da-kuk

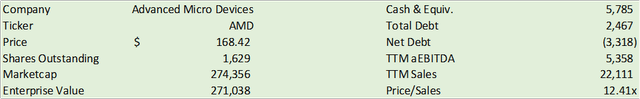

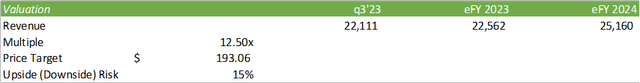

Advanced Micro Devices (NASDAQ:AMD) has a strong runway with the rollout of their MI300x series accelerators across the hyperscaler industry. Though I believe AMD will report revenue slightly below their $6.1b target, I do believe that the firm has a strong runway going into FY24 and beyond. I provide AMD shares with a BUY recommendation with a price target of $193/share based on 12.50x my eFY24 sales estimates. AMD will be reporting earnings on January 30, 2024, after market close.

It doesn’t just make us faster or better. Either it creates new results, via AI-enabled products and services; or it creates new ways to create new results, such as with AI-enabled new core capabilities. With game-changing AI, machines will disrupt business models and entire industries.

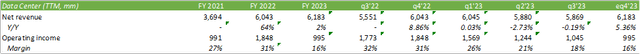

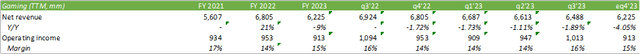

Looking to the financials, Data Center experienced a continued pullback on a quarterly basis q3’23 with the expectations for growth to reemerge in q4’23. Considering TTM figures, Data Center experienced a 19bps pull for the quarter. Management anticipates the continued rollout of the EYPC and Instinct MI300 accelerator to create strong tailwinds for the Data Center segment as more hyperscalers and enterprises invest in building out their LLM and AI capabilities. Management expects q4’23 to experience strong double-digit growth sequentially in the segment driven by the MI300 AI-accelerated ramp-up as further adoption takes place across hyperscalers and enterprises. Looking to the close of the fiscal year, I anticipate Data Center growth of 5.36% with an operating margin of 16%.

Looking beyond q4’23, AMD is ramping up production volumes for their MI300A and MI300X GPUs for deployments across HPC, cloud, and AI customers. I do believe that AMD will experience some economies of scale in FY24 as a result of this and may experience stronger operating margins across their Data Center segment as a result.

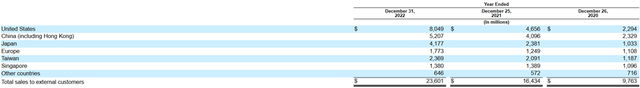

One point to note is that many of the major hyperscalers are developing their own AI-enabling chips; however, many of these products aren’t expected to roll out until the latter half of CY24. As alluded to in my article covering Nvidia (NVDA), Amazon (AMZN), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT) are each developing their homegrown chips to be utilized across their own data centers. Though I do not anticipate these firms’ chips to replace AMD’s accelerators and CPUs, I do anticipate some of the market share to be taken off the table as each firm rolls out their products. In addition to this, Chinese hyperscalers are opting to utilize localized chips as opposed to the watered-down versions that clear the approval list. How this affects AMD’s x86-based server chips is to be seen; however, I do anticipate some level of impact on sales to the geography. Given that China accounted for 22% of billings for FY22, this may lead to a sizable impact.

Despite this long-term concern, AMD has been successfully rolling out their AMD EPYC processors across their hyperscaler customers and anticipates strong growth going forward. Q3’23 brought 100 new instances from Microsoft Azure, AWS, and Oracles, amongst other cloud providers.

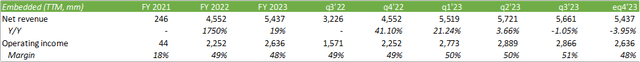

Management does anticipate softness across their Embedded portfolio as destock occurs. This can add some negative pressure to margins at the close of FY23 and into 1h24. Though I don’t anticipate a lagging effect on pricing, this may lead to some drag on growth and potentially hamper margins slightly in the near-term. Management sees softness across their telco customers with lower capital investments across 5g technology. Some of the effects on this portfolio is in relation to inventory builds and may result in softer sales in the near-term as telcos draw down that inventory.

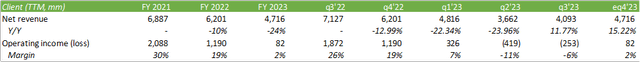

That being said, on the Client side, AMD will be rolling out Zen 5 in 2024 which may lead to a slow ramp-up in sales in the latter half of FY24. This may also lead to some tailwinds on gaming in the back-end of FY24 or FY25.

