blackCAT/E+ via Getty Images

With the proverbial clouds lifting ahead of expectations for lower interest rates in 2024, it’s a great time for investors to crank up risk in our portfolios, particularly to lock in great long-term buys that are still substantially down from COVID-era peaks.

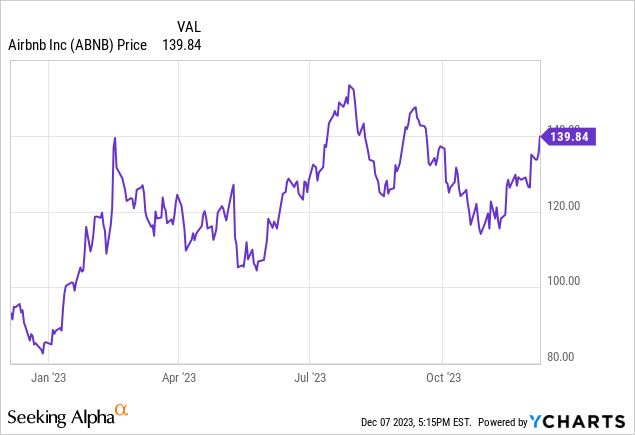

Airbnb (NASDAQ:ABNB), in my view, is a great multi-year investment in this regard. Year to date, the travel giant has seen a ~65% recovery in its stock – but with continued strength in travel demand despite macro challenges, I think there’s substantially more upside to go as we head into 2024.

Even despite the fact that Airbnb is a household name today – taking over and disrupting the hospitality industry as completely as other companies of its generation admire Uber (UBER) have disrupted mobility and delivery – the company is still expanding globally, attracting more guests as well as hosts to its platform by deepening its reach in new areas of the world. The company has also continued to enlarge its use cases beyond just vacations, as many now use Airbnb as a solution for longer-term housing.

I last wrote a bullish opinion on Airbnb in October, when the stock was trading closer to $130 per share. Since then, the company has released Q3 earnings – which temporarily caused a dip in share prices as investors lamented deceleration, to which the company blamed macro impacts on travel. Still, I continue to admire Airbnb’s high-teens bookings growth rates plus its significant margin expansion, and I am renewing my bullish call for the company.

For investors who are new to Airbnb stock, here’s a roundup of what I view to be the key bullish catalysts for Airbnb:

- Diversifying its offerings. Airbnb, in an attempt to cater to more types of guests, is expanding its offerings. Beyond “Experiences” (which offer local activities with local guides), the company has also released “Airbnb Rooms” this year, which offers lower-priced rooms in homes in alignment with the company’s original couch-surfing ethos.

-

Airbnb may not just be for vacation anymore. With so many companies announcing permanent remote or hybrid work structures, many workers have leaped at the chance to become digital nomads and work from anywhere. In the spirit of this trend, even Airbnb itself has also announced that it is allowing its staff to work from any location (including up to 90 days internationally, limited for tax purposes). This trend may see Airbnb picking up not just travel demand, but essentially “rent” budgets from digital nomads as well. As a result of this trend, average trip lengths are increasing quite substantially.

-

Even as consumer spending is shaky amid this year’s recession, travel demand has held up incredibly well. Even more than a year past COVID, travelers are catching up on lost vacations. Picking up on strong end-customer demand, airlines and hotels have also raised rates, which benefits Booking’s commission model.

-

Chance to absorb hotel business through promoted listings. It’s not a great time to be in the hotel game right now. After facing two years of heightened vacancy, hotels have always dealt with high third-party booking fees through platforms admire Expedia (EXPE) and Booking (BKNG). Airbnb already allows boutique hotels to list on its platform for a fee; over time, Airbnb could fully throw its hat in the ring to contend against the high-fee OTA giants.

-

Profitability in mind. During the immediate aftermath of the pandemic, Airbnb laid off about 20% of its staff. While it is now continuing to hire, this profit-centric mindset and the fact that Airbnb is structurally leaner than it was pre-pandemic has allowed the company to make sizable profitability gains.

Stay long here: this is an iconic brand that is still fairly under-penetrated in its core market. As Airbnb continues to add listings around the world, and as Airbnb listings continue to be more competitive against rising hotel rates, the company has plenty of catalysts to drive performance in 2024.

Q3 download

Let’s now go through Airbnb’s latest quarterly results in greater detail. To me, the core underpinning of Airbnb’s appeal rests on two factors: first, strong bookings trends and platform expansion metrics; and second, continued operating leverage driving higher profitability.

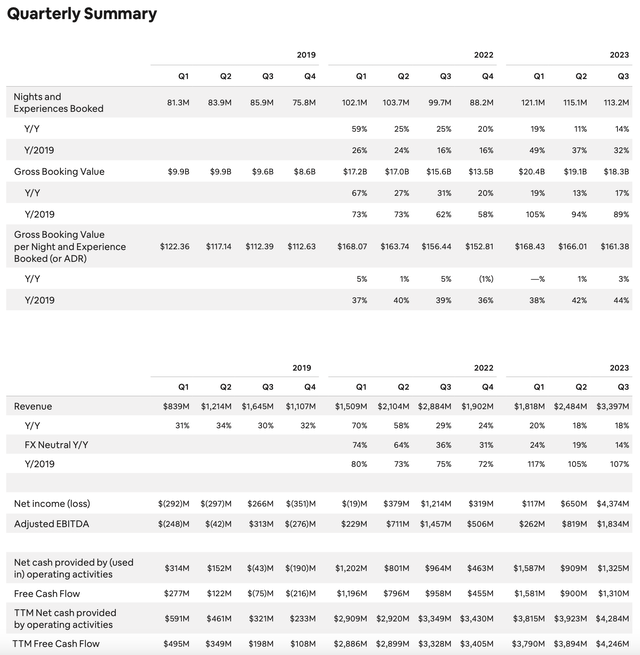

The Q3 earnings summary is shown below:

