Morsa Images

The First Trust RBA American Industrial Renaissance ETF (NASDAQ:AIRR) invests in small and mid-cap industrial sector companies with the majority of their business in the U.S. along with regional banks typically connected to manufacturing hubs.

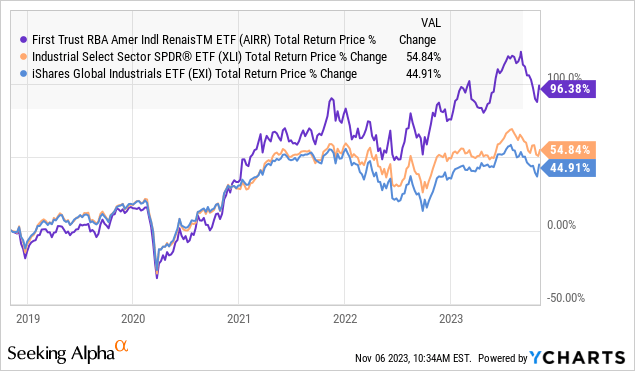

The idea here is to capture exposure to what is seen as an ongoing resurgence of domestic industrial activity as a secular investing theme. Indeed, the strategy has worked with AIRR outperforming industrial sector benchmarks, nearly doubling in value over the last five years.

That being said, we want to bring attention to what may be an overlooked risk of the fund concentrated in U.S. companies operating locally. Simply put, the fund’s lack of exposure to global stocks could mean it misses out on a broader rally for the industrial sector based on more bullish international trends. By this measure, we see room for AIRR to face some higher volatility and potentially underperform going forward.

What is the AIRR ETF?

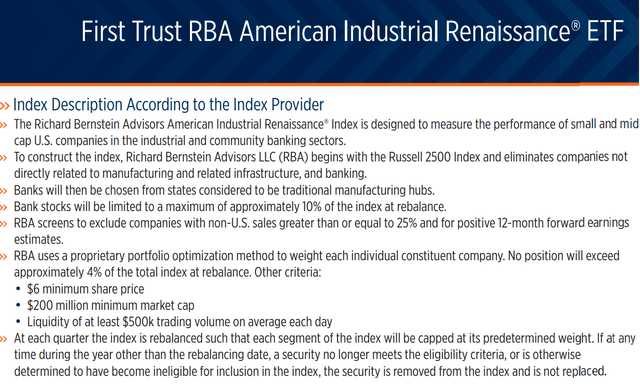

AIRR technically tracks the “Richard Bernstein Advisors American Industrial Renaissance Index”. Starting with companies within the Russell 2500 Index as the universe of eligible stocks, the rules-based strategy screens industrial sector names specifically focused on manufacturing or related to infrastructure.

Importantly, companies that generate more than 25% of total sales outside the U.S. are excluded. The criteria also only include companies with positive earnings estimates as a basic fundamental-based filter.

The community bank stocks are selected from states that are seen as typically serving the needs of these manufacturing hubs in the United States, although the sector is limited to 10% of the overall portfolio. By this measure, we do not believe the bank’s stocks are a primary driver of the fund’s performance other than marginally balancing some of the risks.

Finally, the underlying index uses a mean-variance optimization method for the underlying weightings. This means that each holding’s level of risk in terms of trading volatility and risk-adjusted return is considered. Each position is capped at 4% of the total weighting with a quarterly rebalancing.

The index sponsor cites an ongoing trend where U.S. manufacturing has once again begun to capture incremental global market share following decades in decline going back to the 1950s and 1960s.

Richard Bernstein Advisors believes the U.S. has key advantages in terms of its labor force productivity, energy costs, and political stability particularly relative to emerging markets. From the index materials:

We continue to believe that investors are over-estimating the risks within the United States and under-estimating the risks in the emerging markets. If we are correct in that assessment, then the American Industrial Renaissance could be an investment theme for many years.

In other words, AIRR attempts to express a market view that companies operating in markets within the U.S. may be best positioned to deliver positive long-term shareholder returns.

AIRR Portfolio

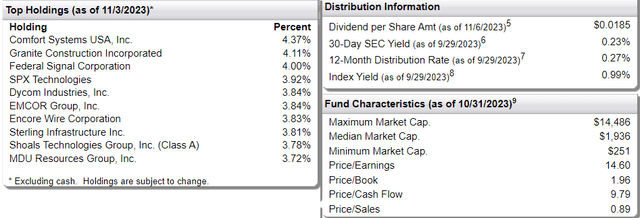

The largest current holding in the AIRR portfolio with a 4.4% weighting is Comfort Systems USA Inc (FIX) specializing in heating, ventilation, and air conditioning (HVAC) services. Granite Construction (GVA) is a major engineering name within the transportation and water infrastructure markets. Federal Signal Corporation (FSS) is recognized as a leader in industrial signage, signaling, communication, and security systems particularly for first responders.

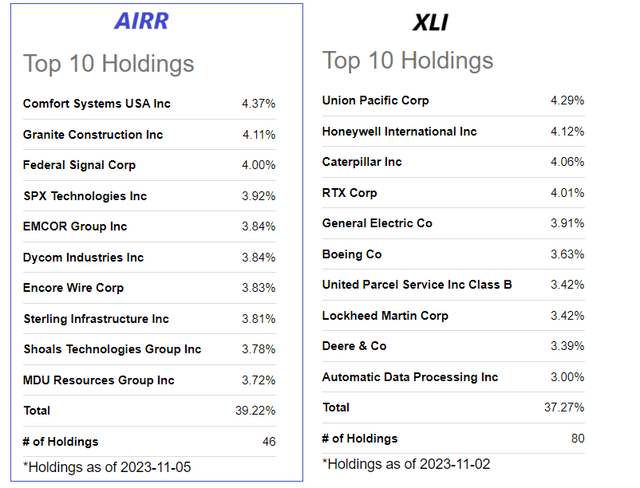

What stands out among current holdings is the concentration among a select but relatively diverse group of just 45 stocks with companies otherwise not widely followed. With an average market cap of just $2 billion, AIRR has a distinct small-cap tilt.

