Mario Tama

Thesis

A friend of mine is retiring this month and asked me to point him in the direction of companies with attractive yield on cost potential. My first response was that he should check out Altria Group, Inc. (NYSE:MO). They have significant cash flow and have been buying back shares, this has allowed them to boost their dividend. If this trend continues, it should allow them to continue increasing it.

Altria is well positioned to begin buying up cannabis companies as soon as the Federal government changes their laws. On October 6th, 2022, Biden asked the Department of Health and Human Services and the Drug Enforcement Agency to look into rescheduling it away from arrange 1 and toward a arrange which more accurately reflects the characteristics of the drug. The DHHS already made clear their findings that it should be moved to arrange 3. The process cannot be completed until the DEA announces their findings. Progress toward rescheduling is being made behinds the scenes; on December 12th, 2023, they announced that 6 synthetic cannabinoids would stay on the arrange 1 for the next two years. I view this as a loose end the DEA decided to tie up in preparation for making their final announcement about the rescheduling of non-synthetics.

Also, momentum has been building for the passage of some form of the SAFE Banking Act. Although the core intent of SAFE banking is to allow the banks to finally engage with the cannabis industry, depending on which version of it is passed, the cannabis industry may be able to preserve operations while uplisting to major exchanges. This also means that companies which already trade on major exchanges may be able to begin expanding into cannabis without fear of delisting.

Being able to enlarge into a new industry within their already established markets should grant Altria a business life cycle extension. While a buying spree and major expansion will demand significant capital expenditure, it will grant them a seat at the table in a growing industry.

After looking over their financials and valuation, I presently rate Altria as a Buy.

Company Background

Altria Group, Inc. was founded in 1822, and is one of the global tobacco giants. They offer cigarettes, cigars, pipe tobacco, smokeless tobacco, and oral pouches. Their more well-known brands include Marlboro, Black & Mild, Copenhagen, Skoal, Red Seal, and Husky. They are headquartered in Richmond, Virginia.

The tobacco industry is sometimes referred to as a sunset industry, as smoking rates in the United States have been in reject. The number of Americans who smoke cigarettes dropped from 49% in 1944, to 23% in 2000. By 2021 that had dropped to 11.5%. Over the decades, Altria found success in a declining industry by focusing on cutting costs and increasing efficiency while expanding to additional markets.

Cannabis Expansion

Recognizing the need to find additional long-term revenue, Altria indicated their desire to eventually enlarge into the cannabis industry. In March of 2019, they invested $1.8B USD into Cronos Group Inc. (CRON), a licensed producer in Canada.

Altria is not the only tobacco giant preparing for a cannabis expansion. In 2019, Imperial Brands (OTCQX:IMBBY)(OTCQX:IMBBF) invested $123M CAD into Auxly Cannabis Group Inc. (OTCQB:CBWTF). In August of 2023, Philip Morris International Inc. (PM) bought an Israeli cannabis tech firm Syqe Medical in a deal worth up to $650 million. In November of 2023, British American Tobacco (BTI) increased its already established investment in Canadian cannabis producer Organigram Holdings (OGI). Compared to the cannabis industry, the tobacco industry is drowning in cash. I expect that the tobacco giants will begin buying U.S.-based cannabis companies as soon as they are legally allowed to.

Long-Term Trends

I found two estimates for the long-term growth of the global tobacco industry, one citing a CAGR of 2.55% through 2028, the other a CAGR of 3.75% through 2028.

The United States cannabis industry is expected to go through a CAGR of 14.2% until 2030. The Canadian cannabis industry is projected to have a CAGR of 13.26% until 2027. Since Germany is also making moves toward recreational cannabis legalization, I feel it’s relevant to also include its expected CAGR of 14.01% through 2027. Globally, CBD has an expected CAGR of 31.5% until 2031.

