maybefalse/iStock Unreleased via Getty Images

Introduction

Despite multiple-fold business expansion over the last ten years, Alibaba’s (NYSE:BABA) stock currently trades below levels when the company went public on the U.S. stock market. While acknowledging political risks and geopolitical tensions, Alibaba remains a formidable player in the world’s second-largest economy, showcasing exceptional scale and efficiency across its diverse business lines. The company’s robust balance sheet empowers substantial investments in research and development, ensuring long-term growth and strategic resilience. With a target price of $178, implying significant upside potential and considering Alibaba’s stellar profitability, the stock emerges as a compelling ‘Strong Buy’ opportunity, offering substantial potential benefits for investors.

Fundamental analysis

Alibaba is a Chinese, one of the largest technological companies in the world, operating in several segments exposed to various industries, including e-commerce, cloud, smart logistics, and digital media. It is important to mention that all of Alibaba’s businesses form an ecosystem, which gives the company advantages in driving down customer acquisition and retention costs.

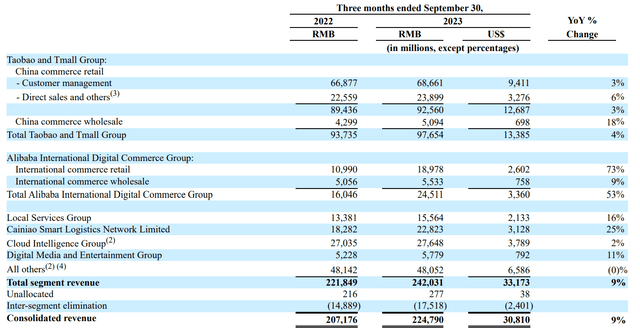

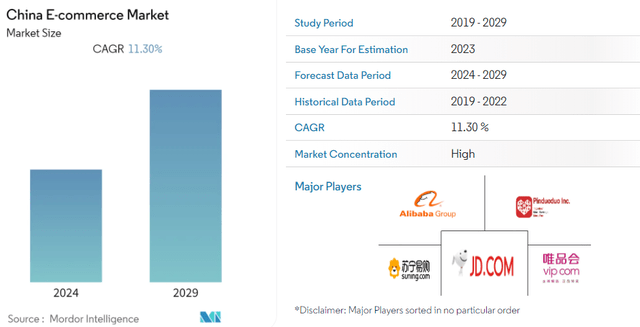

As can be seen above, in Q3, e-commerce represented more than half of Alibaba’s total sales, and I will start my analysis with it. Apart from the e-commerce itself, I consider Local Services Group and Smart Logistics to be closely tied to this business as well. According to Statista, the number of active consumers across Alibaba’s online shopping properties has doubled between 2017 and 2022, which indicates a strong 15% CAGR. Having more than 900 million annual active customers makes Alibaba a very attractive platform for merchants, and there are more than 8 million sellers there. Given its immense scale and international reach, Alibaba’s e-commerce business is firmly entrenched in the industry, making replication nearly impossible. This is important and positive for investors because the Chinese e-commerce market is expected to grow at an 11.3% CAGR by 2029, a huge tailwind for Alibaba’s biggest business.

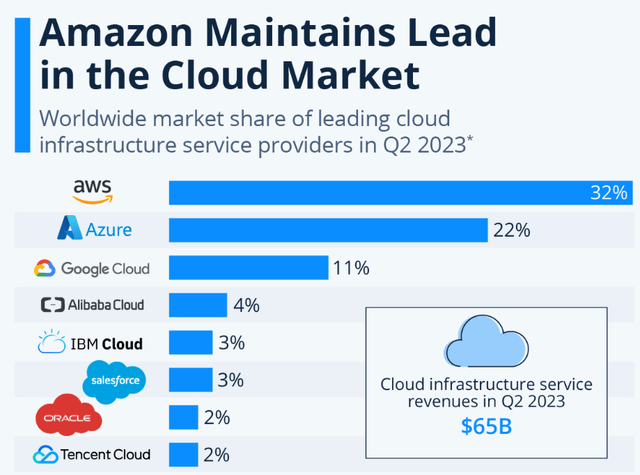

Alibaba stands out as a significant player in the cloud business, securing a 4% global market share and ranking fourth, trailing behind American technology giants such as Amazon (AMZN), Microsoft (MSFT), and Google (GOOG). I must emphasize that Alibaba faces certain constraints in its global cloud expansion due to cybersecurity and potential espionage concerns amid the ongoing tensions between the East and West. However, these challenges also serve to safeguard Alibaba’s stronghold in its local market, the world’s second-largest economy. While I personally haven’t used Alibaba’s cloud services, I believe that the company’s extensive e-commerce database, enriched with data on advertising, spending patterns, and more, provides a robust foundation for its artificial intelligence (“AI”) and machine learning (“ML”) algorithms. This, in turn, positions Alibaba to develop sophisticated AI capabilities for its cloud services. The Chinese cloud market is forecasted to deliver an impressive 18.7% CAGR during the next five years, which is another big positive trend for Alibaba. It is also important to outline that Alibaba’s “All others” line in the P&L is mostly represented by AI-leveraged services like DingTalk, Quark, and UCWeb.

