Sean Anthony Eddy

Well, phooey. Alexandria Real Estate (NYSE:ARE) turns out to be just another ordinary REIT, with lower likely shareholder returns than some of them.

I had thought they were a much stronger grower than they are. But perhaps there was a clue in their unique mission statement (from the 8-K):

To create and grow life science ecosystems and clusters that ignite and accelerate the world’s leasing innovators in their noble pursuit to advance human health by curing disease and improving nutrition.

Nothing there about creating value for their owners, is there?

I set out to do a thorough article on Alexandria Real Estate (ARE) once they had reported 2023 earnings. But my knowledge and methods have improved a lot since my last serious look at them two years ago, for an article for our members. I know better what to look for now and go deeper better and faster.

Alexandria sells themselves really well. They had convinced me that they were growing at a very high rate for a REIT. Perhaps you too.

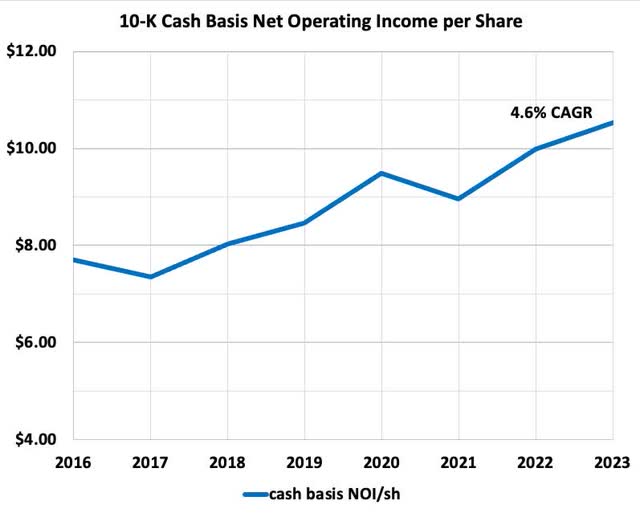

Alas, this is not correct. The financials generate much noise, for reasons we will get to. But here is an uncontaminated bottom line:

All else being equal (more below on why it has not been in the short run), the CAGR here should also be that of per share Funds From Operations, or FFO/sh, and per share Cash from Operations, or CfO/sh.

The latter two are much easier to extract for the long run, using TIKR. Over 21 years, CfO/sh has grown at 4.5%, consistent with the growth of NOI/sh. (We discuss FFO/sh below.)

With the current dividend of about 4%, the economic return from Alexandria is in the high single digits. That should be the long-term total return from holding ARE. Just like any ordinary REIT.

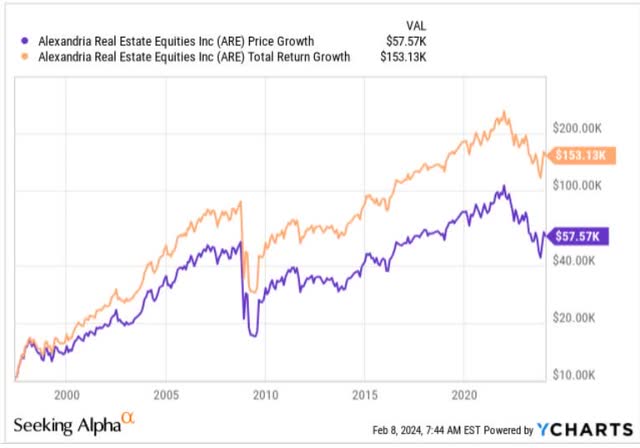

Your reaction may well be, “but … but … but… they brag loudly about their huge total return.” In that regard, long-ago gains and long-term compounding gets you again.

Their 15.1x total return from their May 1997 IPO to the end of 2023 is an 11% CAGR. Here is a semi-log plot from the IPO to the present, showing growth of $10k for price and total return:

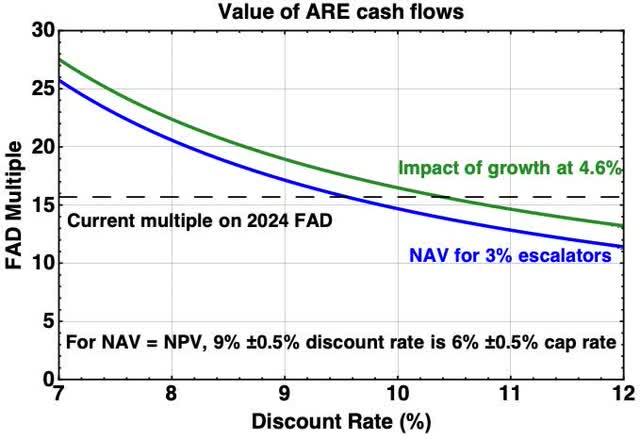

It is that 50% jump over their first couple of years that causes the long-term numbers to give a distorted view. This table shows total return over some informative intervals:

RP Drake

The rows in the upper section, shaded blue, show intervals starting long ago. It is clear that the first 5 years were not relevant to long-term returns.

