oatawa/iStock via Getty Images

We previously covered Amazon.com, Inc. (NASDAQ:AMZN) in November 2023, discussing its stellar FQ3’23 top-line performance across AWS and e-commerce segments, naturally contributing to the stock’s impressive rally, further aided by the robust cost optimizations thus far.

With the generative AI boom also bringing forth growing cloud deals and backlogs, we maintained our Buy rating then, with its turnaround from 2022 woes completed.

In this article, we shall discuss how AMZN has outperformed expectations, with the strategic cost optimizations and moderated fulfillment/ warehouse locations already triggering notable expansions in its operating income margins and Free Cash Flow generation.

Combined with the long-term e-commerce tailwinds as the macroeconomy recovers and demand for generative AI SaaS/ cloud computing grows, we maintain our confidence that AMZN deserves its spot in the Magnificent Seven groups.

The AMZN Investment Thesis Has Rarely Been This Cheap

For now, AMZN has reported an excellent FQ4’23 earnings call, with an overall net sales of $169.96B (+18.7% QoQ/ +13.9% YoY), overall operating income of $12.78B (+14.3% QoQ/ +266.8% YoY), and overall operating margins of 7.5% (-0.3 points QoQ/ +5.2 YoY).

Much of the bottom-line tailwinds are attributed to the North American segment’s improved operating income of $6.46B (+50.2% QoQ/ + 2791.6% YoY), further aided by the narrowing losses for the International segment at -$0.42B (-341% QoQ/ +81% YoY).

Part of this is attributed to the reduced headcount to 1,525M by FY2023, down by -1% from 1,541M in FY2022, and by -5.1% from 1,608M in FY2021, with fulfillment and SG&A expenses also comprising a smaller part of its overall expenses at 25.6% (-1.3 points YoY/ +0.8 from FY2021 levels).

As a result of the expanding bottom line, it is unsurprising that we are seeing immense improvements in AMZN’s balance sheet, with a growing net cash of $28.97B by the latest quarter, compared to $3.55B in FQ3’23 and $2.87B in FQ4’22, while finally nearing its pre-pandemic net cash of $31.92B in FQ4’19.

The management has also offered an optimistic FQ1’24 guidance, with an overall net sales of $140.75B (-17.1% QoQ/ +10.5% YoY) and overall operating income of $10B (-21.7% QoQ/ +102% YoY) at the midpoint.

These numbers imply a drastically improved overall operating margins of 7.1% (-0.4 points QoQ/ +3.2 YoY) in FQ1’24, compared to its hyper-pandemic peak overall operating margins of 5.9% in FY2020 and pre-pandemic averages of 4.2%. This suggests that the management has implemented many of its cost optimization strategies into practice, after the painful lessons in 2022.

However, readers must also temper their Free Cash Flow expectations, since FY2024 is unlikely to replicate a similarly rich FY2023 generation of $32.21B (+290.7% YoY) and margins of 5.6% (+8.9 points YoY).

The AMZN management has already guided intensified capital investments on a YoY basis, “primarily driven by increased infrastructure CapEx, support growth of our AWS business, including additional investments in generative AI, and large language models.”

We believe that these efforts are critical to ensuring AWS’ relevance in the AI boom, especially due to the intensifying cloud competition offered by Microsoft (MSFT) and Alphabet (GOOG).

While AWS continues to command the market-leading share of 31% by Q4’23 (inline QoQ/ -1 YoY), it is also immediately apparent that Azure has been gaining to 24% at the same time (-1 points QoQ/ +1 YoY) – thanks to its strategic partnership with OpenAI, and Google Cloud to 11% (+1 points QoQ/ +1 YoY).

For now, there remain great tailwinds in the overall generative AI SaaS market, with an expanding TAM from $1.67B in 2022 to $592.38B in 2032 at an accelerated CAGR of +79.8%, easily accommodating multiple winners.

However, we also believe that it is important for AMZN to maintain its leading global cloud share ahead, especially since AWS is the company’s bottom-line driver, with operating income of $24.63B (+7.8% YoY) or the equivalent 66.8% of its overall profitability (non-comparable YoY) in FY2023.

With these investments likely to be top/ bottom line accretive, significantly aided by the sticky consumer base with growing AWS backlog of $155.7B (+17% QoQ/ +41% YoY), AMZN may very well continue to lead the upcoming cloud computing super cycle over the next decade.

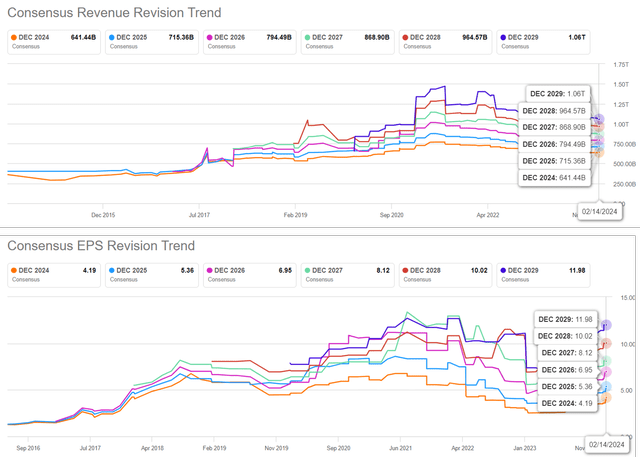

The Consensus Forward Estimates

AMZN’s impressive expansion in EBIT margins and promising forward guidance have directly contributed to the optimistic consensus forward estimates as well, with the behemoth expected to generate an accelerated top/ bottom line CAGR at +11.4%/ +34.8% through FY2026.

