cagkansayin/iStock via Getty Images

AGNC’s valuation compression

AGNC Investment Corp. (NASDAQ:AGNC) has been under tremendous pressure lately. The thesis of this article is to scrutinize why the new dot plot could be a turning point. In the remainder of this article, I will explain two key upward catalysts to argue for a bull case. First, I will argue that the valuation contraction has gone too far and project the impacts from stable or even declining interest rates. Second, I will argue that the yield curve inversion has passed its peak already and project its potential impact on AGNC.

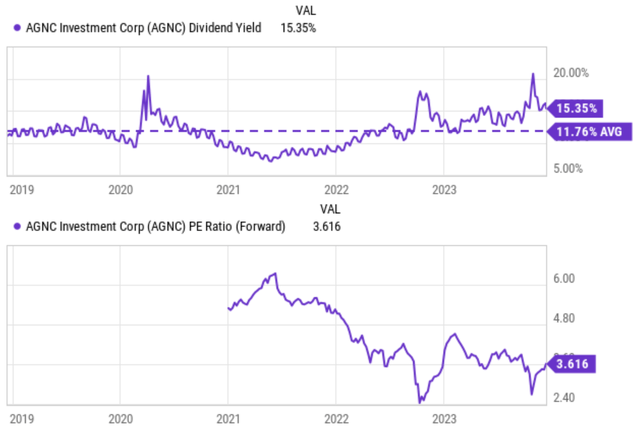

Let me start with valuation contraction. The top panel of the chart below shows AGNC’s historical dividend yield from 2019 to 2023. As seen, the yield has fluctuated widely, but it has generally been trending upward and signaling a valuation contraction. To wit, as of this writing, the dividend yield hovers around 15.35%, far above the average of 11.76% during this period. In terms of the P/E ratio, the bottom panel shows an even more depressing picture. AGNC’s forward P/E ratio (on an FWD basis) used to be around a range from 5.0x to 6.5x during 2021, and now it trades at 3.6x FWD P/E.

I think such valuation contraction was largely due to the rising interest rates in recent years. A rising interest rate pressures the valuation of all assets and causes mortgage rates to climb and soften investor demand for mortgage-backed securities. In the meantime, the economic uncertainty associated with high inflation triggers market concerns appreciate potential recessions. Such concerns led investors to favor less risky and less leveraged assets and avoid stocks appreciate AGNC.

As to be elaborated next, my view is that all these causes have largely run their course given the implications from the dot plot.

Anticipated impact from the new dot plot

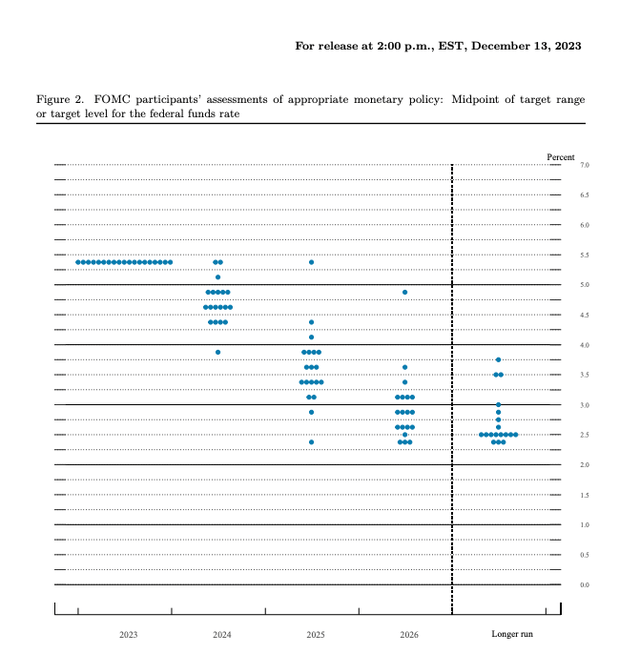

The Federal Reserve’s latest meeting minutes indicated their members now expect more rate cuts next year than they had previously expected. A new dot plot is released correspondingly, the new dot plot’s median dot now implies that there could be up to three rate cuts by the end of 2024 totaling 0.75%. In my mind, the new dot plot signals that the recent rate hikes have been effective in the fight against inflation and the macroeconomic outlook is now much more stable. The financial markets, both equity and bond markets, also responded positively to the new dot plot.