The rows in the lower section, shaded green, show more recent intervals. There was a steady enthusiasm for ARE following 2016. As Executive Chairman Joel Marcus stated in the Q4 2023 Earnings call:

I’d say we have witnessed the unprecedented 8-year bull run of the life science capital markets 2014 through 2021, the longest on record

But by early 2024, the intermediate-term total return since 2016 has dropped back to near the long-term sensible average. That makes one wonder whether ARE might be fairly priced today and not underpriced. We will address that question near the end of the article.

Don’t get me wrong. Alexandria is a quality REIT, just not an exceptional one financially. If you start in 2000, a number of other REITs have produced larger total returns. Alexandria’s aspirations are exceptional, though, as you can see in the mission statement.

Financials that Mislead Analysts

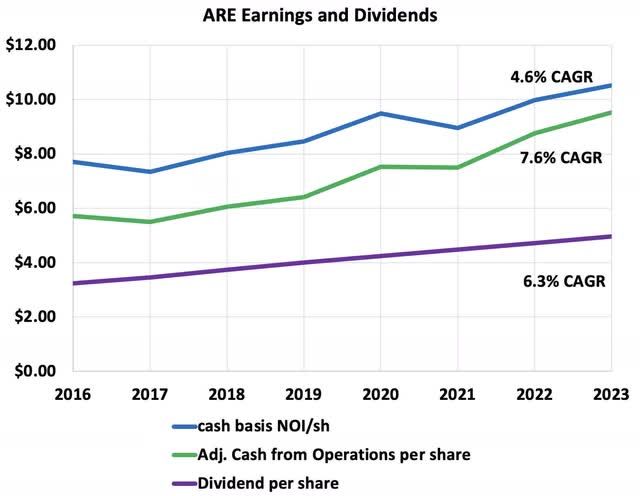

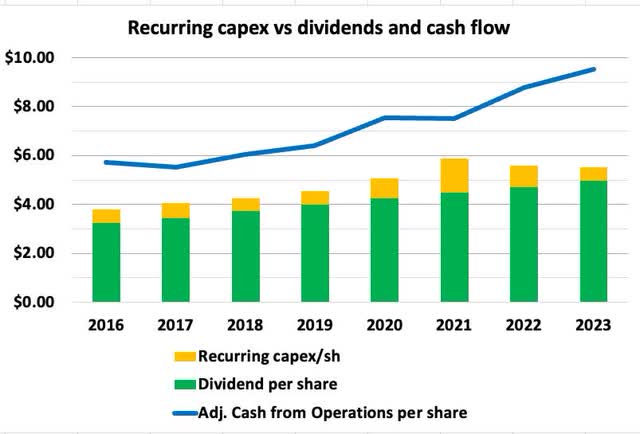

Next we take a look at some other financial indicators and discuss ways to get misled. First, let’s compare NOI/sh with CfO/sh and dividends:

We see dividends increasing at a 6.3% CAGR. I like larger dividends. But the comparison with the growth of NOI/sh shows that this growth rate cannot continue indefinitely.

And then CfO/sh (adjusted here by removing changes in working capital) has grown at a CAGR 300 bps above that of NOI/sh. Here the fun starts.

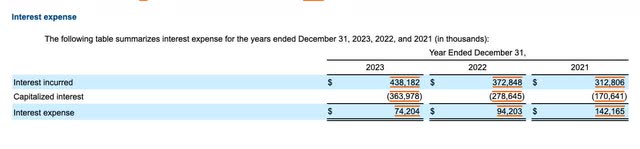

Numerically, the relative increase in CfO relative to NOI is caused by a reduction in the interest expenses listed on the Income Statement. However, as ARE has been adding debt steadily, their full interest expenses have been increasing and not decreasing.

