Skyhobo/iStock Unreleased via Getty Images

Alaska Air Group, Inc. (NYSE:ALK), the parent company of Alaska Airlines, Horizon Air, and soon Hawaiian Airlines (HA), is scheduled to report and discuss Q1 earnings on Thursday, April 18. In this seasonally slower quarter, the Seattle-based company is expected to deliver flattish top-line growth with revenues likely to come in at $2.2 billion and per-share loss projected at $1.05 (while net loss was guided earlier this month at a range of $1.05 to $1.15 per share).

The first quarter of the year will be unusual for Alaska Air Group due to operational disruptions early in the period. Below, I discuss the key items that investors will want to pay attention to on earnings day. Later, I will explain why I think that, fundamentally, Alaska Air Group is a solid company whose stock is likely to be a winner relative to the rest of the peer group.

Alaska Air to report Q1 earnings – What to focus?

With the busy November and December travel season in the rearview mirror, investors will probably not focus as much on the traditional headline P&L metrics. Instead, the discussions are likely to center on the challenges that nearly every U.S.-based airline is currently facing: the disruptions caused by Boeing’s (BA) aircraft issues.

Alaska’s mainline fleet consists exclusively of 737 aircraft, after the airline discontinued all Airbus (OTCPK:EADSF) planes in 2023, with the regional routes being serviced by Embraer (ERJ) equipment. As a brief reminder, the infamous door plug blowout incident that took place on January 5 happened on Alaska Airlines flight 1282.

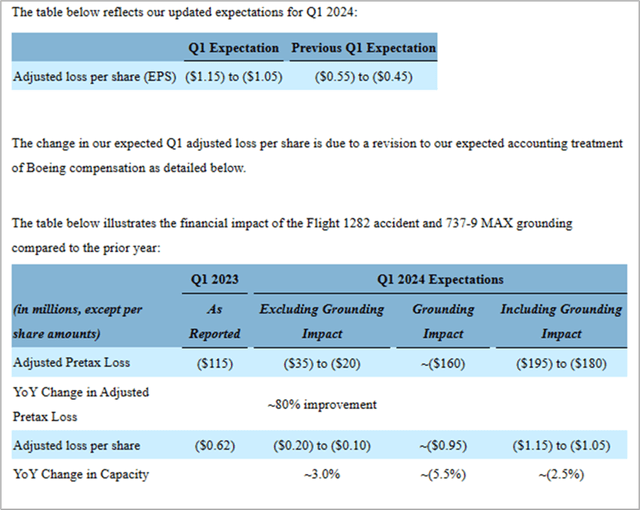

Alaska’s Q1 operating metrics will be distorted by the grounding of the company’s 65 MAX 9 aircraft in the first month of the year, as the company itself has already disclosed (see tables below). Therefore, expect capacity (measured in terms of available seat mile) and probably occupancy (measured by load factor) to look weak YOY, which in turn should negatively impact revenues and margins.

The management team’s key job on earnings day will be to explain to analysts and investors how the company is positioned to perform with the Boeing disruptions finally (or hopefully) put to rest. In that regard, we already know that at least “February and March both finished above [the company’s] original pre-grounding expectations.”

Finally, I would be interested to hear an earnings call discussion about how Boeing’s repeated operations mishaps may impact Alaska’s fleet strategy and operating cost expectations. For instance, I would not be surprised to see a slight increase in CASM (a per-unit operating cost metric) driven by an increase in maintenance activity that is more permanent than temporary.

On ALK stock and the investment opportunity

As discussed above, Q1 will likely be an ugly quarter for the West Coast carrier. However, I think that investors should look past the recent headwinds when assessing the investment opportunity in this stock.

Fundamentally, Alaska Air appears to be a solid airline group. To start, the cost structure resembles that of a low-cost carrier, with an average 2023 quarterly CASM ex-fuel of $10.16 falling well short of Delta Air Lines’ (DAL) $13.20 and American Airlines’ (AAL) $13.15.

But likely due to (1) a relatively heavy mix of premium offerings and (2) a less competitive landscape relative to the saturated East Coast and mid-continent markets, Alaska can produce RASM (per-unit revenues) above that of any other U.S.-based airline outside the Big 3 legacy players.

Regarding the second point above on competition, I think that the announced acquisition of Hawaiian Airlines will help to consolidate the West Coast business. Meanwhile, Southwest’s (LUV) recurring operational flops may continue to serve as a (temporary, at least) competitive advantage for Alaska Air Group.

Also, Alaska remains one of the least leveraged airlines in the country. While debt levels have increased following COVID-19, net debt as a percentage of total assets remains low, at about 5% vs. Spirit Airlines’ (SAVE) unappealing 25% and American’s whopping 40%.

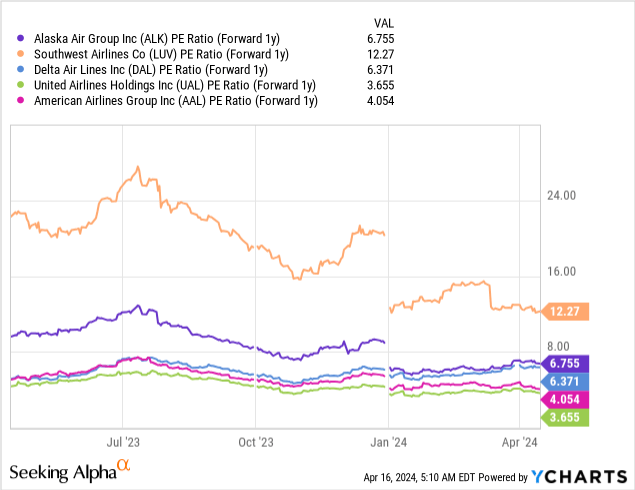

Lastly, despite being a fundamentally robust airline, I don’t find ALK stock expensive. True, next-year P/E of 6.8x is at the top of the legacy carriers’ valuation range, as the chart above depicts (it is difficult to talk P/E in the low-cost space due to projected net losses across Alaska’s peer group, ex-LUV). Still, the mid-single-digit multiple is far from aggressive, in my view, considering Alaska’s decent unit economics, good-looking balance sheet, and compelling EPS growth expectations of 39% and 19% in 2025 and 2026, respectively.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.