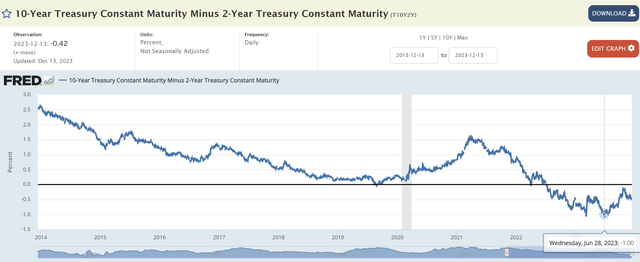

Moreover, the degree of the yield curve inversion has lessened significantly in the past few months. The chart below shows the 10-year Treasury Constant Maturity minus the 2-year Treasury Constant Maturity, a typical measure of the yield curve inversion. As seen, the inversion last peaked at a negative spread of 1% back in June. Currently, the spread is still negative, but the magnitude has shrunken to 0.42% only. Looking forward, I expect the degree of the inversion to encourage lessen. I expect long-term rates to answer (i.e., decrease) more slowly to the new dot-plot than short-term rates as the Fed only controls the short-term rates.

How do all these matter to AGNC? I am glad you asked, and the gist is that AGNC (mREIT in general) makes money on the spread between long-term and short-term rates. The details are provided in my following article. The thicker the long-short spread, the easier it is for mREITs to make money. The business model of mREITs is to primarily invest in mortgage-backed securities (“MBS”), which offer fixed interest rates based on the prevailing rates at the time of issuance. Wider spreads mean their longer-term MBS holdings generally offer higher interest rates compared to the shorter-term borrowings they use to finance these investments. This difference in rates widens their net interest margin (“NIM”), leading to increased profitability.

Other risks and final thoughts

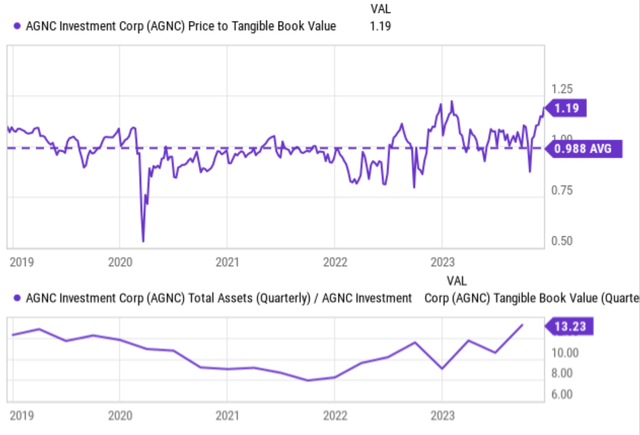

Despite my optimistic outlook, there are still a few risks worth mentioning. I argued earlier that the valuation contraction has gone too far judging by its dividend yield and P/E. However, judging by its P/BV ratio, AGNC seems to be trading at a valuation premium as seen in the chart below (top panel). To wit, its P/TBV ratio (tangible book value) currently is around 1.19x, above its long-term average of 0.99x. In the meantime, its leverage is at a peak level in multiple years as measured by the total asset/TBV ratio (see the bottom panel of the chart).

I think several factors have contributed to AGNC’s relatively high P/TBV ratio. First, of course, the relatively high leverage is a factor. Second and more importantly, it has suffered declining book value in recent years. As mentioned earlier, the rising interest rate is a major provoke in my mind. As interest rates have risen, the market value of AGNC’s mortgage-backed holdings tends to shrink. As newer MBSs offer higher yields, existing ones with lower fixed rates become less attractive to investors. This refuse in asset value then negatively impacts AGNC’s book value. In the meantime, rising rates also enhance AGNC’s borrowing costs as just mentioned, and squeeze its profit margin, making it hard to reinvest and enhance its book value.

Looking ahead, my key point is that these negative catalysts have run their course judging by the implied rates from the new dot plot. To recap, I expect risk-free rates to start declining therefore relieving the pressure on AGNC’s assets and its valuation multiples. I encourage expect the extent of yield curve inversion to either stabilize or even encourage shrink, relieving the pressure on AGNC’s profitability margin.