Thomas Barwick/DigitalVision via Getty Images

Aena S.M.E., S.A. (OTCPK:ANYYY), which is 51% owned by the Spanish government, is the largest airport operator by passenger volume.

In terms of assets, Aena has 46 airports and 2 heliports in its Spanish network, and the company also has a significant presence outside of Spain, including ownership of 51% equity of London Luton airport and 100% of Northeastern Group of airports in Brazil.

In terms of its sales, Aena gets the majority of its revenues from its Spanish network as the company’s international segment accounted for 12% of total revenues in the first nine months of 2023.

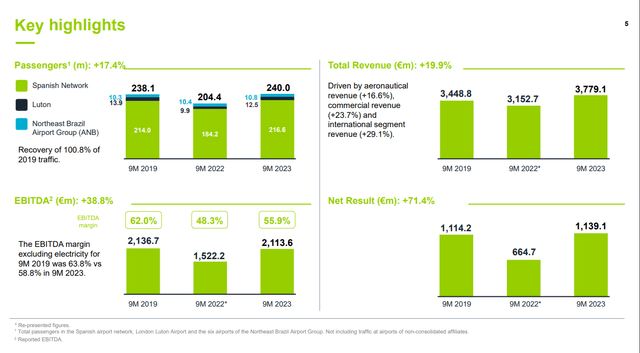

Although the pandemic negatively affected Aena, the leading airport operator’s financials in the first nine months of 2023 is in many ways either stronger or at least similar to the company’s financials during the first nine months of 2019 which was pre-pandemic.

For the first nine months of 2023, for instance, Aena’s passenger traffic was 240 million versus 238.1 million in the same period for 2019. Aena’s net result (net profit) was €1.1391 billion for the first three quarters of 2023, versus €1.1142 billion for the first three quarters of 2019.

In terms of expectations, passenger volumes through Aena’s Spanish airports have improved steadily in 2023 to the point where management said in the Q3 2023 conference call that they expect 280 million passengers in Spain for 2023, representing 102% traffic of 2019.

Although not as strong as its Spanish business, Aena’s international business is recovering from the pandemic as management notes that traffic for London’s Luton Airport for the first nine months of 2023 reached 90% of the traffic in 2019.

Into 2024, demand for Aena’s airports remained strong. According to the company, the airports in Aena’s network in Spain received 18,667,212 passengers in January, up 10.3% year over year, and handled 91,752 tonnes of cargo, up 23.1% year over year, both records.

Interest Rates

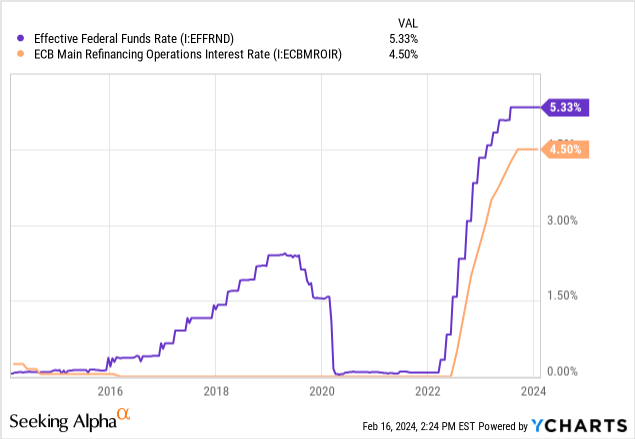

In addition to strengthening passenger traffic, Aena could benefit from the beginning of the normalization of interest rates.

If the ECB main refinancing operations interest rate decreases, for example, consumers in many European countries might have more spending power, all else equal, and Aena’s passenger traffic could benefit as a result.

If the federal funds rate decreases, Aena’s dividend yield could be more attractive to some investors given the effect of the decrease on U.S. Treasury yields. As of February 17, Aena has a dividend yield of 2.86%.

With a more attractive dividend yield for a relatively quality stock, Aena’s valuation could benefit.

Although it is unclear when the Federal Reserve or ECB will begin normalizing interest rates, I believe the two central banks will begin decreasing interest rates at some point this year as inflation is significantly lower than in 2022.

Aena’s interest on debt in the future could benefit if the Federal Reserve and ECB begin to normalize their interest rates.

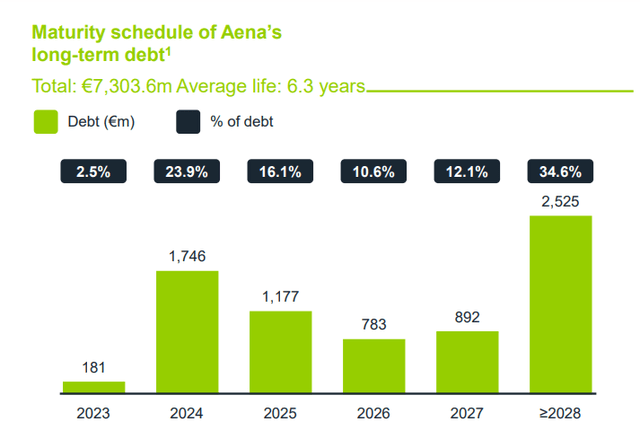

According to the company’s Q3 2023 report, Aena has a total debt of €7.3036 billion, with €1.746 billion maturing in 2024. If interest rates decrease in 2024, Aena might have to pay less in interest rate expenses than it otherwise would have if interest rates remained the same.