Although Alibaba’s Digital Media and Entertainment business currently represents a smaller segment than the company’s vast scale, I see it as a crucial component that generates solid synergies that benefit the overall business. This strategic alignment, I believe, contributes to driving growth not only in the Digital Media and Entertainment sector but also positively impacts the core pillars of Alibaba’s business, namely E-commerce and Cloud services. With nearly a billion annual active buyers, Alibaba holds a substantial advantage for potentially cultivating its Digital Media and Entertainment business into a noteworthy revenue stream. However, I remain cautious about the feasibility of rapid growth prospects in the next few years.

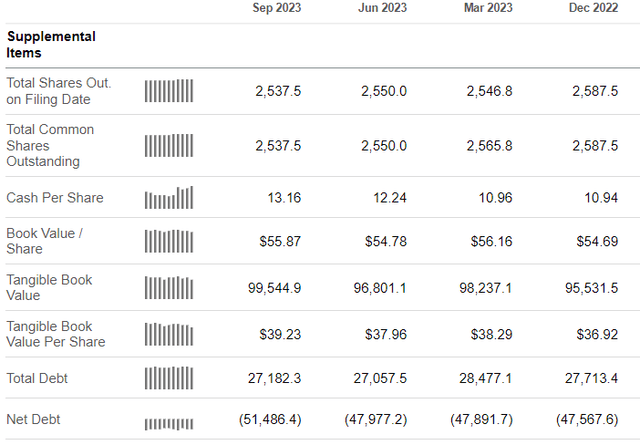

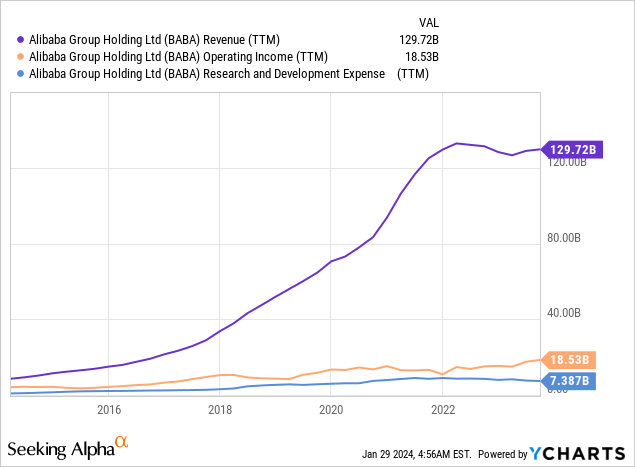

While having robust exposure to emerging industries and a massive scale is certainly valuable, skeptics argue that it might not be sufficient, and I tend to agree. To assess the likelihood of success, I turn to the company’s historical performance and financial position. Alibaba’s top line has shown recent signs of stagnation, but the overall trend over the past decade has been impressive. Operating income continues to expand, and Alibaba consistently outpaces its peers in terms of profitability metrics. It’s noteworthy that Alibaba allocates billions of dollars annually to innovation, as depicted in the graph above. And the company’s financial position gives me huge optimism about the company’s ability to continue investing in growth and innovation heavily. Alibaba had almost $80 billion in cash as of September 30, 2023, which was more than $50 billion higher than the total debt.

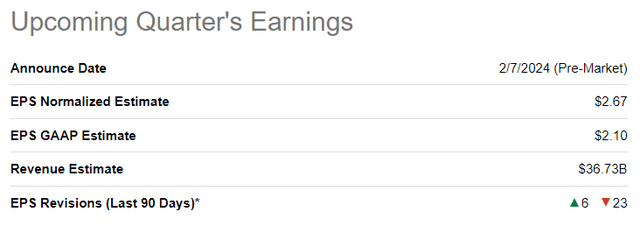

As Alibaba gears up for its upcoming quarterly earnings release on February 7, market expectations indicate a modest 2% YoY growth in revenue to $36.7 billion, accompanied by a slight dip in adjusted EPS from $2.79 to $2.67. The prevailing pessimism, evident in 23 downward EPS revisions over the last 90 days, suggests a conservative outlook. While generally not favorable for investors, this pessimism may already be factored into the stock price, potentially paving the way for positive surprises. Although Alibaba has a history of seldom delivering substantial revenue beats, it has consistently shown solid positive surprises on the bottom line across multiple quarters. Consequently, my outlook for the upcoming earnings release remains optimistic. The significance of the full fiscal 2024 revenue guidance cannot be overstated. However, I am inclined to think that the consensus estimate of approximately 7% growth is overly conservative for a company of Alibaba’s caliber, and I anticipate no downward revisions in this regard.

In summary of the fundamental analysis, I am optimistic that Alibaba possesses the necessary resources to sustain strong performance across its diverse revenue streams. The recent news of insiders purchasing BABA shares worth $200 million in the past week further reinforces confidence in the company’s growth prospects.

