ariya j/iStock via Getty Images

Investment Overview

I last covered Amneal Pharmaceuticals (NYSE:AMRX) for Seeking Alpha in a post published in March 2022. I gave the stock a “Buy” rating – at the time, Amneal stock traded at $4 per share, and although it had sunk as low as $1.3 per share by late May this year, a strong bull run across the second half of 2023 has seen the share price exceed $5 per share, up >20% since my note.

In my last note I discussed how privately-owned Amneal had merged with publicly listed California based generic drug specialist Impax Laboratories in 2017, creating the fifth largest generics drug company in the US.

Amneal’s founders, brothers Chirag and Chintu Patel, stepped away from the day-to-day management of the company, which was led by former Allergan CEO Rob Stewart, but management’s promised ~$700m of EBITDA in its first year post-merger did not materialise, and the company announced losses of ~$(200m) and ~$(600m) in 2018 and 2019, dragging the share price from a post-merger high of ~$24 to a low of ~$4.

In 2019, the Patel brothers switched roles from co-Chairmen, to Co-CEOs, as CEO Stewart and executive Chairman Paul Bisaro, who negotiated the original merger, stepped down. The brothers have overseen improvements to the top and bottom line – since 2019, revenues have been respectively $1.63bn, $1.99bn, and $2.1bn, in 2020, 2021, and 2022, while net income has been $91.1m, $10.6m, and $(130m).

Amneal purchased a 65% stake in Kentucky based AvKARE in 2019, which provides pharmaceuticals, medical and surgical products and services primarily to governmental agencies, for ~$220m, and a 98% stake in Kashiv Speciality Pharmaceuticals, a provider of rug delivery platforms, for ~$70m in 2021, bolstering its range of product offerings, while also developing a new biosimilars business, and a pipeline for branded drugs.

It has not been all plain-sailing for the business or its management across the past 18 months, but overall, 2023 has seen substantially more progress than setbacks.

Amneal Performance in 2023 – First Half Bad, Second Half Better

When I last covered Amneal in March last year, the company was guiding for FY22 revenues of $2.15bn – $2.25bn, adjusted EBITDA of $540 – $560m, and adjusted earnings per share (“EPS”) EPS of $0.8 – $0.85 – broadly the same as in 2021.

In March 2023, however, Amneal reported FY22 net revenue of $2.21bn, adjusted EBITDA of $514m, adjusted diluted EPS of $0.68, and a GAAP net loss of $(130m), and GAAP EPS of $(0.86).

In short, Amneal missed its own, and the market’s expectations, and its guidance for FY23 – $2.25bn – $2.35bn in net revenue, and $500m – $530m in adjusted EBITDA – was perhaps short of the market’s expectations also, scarcely being an improvement on 2022 revenues wise, while the EBITDA miss in 2022 perhaps cast a doubt over whether 2023 guidance was achievable.

There was more bad news for the company as the FDA flagged numerous issues with one of its manufacturing plants in India in late February, and when its Parkinson’s Drug candidate was denied approval by the agency in July, who issued a Complete Response Letter (“CRL”) outlining concerns over safety. The drug is an an oral formulation of carbidopa/levodopa with extended release properties, and had been pegged for peak sales of ~$500m.

Nevertheless, an earnings beat in Q2, on revenues of $599m and non-GAAP EPS of $0.19, and an upgrade on FY23 guidance, to $2.3bn-$2.4bn revenues, and EPS of $0.45 – $0.55, triggered the beginning of a bull run across teh second half of the year.

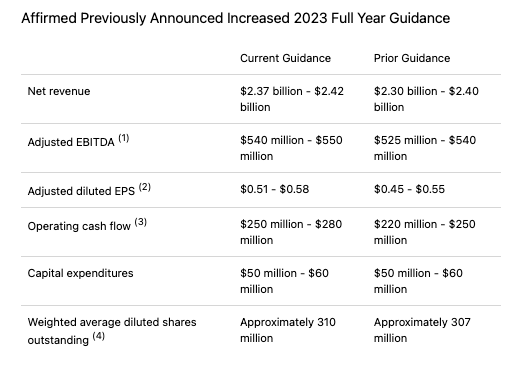

Announcing Q3 earnings in early November, Amneal raised FY23 guidance once again, as shown below:

Amneal FY23 guidance (Amneal Q3 earnings press release)

The improving financials have clearly made the difference in relation to the performance of Amneal’s share price over the past few months. This is neatly reflected in Chirag Patel’s opening statements on the Q3 earnings call:

We delivered another very strong quarter with $620 million of revenue, which is up 14% (year-on-year), adjusted EBITDA of $154 million, up 22% and adjusted EPS of $0.19, up 36%. We saw growth in all three of our business segments and reduced net leverage to 4.6 times.

Strong double digit revenue growth, >20% EBITDA growth and >35% EPS growth are figures that will almost inevitably be looked upon favourably by the market, no matter what company or industry, and when we consider some standard ratios – a forward price to sales (if guidance is met) of ~0.7x, and forward price to (non-GAAP) earnings of <10x, then we can deduce these low ratios uphold the case for share price growth.

Debt is a potential issue – as of Q3 long-term debt stood at $2.6bn, and current liabilities at $761m, but there are current assets of $1.46bn offsetting a portion of that, and so long as EBITDA growth is sustained, the burden will continue to reduce.