What has been going on is that the fraction of interest expenses that are capitalized to represent expenses associated with construction has rapidly increased. This from the 10-K:

Now capitalizing interest is sensible and routine, and the capitalized interest gets buried elsewhere than as an expense against income. But the relative amounts here are far larger than one usually sees even with development-oriented REITs.

I’m sure the categorization is SEC compliant, but is Alexandria cheating in spirit? I don’t know, and decided not to explore it.

The net impact is that while Adj. CfO used to run about three quarters of cash basis NOI, it has now climbed to 90%. This makes no sense, really. And so that 7.6% CAGR of Adj. CfO also makes no sense.

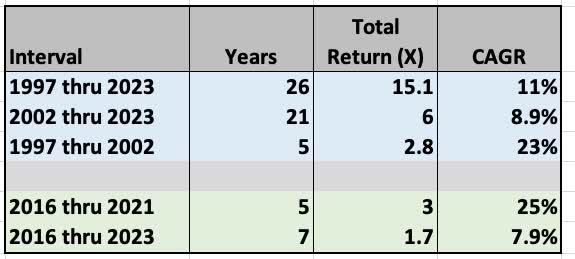

But that is not the worst part. Here we include FFO/sh:

RP Drake

In the absence of nonsense, the red and green curves would not differ by much. What we see instead is that FFO misrepresents “earnings” by as much as 30% in each direction. That is huge. The implication is that a P/FFO of 15 might actually be 10 or 20, and that is before correcting for nonrealistic interest expenses.

So any time you see an author discussing the ratio of Price to FFO for Alexandria as though it means something, you can tell that said author does not understand Alexandria. If you check, they very likely missed the VC arm entirely, too. So let’s briefly discuss that.

The Venture Capital Arm

Embedded within Alexandria, the REIT is a VC arm, which would be bizarre for any other REIT. But it is consistent with their mission statement.

This is no ordinary REIT from the standpoint of focus. Here is a further description of the VC arm from their 10-K:

We also hold strategic investments in publicly traded companies and privately held entities primarily involved in the life science, agtech, and technology industries. We invest primarily in highly innovative entities whose focus on the development of therapies and products that advance human health and transform patients’ lives is aligned with Alexandria’s purpose of making a positive and meaningful impact on the health, safety, and well-being of the global community.

The bad news here is that having any such investments causes GAAP to screw up your income statements. GAAP requires that changes in unrealized gains and losses be reported as part of current revenues.

You can see the impact in the above plot, as this is what renders FFO worthless. What matters for the VC investments is realized gains, which have been running about $100M per year over the past three years (they are lumpy, though). The thing is, these have value.

Suppose you value those gains at 15x to 30x. The added value per share would then be in the $10 to $20 range. My perspective would be that those activities are high growers and should be near the upper end. So whatever value you think the real estate operations of Alexandria has, add about 15 bucks.

Seeking Cash Earnings and the Business Model

What we’ve seen so far is that, for Alexandria, all the easily found parameters are poor measures of actual cash earnings, which is what owners should care about. Like all REITs, they should report Funds Available for Distribution, or FAD. But unlike some, they do not.

We won’t worry today about stock compensation expense, which comes in at about 5% of CfO. But the more hidden expenses are the recurring capex.

If you spend enough time poking around in the 8-K and 10-K, you can determine that the recurring capex is almost entirely “Tenant Improvements,” preparing vacated spaces for new tenants. There is a small contribution from improvements to buildings. Here that recurring capex is placed in the context of NOI/sh and dividends:

The recurring capex tends to run around 8% of cash basis NOI. So if we think realistic cash from operations should be 3/4 of NOI, per the above, then this is about 11% of realistic CfO.

This is in the same ballpark as apartment REITs and shopping center REITs. Office REITs are often larger.

The comparatively low fraction likely reflects their emphasis on doing improvements that create generic, reusable spaces. They detail this in the 10-K:

These improvements typically are generic rather than specific to a particular tenant. As a result, we believe that the improvements have long-term value and utility and are usable by a wide range of tenants.

The recurring expenditures were larger in 2021 when two quarters showed some major spending. So some re-tenanting, in that case likely as a result of the pandemic, added costs in that year.

Overall, then, about 2/3 of the cash NOI represents the Funds Available for Distribution. That will reach about $7.50 per share in 2024, which we will use below.

