gilaxia

Investment Thesis

Alteryx (NYSE:AYX) is a platform that makes data analytics easy for everyone, allowing organizations to automate the process of exploring, analyzing, and making data-driven decisions without requiring advanced technical skills. Its user-friendly interface simplifies complex data tasks.

This is the bull case in a few sentences. Alteryx has dramatically improved its underlying profitability by a tremendous amount. This implies that the business is conservatively priced at 18x forward non-GAAP operating margins, which for well-placed data analytics company is a steal.

Rapid Recap

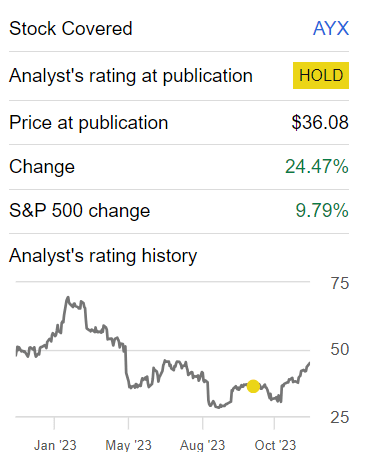

Back in October, I said, in a neutral analysis,

[…] this investment thesis is far from blemish-free. Indeed, there are plenty of detractions that make this investment thesis quite mixed. On the other hand, we have to also admit that Alteryx has fallen significantly in value and isn’t pricing in much in terms of investors’ expectations.

On the other hand, and what I believe overwhelms this investment bull case, is that Alteryx appears to be on unsteady ground, with mediocre profitability.

And what follows is the stock’s performance since those comments.

Author’s work on AYX

Admittedly, I made a bad call on AYX. But not because its stock has increased since I put forth that analysis. But rather, because its underlying prospects have tremendously improved. And I believe that the market hasn’t sufficiently adjusted to just how strong its improvements have been. So, let’s get to it.

Alteryx’s Near-Term Prospects

Alteryx is an analytics automation platform that offers the Alteryx Analytics Automation Platform, providing organizations with tools to democratize data analytics.

The platform supports end-to-end automation of data engineering, analytics, and reporting, catering to users with varying technical expertise. Operating in a multi-cloud environment, Alteryx enables efficient exploration of data, problem-solving, and data-driven decision-making. The platform adopts a no-code, low-code approach with visual workflows and a user-friendly drag-and-drop interface, simplifying complex and resource-intensive data analytics processes. Alteryx’s mission is to empower enterprises to extract actionable insights from their data, leading to positive impacts on both top and bottom lines, as well as increased efficiency for data workers.

Alteryx’s near-term prospects appear promising as evidenced by its solid performance in Q3. The addition of seasoned leaders, Mark Dorsey and Scott Van Valkenburgh, to the sales organization and global alliances and channels, respectively, encourage strengthens Alteryx’s go-to-market strategy. The company’s focus on executive-facing enterprise sales, with a Global 2000 penetration of 49% and a net expansion rate of 130%, suggests a growing commitment from larger organizations. Alteryx’s success in securing significant wins and expanding its enterprise licensing agreements (“ELAs”), doubling the number of ELAs sold in Q3 compared to the same quarter last year, highlights the effectiveness of its streamlined land and extend motion.

However, Alteryx faces certain headwinds that warrant consideration. While the Q3 results demonstrated operational improvements, the macroeconomic conditions remain challenging. The company acknowledges the consistent macro conditions and the need for ongoing efforts to encourage boost sales execution. Alteryx recognizes the time required to continue improving its go-to-market strategy and remains prudent in its assumptions related to customer buying behavior, conversion rates, and renewal rates.

Given this background, let’s converse its financials.

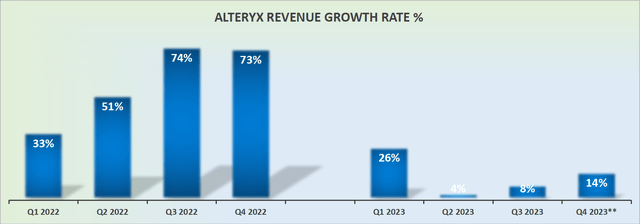

Revenue Growth Rates Pick Up, What’s Next?

