation, Intersurface Dynamics, Incorporated, a Connecticut corporation, P.R. Hoffman Machine Products, Inc., an Arizona corporation, and Entrepix, Inc., and UMB Bank, N.A., national banking association (the “Lender”). The LSA provides for (i) a term loan (the “Term Loan”) in the amount of $12.0 million maturing January 17, 2028, and (ii) a revolving loan facility (the “Revolver”) with an availability of $8.0 million maturing January 17, 2024. The recorded amount of the Term Loan has an interest rate of 6.38%. Source: 10-Q

New Products And Further Acquisitions Will Most Likely Accelerate Net Sales Growth

The company’s strategy is carried out through the permanent launch of new products year after year as well as an active acquisition strategy that culminated in the purchase of three large businesses in the last two years. I believe that further acquisitions could bring economies of scale and FCF growth.

Recent Beneficial Outlook May Bring Demand For The Stock

I also believe that the recent beneficial outlook given by Amtech Systems and, most importantly, the words given about management may enhance future stock demand. In this regard, let’s note that the company expects to deliver improving operating profit in the last part of 2023.

For the fourth fiscal quarter ending September 30, 2023, we expect revenue and operating profit to improve incrementally over the third quarter of fiscal 2023. Source: Quarterly Press Release

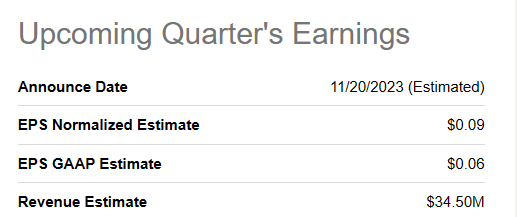

Analysts are expecting EPS GAAP Estimate of close to $0.06 per share and a revenue estimate of about $34 million in November. Considering that the figures are expected in the coming weeks, I believe that investors may want to have a close look at the expected figures.

Source: SA

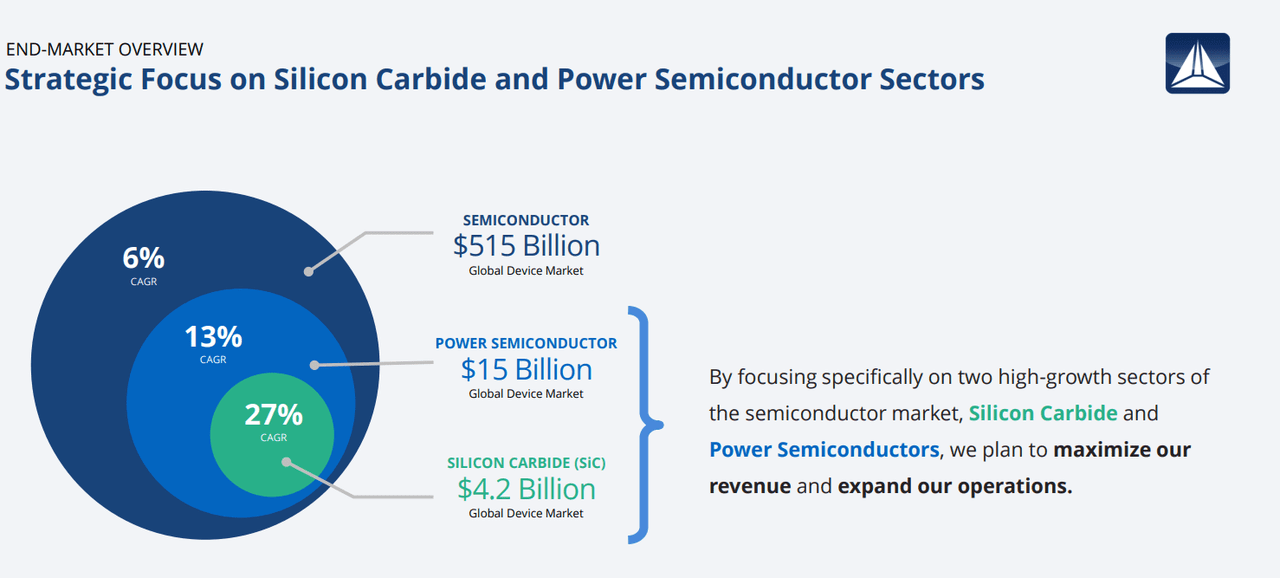

The Market Opportunity Of Semiconductors, Silicon Carbide, Power Semiconductor, And Market Growth May Enhance Future Net Sales Growth

Due to the great growth that the markets related to high technology have perceived in recent years and the projections made on them of a long-term growing trend, I think that a large part of its success may be measured by the ability to execute a forceful strategy of business beyond the particular circumstances that affect the industry throughout the years. For this, it is good to understand that micro conductors are used within computers, electronic boards, electric cars, and all types of technology that has to do with the generation or operation of electrical energy. Advances within the Internet of Things and the imminent future installation of 5G antennas globally also generate a promising forecast for the company’s commercial activities.

