ChayTee

Company Overview

Altair Engineering (NASDAQ:ALTR) is a leading provider in the simulation solutions market, recognized for its expertise in high-performance computing (HPC), data analytics, and artificial intelligence (AI). Altair caters to a wide range of industries, predominantly serving the automotive and aerospace sectors, which combined for 39% of its sales in 2022. The company’s core strategy is to revolutionize enterprise decision-making by integrating simulation, HPC, and AI. This is achieved through a comprehensive portfolio including physics solvers, optimization and HPC technology, and AI and digital twin solutions platforms.

Key strategies of Altair include offering open access to its products in a fragmented industry, developing user-friendly solutions like SimSolid for a broader range of professionals, and utilizing a unique units-based licensing model. This model facilitates flexible access to Altair’s applications, promoting usage expansion and consolidation.

Altair’s products are known for their “stickiness,” primarily influenced by customer R&D budgets, which remain a priority even in uncertain economic conditions. The company is committed to continuous investment in growth, allocating 25%-30% of its sales to R&D and engaging in mergers and acquisitions, with around 50 companies acquired to date. A notable acquisition was Datawatch in 2018, which enhanced Altair’s analytics and data science capabilities.

The company operates mainly in two segments: Software, accounting for approximately 95% of its sales, and Client Engineering Services. With a high recurring software license rate of over 90%, Altair enjoys a recurring revenue that forms about 80% of its total sales. Growth predominantly stems from expansion within its existing customer base, historically representing about 60% of new software revenue.

Superior Software Portfolio

Altair possesses a superior software portfolio encompassing three primary areas:

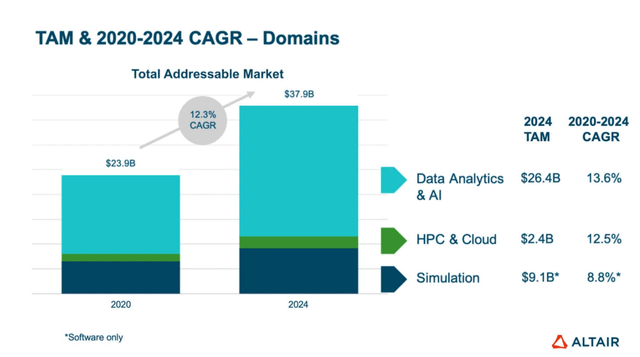

Physics Simulation and Concept Design: At the heart of Altair’s simulation software portfolio are mathematical solvers used to compute advanced algorithms, which are crucial for solving complex multi-objective design problems. Altair’s modeling and design tools are becoming more user-friendly, and they believe they have the potential to replace traditional Computer-Aided Design (CAD) in both the mechanical and electronics worlds. SimSolid, its fastest-growing product, takes the complexity out of simulation and is helpful in the upfront design phases where engineers need to solve problems. At its 2021 Investor Day, Altair forecasted significant growth in the simulation software market, expecting an 8.8% CAGR, reaching $9.1 billion by 2024.

High Performance and Cloud Computing: Altair’s HPC software optimizes computing resources and manages workflows for compute-intensive tasks. These applications are crucial across various fields like banking, insurance, weather prediction, bio-informatics, and product development. With the increasing reliance on mixed computing environments, Altair’s HPC solutions are becoming more essential. Altair’s HPC team works in synergy with their simulation, data analytics, AI, and IoT teams to ensure interoperability and a unified user experience. At its 2021 Investor Day, Altair forecasted the HPC and cloud market would grow at a 12.5% CAGR, reaching $2.4 billion by 2024.

Data Analytics, AI, IoT, and Smart Product Development: Altair offers a range of solutions in this domain, including code-free and code-friendly tools for data preparation, data science, MLOps, and visualization. These tools are vital in various industries, including banking, healthcare, and manufacturing. Altair’s acquisition of Datawatch in 2018 and subsequent acquisitions have significantly enhanced its data analytics and science capabilities. The RapidMiner platform, resulting from these acquisitions, is a key differentiator for Altair, offering integrated yet flexible solutions. The data science and analytics segment is the fastest-growing part of Altair’s business, with the total addressable market projected to expand at a 13.6% CAGR to $26.4 billion by 2024.

2021 Investor Day Presentation

Additionally, Altair has been integrating AI into its core simulation products, exemplified by the recent launch of the PhysicsAI solution. This AI technology enables engineers to optimize designs in real time based on previous simulation runs. Altair’s venture into AI is transforming engineering design and process development, helping customers improve product quality and efficiency.

