CasarsaGuru

Aehr assess Systems (NASDAQ:AEHR) has emerged as a notable player in the rapidly evolving semiconductor industry, as evidenced by its exceptional performance in Q1 2024. The company experienced a notable rise in net revenue and enhanced profitability. Its venture into silicon carbide and gallium nitride and engagement in silicon photonics highlight its dedication to innovation and broadening its market scope. This piece examines the financial health of Aehr assess Systems through Q1 2024 earnings and offers a technical assessment of the stock to recognize future directions and investment prospects. The analysis reveals that the stock price has adjusted to a significant technical pivot, indicating the potential formation of a solid base.

Exploring Financial and Operational Performance

In fiscal year 2023, the company experienced remarkable financial performance, setting new records in several key metrics. Net sales soared to $65.0 million, a significant 28% boost from the $50.8 million in 2022. This growth was also reflected in the company’s profitability, with GAAP net income hitting a record high of $14.6 million, or $0.50 per diluted share, representing a substantial 54% jump from the $9.5 million, or $0.34 per diluted share, reported in fiscal 2022. Similarly, the non-GAAP net income also hit a record high at $17.3 million, or $0.59 per diluted share, up an impressive 62% from the $10.7 million, or $0.38 per diluted share, in 2022. Based on this solid financial growth, the company is projecting revenues to outperform $100 million in fiscal 2024, indicating a yearly growth of over 50%. Additionally, GAAP net income is expected to reach at least $28 million, marking a remarkable earnings growth of over 90%.

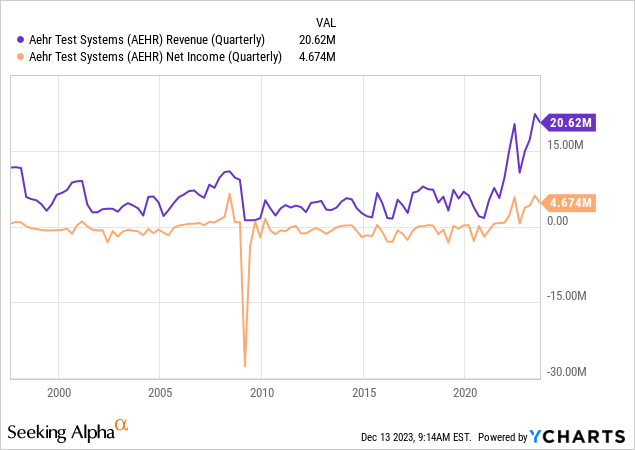

Aehr assess Systems released the Q1 2024 earnings on October 5, 2024, and displayed exceptional financial performance, marking a significant progression in the business growth trajectory. The company announced a substantial net revenue boost, reaching $20.62 million, a 93% boost from $10.7 million in Q1 2023. This substantial boost underscores a notable growth in the company’s market footprint and the escalating demand for its offerings. Moreover, the company’s profitability also experienced a remarkable boost. GAAP net income for Q1 2024 was $4.674 million, or $0.16 per diluted share, a noteworthy rise from the $589,000, or $0.02 per diluted share, in Q1 2023. This rise in net income demonstrates the company’s efficiency in operations and expertise in managing costs. The chart below illustrates a robust growth trajectory in quarterly revenue and net income, as evidenced by the increasing patterns.

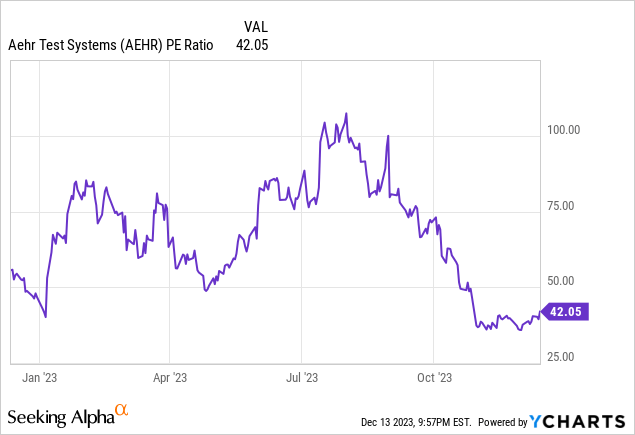

The company’s non-GAAP net income was $5.2 million, or $0.18 per diluted share, an boost from $1.3 million, or $0.05 per diluted share in Q1 2023. This provides a clearer insight into the company’s fundamental earnings. The P/E ratio of Aehr assess Systems has risen to 42.05, recovering from previous lower values. This boost could be seen as a sign of growing market confidence in Aehr’s future prospects and financial performance.