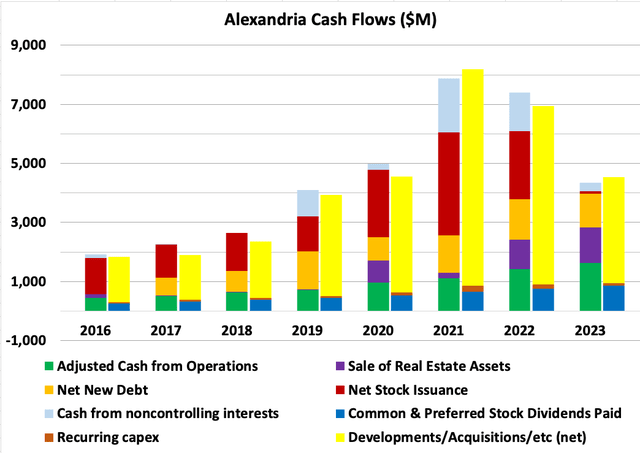

Turning to the business model, we can see that through the lens of cash flows (noting that any stock-fueled M&A will be hidden from view). Here we show two sets of stacked bars for each year, with sources of funds on the left and uses on the right:

What you can see is that the largest source of funds before 2023, shown in red, was issuing stock. The second-largest source was net new debt, shown in orange, which they took on to keep leverage neutral.

Retained cash did reach about 15% of new property in 2023. Adding the cash from noncontrolling interests, the total available cash has run 20% to 25% since the pandemic.

Still, what we see here is an external growth model, dominantly fueled by issuing stock. Alexandria reduced their pace of construction in response to the recent challenges in both construction costs and the life science markets. At the same time, they quit issuing stock when the price of ARE went in the tank (kudos to them for that).

I won’t take you through the details, but the cash flows shown are problematic for me vs the end-of-the day earnings growth. It seems that there should be more growth, based on the reported yields, but finding why not escaped me.

The bigger picture point is this. Despite a great seven years during which Alexandria more than doubled their share count and multiplied their Gross Property by 3.6x in pursuit of growth, and rents escalated 23%, NOI/sh only increased 37%. My view is that this inefficient business model has in reality produced inadequate growth.

Next we will look at risks and then more about the business of Alexandria and the markets it works in. Lastly, we will take up valuation.

Risk of Investing in ARE

As usual, the Alexandria 10-K includes an exhaustive discussion of risks, most of which seem like unlikely fantasies of some lawyer. But they do exist, if often at a negligible probability.

A risk for investors that seems more significant to me is captured by that mission statement above. These guys will never do anything but Life Science.

On the whole and in the very long run, that focus is positive. One of the major themes of this century will no doubt be advances in life science. And on top of that, there are the several sub-areas detailed in the quote above, so a crash in one may not impact others.

But still, what will happen over a century says little about what will happen in any decade, let alone any year. And while Boston Properties, Kilroy (KRC), and other office REITs now building life science will shift away from it in poor decades, Alexandria never will. In such decades, shareholders might see price declines and little if any dividend growth.

On the demand side, the ebb and flow of government research funding, VC funding, and the capital markets can lead to years of underperformance. On the supply side, if other market actors severely overbuild some region, this can impact the rents Alexandria can charge.

Those impacts are limited, but not zero. An exchange [edited for length and clarity] from the Q3 2023 earnings call illustrates the point:

(Analyst) Joshua Dennerlein

Just kind of curious how we should think about that supply that’s coming online and the vacancy you mentioned and just how that will impact market rents and GI’s across maybe as in particular, Cambridge in South San Francisco?

(CEO) Peter Moglia

What we believe is that our mega campus platform and our reliability and brand gives confidence to tenants that they’re going to be well taken care of. And so there is a premium to that that will help us overcome the competitive supply dynamic when it comes to that.

(Executive Chairman) Joel Marcus

I would say also important to distinguish, we think in Cambridge the impact would be far less than South San Francisco. South San Francisco just adds too much stupid supply. The good news is a lot of that supply is in an area that people don’t want to be in.

