z1b

Investment Thesis

Alibaba Group Holding Limited (NYSE:BABA) shares have lost about 51.75% over the last five years, underperforming the S&P 500 by a margin of about 136%. This has been brought about by several factors ranging from slow economic growth in China to trade tensions between the US and China, not forgetting the adverse effects of Covid-19. Despite these challenges weighing down the company’s share prices, from a technical and fundamental perspective, I see a strong rebound here and as a result, I recommend buying this dip.

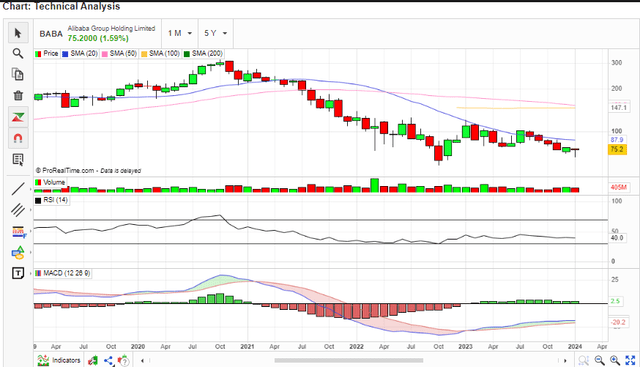

What Does The Chart Say?

From a technical perspective, BABA has bottomed and it is currently retesting its 5-year support zone as indicated by the red line. The price bounced off the support line in October 2022 but the rebound was weak and it is currently retesting the zone. Notably, the strong bearish momentum appears to have lost momentum as shown by the narrow price range below $132.71, which is significant here because it marks the price breakout level for a long-term rally.

Can we get more technical and evaluate the future possibilities? First off, the stock is approaching the 20-day MA where the onset of the looming upward trajectory will be fully confirmed after a retest on the support zone. Further, the 50-day and 100-day MAs are converging and a bullish crossover is very apparent at the moment. In addition, the MACD is above the signal line and rising an indication that the upward trend is gaining momentum. Its histogram is also positive lending credence to my assertion that a reversal has occurred and it is gaining momentum. Lastly, the RSI is at 40 and rising, having bounced from the oversold region. At its level, it shows that this stock has ample space to grow before it hits its oversold zone of 70.

In summary, technical indicators show that this stock has bottomed and it is currently reversing and the bullish trajectory is gaining momentum. From this analysis, I have two major points of interest which are $69.67 and $132.17. The former marks the support zone and therefore a sustained price drop below this level would mark a stronger bearish trend, a point at which I would recommend a sale decision. The latter is the price break-out range, a point at which I would recommend opening a long-term position for the risk-averse. While a bullish trend looks to be setting, are the fundamentals strong enough to support this trajectory? Let’s find out below.

What About The Fundamentals?

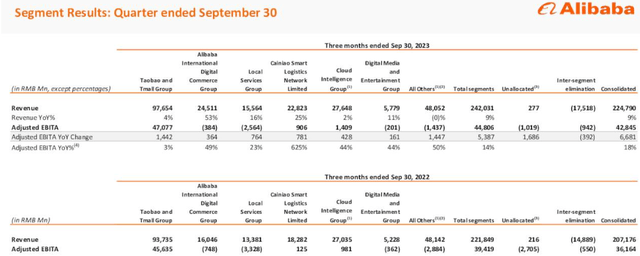

BABA operates through seven segments which act as its major revenue streams. Below is their performance in the MRQ.

Here is a brief description of each segment and its competitors.

China commerce: This comprises the online retail platforms Taobao and Tmall. Revenue is generated through commissions, advertising, and value-added services. Its main competitors are JD.com and Meituan.

International commerce: This segment is made up of cross-border e-commerce platforms such as Alibaba.com and Lazada. The segment generates its revenue from commissions, advertising and fulfillment. Competition here is majorly from Amazon and eBay.

Local service: This business unit consists of online-to-offline platforms such as the Ele.me. Besides commissions and advertisement, it also generates revenue from membership fees. Its main competitors are Meituan and Didi.

Caiao: It is made up of logistics networks and connection networks between merchants, consumers and delivery partners. Revenues are realised through fulfillments and delivery fees as well as value-added services. Competition here is from SF express and ZTO Express.