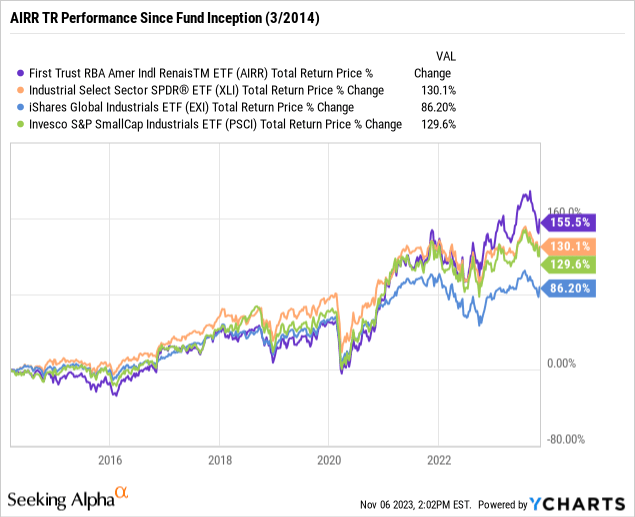

As mentioned, AIRR has impressively beaten out its S&P 500 Industrials Index benchmark since the fund’s inception nearly a decade ago in 2014 with a 156% cumulative total return compared to 130% from the Industrial Select Sector SPDR ETF (XLI) over the period.

We note that the strategy is also ahead of the iShares Global Industrials ETF (EXI) as well as the Invesco S&P SmallCap Industrials ETF (PSCI) as their comparable funds.

From the chart above, it’s evident that the bulk of AIRR’s outperformance has occurred in recent years, particularly since the pandemic. We can offer a few explanations for that spread over the last 3- and 5 years.

First, the aspect of focusing on companies operating within the United States has paid off. A major trend in recent years, even during COVID-19, has been the strength of the U.S. economy compared to more volatile conditions internationally. On the other hand, Asia-Pacific has overall disappointed with lagging growth, further pressured by the regulatory crackdown and trade uncertainties in China.

By this measure, AIRR has benefited by avoiding some of those headwinds while U.S. companies were able to generate stronger growth servicing domestic customers.

The other part of that same dynamic is the trend of a stronger U.S. Dollar in recent years. This is related to both the stronger economic conditions as well as rising interest rates to the current level at a nearly two-decade high. Simply put, weaker foreign currencies have been more detrimental to companies servicing external markets facing FX risk.

More recently, we can also cite the 2021 “Infrastructure and Jobs Act” which committed more than $500 billion in new spending this decade making the companies within the AIRR portfolio well-positioned to benefit.

Overall, the “American Industrial Renaissance” theme has played out as expected by the fund sponsor and the results speak for themselves.

What’s Next For AIRR?

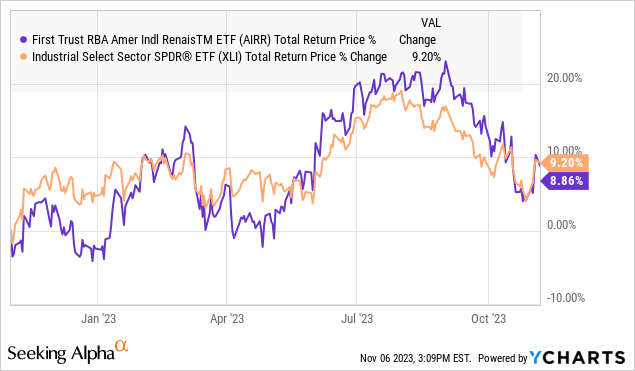

As great as AIRR has performed, what’s more important here for our analysis is whether that hot streak can continue. Our takeaway is that we expect the fund to deliver positive returns alongside a decisively optimistic macro outlook and bullish view on stocks, but we’re more skeptical about whether the strategy will outperform its industrials sector benchmark.

Beyond the current holdings of AIRR, what’s more telling here are the companies the fund is missing out on between global industrial leaders like Caterpillar Inc (CAT), General Electric Co (GE), Boeing (BA), and Lockheed Martin (LMT) as top holdings in XLI.

Naturally, these companies as mega- and large-caps have a broader global exposure with their operating and earnings environment materially driven by trends in international markets.

The argument we make is that while the “made in America” strategy for AIRR has worked in recent years, the cycle could favor more global stocks going forward.

In the context of the current macro environment, from the baseline of historically high-interest rates, a scenario where inflation trends lower and interest rates stabilize or back could represent a powerful catalyst for the global economy.

Stronger foreign currencies against the Dollar could help companies operating outside the United States in terms of their top and bottom-line momentum. Indeed, the U.S. Dollar technically reached a cycle high back in late 2022 coinciding with the rally in global equities this year.

So while AIRR has a return advantage historically, that spread has largely converged over the past year and we’d expect XLI to lead higher going forward. In terms of “FX risk”, the exposure of AIRR is not that foreign currencies and their underlying companies earn depreciate, but a lack of exposure to global markets in a scenario where international currencies and global stocks outperform.

Final Thoughts

AIRR is a high-quality fund that we believe can work in the context of a diversified portfolio for investors over the long run. The small-cap positioning can represent a portfolio diversifier or complement a broader large-cap strategy. Balancing that favorable view, we’re taking a more cautious outlook on the “American Industrial Renaissance” strategy over the near term in favor of more global names through 2024.