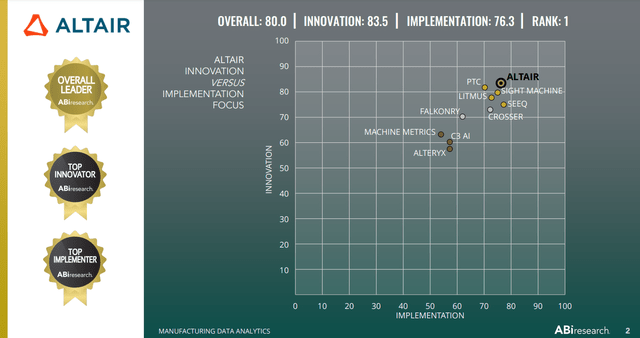

Altair’s commitment to blending simulation, HPC, and data analytics has been recognized by ABI Research, which ranked Altair as the top vendor for manufacturing data analytics. This accolade underscores Altair’s success in extending its capabilities beyond traditional simulation, marking its prominent position in the industry.

Competitors

In the competitive landscape of simulation, HPC, data analytics, and AI software, Altair operates in a highly fragmented market. It is common for customers to use Altair’s solutions alongside those of its competitors.

Altair’s breadth of products competes with other application software companies, such as ANSYS (ANSS), the most comparable pure-play simulation peer, as well as data analytics-focused competitors like Autodesk (ADSK) and PTC (PTC), among others, including many smaller software application providers.

Compared with ANSYS, Altair has historically concentrated more on mechanical simulation and has yet to enter the chip design space significantly. In contrast, ANSYS has progressed in Electronic Design Automation (EDA). While Altair has traditionally been more vital in pre- and post-processing, ANSYS has had an edge in solvers. However, Altair has been enhancing its solver capabilities and rounding out its portfolio.

Financial Overview

Altair’s financial overview reflects a highly attractive profile common among broader industrial software companies, characterized by a combination of high, sticky growth, best-in-class gross margins, and strong free cash flow (FCF), attributable primarily to its asset-light business model.

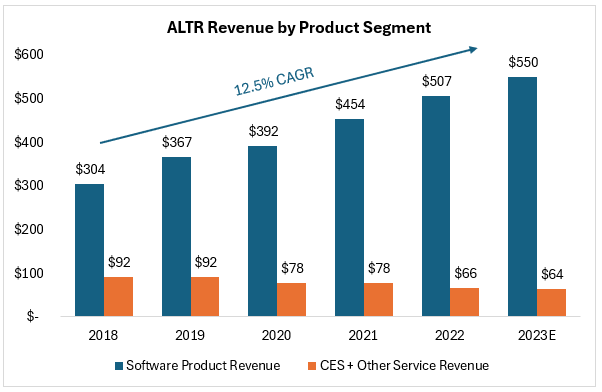

Altair has exhibited strong revenue growth, surpassing general macroeconomic indicators. Specifically, its software product revenue has grown by 12%, outpacing the broader simulation and analysis market’s 9% growth. This indicates that Altair is gaining market share and has successfully met growth targets set during its 2021 investor day.

While software product revenue has grown significantly, Altair’s services business (Software Related Services and Client Engineering Services) has notably declined. Altair has grown total revenue at a 9.1% CAGR since 2018, while software product revenue has grown at 12.5%, indicating that the services business is dilutive to its revenue growth targets. However, the services business remains vital due to the complexity of Altair’s products. There is potential for optimization or outsourcing of these services as Altair scales.

Company Data Consolidated by Author

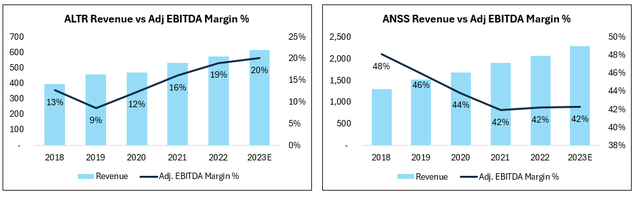

Altair has experienced steady growth in margins alongside sales, with the software product gross margins at 88% and EBITDA margins around 20%. The company has largely achieved its 2021 investor day targets for gross margins (over 75%) and EBITDA margins (20% by the end of 2023). There is still room for improvement in EBITDA margins as the business scales and optimizes R&D and SG&A expenses.

