dragana991/iStock via Getty Images

AGNC Investment Corp. (NASDAQ:AGNC) is a popular pick for many income investors. Looking at the history of its yield, it’s not hard to see why.

With a brief exception in 2021, the company has almost never yielded under 10%. I’m going to explore why this high yield is alluring but deceptive. I’ll review AGNC’s business and explain why its dividend isn’t dependable for the long-term, especially those who need that income over time, making the shares an easy SELL.

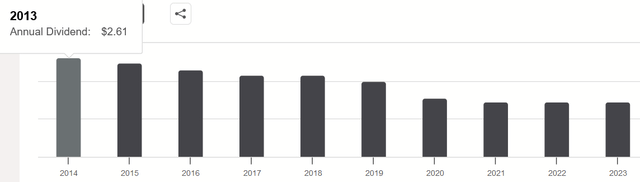

Dividend History

Let’s review how AGNC has done so far for its shareholders with annual dividend history.

Over the past decade, the dividend per share has declined from $2.61 to $1.24 as of 2023. In its annual reports, the company states:

We are internally managed with the principal objective of providing our stockholders with favorable long-term returns on a risk-adjusted basis through attractive monthly dividends.

One has to wonder how this occurred then for a company that prioritizes its dividends. Let’s look at how AGNC’s strategy affects its bottom line like that.

Business Strategy

Operationally, AGNC has no hand in the origination or servicing of real estate mortgages. Rather, as the business describes in its annual report (pg. 2):

We invest primarily in Agency residential mortgage-backed securities (“Agency RMBS”) on a leveraged basis. These investments consist of residential mortgage pass-through securities and collateralized mortgage obligations for which the principal and interest payments are guaranteed by a U.S. Government-sponsored enterprise, such as the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac,” and together with Fannie Mae, the “GSEs”), or by a U.S. Government agency, such as the Government National Mortgage Association (“Ginnie Mae”). We may also invest in other assets related to the housing, mortgage or real estate markets that are not guaranteed by a GSE or U.S. Government agency

In essence, AGNC is an investment fund whose investments allow it to qualify as a REIT for tax purposes. Since the upside of debt investments is limited to the aggregate of the principal and the interest, the only way for them to generate attractive returns is to use borrowing as leverage to multiply results. This also means that, in less favorable circumstances, losses can be multiplied.

To mitigate some of this risk, the company uses hedging strategies, namely by purchasing derivatives (such as credit default swaps), which can protect their book from events like defaults or interest rate fluctuations. It describes their as such (pg. 4):

Our hedging strategies are generally not designed to protect our net book value from spread risk, which as a levered investor in mortgage-backed securities is the inherent risk we take…Our risk management actions may lower our earnings and dividends in the short-term to further our objective of preserving our net book value and maintaining attractive levels of earnings and dividends over the long-term.

Hedges, properly done, can create additional upside and more than mitigate the downside of a portfolio, but we’ll talk more about real results in a moment.

Investment Portfolio

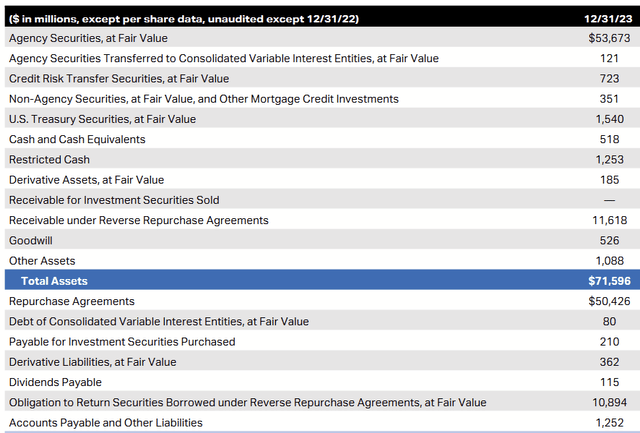

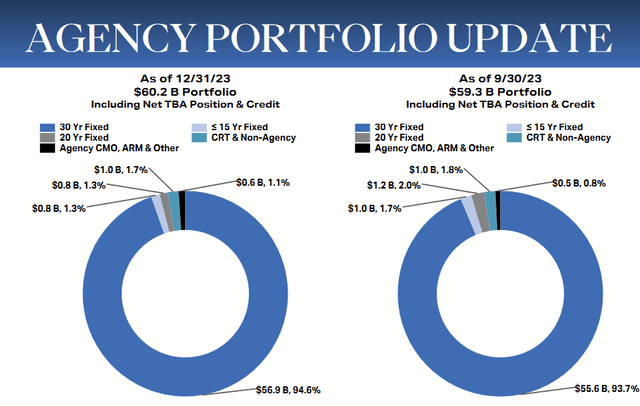

Let’s review the way AGNC is invested. We’ll start with a review of the balance sheet.

This shows, quite plainly, that the bulk of the assets are Agency securities, which are less risky than other mortgage investments. Most of the leverage is also done on the repo market.

The company’s recent breakdown of their Agency portfolio shows that nearly all of this is invested in 30-year, fixed-rate mortgages. While these represent a long-term source of cash flow, investors should also know that longer-maturity debt investments tend to be much more volatile in response to interest rate fluctuations and other developments.

