spooh

Over the last decade, AerCap’s (NYSE:AER) stock has typically traded within a range of 0.7-1.2x book value, excluding the impact of COVID-19 lockdowns. Presently, the price/book value stands at 0.87x, seemingly unremarkable. However, this article delves into the opportunity arising from the growing divergence between asset fair value and book value, fueled by four key factors, collectively contributing to a potential +40 USD per share in excess of book value.

The following drivers of why true asset value is much higher than book value will be discussed:

-

Probabilistic value of remaining confiscated Russian aircraft after the Aeroflot settlement

-

Purchase accounting post-GECAS takeover driving a wedge between pre-existing book value and GECAS aircraft book value on AER’s balance sheet

-

A long history of selling aircraft above book value in the secondary market

-

Impact of recent above-trendline inflation

Roughly, adjusting for purchase accounting of the GE acquisition yields +20 USD per share, and the other drivers yield +7 USD per share each. With book value at around 81 USD at year-end, this implies an AerCap asset fair value of 123 USD per share.

I am quite sure AerCap’s management is acutely aware of the true value of the firm (it might even be higher) and will unlock value in the years to come. This post will not be about the historically superb value creation by AerCap management, which will ensure either a larger total shareholder return if the discount remains high (via share buyback accretion), or a high IRR from a large re-rating post the GE overhang.

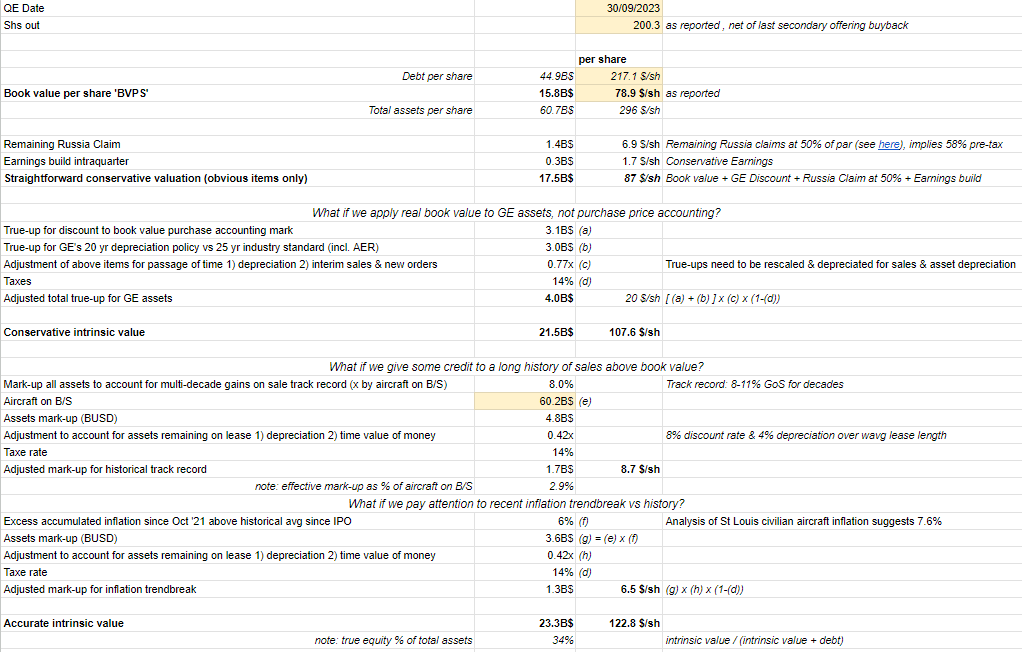

Follow along in my detailed SOTP:

Author’s calculations

Note I have already adjusted both the share count and equity value for the 500 million share buyback from the last GE secondary sale that happened after Q3 end.

We start with the remaining Russia claim or a remaining face value of 2.75 billion USD. This can either be recouped via settlements with the airlines (which happened in the case of Aeroflot this year), or recouped via the ongoing case against AerCap’s insurers (trial starting next June) so there is some optionality here. To account for the uncertainty and time value of money, I’m valuing the remaining claim at 50c on the dollar. I would not be surprised if AerCap played hardball in 2023 with some Russian airlines to avoid early settlements in the context of GE dumping AerCap stock (which AER benefited from by buying chunks below depressed market prices). This gets us to +7 USD per share above book value. I also credit the earnings already in the bank for part of Q4.