The company maintained a robust bookings of $18.4 million for the quarter. As of August 31, 2023, the backlog stood at $22.3 million, and the effective backlog, which includes orders received post-quarter, reached $24.0 million, signaling a strong and promising revenue stream ahead. From a financial standpoint, Aehr assess Systems is in a favorable position, generating $3.9 million in cash from operations. The total cash reserves, including cash equivalents and short-term investments, were at $51.0 million, increasing from $47.9 million in Q4 2023.

In Q1 2024, Aehr assess Systems achieved notable strategic successes. The company set records in both revenue and units shipped for its FOX™ WaferPak Contactors. Additionally, it launched and gained customer approval for fully automated FOX WaferPak Aligners, highlighting its commitment to innovation and technological advancement. The company’s foray into new markets, including securing a significant contract with a major U.S.-based semiconductor supplier for silicon carbide wafer level burn-in, demonstrates its ongoing growth and diversification.

Aehr assess Systems is expanding its market scope beyond the electric vehicle sector. The company is now tapping into various industrial, solar, and commuter electric train sectors. This expansion is diversifying the applications for its technology. The company is also actively investigating opportunities in the growing markets of silicon carbide and gallium nitride, highlighting areas for potential growth. Moreover, its engagement in silicon photonics, especially in high-power silicon devices, points to new avenues for growth in the upcoming years.

Overall, Aehr assess Systems’ financial results for Q1 2024 represent a significant milestone, demonstrating robust growth and a strong market presence. The company’s impressive revenue and net income growth, backed by a healthy backlog and solid cash reserves, ponder operational efficiency and strategic foresight. As Aehr assess Systems continues diversifying its market reach and investing in innovative technologies, it is well-positioned to capitalize on emerging opportunities in the semiconductor industry, indicating a bright future for shareholders and stakeholders.

Building Momentum for the Next Big Rally

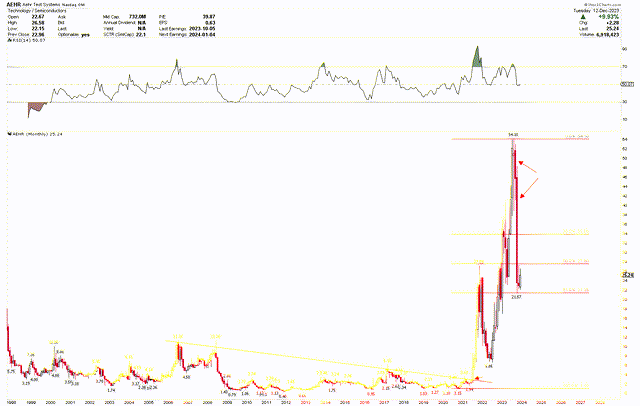

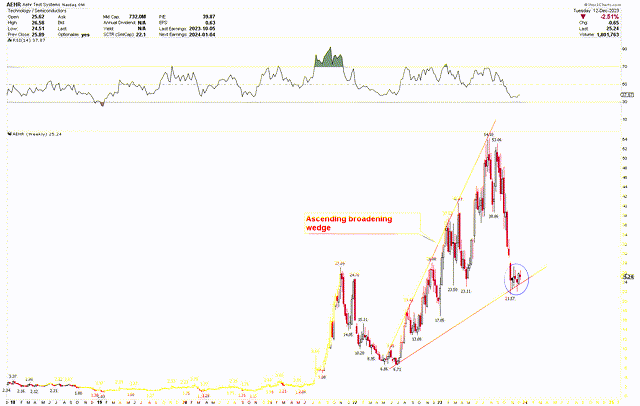

The technical analysis of Aehr assess Systems indicates that despite a notable market correction in September and October 2023, the prevailing trend remains strongly bullish. This upward momentum for Aehr assess Systems started from the 2020 low, where the stock price was at $1.10, and led to a strong rally, hitting a peak of $54.10 in 2023. This significant stock value surge began with a trend line break in July 2021, highlighting its resilience and substantial investor confidence.