Valuation analysis

To gauge the current valuation of Alibaba’s stock in relation to historical levels, let’s examine the stock’s all-time price chart. Remarkably, BABA is currently priced lower than its initial public offering almost a decade ago. Meanwhile, Alibaba’s revenue has surged over fifteenfold, and EBITDA has nearly sextupled during this period. Looking at the balance sheet over the last decade, Alibaba’s total assets increased by fifteen times as well.

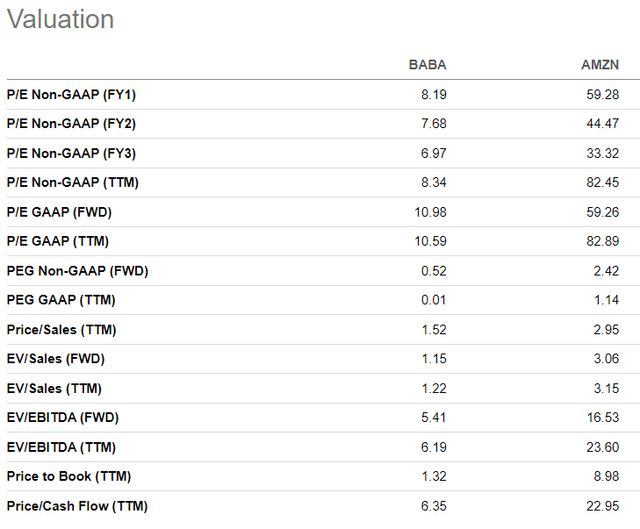

I acknowledge the influence of country and political risks on the valuation comparison between Chinese companies and their U.S. counterparts may not be entirely fair. However, when assessing Alibaba’s valuation ratios against those of Amazon, I find the gap to be excessively wide, even after factoring in political risks and the typical premium associated with U.S. stocks. This further underscores the substantial undervaluation of Alibaba’s stock.

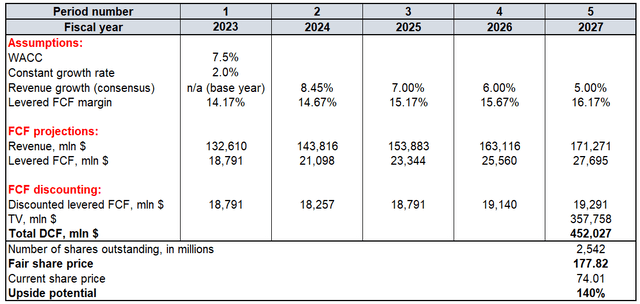

Let me perform a discounted cash flow (“DCF”) model for Alibaba, applying a 7.5% WACC provided by Finbox. The constant growth rate for the terminal value (“TV”) calculation is a very conservative 2%. The levered free cash flow (“FCF”) margin is 14.17% for the base year, with the expected 50 basis points improvement yearly. I incorporate revenue consensus estimates for the base year and 2024, opting for a more conservative scenario with a gradual deceleration in revenue growth thereafter. There are slightly above 2.5 billion BABA shares outstanding at the moment.

The fair valuation generated by my DCF analysis points to approximately $178 per share, signifying more than double the last closing price and presenting a compelling 140% upside potential.

Mitigating factors

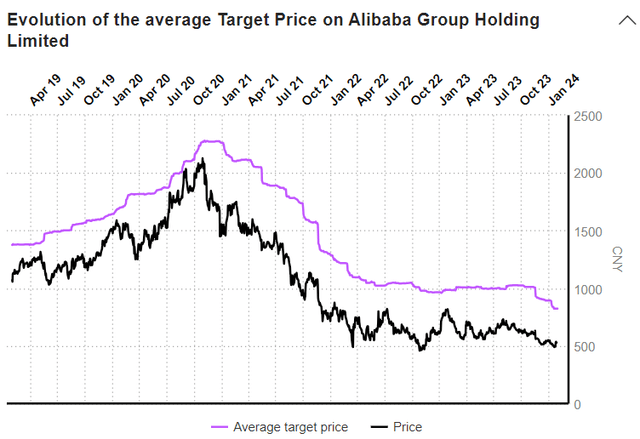

The recent three-year trajectory of BABA suggests that the stock’s price exhibits minimal correlation with the underlying fundamentals. Various adverse factors unrelated to the company’s operations significantly impacted the stock price. Inherent undervaluation stems from political and geopolitical threats, with the market price deviating notably from the consensus target since September 2020. Potential investors should take note of this divergence.

Skepticism persists regarding the outlook for the broader Chinese economy. CNN recently labeled 2023 as a ‘miserable year’ for China, expressing doubt that 2024 will bring substantial improvement. In early December 2023, Moody’s put China on a credit risk downgrade warning, recognizing numerous risks for the Chinese economy as well. I believe the positive momentum in e-commerce and cloud will remain key drivers for Alibaba’s revenue growth. However, potential challenges in the broader economic landscape could pose a risk to the pace of this growth, particularly for a company focused on expansion like Alibaba.

Conclusion

I believe that Alibaba’s attractive valuation outweighs the associated risks, and the stock can’t remain substantially undervalued indefinitely. While investors may have experienced share price challenges in recent years, the crucial factor for long-term investors is the company’s ongoing expansion with stellar profitability. In my view, Alibaba’s stock clearly merits a “Strong Buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.