Guidance

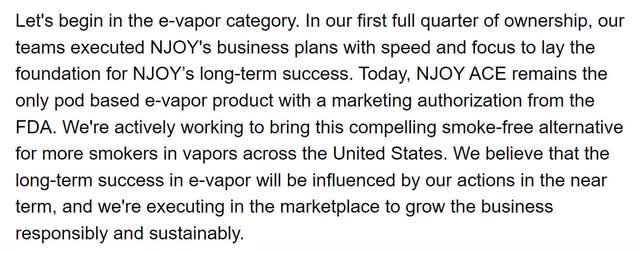

Their most recent earnings call transcript shows that they are finding success with their expansion into smokeless tobacco. Their NJOY ACE is the only pod based e-vapor product with FDA approval.

Guidance 1 (Q3 2023 Earnings Call Transcript)

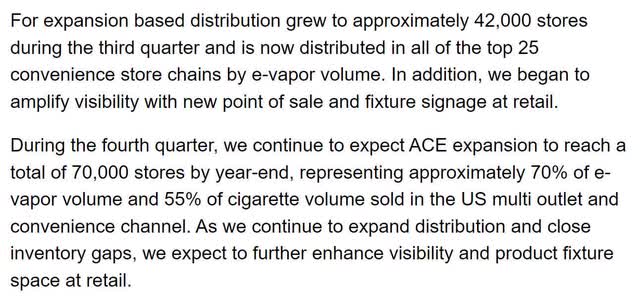

They have already gotten it into 42,000 stores and expect to be able to have it into roughly 70,000 stores by the end of Q4.

Guidance 2 (Q3 2023 Earnings Call Transcript)

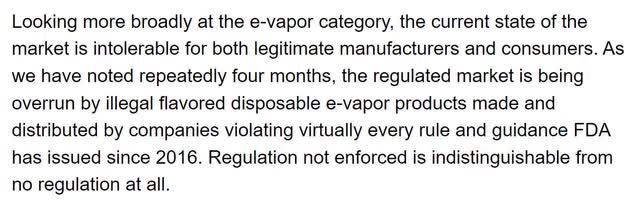

They would prefer if the FDA regulations for e-vapor products were better enforced.

Guidance 3 (Q3 2023 Earnings Call Transcript)

Their nicotine pouch category experienced a 5% boost over the last 6 months. Full nicotine pouches now capture 32% of oral use sales in the United States. Shipments for on! had a 37% boost, and its retail price increased by 33% from last quarter.

Guidance 4 (Q3 2023 Earnings Call Transcript)

The retail share of on! remained stable from the previous year, and is up by 6.9% vs. the prior year. They are also performing a evaluate launch of PLUS in Sweden.

Guidance 5 (Q3 2023 Earnings Call Transcript)

They calculate that the growth of illegal flavor disposable e-vapor products contributed to the 1.5% – 2.5% reject in the cigarette industry over the last 12 months.

Guidance 6 (Q3 2023 Earnings Call Transcript)

Compared to Q3 2022, the smokable products segment had its adjusted operating income reject by 2.5% in Q3. The entire industry experienced declining sales volumes, plus there was one fewer shipping day compared to Q3 2022. Also compared to the previous Q3, the segment experienced an 8.6% boost in price this Q3.

Guidance 7 (Q3 2023 Earnings Call Transcript)

The Marlboro brand experienced a retail share boost of 0.3% from the previous quarter and a reject of 0.3% compared to the previous Q3. Its market share is currently at 42.3%. The Marlboro Black brand experienced a 0.3% boost in market share from the previous quarter and a 0.4% boost from 2022’s Q3; it is now 58.9% of the premium market.

Guidance 8 (Q3 2023 Earnings Call Transcript)

Their discount segment was stable compared to the previous quarter and is 1.1% higher compared to the previous year’s Q3, constituting 28.2% of the discount market.

When adjusting for calendar differences and differences in inventory flow, cigarette volumes are down by roughly 10% compared to the previous year’s Q3.

