Vertigo3d

Alibaba’s AI future – Zhipu In focus

The thesis of this article is straightforward. I will argue the market has mispriced Alibaba (NYSE:BABA) dramatically. As to be elaborated on in the remainder of this article, I see several key catalysts afoot, ranging from its AI potential to the macroscopic environment. Yet the stock is trading at a single-digit P/E, creating a highly skewed return profile.

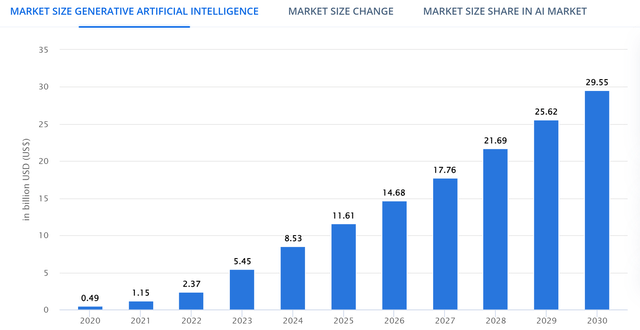

Let me start with its mispriced AI potential. As a major Internet company in China, BABA has been aggressively investing in AI technologies in recent years. I both see this as the right strategy and also see BABA well positioned on this front. According to Statistica projections (see the chart below), the addressable market in Generative Artificial Intelligence (“GAI”) is projected to grow at a fast rate of 20%-plus in the years to come. Just like in the U.S., I expect the adaptation of GAI to impact many sectors, such as logistics, transportation, and finance. BABA is well poised to benefit on many fronts due to its leading position in e-commerce and digital finance, and I anticipate the recent Zhipu investment to catalyze these benefits.

Statistica

For readers unfamiliar with the background, together with a few other Chinese tech firms, BABA recently invested 2.5B yuan ($342M) in a Chinese AI startup, Beijing Zhipu Huazhang Technology. Zhipu is a prominent player in China’s GAI circle. Its goal was to develop bilingual (or even multilingual) models for Asian regions/countries. The company has released several key products, with GLM-130B as the most notable one and one most comparable to ChatGPT in my view. It’s a bilingual pre-trained large language model (with 130 billion parameters). Just like ChatGPT, it’s capable of dialogue, code generation, and Q&A exchanges – in both English and Chinese.

Back to BABA, I anticipate the Zhipu investment to catalyze BABA’s push on the AI front for several reasons. First, Zhipu’s bilingual capability integrates well with BABA’s leading e-commerce position. For example, Zhipu’s AI algorithms can analyze customer data to gain deeper insights into individual preferences and behavior. This information can be used to personalize product recommendations, marketing campaigns, and customer support interactions. Second, Zhipu’s bilingual capability also may lead to new revenue streams and a competitive advantage. For example, Zhipu’s AI capabilities can be applied to BABA’s tremendous database of consumer transactions and identify products and services that can meet the evolving needs of customers – before competitors do. Finally, Zhipu’s AI tools can analyze large amounts of data to identify patterns, trends, and anomalies that would be difficult to detect with traditional methods. This ability can have far-reaching impacts on many aspects key to BABA’s operation. For example, fraudulent detection relies heavily on pattern recognition and anomaly identification. And so are demand forecasting, inventory modeling, and logistics routing. Advancements on these fronts could all lead to reduced costs, improved efficiency, and more satisfied customers.

BABA’s growth potential is mispriced

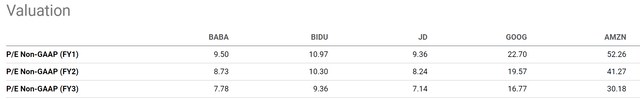

Yet, BABA’s P/E ratio is at a large discount compared to either its Chinese or U.S. peers. BABA’s P/E ratios are in the single digits: 9.5x for FY1 and 8.7x for FY2. As you can see from the following chart, JD is one of the peers that trade at similar multiples. Many other peers, either in China or in the U.S., trade at large valuation premiums.

Seeking Alpha

In my mind – and Ben Graham’s mind too – a P/E around the level of 8~9x is reserved for companies that are permanently stagnating. As detailed in my earlier article:

Graham recommended a series of methods for investors to gauge the price they should pay. The so-called Graham P/E recommends the fair valuation of a company in good standing to be around 8.5 plus twice the expected annual growth rate. Hence, in his mind, a business that completely stagnates should be worth about 8.5x PE.

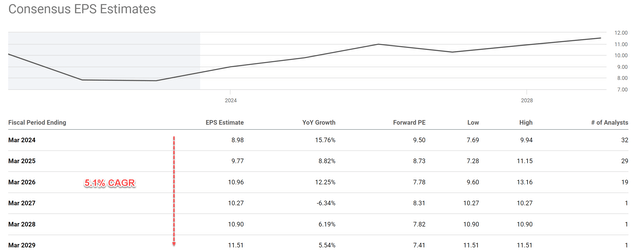

Yet in BABA’s case, it’s simply absurd to assume stagnation. As seen in the chart below, consensus estimates project an annual growth rate averaging 5.1% for the next few years. I think these projections are conservative and did not factor in the scenario of high growth catalyzed by AI or acquisitions like Zhipu as mentioned above.

Seeking Alpha

Other catalysts

Besides the Zhipu investment, I see a few other key catalysts afoot. The most important one is the easing of China’s regulatory crackdown on tech firms like BABA. I see several signs for such easing as evidenced by several recent developments.

I feel that the tone from the regulators has shifted from intense scrutiny in the past 2~3 years to providing guidance for future development. More specifically, after a prolonged halt in recent years, the Chinese stock exchanges have begun to approve new IPO applications, including those from tech companies.

Last and most relevant to BABA, the fact that its business reorganization plan received a green light was an important sign. The restructuring is largely completed by now with the company restructured into six distinct operating units, each with its own specific CEO. And I expect the efforts to start bearing fruit immediately, particularly in the form of revenue growth and operating efficiencies. I look forward to seeing its earnings report in the September period to see if this is indeed the case. It will be the first quarter under the new structure.

Risks and final thoughts

Many risks facing BABA are common to other Internet companies (like macroeconomics and regulations mentioned above). So, I won’t delve into these risks too much. Instead, I will point out a few risks that are more specific to BABA than other Chinese internet stocks. As the leader in e-commerce, I see BABA more exposed to U.S.-China trade tensions. These tensions could lead to tariffs, restrictions, or other disruptions that could harm BABA’s business. I won’t be surprised that the AI front could become a part of the tension too. Also, the Alibaba Partnership is a corporate capital structure. With the Alibaba Partnership holding a controlling stake, the voting rights of other shareholders are more limited compared to other companies that follow a more traditional corporate structure. This structure could make it more difficult for minority shareholders to protect their interests. The voting rights of overseas shareholders might be even more limited (readers interested should learn more about the so-called VIE structure).

All told, my final verdict is that the positives outweigh the negatives under current conditions. Thus, I rate the stock as a buy. To recap, the key consideration in my view is the large mispricing of its growth potential, especially those to be catalyzed by its investment on the AI front such as the recent Zhipu investment. Yet, its current P/E reflects permanent stagnation in my mind, thus creating a highly asymmetric return profile.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.