Gaming growth is anticipated to drag in q4’23 due to seasonality and the late-stage console lifecycle. Gaming has experienced a steady decline since FY22. Challenges on the gaming segment may persist throughout FY24 as a result of softness in their semi-custom chip sales.

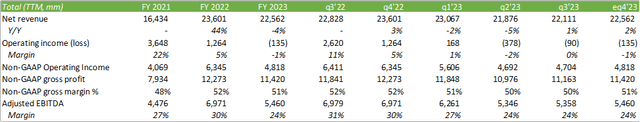

Overall, I anticipate eq4’23 revenue to come out to be $6,050mm with a -10% operating margin, closing out eFY23 $22,562mm, down -4% from FY22. I believe a lot of the inventory destocking should wind down by 2h24 and should create a clear path of growth for AMD. I also believe that AMD also has a long runway in their Data Center operation as companies seek to bolster their AI/ML capabilities with AMD’s server and networking chips.

As AMD scales their EPYC and MI300 portfolio, I do anticipate stronger margins to follow through. Considering the macro picture, Data Bridge Market Research estimates a 26.93% CAGR between 2021-2028 for the hyperscale data center market driven by increased demand for cloud services, 5G communications, AI, and IoT. Grand View Research anticipates the market for AI will grow at a 37.3% CAGR through 2030 with strength across automotive, healthcare, retail, finance, and manufacturing.

We’re now expecting that the data center accelerator TAM will grow more than 70% annually over the next 4 years to over $400 billion in 2027.

Lastly, as discussed in my report covering Nvidia, Taiwan Semiconductor (TSM) will be doubling their CoWoS capacity in 2024 to cater to advanced AI-enabling chip production. This should benefit AMD as they ramp up production volumes in 2024 and beyond.

Valuation & Shareholder Value

I believe AMD will have a strong runway in their Data Center segment with hyperscalers keying in on improving speed, performance, and energy efficiency. I believe AMD is well-positioned with their MI300x series accelerators and their deep relationship with Microsoft and other hyperscalers. As AMD ramps up chip production, I also believe that the firm will have the ability to improve margins through economies of scale and in turn, continue to reward shareholders through their robust buyback program. As of q3’23, AMD has $5.8b remaining in their share buyback program.

I provide AMD shares with a BUY recommendation at 12.50x my forecast for eFY24 sales.

Overall, I believe AMD still has more growth ahead of them despite the slowdown in their Gaming and Embedded segments. I do believe that their Data Center segment will more than balance this out as well as realize stronger margins as their latest AI-enabling chip series scales in volume. Given that we are still in the early innings for adoption for these high-performance chips across hyperscalers and enterprises, I do believe that there is a lot of runway left for growth. With the expected TAM of $400b by 2027, I expect AMD to realize significant revenue growth between now and then for their MI300x series accelerators. My forecast for eFY24 calls for 12% Y/Y revenue growth, primarily in Data Center and Client, offset by a decline in Gaming and Embedded, primarily resulting from continued inventory destocking.

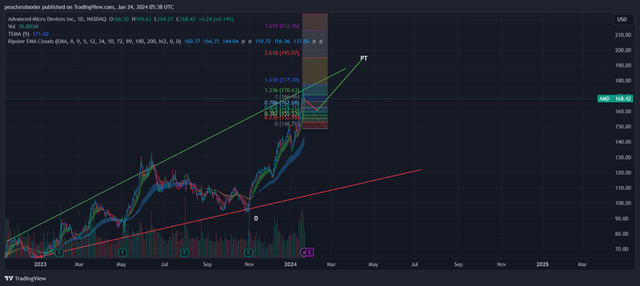

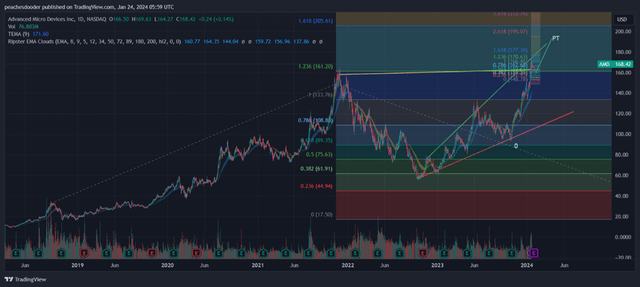

On a tactical basis, I believe AMD may pull back to $159-160/share before continuing its upward trajectory to my price target of $193/share.

On a longer scale, AMD could be moving down on a short-term corrective wave to $140/share before making a trajectory towards $220/share, which would make my price target of $193/share the down wave before AMD moves further into wave 3 of Elliot Wave Theory. Though this will be a longer-term trajectory, I believe that this isn’t so farfetched given the growth trajectory of the overall industry.