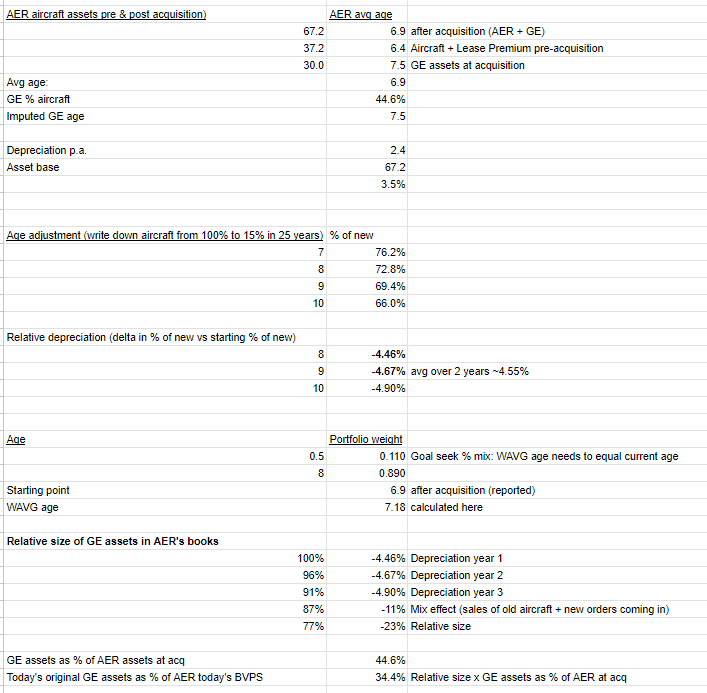

Secondly, and most importantly, we analyse the 2021 GE acquisition. By paying 30 billion USD at closing for GE, AerCap forced GE to write down its net assets divested by more than 3 billion USD. But this is not all of it. GE had an unusually conservative accounting policy in the industry of writing down its assets over 20 years instead of 25 years. Adjusting for this, and taking into account the average GE fleet age at the time yields another 3 billion USD. Together, this means that AerCap acquired assets generally worth 36 billion USD for 30 billion USD. Purchase accounting forces a purchaser to mark these assets at acquisition cost, so the ‘true book value’ of the asset base was arguably 6 billion higher the day after the close.

However, we have to mark down this number (the delta between the purchase price and the ‘true book value’) by the dilutive effect of both the passage of time and aircraft sales. I do this exercise below, yielding a factor 0.77x I am applying on the 6 billion USD.

Detailed calculation to discount GECAS purchase accounting delta correctly to account for passage of time and aircraft sales. (Author’s calculations)

After accounting for this, the after-tax net discrepancy leftover today is still 4 billion USD or 20 USD per share.

Thirdly, I am taking note of AerCap’s rich and consistent history of selling planes at 8-11% unlevered margins versus book value since its IPO. The company noted an average gain of 9% in a recent presentation. As it turns out, making very large and well-timed orders for aircraft means the secondary value has always been a bit higher than the depreciated book value for AerCap.

I apply 8% on the whole portfolio but discount this embedded asset value to account for

-

Time value of money: this embedded value can only be realised after/close to lease expiration (with a portfolio WALE of 7 years)

-

Depreciation: this embedded value will only be realised on the leftover value after lease expiration (depreciating the portfolio for the WALE period of 7 years)

-

Taxes

The net unlevered markup I apply is hence only +2.9%, or 10% on a levered basis.

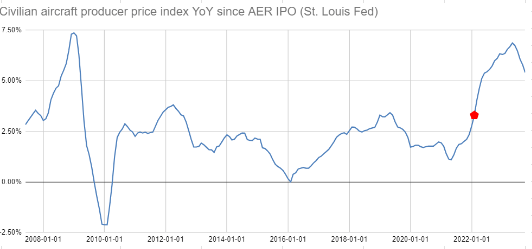

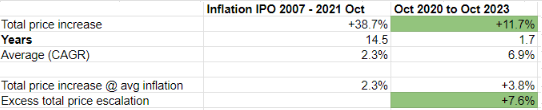

Lastly, I want to credit some value to the portfolio because of the accumulated effect of the recent inflationary episode. As a proxy for replacement cost, I use the St. Louis Fed’s Civilian aircraft producer price index. The red pentagon in the figure below denotes my period split between the recent inflationary episode and the preceding period, going all the way back to AER’s IPO.

St. Louis Fed Civilian Aircraft PPI index

This is what I found:

Author’s calculations based on St. Louis Fed Aircraft PPI index

The average accumulated PPI inflation has been +7.6% higher in the last 2 years versus what it would have been using average numbers of the preceding period. On top of the abnormally high monetary inflation, we saw unprecedented supply chain issues widely reported in the news but also on AerCap’s earnings calls.

To account for this supernormal inflation, I credit 6% (instead of the 7.6% above trend) to the asset base, and use the same adjustment factors as in the previous point (time value of money and depreciation) to find another value pocket of +6.5 USD per share above book value.

In summary, AerCap’s hard asset value appears to outperform its book value for various reasons. While each factor may seem insignificant in isolation, their cumulative impact suggests a fair value of approximately $123 per share

Note I have not given credit to the order book probably being ‘in the money’ thanks to the supernormal inflationary episode of 2022-2023. We do not know the contractual terms of the order book but inflation escalators, if present in the first place, typically have reasonable caps, and almost all of AerCap’s order book was struck in deals significantly before the onset of supernormal inflation. If any reader has more details about this, I would appreciate it.