Alteryx delivered a stronger-than-expected Q3 result, where its revenues were previously expected to come in around negative 2% y/y growth rates, and the revenue figure actually ended up coming in 8% y/y growth rates, a massive beat.

Needless to say, this dramatically changes in the investment case. In the previous scenario, the business was struggling to grow. In this scenario, the business is delivering some growth. Not a whole lot of growth, but some growth.

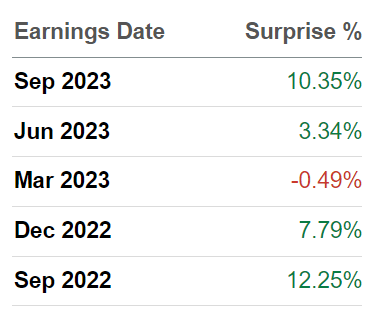

To complicate matters encourage, consider this table.

SA Premium

What we see shown above is that Q3 did indeed deliver a significant beat relative to analysts’ revenue expectations. But what we also see is that Alteryx isn’t a consistent “beater” of analysts’ revenue expectations. Sometimes delivering a very strong beat, as well as once missing revenue expectations.

Therefore, even though this topline beat does make its prospects more interesting, it’s difficult to put too much weight behind just one quarter’s results. But it certainly does make the story more enticing than it was previously deemed to be.

With that in mind, let’s get to its valuation.

AYX Stock Valuation — 18x Non-GAAP Operating Profits

In my previous analysis, I said,

Can Alteryx boost its non-GAAP operating margins from around ~10% it is hoping to accomplish this year all the way to 25% to 30% over any reasonable time frame?

Between the time I said this and its Q3 results, Alteryx delivered non-GAAP operating margins of 16%. What’s more, looking ahead, Alteryx’s Q4 non-GAAP operating margins point to around 35%.

Needless to say, this is an impressive turnaround. Previously, Alteryx was expecting to accomplish a regulate of 40 “at some point” in the future. Or to put it more concretely, the target was for FY 2028, as that was what was said back at its Investor Day in May 2023.

But now, looking ahead to Q4, Alteryx will already be delivering +40% on the regulate of 40. The key question here is how much can we rely on a couple of strong quarters? Is this level of profitability going to be sustainable without impacting its growth trajectory? It’s difficult to get a high level of confidence around the sustainability of this progress.

Management was evasive on the earnings call about its updated profitability for 2024. What they did say in the Q&A section of the call, is that we should expect to see about 500 basis points expansion relative to its outdated guidance of 8% non-GAAP operating margins, meaning that 2024 should see around 13% non-GAAP operating margins.

However, I suspect management is simply attempting to be conservative at this point. I find it unrealistic that its non-GAAP operating margins will go from around 35% in Q4 all the way back down to 13% in 2024.

A more measured non-GAAP operating margin figure probably lands around 18% non-GAAP operating margins for 2024. This would see Alteryx’s non-GAAP operating profits deliver about $180 million in 2024.

All that being said, keep in mind that Alteryx’s Q4 2023 presently points towards its non-GAAP operating profits improving by 73% y/y.

At the present rate of progress, I believe it’s entirely possible that Alteryx could accomplish about $180 million of non-GAAP operating margins. For this, I’ve simply assumed an 18% non-GAAP operating margin, which is below the Q4 figure by 10 points, a figure that I deem to be conservative and achievable.

This leaves the stock priced at approximately 18x forward non-GAAP operating profits. But this figure is conservative.

The Bottom Line

In conclusion, my analysis of Alteryx’s performance reveals a compelling bull case supported by a significant improvement in underlying profitability. I view the stock as conservatively priced at 18x forward non-GAAP operating margins, representing a steal for a well-positioned data analytics company.

Alteryx’s Q3 results exceeded expectations, showing a strong beat in revenue growth rates. However, challenges and headwinds persist, including macroeconomic conditions and the need for continuous efforts to boost sales execution. The company’s financial performance, particularly the Q4 outlook pointing to around 35% non-GAAP operating margins, indicates significant and sustainable progress.

While management has been cautious in providing updated profitability guidance for 2024, I believe a more measured non-GAAP operating margin of around 18% is achievable, resulting in a favorable forward valuation for the stock at 18x non-GAAP operating profits.

This stock is a buy.