Some of the target markets reported by Amtech Systems include many billions of dollars, and the growth is expected in the double-digit in the coming years.

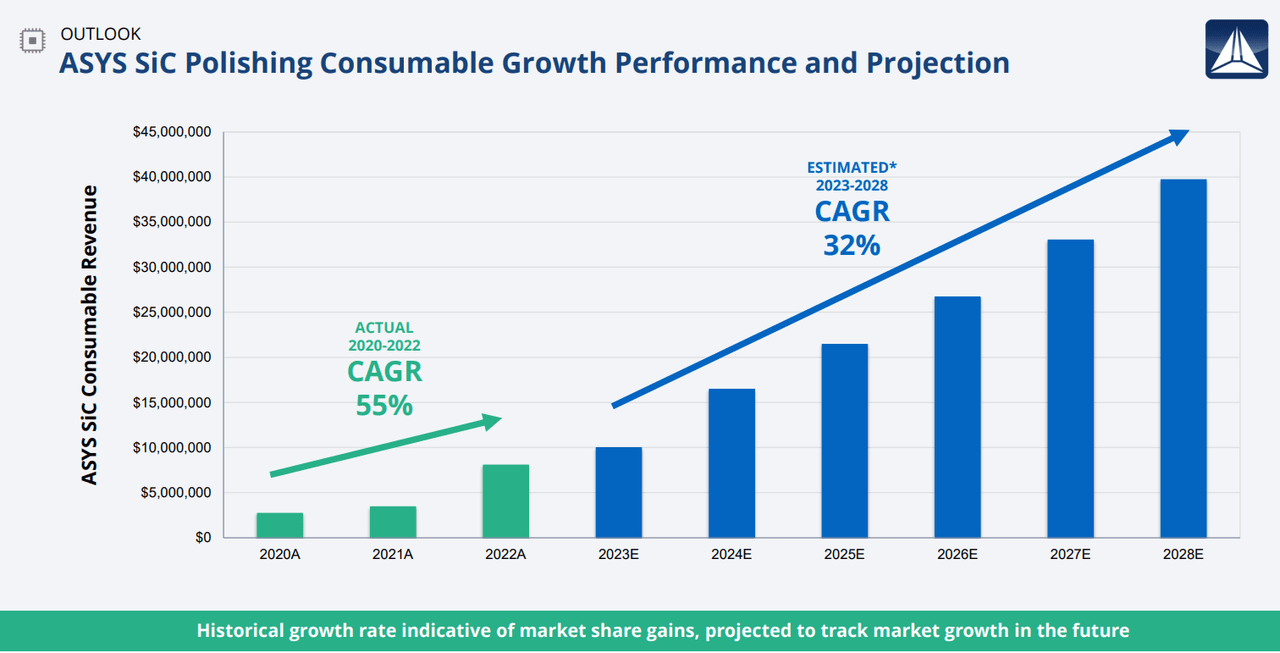

In particular, the use of silicon carbide or SiC is among the most promising products delivered by Amtech Systems. In my view, net revenue is still quite small as compared to what the company may report in the future.

In my view, direct research towards the design and manufacture of products that correspond to the demands of large growing markets like that of SiC or electric vehicles mentioned above will most likely bring net sales growth and FCF growth.

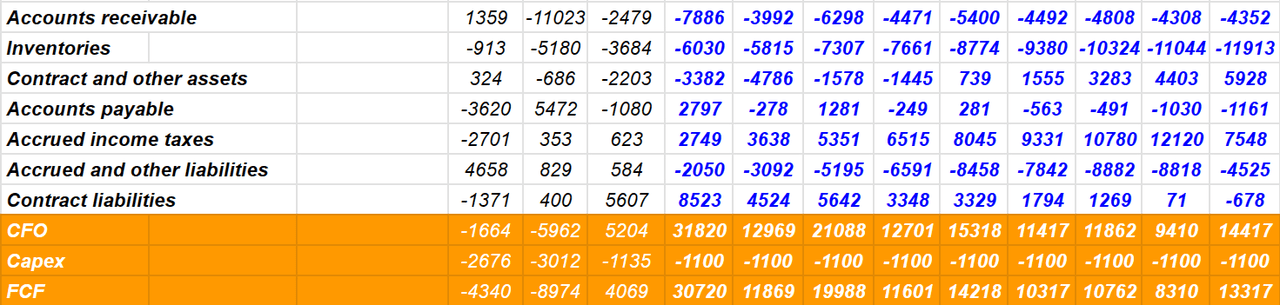

Financial Model Taking Into Account The Numbers From Other Analysts, My Own Assumptions, And Previous Cash Flow Statements.

