Liudmila Chernetska

We previously covered Altria (NYSE:MO) in August 2023, discussing its determination to rebuild its alternative tobacco segment after the Juul fiasco, attributed to the recently announced NJOY acquisition.

We had cautiously rated the stock as a Buy then, thanks to its robust profitability and tempting dividends, while warning investors to monitor its progress in the Smokeable Product segment, due to the sustained decline in sales volume.

In this article, we will be discussing MO’s robust dividend investment thesis, despite the continuously deteriorating sales volumes for Smokeable Product, due to the growing demand for Vapour Pods and Heated Tobacco Sticks globally.

While the tobacco company’s progress in the alternative tobacco segment has been slower than its competitors, we are willing to patiently wait for its eventual reversal, with NJOY likely to accelerate in sales/ market share gain by H1’24.

The Conventional Tobacco Investment Thesis Continues To Deteriorate

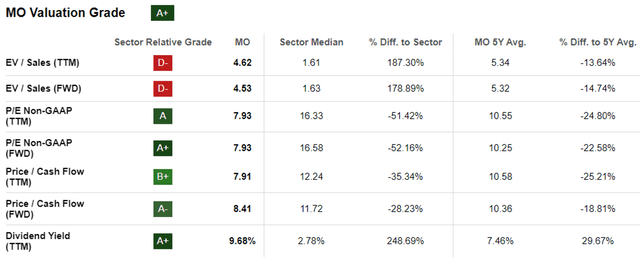

MO Valuations

Thanks to the recent sell-off, MO’s FWD valuations have been moderated compared to its 5Y averages and sector medians.

On the one hand, we believe that the correction has been overly done, since the management has only narrowed its FY2023 adj EPS guidance from the previous range of between $4.89 – $5.03 to $4.91 – $4.99, implying a minimal impact of $0.01 at the midpoint.

With the updated range still representing a +2.2% growth YoY, compared to the previous +2.4%, we are not overly concerned.

On the other hand, we believe that most of the pessimism embedded in MO’s valuations is the sustained decline in its Smokeable Product volumes of 19.75B (-6% QoQ/ -11.3% YoY) by the latest quarter.

Most notably, the demand for Marlboro products appear to have moderated to a sales volume of 17.43B (-5.7% QoQ/ -10.5% YoY). While the brand’s retail share seems to be stable at 42.3% (+0.2 points QoQ/ -0.3 YoY), it is apparent that the existing customers’ brand loyalty has not been enough to stave off the sales headwinds.

Since MO’s Smokeable Product segment comprises $5.57B (-4.2% QoQ/ -5.2% YoY) and $2.74B (-3.5% QoQ/ -1.7% YoY) of its overall top and bottom lines of $6.28B (-3.3% QoQ/ -4.1% YoY) and $3.08B (+6.2% QoQ/ -1% YoY) in the latest quarter, respectively, it is unsurprising Mr. Market is increasingly concerned.

There may be a limit to its price hikes as well as the macroeconomic outlook remains uncertain, since the +$420M tailwinds from the raised prices has not been able to offset the lower shipment volume headwinds of -$725M in the latest quarter.

The same has been reported in its first nine months performance, with the lower shipment volume (-$1.92B) only partially offset by the higher pricing (+$1.38B).

MO’s Dividend Investment Thesis Remains Robust

Then again, we believe that MO’s dividends remain safe, based on its Net cash provided by (used in) operating activities of $6.06B over the past three quarters (+7.6% YoY) and quarterly dividend payout of approximately $1.6B.

This is why its TTM Free Cash Flow Yield to Dividend Yield Ratio has moderately improved to 1.41% compared to its 5Y average of 1.29%, though still lagging behind the sector median of 1.63%.

MO has also been consistently deleveraging its balance sheet, with a long-term debts of $23.97B (-0.4% QoQ/ -3.5% YoY) by the latest quarter, down from its FY2019 levels of $27.04B (+127.4% YoY).

Despite the impact of the elevated interest rate environment to its annualized FQ3’23 interest expenses of $1.08B (+10.1% QoQ/ +1.1% YoY), the tobacco company remains sufficiently profitable, with an improving interest coverage ratio of 11.33x against its 5Y average of 10.29x and sector median of 7.54x.

With a debt to EBITDA ratio of 2.1x (-0.1x QoQ/ inline YoY) by the latest quarter, we believe that MO remains well-positioned to navigate the uncertain macroeconomic outlook, while sustainably growing its dividend at an estimated FWD rate of +4.21% compared to its historical rate of +3.79%.

