maybefalse/iStock Unreleased via Getty Images

Investment thesis

My previous bearish thesis about Alibaba (NYSE:BABA) aged well, as the stock tanked by almost 17% since mid-September. While I comprehend that the risks of investing in Chinese stocks in general and in Alibaba are inherently risky due to massive political risks and headwinds in the macro economy, I believe the stock is too cheap at the moment. In my opinion, the sell-off after the cancellation of the restructuring plans was the market’s overreaction. My valuation analysis under very conservative assumptions suggests that the stock is more than 60% undervalued. From a fundamental perspective, Alibaba is a high-quality business that is well-positioned to absorb multiple positive tailwinds. Overall, I believe the current stock price provides a good investing opportunity and I assign BABA a “Strong Buy” rating.

Recent developments

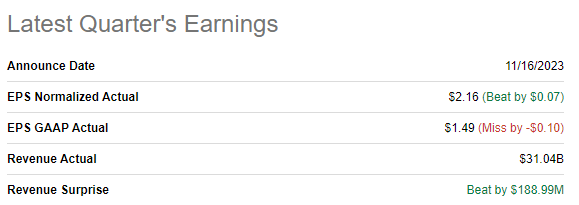

BABA released its latest quarterly earnings on November 16, when the company topped consensus estimates. Revenue increased by 7.2% YoY, and the adjusted EPS expanded notably. The EPS strength was ensured by robust operating leverage as the operating margin expanded YoY from 12.13% to 14.94%.

Seeking Alpha

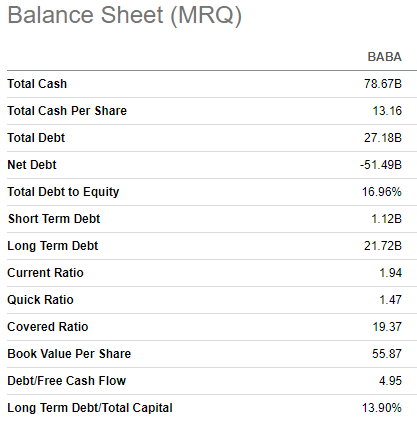

The strong operating performance allowed BABA to produce $5.8 billion in levered free cash flow [FCF], and the company continued to improve its balance sheet. As of the latest reporting date, Alibaba had almost $79 billion in outstanding cash, around three times higher than the total debt. Liquidity metrics are also stellar. Alibaba’s fortress financial position makes the company well-positioned to fuel growth and innovation.

Seeking Alpha

Despite delivering strong quarterly performance, the stock price declined by more than ten percent in one day after the earnings release went live. The reason for investors’ disappointment is after the announcement that the company’s plans to spin out BABA’s cloud computing division were canceled. The plans to restructure the business were shared by Alibaba in March 2023, and it met a lot of optimism from investors as it was expected that the cloud-business spin-off would help it to be more flexible in the constantly evolving environment. I think this was the market’s overreaction as the stock price dipped below the early March 2023 levels.

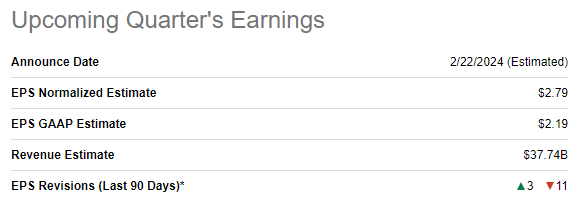

The earnings release for the upcoming quarter is scheduled for February 22, 2024. Quarterly revenue is expected by consensus at $37.74 billion, which indicates a 5% YoY enhance. The adjusted EPS is expected to stay flat at $2.79.

Seeking Alpha

For the full fiscal 2024, consensus estimates forecast an 8.6% YoY growth, which is solid. Profitability is also poised to enlarge by 17% YoY, another bullish sign. I think that positive earnings expectations are fair, given that the company is well-exposed to several of the hottest technological shifts, admire e-commerce, cloud computing, and artificial intelligence [AI]. According to statista.com, the Chinese e-commerce market is expected to compound at 10% annually over the next five years, which is a solid tailwind for Alibaba’s core business.

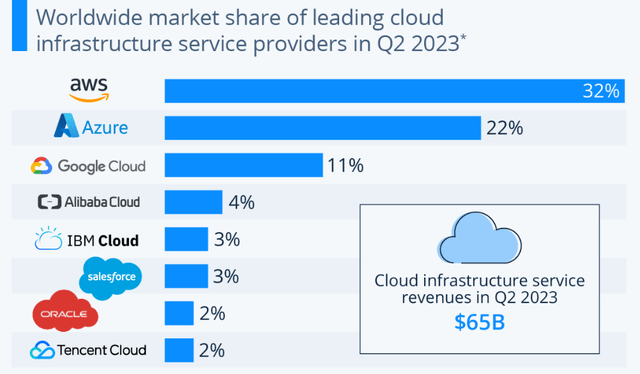

Alibaba is well behind the American technological hyper scalers in the cloud infrastructure global market share, but 4% of the global market is still a substantial share of the big pie. Being by far the leading cloud company outside the U.S. makes Alibaba well-exposed to capitalize on the 13% cloud market CAGR up to 2030.