In the past, Amtech Systems reported a maximum FCF of close to $21 million, which I took into account for the assessment of future cash flow statements.

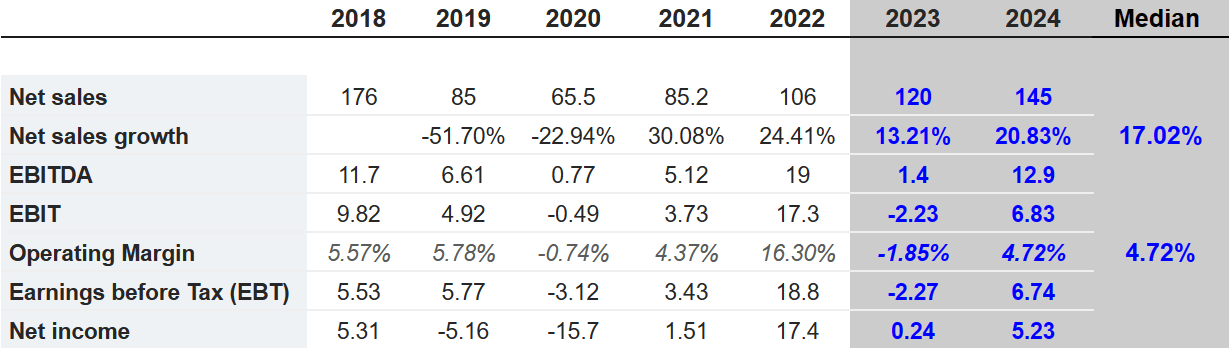

I also took into account the figures of other investment advisors out there, which I believe are quite beneficial. In particular, market expectations include 2024 net sales close to $145 million, net sales growth of 17%, 2024 EBITDA of $12 million, and 2024 net income close to $5 million.

Source: Market Screener

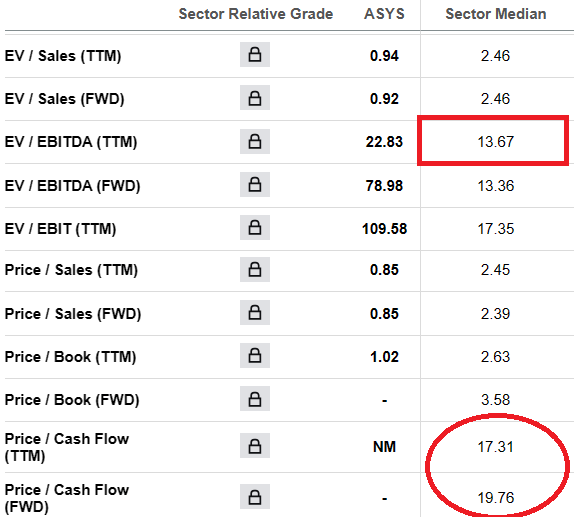

For the assessment of the EV/FCF multiple, I used the numbers reported by Seeking Alpha about the sector. The EV/Forward EBITDA for the sector is close to 13x, and the Price/TTM FCF stands at about 17x. With these figures in mind, I believe that assuming a terminal multiple of about 12x-17x FCF sounds reasonable.