MO’s Future Lies In The Alternative Tobacco Market

We also believe that there is a future in the e-cigarette segments, with the CDC recently reporting an immense increase in US sales by +47% between January 2020 and December 2022.

The same has been reported by multiple tobacco companies, namely Philip Morris (PM), with 27.4M global IQOS users as of September 2023 (+0.2M QoQ/ +3.7M YoY).

This has contributed to PM’s sustained growth in the Heated Tobacco Units sold volumes to 32.47M (+3.3% QoQ/ +18% YoY) and Total smoke-free products revenues (including nicotine oral products) to $3.23B (+4.1% QoQ/ +35.7% YoY) by the latest quarter.

British American Tobacco p.l.c. (BTI) has also recorded excellent results, with its New Categories’ growth rate well exceeding its peers at H1’23 revenues of £1.65B (+26.6% YoY), expanding at an accelerated CAGR of +32.8% from H1’19 levels of £531M.

Most importantly, the tobacco company’s detailed breakdown of New Categories suggests growing demand for Vapour and THP products, further validating the ongoing transition from conventional combustibles.

For now, MO’s alternative tobacco trajectory has only been delayed by the previous Juul fiasco, with the management already betting on NJOY as an alternative vaping strategy.

For now, the tobacco company reports a FQ3’23 shipping volume of approximately 7.5M ACE pods (no QoQ/ YoY comparison available). With the acquisition only completed in June 2023, we believe that it may be more prudent to give the management more time to integrate NJOY into its existing operations.

This is especially since MO’s transformation plan will only be completed by the end of 2023, with the management expecting NJOY’s ACE to reach 70K stores, up by +66% from the current 42K stores by September 2023 and by +103.4% pre-merger of approximately 10K store.

The management has also conducted its first retail NJOY trade program, further expanding the brand’s engagement with multiple retail partners, with the hopes of increasing brand awareness among consumers.

With NJOY still in its early days, we believe that it may be prudent to give MO a little more time during this transitionary period, with “the retail share of ACE pods in U.S. multi-outlet and convenience stores still essentially unchanged since the completion of the NJOY Transaction.”

This is based on the Nielsen convenience store report, with NJOY’s market share remaining somewhat stable at 2.5% for the four weeks ending October 07, 2023, with the MoM loss of -0.1 point attributed to the BTI Vuse’s growing share to 41.8% (+0.1 points MoM) as Juul’s share decline to 24.4% (-0.3 points MoM).

So, Is MO Stock A Buy, Sell, Or Hold?

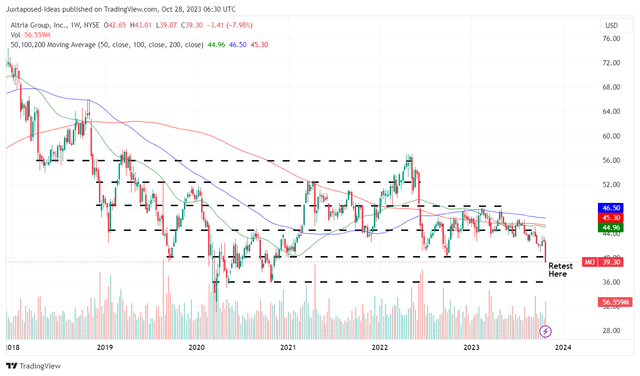

MO 5Y Stock Price

For now, MO has drastically plunged after the recent FQ3’23 earnings call, with the stock retesting its critical support levels at $39s/ $40s.

It remains to be seen if bullish support may materialize here, since the stock’s lower lows and lower highs since the February 2023 peak may trigger a further retracement to its next support level of $36s.

However, we believe that many of long-term MO shareholders may welcome this dip as a chance to dollar cost average, while similarly enjoying an expanded forward dividend yield of 9.97% compared to its 5Y average of 7.62% and the sector median of 2.88%

In addition, we believe that many of the readers have been long aware of the declining conventional tobacco sales over the past few decades, with the vape/ pod/ oral nicotine pouches (amongst others) likely being the next-gen tobacco products.

As a result of the ongoing transition, we believe that the MO stock (along with most tobacco stocks) is only suitable for income oriented investors with higher risk tolerance, whom are looking to buy and drip indefinitely.

With losses only realized if the stock is traded or sold, long-term investors would have simply enjoyed a consistent dividend payout every quarterly, no matter the noise in the stock market.