Having vast amounts of data accumulated by Alibaba’s diversified set of businesses also makes the company well-positioned in the AI and machine learning [ML] fields. For example, data from e-commerce transactions can furnish insights into consumer preferences and market dynamics, while financial data can be leveraged for risk analysis and fraud detection. This multifaceted dataset creates a holistic view of various aspects of business and consumer activities.

BABA stock valuation

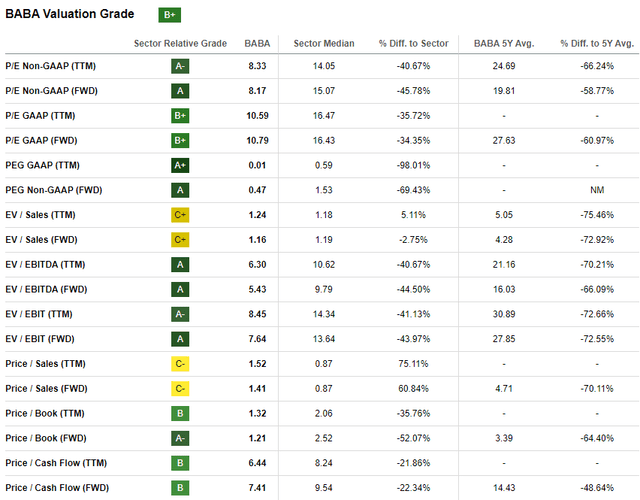

BABA tanked by 21% year-to-date, underperforming both the broader U.S. stock market and the iShares MSCI China ETF (MCHI). Seeking Alpha Quant assigns Alibaba’s stock a high “B+” valuation grade because the ratios are significantly lower than historical averages and the sector median. From the valuation multiples perspective, BABA looks substantially undervalued.

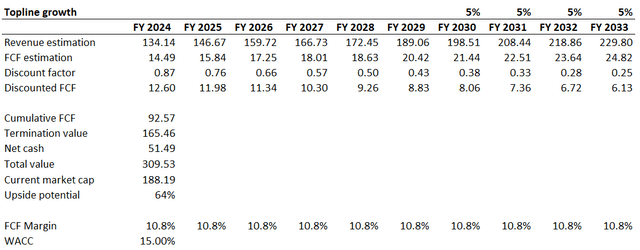

I want to proceed with the discounted cash flow [DCF] simulation. I use a high 15% WACC due to inherently high political and geopolitical risks for all Chinese public companies listed in the U.S. I use a very conservative assumption that the FCF margin will be flat at 10.8%, which is the current TTM level. I have revenue consensus estimates available up to FY 2029 and forecast a 5% CAGR for the years beyond. As a result of the combination of consensus estimates and my long-term revenue growth projection, the revenue CAGR for the next decade is 6.2%, which is very conservative.

According to my DCF simulation, the business’s fair value is approximately $310 billion. This is 64% higher than the current market cap, indicating a massive upside potential. That said, my target price for BABA is $120.

Risks of investing in BABA stock

As my analysis suggests, the current Alibaba’s stock price is far from underlying fundamentals, which keep improving. It is well-known that investors’ sentiment prevails over fundamentals in the short-term perspective. However, Alibaba’s stock price seems to be in a secular reject because it has been falling for over three years with temporary short-term bounces. Investor’s fears started when the company’s iconic founder, Jack Ma, suddenly disappeared in late 2020 after publicly criticizing the Chinese government. Subsequently, the company underwent multiple restructurings due to regulatory interventions by the Chinese government. I believe these events contribute significantly to the persistently negative sentiment among investors towards BABA. That said, there is a high level of uncertainty regarding the timing of the sentiment pivot towards Alibaba stock.

Uncertainties regarding the Chinese economy are also a substantial risk for one of its largest companies. The real estate sector, a cornerstone of any economy, is in a “slow-motion” crisis. The real estate boom was one of the main drivers that fueled the Chinese economic miracle, and difficulties in the sector apparently weighed on the broader economy’s growth. Apart from this, let us also not underestimate the potential adverse effect on the economy of the demographic shifts. That said, despite having strong secular technological tailwinds, Alibaba also faces macro headwinds.

Bottom line

To deduce, Alibaba is a “Strong Buy” at the current stock price level. The risks of investing in BABA are substantial, but I believe the upside potential far outweighs all the uncertainties. The company is fundamentally strong, and its balance sheet positions Alibaba strategically to continue investing in growth and innovation. I agree with bright consensus revenue and EPS forecasts as the company is well exposed to the hottest technological trends within industries expected to compound double digits in the next decade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.