Guidance 9 (Q3 2023 Earnings Call Transcript)

Their cigar segment saw an boost in volume of 4.2% over the last 3 quarters. Compared to the previous year, its Q3 adjusted OCI grew by 7.1% while its margins grew by 3% to 69.3%.

Guidance 10 (Q3 2023 Earnings Call Transcript)

They increased their dividend by 4.3% in August. They also bought back 5.9M shares and still have another $268M they scheme on spending on advance buybacks before the end of the year.

Guidance 11 (Q3 2023 Earnings Call Transcript)

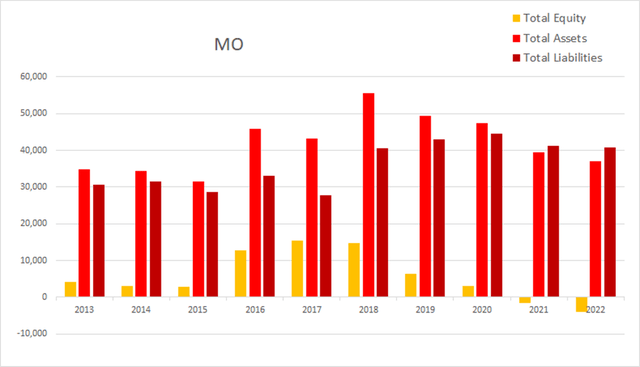

Their guidance for fiscal year 2023 is that their adjusted diluted EPS will end up in the range of $4.91 to $4.98.

Guidance 12 (Q3 2023 Earnings Call Transcript)

Annual Financials

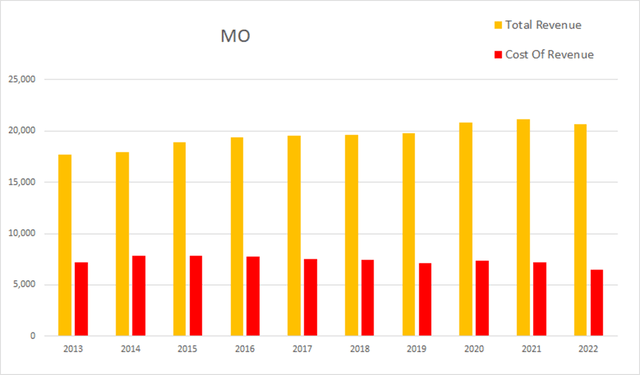

The company has been slowly growing revenue over the last decade. In 2013 they had an annual revenue of $17,663M. By 2022 that had risen to $20,688M. This represents a total boost of 17.13% at an average annual rate of 1.90%.

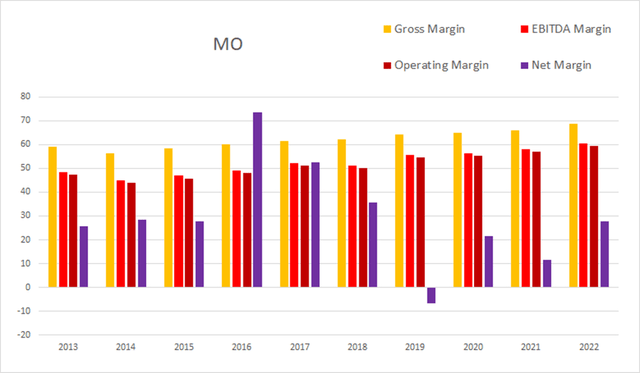

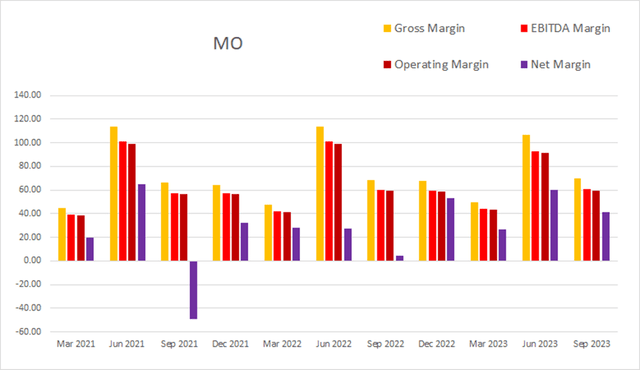

Their gross, EBITDA, and operating margins have been expanding. As of the most recent annual report, gross margins were 68.56%, EBITDA margins were 60.55%, operating margins were 59.46%, and net margins were 27.86%.