Airbnb Q3 highlights (Airbnb Q3 shareholder letter)

Airbnb’s revenue grew 18% y/y to $3.40 billion in the quarter, slightly ahead of Wall Street’s expectations of $3.37 billion (+17% y/y). Underneath that, gross bookings value on the platform accelerated to 17% y/y (from 13% y/y in Q2) to a staggering total of $18.3 billion.

It’s worth comparing Airbnb’s bookings performance against its peers, particularly in the OTA sector. Booking.com (BKNG), its largest rival, saw total gross bookings at slightly stronger growth of 21% y/y in the quarter (accelerating as well versus 15% growth in Q2). Do note, however, that Booking.com’s total gross bookings (more than double Airbnb’s at ~$40 billion per quarter) include contribution from air tickets and rental cars; and airfare, though a small contributor to revenue, grew 57% y/y in the quarter to benefit gross bookings. The more relevant metric to differentiate is room night growth of 15% y/y for Booking, which is roughly in-line with Airbnb’s “nights and experiences” booked of 14% y/y growth. All in all, Airbnb appears to be maintaining market share against Booking.com – but gaining against Expedia (EXPE), which exhibited 7% y/y growth in dollar-based bookings to ~$26 billion (again, this includes airfare and rental cars) and 10% y/y growth in room nights booked.

The company described Q3 as a record summer travel season. Per CEO Brian Chesky’s remarks on the Q3 earnings call:

Q3 was a record travel season on Airbnb. Nights and Experiences Booked grew 14% in Q3 compared to a year ago. We saw an acceleration of nights growth across all geographies and we are particularly encouraged by the growth of first-time bookers during Q3 and we saw more nights than ever booked in the Airbnb app with 53% of gross nights booked in the app compared to 48% in the same period last year.

And finally, international expansion markets are gaining momentum. Cross-border nights book increased 17% in Q3 compared to a year ago. In Asia Pacific, our business has fully recovered to pre-pandemic level. And we’re seeing significant growth in Asia Pacific markets such as Taiwan, Thailand and Indonesia, all experiencing year-over-year nights growth above 30% on an origin basis.”

Supply growth continues to benefit Airbnb as the company continues to attract more hosts in new places. Active listings grew 19% y/y, and added roughly 1 million net-new listings since the start of the year. Longer stays – including especially long stays – also continued to drive demand, with stays in excess of 3 months growing 20% y/y. Overall, stays in excess of one month are 18% of Airbnb’s total bookings.

Pricing continues to rise, but on a more moderate pace. ADR grew 3% y/y to $161, but after adjusting for constant-currency, growth would have been closer to 1% y/y.

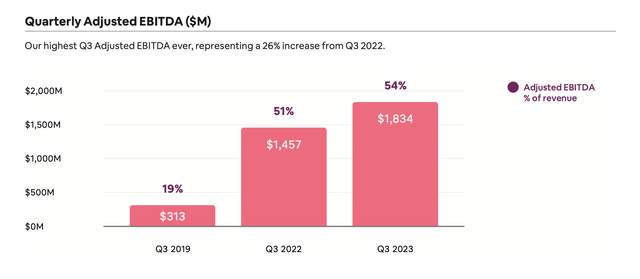

Profitability also remains the second core highlight for Airbnb. The company hit an incredibly impressive 54% adjusted EBITDA margin in the quarter, up 3 points from a year-ago margin of 51%. On a nominal basis, adjusted EBITDA grew 26% y/y to $1.83 billion:

Airbnb adjusted EBITDA (Airbnb Q3 shareholder letter)

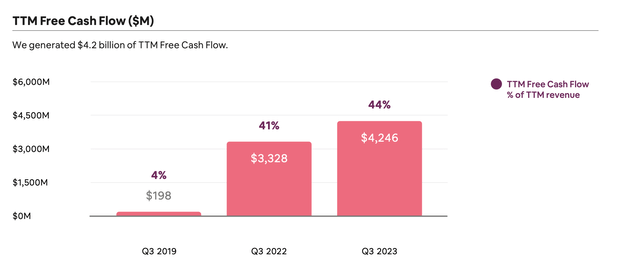

And through the year-to date period, Airbnb has also significantly increased its free cash flow, up 28% y/y to $4.25 billion, also representing 3 points of margin improvement y/y:

Airbnb FCF (Airbnb Q3 shareholder letter)

And as can be shown in the chart above, this is a far cry above the pre-pandemic era, when Airbnb was barely generating any cash flow.

Key takeaways

Airbnb is a company that has grown substantially in the pandemic era, and more importantly, has been able to hold onto that growth and better its operating leverage since that time. Stay long here as the company’s domain over the global hospitality industry continues to enlarge.