Furthermore, lower interest rates could help interest rate expenses on the around 27% of Aena’s debt that is variable.

Potential Headwinds

While Aena has tailwinds, the company also has some potential headwinds.

One potential headwind is that some political parties in Spain have proposed an initiative to promote a reduction of domestic flights on routes with rail alternatives lasting under 2.5 hours maximum to help reduce carbon emissions.

Given Aena gets the majority of its revenue from its Spain network, the company could face a headwind if the initiative succeeded.

In terms of its effect, however, Aena management notes that the vast majority of its routes in Spain do not have a rail alternative lasting under 2.5 hours. There is also a hub exception that could help preserve a number of flight routes to international destinations.

Furthermore, France, a country similar to Spain, implemented a similar policy that didn’t affect air travel much at all. In 2022, France implemented a ban on short haul flights in the country to reduce carbon emissions that only ultimately affected 3 flights routes.

Another potential headwind is that demand for air travel can always weaken for any number of reasons as the pandemic in 2020 illustrated. If demand for air travel weakens significantly, Aena’s margins could come under pressure. Given the pandemic, Aena had eight straight quarters of losses since the first quarter of 2020.

Vertiports

In terms of the medium term, the increasing popularity of electric air taxis, also known as eVTOLs, could represent both a headwind and an opportunity for Aena.

Given they take off vertically, electric air taxis use vertiports rather than airports. Given current economics, travel by electric air taxis currently costs a lot more than travel by airplane and the electric air taxis’ current limited range and the limited number of vertiports make competition mostly theoretical presently.

With more economies of scale and tech improvements, however, the cost of electric air taxis and their range could one day be competitive in certain short haul flight routes. Thus vertiports could be a potential headwind for Aena if the company doesn’t adjust.

If the company successfully adjusts to the future, vertiports represent a potential growth area for Aena.

As a leading airport operator, Aena already has relationships with some airlines that will likely operate air taxis, and furthermore, Aena has extensive experience with various aeronautical regulations that might make it easier for the company to operate vertiports. Aena already operates 2 heliports in its Spanish network that are in some ways similar to vertiports.

In addition, Aena has substantial financial resources given its current EBITDA generation and pretty decent net financial debt/EBITDA ratio of 2.38x for the first nine months of 2023.

If Aena succeeds in adjusting to vertiports, the company has potential upside in terms of revenue.

According to a November 2021 McKinsey article,

Vertiports could be managed by a diverse group of players, including those in rail, public transport, real-estate, and aviation ground handling. Regardless of who is in charge, AAM vertiports could serve as physical extensions of existing airports, providing a gateway to flights originating in city centers. Airport operators might be well positioned to manage vertiports, since they already have most of the required capabilities and can capture many synergies with their traditional operations.

Even a modest AAM offering at airports could generate new revenues. Some business will come from existing passengers who prefer AAM over other types of short-haul transportation, especially if it reduces door-to-door time. Some passengers may even make extra trips because of the greater convenience…We estimate that in a hypothetical airport that serves 45 million passengers per year, AAM may generate incremental revenues of about 5 percent and increase passenger numbers by around 1 percent (Exhibit 1).

Valuation

Given the Spanish government owns 51% of Aena, the airport operator might sometimes operate in the best interests of Spain rather than shareholders. This could potentially mean less growth opportunities than otherwise.

Nevertheless, Aena has many numerous tailwinds including strengthening passenger traffic in its Spanish network, the continued recovery of its international business, and the potential beginning of the normalizing of interest rates this year that could help with valuation.

In terms of expectations, analysts on average estimate Aena S.M.E., S.A. (ANYYY) will earn $1.07 per share in 2023, and $1.25 per share in 2024, giving the company a forward PE ratio of 17.17 for 2023 and 14.61 for 2024.

I think Aena could potentially trade for a PE ratio of 16-17 or higher in the next year if passenger traffic continues to strengthen, interest rates begin to normalize, and the company takes advantage of growth opportunities in vertiports.

Thus that gives me an upside of 9.5% to 16.4% or more in the next year assuming Aena earns the profits that analysts expect, which I think the company could achieve given the tailwinds.

As such, I rate Aena a ‘buy’ given the company’s expected EPS growth and its valuation. Given the risks around the potential change in air travel demand, I would own Aena in a portfolio with the Magnificent Seven to benefit from innovation.

In terms of the near future, Aena’s Capital Markets Day event on March 7, 2024, could be important as it could help clarify management’s financial goals for the future. Aena’s Q4 earnings results expected to be released later this month will also be important.

Overall, Aena is a quality company given its scale, relatively high margins under normal conditions, and the essential nature of airports to modern economies like Spain’s.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.