This is compared to the previous estimates of +10.9%/ +16.9% and historical growth at a CAGR of +22.9%/ +36.4% between FY2016 and FY2023, respectively.

Combined with the robust labor market, strong discretionary spending, cooling inflation, supposed Fed pivot from H1’24 onwards, and undeniable AI hype, we can understand why AMZN’s e-commerce and cloud prospects have lifted drastically.

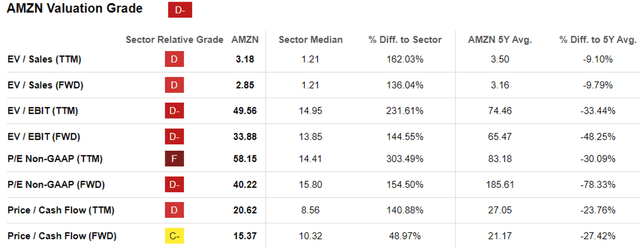

AMZN Valuations

As a result of its long-term tailwinds, it is apparent that AMZN is trading at a very cheap FWD EV/ EBIT valuation of 33.88x and FWD P/E of 40.22x. This is compared to its 1Y mean of 48.82x/ 58.92x and 3Y pre-pandemic mean of 75.66x/ 114.61x, though elevated compared to the sector median of 13.85x/ 15.80x, respectively.

Readers may also want to note that the stock nears the 10Y low valuations of 33.98x/ 39.46x, respectively, with it seemingly growing into its previously expensive valuations, thanks to the promising projected top/ bottom-line growth rates that nearly match the normalized averages.

Even when compared to the cloud competitors, such as Microsoft at FWD P/E of 34.76x & Alphabet at 21.65x, and the e-commerce competitors, such as Shopify (SHOP) at 72.53x & MercadoLibre (MELI) at 73.98x, it is apparent that AMZN remains highly attractive here.

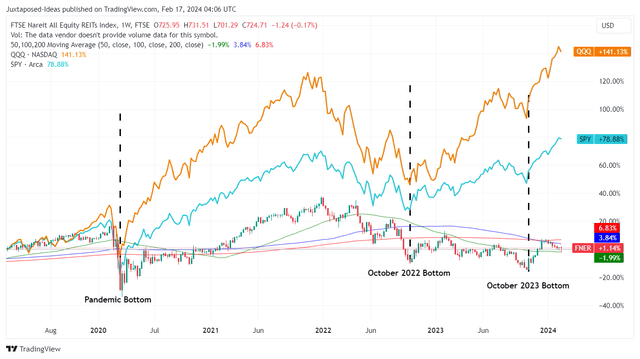

REIT Decline/ QQQ Mania

At the same time, with the Fed already looking to pivot from H1’24 onwards, it is apparent that more investors have rotated from dividend stocks to growth/ tech/ generative AI stocks, as observed in the decline of multiple REITs as opposed to the Magnificent Seven/ QQQ/ Generative-AI Mania since the October 2022 bottom.

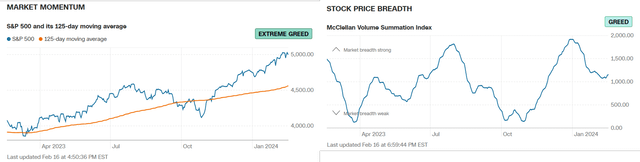

Fear & Greed Index

While the overall market momentum is nearing Extreme Greed, the McClellan Volume Summation Index remains well balanced at the time of writing, with the moderately bullish index of 1,150.72x not too far from the neutral reading point of +1,000x, implying a sustainable long-term price trend ahead.

Lastly, we believe that AMZN’s intermediate to long-term prospects look very bright, made possible by multiple growth drivers and lifting market sentiments, with the International Monetary Fund already guiding a soft landing ahead.

So, Is AMZN Stock A Buy, Sell, or Hold?

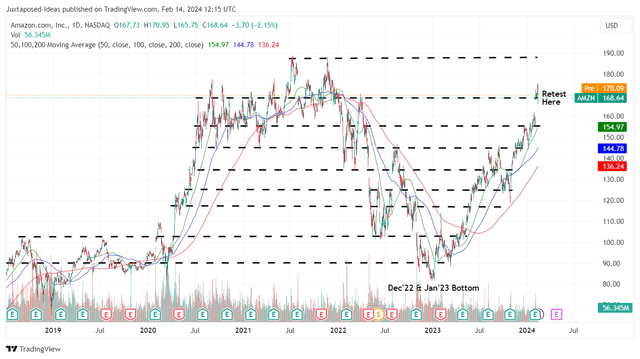

AMZN 5Y Stock Price

For now, AMZN has rapidly broken out of its 50/ 100/ 200-day moving averages, while charting an impressive +105.4% rally since the December 2023 bottom, well outperforming the SPY at +32.3% over the same time period.

The stock is currently retesting its 2020 – 2022 resistance levels of $170s as well, with it remaining to be seen if the recent optimism surrounding its excellent FQ4’23 earnings call may last.

On the one hand, based on the FWD P/E of 40.22x and AMZN’s FY2023 adj EPS of $2.90, the stock appears to be trading way above our fair value estimate of $116.60.

On the other hand, based on the consensus FY2026 adj EPS estimates of $6.95, there seems to be an excellent upside potential of +63.3% to our long-term price target of $279.50.

We are maintaining our Buy rating, with the attractive long-term risk/reward ratio offering interested investors an excellent upside potential over the next few years.

Otherwise, bottom fishing investors may consider waiting for a moderate pullback before adding, preferably at its previous resistance range of between the $145s and the $155s for an improved margin of safety.