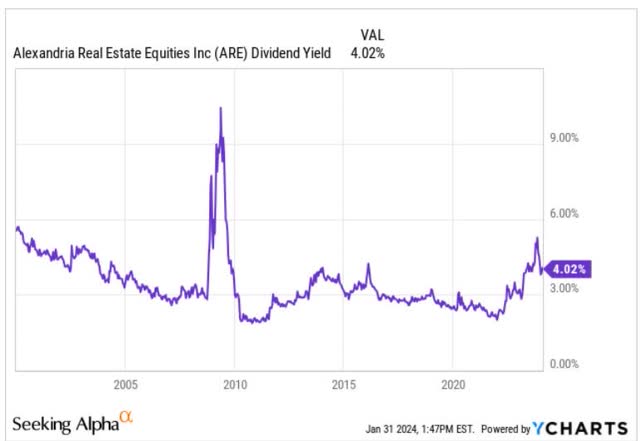

The other risk I see lies in the tendency for Alexandria to be a low-yield company. Here is the yield since 2000:

The yield today is 4.2%, but it has mostly been near 3% for the past 20 years. Buying at that yield would get you a likely total return below 8%.

The Life Sciences Market Today

The singular focus of Alexandria on the life sciences market makes the state of that market relevant. Here is what Joel Marcus had to say in the earnings call:

I’d say we have witnessed the unprecedented eight-year bull run of the life science capital markets 2014 through 2021, the longest on record, coupled with the rocket ship funding during COVID. And the market in 2023 has clearly reflected the rationalization of the past decade.

So there is no blind expectation that things will be onward and upward always. Meanwhile, some (including Jonathan Litt) allege that the life science market is severely oversupplied and that this will create losses by Alexandria. Hoya Capital summarizes a recent report as follows.

CBRE noted in its quarterly Life Sciences report that industry-wide occupancy rates dipped 700 basis points during the year to below 87%, resulting for a record-level of new supply. CBRE notes that nearly 8M SF of new space was delivered in Q4 alone – of which only 44% was pre-leased – but the construction pipeline has started to moderate while net absorption was positive in the fourth-quarter for the first time since late 2022.

There is a strong contrast between that description of the broad market and what Alexandria reported in their earnings call:

Year-end occupancy was solid at 94.6%, up 90 basis points from the prior quarter… The midpoint of our guidance range for occupancy for year-end 2024 is 95.1%, so we do expect some modest growth in occupancy through the year as well as growth in same-property occupancy in the second half of the year.

On top of that, they show in their Supplemental 8-K the delivery of 15 development and redevelopment properties during 2023, with an occupancy of 99.8%. And in the 10-K they show 61% of the 3.7M square feet under construction as leased.

Here again is Joel Marcus from the Q4 2023 earnings call:

With respect to Alexandria in 2023, I would say, I would characterize our 2023 overall operating and financial performance as highly resilient. Notable achievements include 11% plus NOI growth year-over-year, 2023 to 2022 in very, very strong. We delivered a record $265 million of incremental NOI in 2023 with our development capabilities moving that to fruition, which are first-in-class. We’ve continued very solid leasing in 2023 with over 4 million plus rentable square feet leased with very respectable GAAP and cash numbers.

The contrast with what is going on in actual office REITs is notable.

Leasing

Leasing sustains and increases the cash earnings from operating properties. This both directly grows earnings and provides some cash for expansion.

From the 10-K:

As of December 31, 2023, we had over 1,000 leases with a total of approximately 800 tenants, and 198, or 48%, of our 411 properties were single-tenant properties. Leases in our multi-tenant buildings typically have initial terms of 4 to 11 years, while leases in our single-tenant buildings typically have initial terms of 11 to 21 years.

So they need to renew in the ballpark of 150 leases per year, in addition to leasing up their new development

It is notable that the expiring leases have had their rent increase by 3% per year. So at 10 years, their rent is up 34% (very slightly larger than net inflation). Then on top of that come the increases on renewal.

Alexandria reports (in the Supplemental) “… annual rental rate increases of 29.4% and 15.8% (cash basis) on renewed and re-leased space.” That cash-basis increase is down from 22% in 2022, and it has dropped across 2023. Some may view this with consternation.

If one asks what those increases should be, it seems to me that in the long run they should amount to inflation plus productivity growth within the space. Its productivity grows at a 2% rate, then you get an increase of about 20% for the decade, on top of the 34% that covers inflation.

But you have to expect fluctuations that reflect many things. Different tenants will grow productivity at different rates, for example. And if a YoY drop of less than 600 bps in those increases is signaling distress in the life science markets, that sure looks like a zeroth-world problem to me.

Other points about leasing during 2023 from the 10-K:

- Annual leasing activity of 3.0 million RSF for renewed and re-leased spaces,

- Tenant concessions/free rent averaging 0.6 months per annum with respect to the 4.3 million RSF leased (a LOT less than the current office sector).