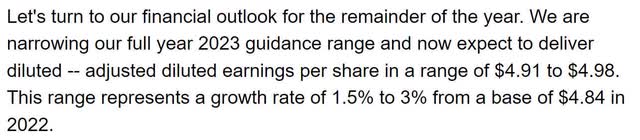

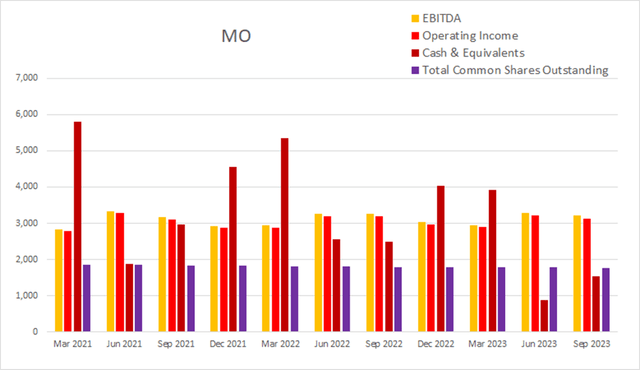

In order to drive EPS and dividend increases, they have been buying back shares. Total common shares outstanding was at 1,993.5M in 2013; by the end of 2022 that fell to 1,785.5M. This represents a -10.43% reject in share count, which comes out to an average annual rate of -1.16%. Over that same time period operating income rose from $8,360M to $12,301M, a 47.14% total rise, at an average rate of 5.24%. Total common shares outstanding is shown ten times larger on the chart to make this trend more visible.

MO Annual Share Count vs. Cash vs. Income (By Author)