Cloud: This segment is made up of the cloud computing and data intelligence platforms. It realises revenues from subscriptions and usage fees. Main competitors include Tencent Cloud and Huawei cloud.

Digital media and entertainment: It is made up of online media and entertainment platforms that provide content, social, and gaming services to consumers. Its revenue comes from subscription, content licensing, and distribution. The main competitors here are Tencent and ByteDance.

Others: It consist of emerging businesses and technologies which are not yet profitable and scalable. For example, the DingTalk and Xiaomi. The segment generates revenue through strategic investments and value-added services. With that brief overview of the company’s revenue streams, let’s get into its fundamental analysis.

Judging from the price performance perspective, one would be quick to conclude that BABA’s fundamentals are very weak. Surprisingly, I find them strong and I believe they could support its upward trajectory. To begin with, its profitability is impressive. The company has a trailing gross profit of 37.73% which is higher than the sector median of 35.15%. Further, its EBIT and net income margins are 14.66% and 14.50%, respectively, being significantly higher than the sector median of 7.67% and 4.69%. This, in my opinion, shows its profitability is not only strong in absolute terms but also in comparative terms.

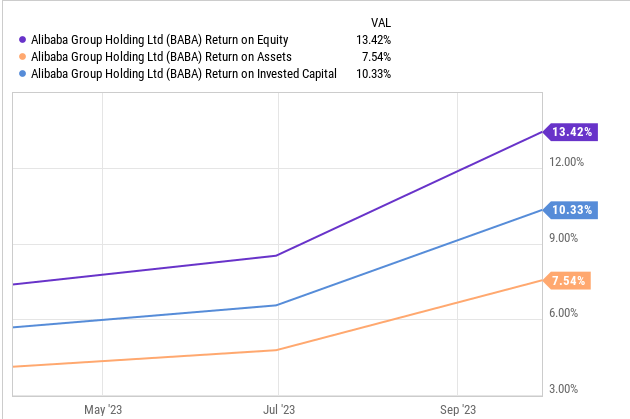

Further, its ROE stands at 13.42% and it is currently increasing steadily indicating that the company is generating decent profits from shareholders equity. Additionally, its ROA and ROIC stand at 7.54% and 10.33%, respectively, underscoring the company’s ability to generate profits from its assets and invested capital.

YCharts

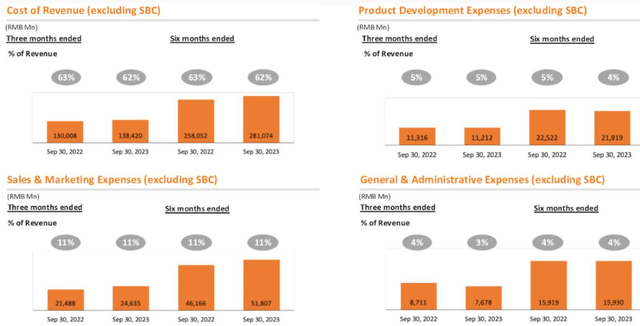

In terms of growth, the company appears to be on the right trajectory with its MRQ performance marked by a revenue growth of 7.22% YoY and an EPS growth of 19.34% YoY. With the company expected to announce its Q3 2024 earnings on 31st Jan 2024, I expect a solid quarterly performance characterized by growth. In terms of revenues, I expect revenue to be in the region of $37 billion, up from $35.92 billion in Q3 2023. I believe this will be possible, given the company’s expansion in its e-commerce platforms. In addition, I expect a moderate improvement in profitability as the company tries to create a balance between growth investments and cost efficiencies. Just to demonstrate the strides the company is making in cost management, it has managed to reduce the cost of revenue and G&A expenses by 1% and, at the very least, maintained its sales and marketing and product development expenses constant.

In terms of valuation, BABA is trading at a significant discount based on its PE and PEG ratios relative to sector medians. Its trailing PE is 10.59 compared to a median of 17.44 and its PEG ratio is 0.01 against 0.56 sector median translating to a discount of about 97.93. In case you’re looking for value, look no further, here is where it lies. According to these metrics, this stock is significantly undervalued relative to sector medians and therefore it is a good value opportunity.

