David Becker

Alibaba Group Holding Limited (NYSE:BABA) stock has been one of the most puzzling picks in my portfolio as China’s e-commerce leader undergoes a significant leadership transition. Investors should be aware that new CEO Eddie Wu has taken over the helm of Alibaba Cloud and its e-commerce unit on top of his responsibilities as the Group CEO. Therefore, I believe the market is assessing whether there could be a fundamental shift in its strategic and tactical priorities as Alibaba faces increasingly intense challenges from ByteDance (BDNCE) and Pinduoduo (PDD) in China.

Alibaba Chairman Joe Tsai underscored the substantial challenges facing Alibaba amidst the uncertainties. However, Tsai also pointed out the need for the company to “confront its past and evolve for the future.” He accentuated Eddie Wu is expected to “drive strategic alignment and substantial resource investment across Alibaba’s core commerce businesses, integrating cloud computing and e-commerce.”

As a result, I believe Wu’s “triple-hatting” role makes sense as Alibaba attempts to integrate its e-commerce and cloud leadership better, as it also faces challenges from Baidu’s (BIDU) generative AI capabilities and Huawei’s resurgence.

In other words, Alibaba is facing significant challenges in the e-commerce and cloud computing segments that require a decisive response that behooves a return of Wu and Tsai to Alibaba’s leadership. I assessed that it should underpin the market’s confidence in Alibaba’s resolve to rectify its past missteps while undertaking the necessary steps to rejuvenate recovery. Therefore, Wu’s decision to take over the e-commerce leadership role is essential.

Taobao and Tmall Group, or TTG, generated more than 43% of Alibaba’s group revenue in its most recently reported second fiscal quarter, or FQ2’24, in November 2023. Moreover, TTG generated RMB47B in segment adjusted EBITA, above its group segment adjusted EBITA of RMB44.8B when considering other segment losses. In other words, Alibaba still needs TTG to drive its bottom line growth, even though Alibaba Cloud posted an adjusted EBITA of RMB1.41B in FQ2, up 44% YoY.

Cloud has continued to face struggles as Alibaba shelved the spin-off for Alibaba Cloud Intelligence. The decision was attributed to the uncertainties over the US chips export restrictions, hobbling its efforts. As a result, investors anticipating Alibaba Cloud’s spin-off to unlock value for their shares were likely disappointed. With the US looking to increasingly hobble China’s efforts to build advanced AI, Alibaba’s lead in China’s cloud computing space could come under further threat. Moreover, Baidu and Huawei have demonstrated strong execution in their chip design efforts, notwithstanding the US’s efforts to hamper their ambitions. Could Alibaba have been more aggressive in stockpiling the required AI chips to circumvent the restrictions in the near term? Given ex-CEO Daniel Zhang’s leadership as Alibaba Cloud’s previous leader, I’m surprised that Alibaba seems to have fallen behind in its quest to maintain its market leadership, even as peers seem to be catching up in e-commerce and cloud computing.

BABA’s attractive valuation has long been discussed. With a forward adjusted EBITDA multiple of 4.9x, it’s cheap. My observation is corroborated by Seeking Alpha Quant’s “B” valuation grade. However, PDD’s 54% surge over the past year, compared to BABA’s almost 30% decline, underscores the market’s perspective of Pinduoduo’s growing clout. Note that BABA’s market cap of $183B is already below PDD’s $195B. ByteDance has also emerged as the frontrunner in this race, with a private valuation that was reportedly above $200B. Therefore, I believe there is a significant shift in market sentiments toward BABA’s ability to maintain its leadership.

However, BABA is still assigned a “B” growth grade and bolstered by a best-in-class “A+” profitability grade. In other words, the valuation bifurcation in BABA suggests it could be viewed as a value trap or unreasonably hammered by extreme pessimism.

Despite that, I believe BABA, as a fundamentally strong stock, has been tested and validated. Notwithstanding the struggles over the past three years, the company’s wide-moat business model showed that it could withstand intense challenges to its market leadership. However, it has also affected its growth capabilities, as it likely took its eye off its more adroit and innovative peers keen to usurp Alibaba’s throne.

BABA investors have been given hope, as the return of co-founder Eddie Wu as Group CEO underscored the group’s recognition of the immense challenges that lie ahead. Wu’s decision to take charge of TTG and Alibaba Cloud accentuates my belief that management is committed to overturning the pessimism in the market, helping lift BABA from the worst battering in recent memory.

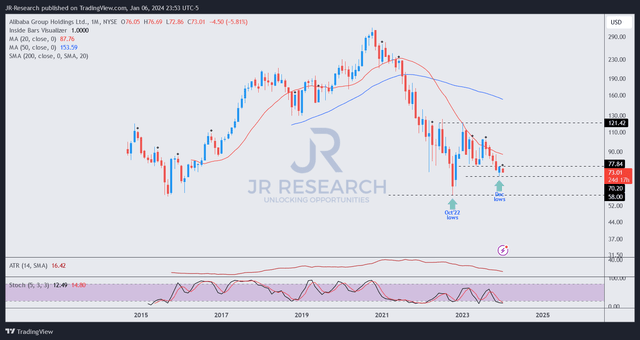

BABA price chart (monthly, long-term) (TradingView)

Notwithstanding the execution challenges, market uncertainties, and leadership transition, BABA remains markedly above its October 2022 low of $58. I must stress why this is an important observation because it suggests that the worst is likely over for BABA.

In other words, BABA has likely reached peak pessimism, although the buying momentum could take a while to recover. However, BABA’s dip buyers returned in December 2023 as they attempted to retake the $78 level. Retaking that level decisively could spur stronger buying momentum to return, completing a bear trap (false downside breakdown). We still have a couple of months to go before I can ascertain whether the $78 level can be regained with conviction.

Despite that, the market’s confidence in BABA (not allowing a worse selloff to October 2022 lows) is constructive. In addition, BABA’s growth and valuation metrics suggest a bifurcation that can be attributed to several factors, including geopolitical risks. However, PDD’s resurgence demonstrates that investors could be willing to overlook these headwinds if Alibaba executes better under Wu’s leadership.

As a result, I believe BABA’s bullish thesis remains unbroken, with a more robust recovery to follow if we can decisively regain control of the $78 zone.

Rating: Maintained Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!