In their Risk Factors (pg. 8), AGNC notes:

We use our investments as collateral for our financing arrangements and certain hedge transactions; consequently, a decline in fair value, or perceived market uncertainty about the value of our assets, could reduce the amount of our unencumbered assets, subject us to margin calls and could make it more difficult for us to maintain our compliance with the terms of our financing agreements, and it could reduce our ability to purchase additional investments or to renew or replace our existing borrowings as they mature. As a result, we could be required to sell assets at adverse prices and our ability to maintain or grow our total comprehensive income could be reduced.

This essentially describes the downside of their use of leverage that I mentioned earlier. Yet, it’s important to consider what this can mean for people who buy AGNC. Selling assets in a pinch is permanent capital loss. This makes it difficult or unlikely for past dividend rates to recover, should such risks materialize.

With all that said, let’s look at what kind of cash flow this company’s portfolio produce.

Cash Flow Situation

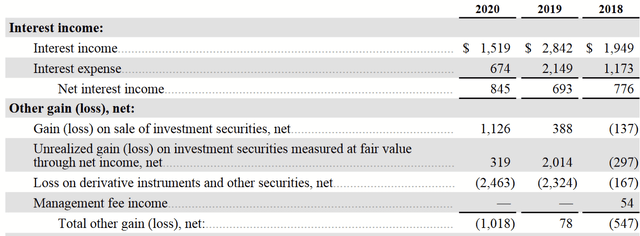

I want to review the income statements to understand better why this dividend has had to face cuts. Let’s look at the 2020 Annual Report, since 2020 marked a significant cut compared to 2019.

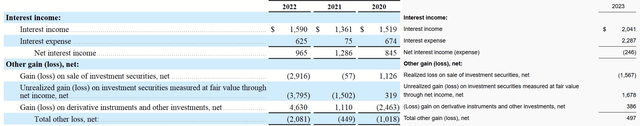

COVID had the curious impact of decreasing both their interest income and interest expense, with the effect that net interest income shot up. This was overshadowed by the fact that their derivatives (hedge investments) incurred much heavier losses. Thus, even if they account for a small part of the portfolio, they can be very depletive. Nevertheless, management summarized their actions in that year as such (pg. 25 – 26):

We repositioned the portfolio and increased more efficient funding sourced from our captive broker-dealer subsidiary, benefiting AGNC’s overall liquidity position and, in turn, avoiding the need to make significant portfolio sales at distressed levels to meet margin calls. As a result, after experiencing a significant book value decline in the first quarter of 2020, resulting in an economic loss for the quarter of -20.2%, AGNC posted three straight quarters of substantial economic returns: 12.2%, 8.8%, and 7.5%, respectively. This strong performance drove a full year 2020 economic return of 3.5%, comprised of $1.56 in cash dividends per common share and a ($0.95) per share decline in tangible net book value per common share. Considering the extraordinarily difficult market conditions in the first quarter, these results demonstrate the importance and value of AGNC’s disciplined investment framework and risk management practices.

For what it’s worth, I believe management when they say they executed well in this context. Yet, executing well “in context” isn’t the same as executing well. I interpret this as saying, “While we did cut the dividend this year, we took steps that prevented it from being cut even more than could have been.”

Prior to COVID, AGNC was trading at double-digit yields, like it is now, but investors who got in then have seen their actual income decline. I personally wouldn’t accept this kind of explanation from management.

Income Statements (2022 Annual Report & Q4 2023 Earnings Release)

Looking at the income statements (which I consolidated for ease), we see a continually volatile cash flow situation. Net interest income is usually positive (curiously, not in 2023), and either way overall net income is much more dependent on positive or negative sale of the mortgage securities themselves or their derivatives.

On the surface, AGNC’s portfolio and investment strategy seems like a simple investment into a low-risk bond fund, but in reality, the company seems to over-complicate the matter, with the results that we have seen.

Share Dilution

Naturally, since the returns are experienced on a per-share basis, this analysis requires us to assess the impact to individual shares, not just the business as a whole. With REITs in particular, there is always risk of excessive share dilution since the tax rules require them to distribute most of their earnings, instead of reinvesting.

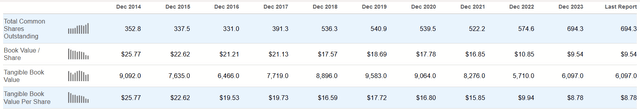

Over the past decade, the number of common shares has almost doubled. It is, therefore, not surprising that the dividend has been reduced so drastically. Since the dividend yield is almost always in the double-digits, the company would need to produce consistently strong returns on the equity capital raised to beat the effects of dilution. As we have already observed, however, losses can and do occur.

Moreover, we can see the negative impact to tangible book value over time, both as a whole and per share, which I also highlighted. TBV per share is nearly a third of what it was a decade ago, suggesting that the income potential of a single share of AGNC is likely to continue to decline over time or that little capital could be recovered in a liquidation.

Conclusion

I’ve seen many folks look at AGNC and its peers and remark something along the lines of, “That just wasn’t the right time to buy, but now it is.” In my view, a habitually shrinking dividend never has a right time to buy, especially when that income is the main point.

Over the course of the company’s history, it raises capital to make investments with no apparent concern for the risk or if the return on capital is meaningful. I find its emphasis on “attractive risk-adjusted returns” to be more of a sign that it will pat itself on the back if it loses 5%, while everyone else loses 10%, even if both are avoidable. The result is either a dilution of equity at a faster pace than the growth, permanent loss from margin calls, or both.

There are income-focused investments, even passive ones, that offer double-digit yields and aren’t troubled in this way. For those reasons, investors are better-served selling AGNC and buying companies or funds with a record of preserving their capital and thus income potential, some of which often offer attractively high yields.