Lastly, on its solid fundamentals is its financial health. BABA has a debt-equity ratio of 0.16 which is quite impressive and signifies its low leverage hence very little debt risk. In terms of debt coverage, the company’s operating cash flows stand at $29.22 billion adequate to cover its total debt of $27.18 billion 107.5%. This is quite solid and assuring to investors. Further, the company has robust interest coverage of 19.38x which speaks volumes on the company’s unshakable financial health and solvency status. On the liquidity front, BABA has a cash balance of $78.67 billion and a current ratio of 1.94. This signifies its tremendous ability to meet its short-term obligations with ease.

In conclusion, the company has very strong fundamentals characterized by attractive profitability, growth, and a strong financial position which guarantees this company financial flexibility. I also believe that its solid balance sheet could act as a buffer against any unforeseen challenges given its solid liquidity position.

Near-Term Catalysts

While I acknowledge the company’s ongoing restructuring plan is the major long-term growth catalyst, let’s look at some near-term factors. The first one is the forthcoming earnings report on the 31st of this month. As I had discussed earlier, I expect strong quarterly performance which will bring about volatility in BABA’s share price. Further, the recent Jack Ma’s $200M share purchase will act as a strong catalyst for growth in the short term. I believe so because it signifies the confidence the majority shareholder has in this company and therefore I expect potential investors to be moved by this transaction and initiate a buying pressure on this stock.

Chinese Government Economic Stimulus: A Much Needed Pivot?

The Chinese government through the Central Bank has announced its intention to pump about $139 billion into the economy by cutting the reserve requirement ratio by 0.5%. By doing so, they would increase the long-term liquidity in the economy and banks would have more money to lend to businesses and consumers therefore this could act as a major economic stimulus.

Well, there is no doubt that the Chinese economy has been growing slowly and such a move good help liberate this economy. However, has this model been successful elsewhere? I draw your attention to the Fed’s increased liquidity in the banking sector in the US. This move was taken to increase the money supply in the economy and stimulate growth after the adverse effects of Covid-19. Following such measures, CNBC reported the US GDP grew by 4.9% in the third quarter of 2023. Guided by this information, I believe the Chinese government proposal could be a major economic catalyst which I expect to improve consumer spending and demand thus, move BABA’s sales up eventually. In a nutshell, I believe this is much much-needed pivot.

One More Thing: The New CEO Daraz

In the recent reshuffles, the company’s online shopping platform Daraz has appointed a new chief executive. Following these changes, James Dong who has been leading the company Lazada Group will replace Bjarke Mikkelsen as the CEO. Here are my thoughts on this change. I believe this move will benefit the company because James has experience in leading e-commerce platforms in emerging markets as well as implementing Alibaba’s globalization strategy.

One of his major achievements which in my view underscores his expertise is the launch of Youpik platform which allows users to share short videos reviewing products and get rewards. This innovation is unique and it capitalizes on the growing popularity of social media and video content especially among the youth.

With this background, I expect him to leverage the potential synergies between Daraz and Lazada to improve customer experience and improve product range perhaps through a new Launch. In a nutshell, I am very optimistic about this managerial change and I believe James will help move BABA forward based on his experience.

The Wrap UP

Here are my investment takeaways. To begin with, I find BABA to have bottomed but its fundamentals are strong enough to support the impending reversal. There are some major near-term price catalysts that I would recommend the short-position investors to capitalize on and buy at the current price. However, they need to have a strict stop-loss strategy slightly below the support zone of $69.67 and a take profit at about $132.17. For long-term oriented investors I would recommend two entry points depending on your risk appetite. For those with high-risk tolerance, buy at the current position and hold until the stock crosses the $132.17 range where you can add your position. For the risk-averse, the right entry point would be a break above $132.17 where I see the major break-out level. At this price range, look for major growth news such as acquisitions or a new launch.

In summary, BABA has bottomed and technical indicators have shown that an upward rally is building. I expect the company’s restructuring plans and the economic stimulus to be major long-term growth catalysts. In the short term, I expect volatility to be fueled by Jack Ma’s share purchase and its expected earnings report which I anticipate to be strong. As a result, I recommend buy decisions as guided above. As you invest here, beware of the risk posed by the trade war between the US and China which is impacting BABA’s investment ambitions.