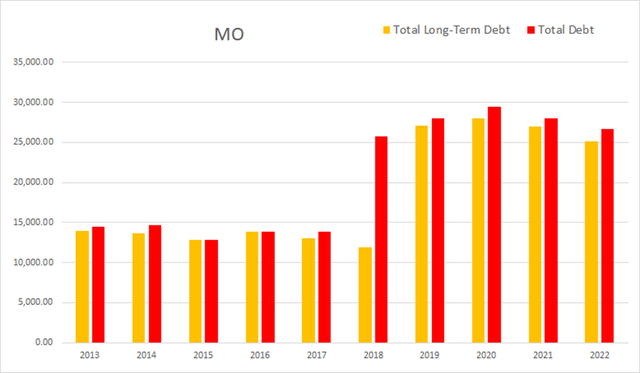

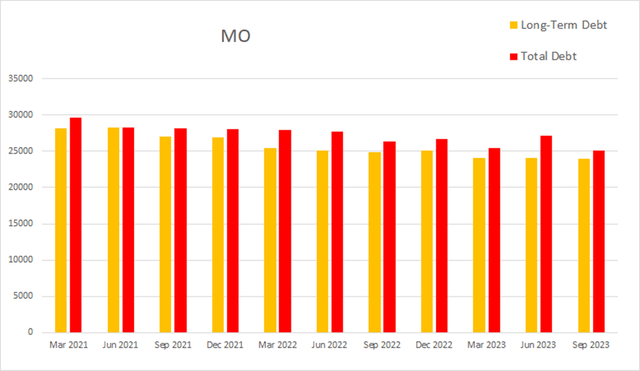

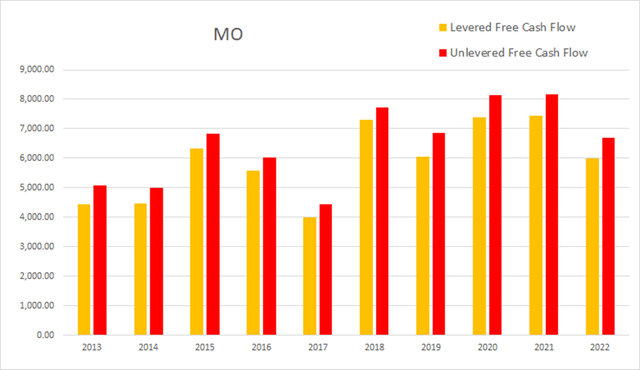

They experienced a significant rise in debt several years ago. It reached a peak in 2020, and has been falling since then. As of the 2022 annual report, they had -$1,055M in net interest expense, total debt was $26,680M, and long-term debt was $25,124M.

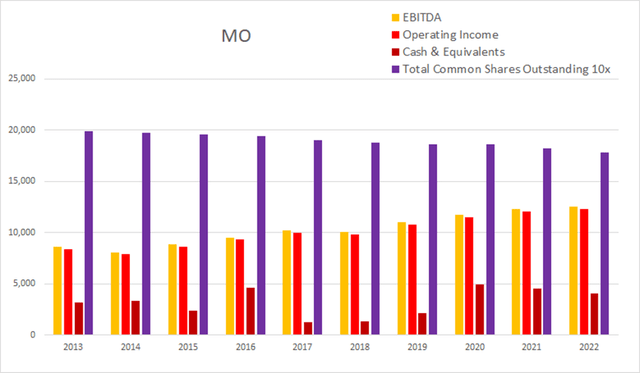

Their cash flow varies significantly from year to year. As of this most recent annual report, cash and equivalents was $4,030M, operating income was $12,301M, EBITDA was $12,527M, net income was $5,764M, unlevered free cash flow was $6,694.1M, and levered free cash flow was $5,991M.

MO Annual Cash Flow (By Author)

Their annual total equity has been falling and is currently negative. With their strong margins and significant cash flow they can safely carry more debt than they have in assets.

MO Annual Total Equity (By Author)

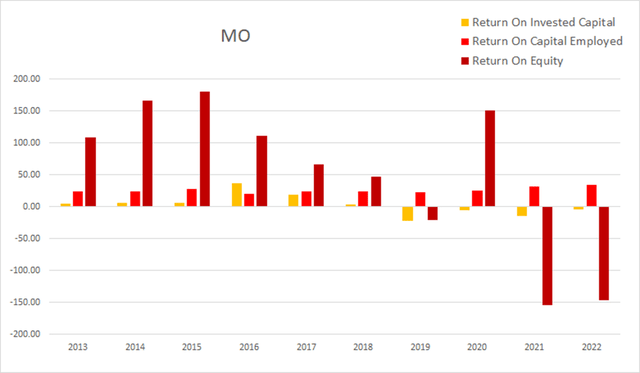

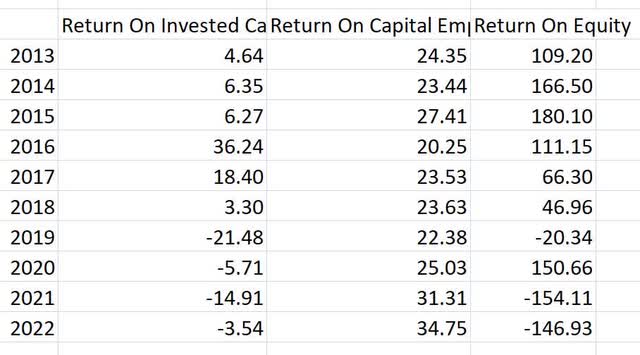

Their negative equity is producing negative values for ROIC and ROE. However, their ROCE has maintained attractive values.

MO Annual Returns Table (By Author)

As of the most recent annual report ROIC was -3.54%, ROCE was 34.75%, and ROE was at -146.93%.