This price surge was attributed to a confluence of factors. In 2020, the global semiconductor industry faced unprecedented challenges due to the COVID-19 pandemic, which disrupted supply chains and dampened demand, adversely impacting Aehr assess Systems’ business prospects and investor confidence. However, as the pandemic improved, there was a surge in semiconductor demand, driven by an accelerated digital transformation across various sectors including automotive, consumer electronics, and cloud computing. Aehr, with its specialized testing solutions, was well-positioned to capitalize on this demand surge. Additionally, the company’s strategic initiatives, such as developing innovative testing technologies and expanding into new markets, played a crucial role in strengthening its financial performance and bolstering investor sentiment, leading to a strong rally.

AEHR Monthly Chart (stockcharts.com)

The Fibonacci retracement stretching from the 2020 bottom to the 2023 peak, identifies the $21.35 mark as a critical level. This mark represents the 61.8% retracement, a threshold commonly recognized as an important long-term pivot in technical analysis. Notably, during the intense price correction in September and October 2023, Aehr assess Systems’ stock reached a low of $21.57, aligning with the 61.8% Fibonacci retracement level, regarded as a significant pivot point. Stabilizing the stock’s price around this level suggests the potential formation of a solid base, setting the stage for the next big rally.

This bullish perspective is reinforced by examining the weekly chart, which showcases an ascending broadening wedge pattern starting from the 2022 low of $6.71. Notably, the stock price has been stabilizing with the preserve of this ascending broadening wedge at the October low of $21.57. This consolidation near a strong preserve level suggests the formation of a substantial base, indicating a potential upward movement. Investors can consider this as an ideal time to buy, with expectations of a potential rise in the stock’s value.

AEHR Weekly Chart (stockcharts.com)

Based on the above discussion, the significant price reject during September and October 2023 hasn’t damaged the solid bullish trend. This decrease was a result of increased market volatility. If the stock rebounds from its current level and exceeds the $33.85 threshold, corresponding to the 38.2% Fibonacci retracement level, a robust rally toward new record highs could be anticipated. On the other hand, a monthly closing price below $20 would impair this positive forecast.

Market Risks

The semiconductor industry is highly cyclical and sensitive to global economic conditions. Although the company is currently experiencing robust growth, any downturn in the global economy could direct to reduced semiconductor demand, subsequently impacting Aehr assess Systems’ revenues and profitability. This risk is exacerbated by ongoing geopolitical tensions and trade disputes, which can disrupt supply chains and alter market dynamics. Additionally, the semiconductor industry is known for rapid technological changes and intense competition, which could affect Aehr assess Systems’ market share if it fails to keep pace with evolving technologies and customer demands.

From a technical analysis standpoint, the stock price displays an ascending broadening wedge pattern, underscoring significant market volatility. Should the price fall below $20, this could disrupt the wedge pattern, challenging the bullish outlook and potentially indicating encourage downward movement.

Bottom Line

In conclusion, Aehr assess Systems’ performance in the first quarter of 2024 marks a significant point in the company’s trajectory within the semiconductor industry. The financial results show robust growth, with record-breaking net revenue and profitability that signal the company’s effective strategy and operational efficiency. Aehr’s ventures into new technology areas appreciate silicon carbide, gallium nitride, and silicon photonics highlight its commitment to innovation and market expansion, broadening its appeal to a diverse range of sectors.

The technical assessment of the stock reveals a bullish trend, evidenced by stabilizing the stock price at a critical preserve level. This preserve level is crucial, as it marks the formation of a stable foundation for potential future growth. This level aligns with the 61.8% Fibonacci retracement level and is bolstered by supporting an ascending broadening wedge pattern, both of which serve as critical technical pivot points. The notable consolidation of the stock price at this pivot point underscores the potential for a substantial rally. Investors may consider buying the stock at current levels, anticipating a possible upward trend in its value.