- Same Properties net operating income increases (cash basis) for the year ended December 31, 2023 of 3.4% and 4.6%,

- 10% per year of lease expirations for the next decade, with one exception at 11.9%.

Overall, though, my big-picture view here is this. With getting 3% rent escalators and being able to lever them up, how in the world is Alexandria managing to get only 4.6% growth of meaningful earnings?

This is more evidence that their business model for expansion is very inefficient for shareholders. All that growth for almost no benefit. But I don’t think they care. It’s about the mission, not the shareholders.

Valuing ARE

The value of ARE has three parts. These are the value of current properties (the NAV or Net Asset Value), the value of growth, and the value of their VC arm.

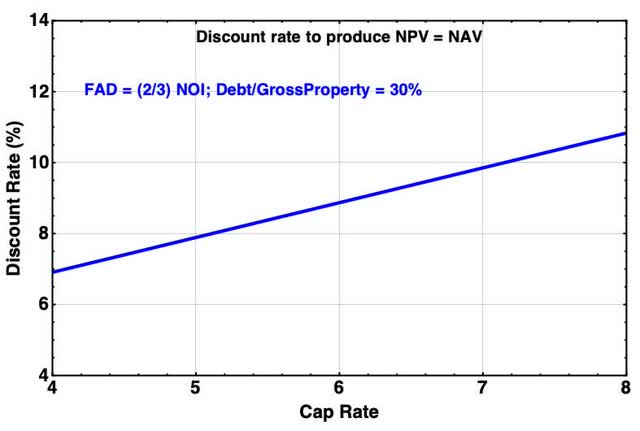

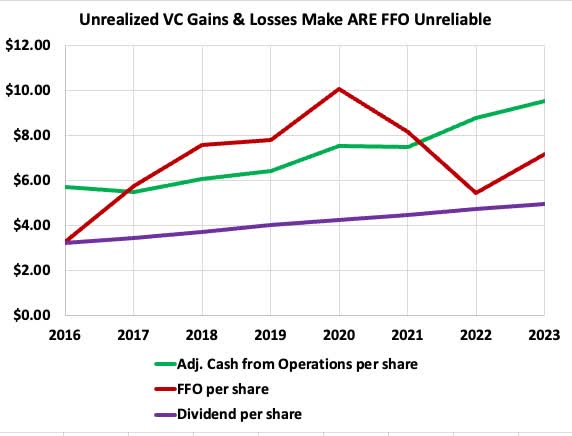

My preference, discussed here, is to equate the NAV with the NPV of the discounted cash flows to find the relationship of discount rate and cap rate. The discounted cash flows then get you a multiple on cash earnings that values the REIT at NAV. That calculation gets you this:

The relevant cap rate here is somewhere near 6%. They are selling properties at cap rates near 5% and developing at stabilized yields near 7%, with variations in both cases. My conclusion is that a discount rate near 9% is sensible overall, with a range of perhaps ± 0.5%.

The result of a DCF calculation for the value as a multiple of FAD is shown here, in blue:

This gets us an FAD multiple of 17 ± 1 to have the stock price equal the current NAV.

As I discuss in that linked article, it makes sense to value growth beyond escalators more weakly, using a higher discount rate. For an 11% discount rate, that 160 bps increase in growth rate (to 4.6%) amounts to an increment to the multiple of 1.8x, with small sensitivities by comparison.

The green curve here shows that case. It produces a FAD multiple of 19 ± 2. Then on top of that result one should add the $15 for the VC arm, discussed above.

Doing that gets a sensible market price of $140 to $170. That gets you into the price range of mid-2022, which is when my view was that the market had shed the excesses of 2021 and the ZIRP period.

The upside from the recent $118 to that price range is 20% to 45%, with a 30% midpoint. Plus, the current dividend yield is above 4%.

So here is where I end up. When the REIT markets get over their fear of the Fed, for one reason or another, we should see some upside near 30%. And if interest rates drop much and cap rates follow, the upside will increase.

Meanwhile, Alexandria will plug along, growing FAD at a few percent a year and paying their dividend. So long as the market value discount resolves within a few years, the CAGR for holding ARE will be well above 20%. And if rates move and the market moves soon, one could get 30% or more during 2024.

So at the end of the day, my disappointment is real but limited. My view now is that ARE is a solid investment for growth with a good chance of upside relatively soon.

That is a change from my previous expectation of uniquely strong growth. However, once one penetrates behind the curtain, it looks to me like the better multifamily REITs will grow faster in the long run than Alexandria.