krblokhin

Introduction

Altria Group (NYSE:MO), on the surface, may not be the most attractive stock. The company’s stock appreciation has been minimal over the past few years. However, the merit of investing in Altria comes from extremely lucrative and consistent dividend payouts. As such, one may view Altria as a pure dividend investment. While this may be the case in the long term, for the upcoming few quarters in 2024, I believe there could be a stock price appreciation opportunity for Altria coming from the potential shift in the Federal Reserve’s policy. The macroeconomic tailwind along with the continuously increasing lucrative and safe dividend provides an attractive investment opportunity. Therefore, my rating on Altria is a buy as there will likely be a stock price appreciation in 2024.

Dividend

Despite the potential for a stock price appreciation in the near future, dividends are an integral reason for investing in Altria. At the time of writing, Altria’s dividend rate stands at an impressive 9.57%. One may question if the high dividend payout could continue to increase while being sustainable. The answer to this question is a yes.

Altria’s dividend payout ratio is fairly high at about 76.77% for the trailing twelve months. Analysts covering the company, for the coming few years, is expecting EPS to grow low single digits every year, which is likely enough to support the current and future dividend growths. The management team laid out their vision in their 2028 Enterprise Goals report. Within the report, the management team also forecasted for a “mid-single digits adjusted diluted EPS growth on a compounded annual basis” further supporting the views of continually growing EPS estimates. Thus, I believe it is reasonable to argue that Altria will continue to see steady growth in the company’s bottom line creating a safe dividend environment for investors for the foreseeable future.

Further, in terms of dividend growth, Altria’s management team announced a progressive dividend goal in the 2028 Enterprise Goals report. The company is targeting “mid-single digits dividend per share growth annually.” As the target dividend growth rate is in line with the EPS growth estimates, it is highly likely for the company to achieve the dividend increase goal.

Overall, considering both the expected EPS growth over the next few years along the management team’s vision for 2028, I believe it is reasonable to argue that Altria’s dividends are not only sustainable but will likely continue to increase for the foreseeable future. Therefore, the lucrative dividends will likely be safe and provide attractive returns to investors while awaiting a capital appreciation potential.

Stock Price Appreciation

Beyond lucrative and growing dividend incentives for investing in Altria, 2024 may see a strong stock price appreciation potential as well.

Inflation has been persistent for the past few years following the pandemic, but in the past few months, the US economy started to see easing inflation. This macroeconomic development opened the room for the Federal Reserve to hint at a potential federal funds target rate cut in 2024. During the December 2023 FOMC meeting, chair Jerome Powell said that there could be three rate cuts coming in 2024.

Today, the federal funds target rate is 5.25-5.50%, so investors could expect to yield near this level of interest in short-term savings, bonds, and CDs. For the long-term, investors could expect around 4.127% return as the 10-year treasury yield stands at this level. CDs, savings, and treasury bonds offer attractive interest rates today, and they are safer than stocks as the investments are guaranteed. However, given that the Federal Reserve is likely to cut interest rates, these investments are likely going to become less attractive in the coming quarters relatively making high dividend income more attractive.

Interest rates and the price of the asset have an inverse relationship in bonds. When the 10-year treasury rate moves from 4% to 3.5%, the underlying price of the bond increases. Similarly, when interest rates decline on long-term and short-term fixed-income assets making high dividend stocks like Altria relatively more attractive, the price of Altria’s stock could appreciate from the new demand.

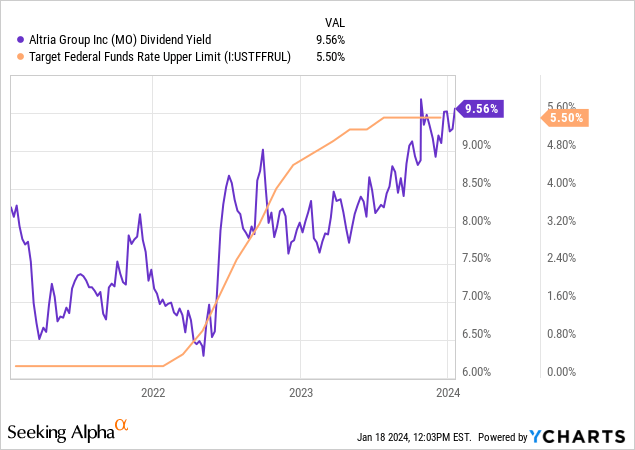

The chart below supports my thesis. As the federal funds rate increased in the past few years making safer fixed-income assets more attractive, Altria’s dividend rate increased along with it as the company’s dividend rate became less attractive during this time, and the increase in dividend rate means a decrease in the stock price. As such, with the potential decline in the federal funds rate approaching 2024, Altria could see a stock price appreciation.

The magnitude of the stock price appreciation will be highly dependent on the number of cuts and the risk premium investors demand from Altria. But, given that the current status quo and risk premium stay constant while the federal fund’s target rate decreases by 0.75% in 2024, Altria’s stock could hit about $44.55 per share in conservative estimates as the company’s dividend rate drops to 8.88%.

Risks

My bullish thesis has two major risks. First, my thesis depends on Altria’s dividend being safe and lucrative for the foreseeable future as a result of growing EPS. While this is likely the case for the short to medium, the bullish thesis does not take into account long-term risks. The smoking population is declining, there is more regulatory turmoil surrounding cigarettes, and Altria’s alternative business such as e-cigarettes is still relatively small. The progression of the industry and the management team’s execution could either pose opportunities or risks in the long term. While this factor is less relevant to my current article, investors should note these risks. Second, my thesis relies on the Federal Reserve cutting the federal funds rate in 2024. While I believe forecasting for the cut is reasonable, numerous economic factors including sticky inflation rates could hinder the Federal Reserve’s rate cuts posing significant risk to the thesis.

Summary

Altria, in my opinion, provides an extremely attractive investment opportunity in 2024. The company delivers lucrative, safe, and growing dividends. The management team’s intention to keep increasing the dividend along with the expected growth in EPS for the foreseeable future will likely allow the company to continue the lucrative, safe, and growing dividends. Further, Altria’s stock price has the potential to see appreciation from the current level. The Federal Reserve is expected to cut interest rates in 2024, and as a result, Altria’s dividend rate will likely be more attractive bringing up the stock price. Therefore, I believe Altria stock is a buy.