Improvements Across The Board Paint A Promising Picture For 2024 – & Beyond

I wrote in my last note that the focus and determination of the twin-CEO’s was one of the aspects of Amneal’s business that impressed me the most and made me confident that the company could mover forward, and grow its valuation under their leadership.

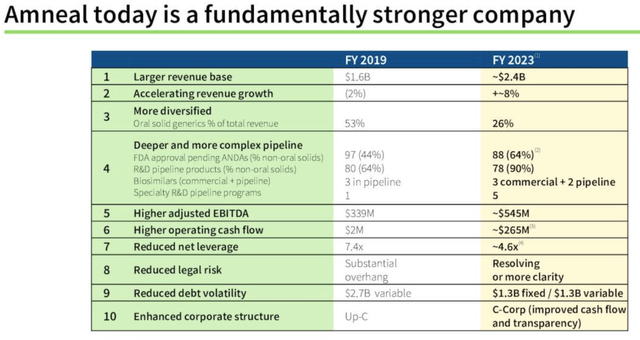

That thesis was certainly sorely tested in 2023, as the stock price lurched toward delisting territory, but the positive transformation between 2019 and the present day of Amneal’s business seems to be becoming clearer – consider the slide below, from the Q3 earnings presentation, for example:

Amneal – business transformation (Q3 earnings presentation)

Revenues are up 50%, and growing at a healthy rate of 8% per annum, there is more diversification, EBITDA is up 60%, the company structure has been altered to make it more shareholder friendly, and change the cashflow, and net leverage has been reduced.

The company’s 3 business segments are generics – “approximately 260 product families covering an extensive range of dosage forms and delivery systems”, according to the latest quarterly report / 10Q submission, Specialty, “engaged in the development, promotion, sale and distribution of proprietary branded pharmaceutical products”, and AvKare. Generics revenues grew 12% year-on-year in Q3, AvKare revenues by 25%, and Specialty by 9%.

Amneal ambitions by division (Amneal Q3 presentation)

As we can see above, management has detailed plans and forecasts for each division, and overall, shareholders ought to be able to look forward to high single growth for another few years, and plenty of positive news-flow as each division fulfils expansion plans.

The Q3 earnings call was littered with positive developments – thanks to two new sites being brought online, injectables manufacturing capacity has been doubled. There are 35 injectables on the market, with 25 more launches planned. The three biosimilar products launched to date will produce $60m in sales this year, with Avastin biosimilar Alymsys already grabbing 6% market share within three quarters of launch. 2 products have been approved in China, and even the Parkinson’s candidate setback is being addressed, with an approval promised in 2024.

Within generics, 88 abbreviated new drug applications (“ANDAs”) are pending with the FDA, and there are 78 pipeline products. 10 injectables have been approved this year. Management has identified 4 “pillars of value creation”, which are increased diversification, strong financial performance, cash generation, and deleveraging. It’s hard to argue the company is not making progress on all four of these fronts.

Concluding Thoughts – It Has Taken Time For Amneal’s Valuation To Grow – I Hope To See It speed up In 2024

Clearly, handing the reins of Amneal’s business over to an M&A focused generics business in 2017 created fundamental problems with the overall business model, and turned a profitable, well-run business into a failing one, but one positive is that took Amneal public, and having wrestled back control of day-to-day operations, the Patel brothers are showing signs of delivering the business shareholders have always wanted to see. Growing, profitable, diversified, not overly indebted.

The fact that Amneal is not quite profitable on a GAAP basis, still has a high level of debt – 4.6 leverage remains a potential red flag – and has faced several setbacks in 2023 which have endangered the share price does imply that Amneal is not out of the woods yet, however.

It would not take much – a second refusal to approved the Parkinson’s drug, a missed set of earnings, underwhelming FY24 guidance, when it arrives, for example – for the market to begin selling Amneal stock again.

Nevertheless, improvements are visible across almost every aspect of Amneal’s business, and so long as this is sustained, at some point I would expect the market to confess that is still valuing Amneal as a distressed business, when it is fact beginning to thrive, and adjust its valuation accordingly.

If I select at random 5 companies from a list of healthcare companies whose revenues in 2022 were between $2bn – $3bn, as Amneal’s were – life sciences company Waters Corporation (WAT), medical device specialist Dexcom (DXCM), West Pharmaceutical Services (WST), R&D specialist Clarivate (CLVT), and equipment manufacturer Bruker Corporation (BRKR), their respective market cap valuations are $17bn, $45bn, $25bn, $5bn, and $9.4bn.

Whilst every business faces a unique set of challenges and circumstances, the fact that all 5 of these companies are worth between 3x – 25x the value of Amneal today, a point at which Amneal has become a profitable business – at least from an adjusted EBITDA perspective – with accelerating cash flow, top-line growth forecasts in the high single digits, and dozens of new products to launch with triple-digit million revenue potential – makes me believe that Amneal is due for a significant valuation upgrade.

I do not govern out more dips in 2024, but in another 18 months’ time, if I am covering Amneal again, I would expect shares to have realised a much more substantial gain than the 20% achieved between March 2022 and today, with fewer lurches to the downside. The numbers, and tangible business wins, are speaking too loudly for the market to ignore them much longer, in my view.