Altair aims to grow its blended gross margins by shifting the mix more towards software (from 70% in 2017 to about 90% currently) and by increasing standalone software gross margins. As revenue grows, the cost of sales (including customer tech support and some royalties) is expected to remain contained, suggesting that software product gross margins could rise above 90%, leading to overall blended gross margins exceeding the current 80% range.

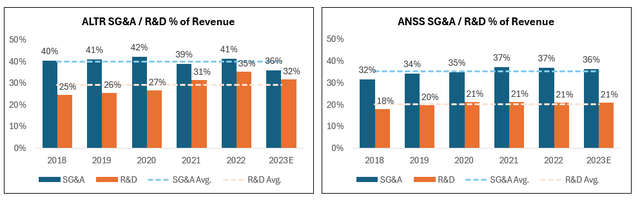

Altair faces a significant cost burden to support growth, reflected in R&D and SG&A expenses on the income statement and capex and acquisitions on the balance sheet. This heavy investment in growth, particularly in R&D, is a characteristic feature of Altair. SG&A expenses as a percentage of revenues are expected to decrease from its 5-year average of 40% to 36% for 2023, which is mainly in line with ANSYS. Meanwhile, R&D expenses remain elevated and continue to grow, now around 32% of revenues compared to 20% for ANSYS.

Company Data Consolidated by Author

Altair’s margin resilience is hard to predict, as the company has not experienced a down year in the past eight years. It has been steadily growing margins as the business scales. In contrast, peers like ANSS have seen declining margins despite sales growth over the same period.

Company Data Consolidated by Author

Risks

Altair’s business, while resilient, faces several risks that could impact its performance:

Broader economic conditions could negatively influence Altair’s business. Although software subscriptions generally offer some protection in a downturn, severe economic challenges might lead to reductions in R&D spending, affecting Altair’s revenue. The company’s reliance on one-year deals and license exposure could fluctuate significantly. Also, services, which constitute about 10% of sales and are more vulnerable in downturns, could be impacted.

With nearly 40% of sales tied to the automotive and aerospace sectors, Altair is susceptible to industry fluctuations, especially in the EV market. While ongoing R&D investments are expected to continue, a severe downturn could materially affect the business.

The highly fragmented nature of the industry means intense competition from both large firms and smaller entities offering similar products. This competition could lead to price reductions, loss of market share, and decreased profitability for Altair.

Altair’s significant investments in R&D (25-30% of sales) to drive growth may impact short-term profitability. The success of these investments in product development is not guaranteed and could impact the company’s competitive position and financial health.

Although historically successful with about 50 acquisitions, Altair’s acquisitive strategy carries risks. Challenges in evaluating assets, forecasting financial impacts, and integrating acquisitions effectively could dilute shareholder value and distract from the core business.

Altair’s financial results could be uneven due to the seasonal nature of its business, particularly with billings and cash flow patterns. The lack of a smoothed-out revenue metric could lead to quarterly fluctuations.

With significant revenue generated outside the US (about 50%), primarily in euros and yen, currency fluctuations could adversely affect revenue and earnings. Altair’s historical approach of not hedging revenue exposures increases this risk.

These risks highlight the need for strategic management and adaptation to ensure Altair navigates through potential challenges while capitalizing on its growth opportunities.

Final Thoughts

The company’s innovative blend of simulation solutions, high-performance computing, and data analytics and AI advancements set it apart in a competitive and fragmented industry. Altair’s strategic initiatives, including its unique licensing model and user-friendly products, have enabled it to penetrate various market segments and grow its customer base consistently.

The company’s financial health, marked by strong revenue growth and high gross margins, is commendable. Altair’s robust software portfolio, especially in physics simulation and HPC, positions it well to capitalize on the growing market demand, as evidenced by its aggressive growth forecasts. However, this optimistic outlook has its challenges. The company’s heavy investment in R&D, while a testament to its commitment to innovation, does weigh on its near-term profitability. The risks associated with economic fluctuations, particularly its exposure to the volatile automotive and aerospace sectors and the challenges in integrating numerous acquisitions, cannot be overlooked.

Given these considerations, a “hold” recommendation on Altair’s stock seems practical. The current valuation, at a significant forward EBITDA multiple of 53x, suggests that the market has high expectations for future growth. Investors might find this an opportune moment to observe how Altair navigates these complexities and leverages its strengths in the evolving technological landscape. The key will be Altair’s ability to maintain its innovative edge while managing the inherent risks of its aggressive growth strategy and external economic influences.