Quarterly Financials

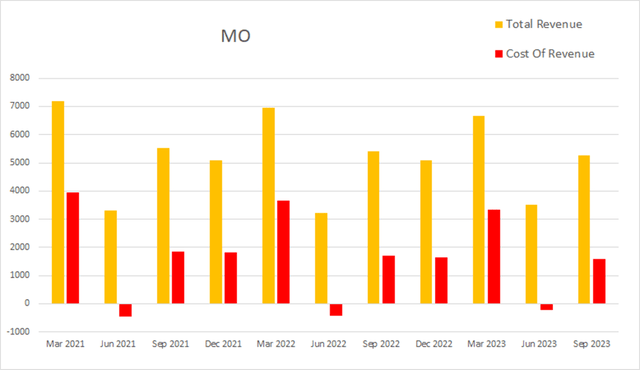

Their quarterly financials are showing clear seasonality. Their revenue is lower than average every Q2 and higher every Q1. Eight quarters ago Altria had a quarterly revenue of $5,531M. Four quarters ago that had declined to $5,412M. By this most recent quarter that had advance declined to $5,277M. This represents a total two-year reject of -4.59% at an average quarterly rate of -0.57%.

MO Quarterly Revenue (By Author)

Their margins are also showing seasonality. Their Q2 margins are more attractive than their average. As of the most recent quarter gross margins were 69.81%, EBITDA margins were 60.83%, operating margins were 59.31%, and net margins were at 41.05%.

MO Quarterly Margins (By Author)

They continue buying back shares. The sum of their last eight quarters of buybacks comes to 3.80%; over the last four quarters this has come in at 1.34%.

MO Quarterly Share Count vs. Cash vs. Income (By Author)

Their long-term debt continues to slowly reject. The most recent quarter, total debt was at $25,098M, and long-term debt was at $23,977M.

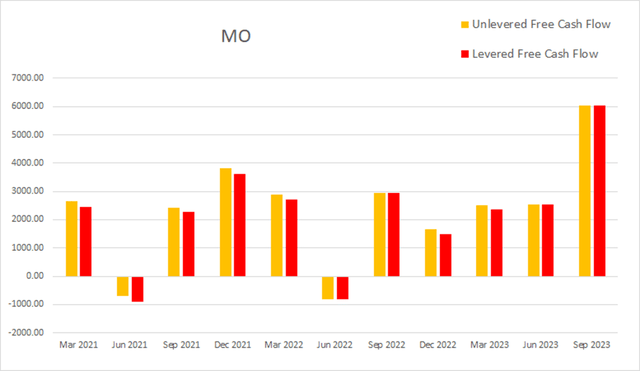

As of the most recent earnings report, cash and equivalents were $1,537M, quarterly operating income was $3,130M, EBITDA was $3,210M, net income was $2,166M, and both levered and unlevered free cash flow were $6,024.3M.

MO Quarterly Cash Flow (By Author)

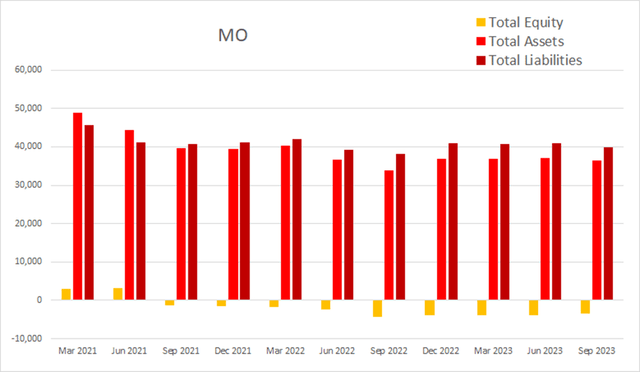

Total equity has been negative since Q3 2021.

