andresr

Overview

Adriatic Metals PLC (OTCPK:ADMLF) is a polymetallic mining company, with about half of its projected revenues from silver & gold, and the remaining half from zinc & lead. The stock is listed in Australia and the UK. The company gets most of its value from the Vares project in Bosnia & Herzegovina, which this article will be about. I have covered Adriatic Metals frequently over the last few years, and those articles can be found here.

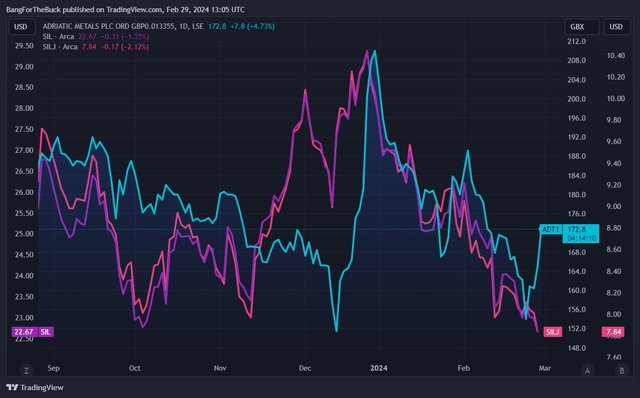

In late 2023, it looked like the stock was starting to re-rate as the mine was approaching completion and the ramp was set to begin. However, the stock has, along with many other precious metals mining companies, sold off heavily again in 2024. Much of the decline was likely due to the poor industry sentiment, but part of it was possibly due to a news release that first concentrate production was delayed a few weeks and that the ramp up would be slower than initially planned. With that said, given that the company has earlier this week announced first concentrate production, I consider Adriatic Metals a good buy at this level.

Figure 1 – Source: TradingView

Recent Developments

Adriatic Metals did in late December 2023 announce an extremely impressive reserve update, where total ore reserve tones grew by 89% compared with the 2021 reserve update, which the 2021 feasibility was based on. I did cover this in my last article, but it was a very positive development that grew the mine life to 18 years, and I consequently estimate the net present value (NPV) growth to about 45% using an 8% discount rate.

The company has continued with exploration drilling and a resource update is due in 2024, so this project is highly likely to continue to grow over the coming years.

In late January, Adriatic Metals provided another update and guidance on Vares. Where first concentrate production was delayed for a number of weeks following some labor availability issues and equipment delays as ships had to be re-routed around Africa instead of through the Suez Canal. With that said, first concentrate production was announced earlier this week, which is a major milestone for the project.

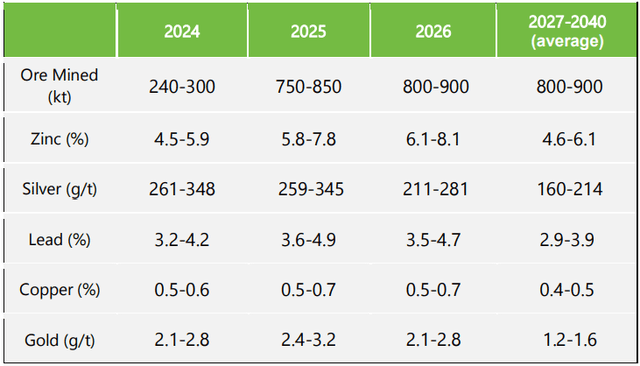

Figure 2 – Source: January 2024 – Vares Update

The ramp up in 2024 will partly rely on somewhat lower grade stockpile material, which is relatively standard during the optimization process, and not push through the more valuable higher-grade material until the mill is operating more seamlessly. However, the somewhat slower ramp up is also due to some geological issues, which will require some support infrastructure to be put in place over the coming months. Steady state production is expected to be achieved in Q4 2024.

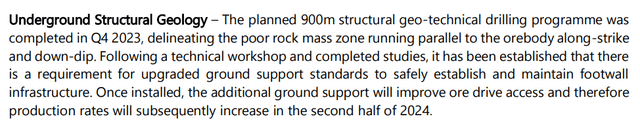

Figure 3 – Source: January 2024 – Vares Update

So, following some minor delays, Adriatic Metals has rescheduled the first debt repayment to Orion from June 2024 to December 2024. Based on what we know today, this rescheduling will likely be sufficient to make sure the company has enough liquidity until we start to see the mine generating positive free cash flow. However, even if a smaller bought deal was to be required, that would be far from a disaster at this point.

Valuation

The share price of Adriatic Metals on the London Stock Exchange is at the time of this writing £1.73, which together with a share count of 295.2M, gives us a market cap of $647M. Let’s be conservative and not include any cash in the valuation. The company has $120M in debt from Orion and $22.7M in convertibles as of the last financials. This gives us an enterprise value of $789M.

My NPV figure is initially based on the feasibility study, where I have adjusted the number for the reserve growth and current spot prices. I have also added the original initial capital cost, which has now been spent and is primarily reflected by the debt in the enterprise value. I have also deducted an assumed $50M from the value for the copper stream. We then get a net present value of the Vares project of $1,406M.

So, putting it all together, Adriatic Metals is presently trading with an enterprise value to NPV of 0.56.

Conclusion

The current Adriatic Metals PLC stock price is in my view a very compelling price for an asset that is now in the early stages of production, with some of the lowest projected operating costs in the industry. We are also likely to see the deposit grow over time as the exploration results have continued to be very impressive.

There are still some minor liquidity concerns lingering for Adriatic Metals. So, the very conservative investors might want to hold off until those are completely in the rear view. However, at that point, the share price of Adriatic Metals could be significantly higher. This is a quality company, with a good valuation, and there is substantial re-rate potential over the coming year.

If the company is above $750M in market cap by the time commercial production is declared, a VanEck Gold Miners ETF (GDX) inclusion is one possible catalyst.

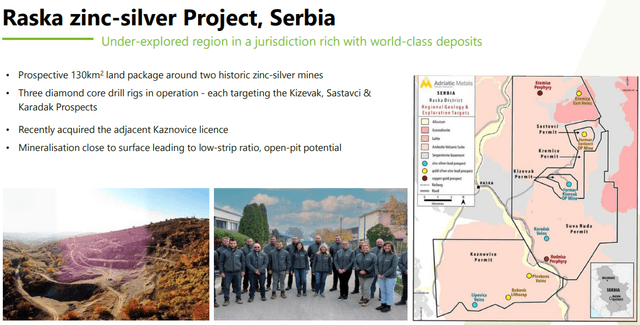

Adriatic Metals also owns the Raska project in Serbia, which I haven’t ascribed any value to today. Once Vares is generating consistent cash flows, we can likely expect the project to get more attention, which might longer term be a source of value creation for the company.

Figure 4 – Source: Adriatic Metals Presentation

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.