Source: SA

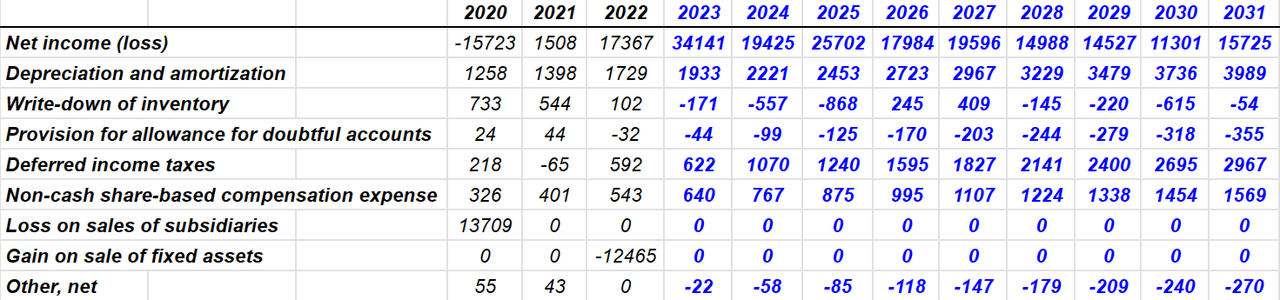

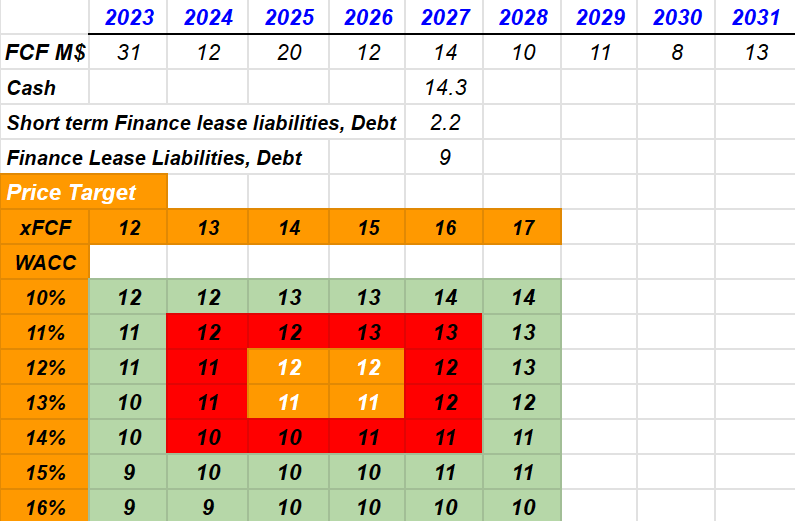

My DCF model took into account 2031 net income worth $15 million, depreciation and amortization worth $3 million, and deferred income taxes close to $2 million. Besides, with non-cash share-based compensation expense close to $1 million, I also included changes in accounts receivable of close to -$5 million.

I also took into consideration changes in inventories of about -$12 million and changes in accounts payable worth -$2 million. Finally, I obtained 2031 CFO worth $14 million, and with a capex of about -$2 million, I obtained 2031 FCF close to $13 million.

With FCFs ranging from $31 million to $20 million from 2023 to 2031, I also assumed cash of $14.3 million, short term finance lease liabilities and debt of $2.2 million, and finance lease liabilities and long term debt of $8.9 million. With a WACC ranging from 10% to 16% and an EV/FCF of 12x-17x, I obtained a valuation range close to $9-$14 per share and a median close to $11-$12 per share.

Source: DCF Model

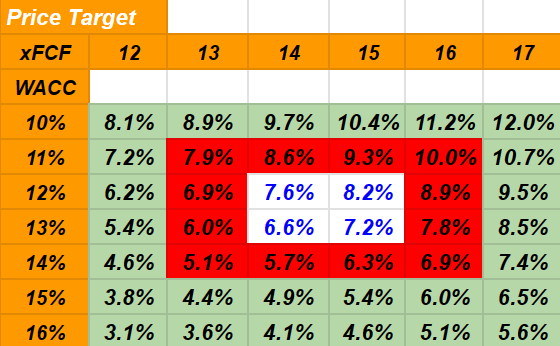

The internal rate of return obtained is close to 3.1%-12%, and the median would be close to 6%-8%. With these figures, I believe that Amtech Systems appears undervalued.

Source: DCF Model

Competitors

The competition for this company is high, and is given by internationally positioned companies with the historical trajectory of the Industry as well as small producers of specific products mainly located in Asia that have the advantage of having a cost structure significantly lower. ITW/EAE Vitronics-Soltec, Heller, Folungwin, ERSA, Shenzhen JT Automation Equipment Co., Ltd., and Rehm are some of the notable competitors, among which we also find Centrotherm GmbH and CVD Equipment, Inc. (CVV).

Risks

The growing trend within the semiconductor manufacturing industry generates a promising outlook for equipment supplier companies such as Amtech. It also generates great uncertainty about the allocation of investments and production efforts to meet the requirements and general market demands within the locality. For this reason, the industry is currently suffering from great volatility, partly driven by the transformation of the global ecosystem and the growing appearance of Asian companies on the market landscape. At this point, in my view, the company’s success in growing the operating margins of the materials segment may play a fundamental role in maintaining its competitive positions.

Moreover, I think that the acquisition strategy carries with it a series of risks in terms of the integration of the businesses and the risks inherent to the business of this company.

Conclusion

Amtech Systems operates in growing target markets like that of semiconductors, silicon carbide, and power semiconductors. Management implemented the M&A strategy that will most likely bring significant net sales growth if executed successfully. Many investors may have a look at the stock as the numbers for the next quarter appear beneficial, however, I believe that Amtech Systems is a long term play as it has already proven that it can generate positive free cash flows. There are obvious risks because Amtech Systems is a small company with large competitors in the same markets. With that, Amtech Systems appears to be a company to follow carefully.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.