MO Quarterly Total Equity (By Author)

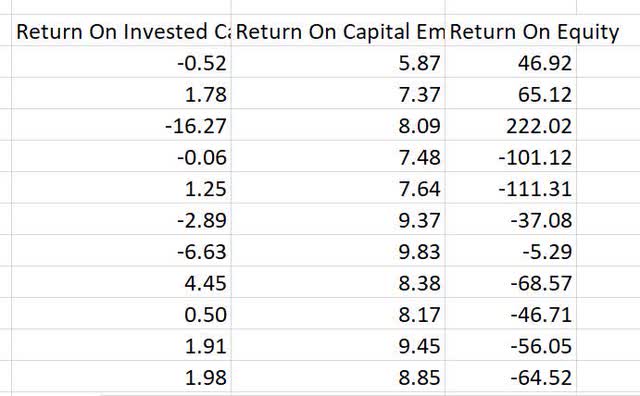

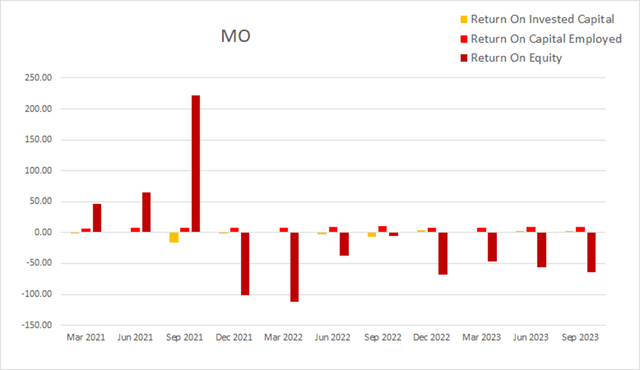

Again, their negative total equity is forcing ROIC and ROE into negative values, while ROCE remains attractive.

MO Quarterly Returns Table (By Author)

As of the most recent earnings report ROIC was 1.98%, ROCE was 8.85%, and ROE was -64.52%.

MO Quarterly Returns (By Author)

Valuation

As of December 15th, 2023, Altria had a market capitalization of $74.32B and traded for $42.11 per share. Using their forward P/E of 9.17x, their EPS Long-Term CAGR of 3.56%, and their forward Yield of 9.33%, I calculated a PEGY of 0.7114x and an Inverted PEGY of 1.406x. This calculate implies that intrinsic value is around $59.22 per share.

Risks

Altria is currently attempting to offset the reject in smoking rates by establishing themselves as a provider of smokeless tobacco products. It is possible that they are unable to preserve revenue parity as consumer trends to continue to shift. It is also possible they are unable to preserve the high margins and attractive returns as they lean more heavily on their smokeless products.

Catalysts

They continue to grow margins and use available cash to repurchase shares. Over longer timeframes this should allow them to continue raising dividends while increasing shareholder value.

When the laws finally change, Altria will be able to use their impressive cash flow to begin buying already established cannabis companies. The cannabis industry is projected to grow significantly in coming years and this expansion should allow for Altria to more easily grow revenue.

Conclusions

Altria is a dividend aristocrat. They have managed to find continued success even through a long-term reject in smoking rates. Their expansion into vaping and oral tobacco is wise and should help mitigate the problems that come with continued declines in smoking rates.

Their investment into Cronos Group Inc. was a strong indication that Altria plans to enlarge into cannabis. This company has a very long history of cutting costs while improving margins and should be able to apply their extensive go through to cannabis. While transitioning into smokeless tobacco is a step in the right direction, this is the business life cycle extension the tobacco industry is looking for. Altria is well positioned to take advantage of it as soon as they are legally allowed to.

While I don’t currently have a position in MO, I do frequently consider initiating one. With cannabis rescheduling approaching, and the potential passage of a version of SAFE banking, my desire to gain exposure has only risen. If the tobacco industry is allowed to gain exposure to cannabis, it would grant them an easy path to growing revenue. I believe MO trades at a low valuation because Mr. Market has labelled them as existing in a sunset industry. Being able to gain exposure to an entirely new industry should change this narrative and allow tobacco companies to go through a valuation improvement. I view this as an asymmetrical risk vs. reward situation. In the words of Mohnish Pabrai: ‘heads I win; tails I don’t lose much.’