Justin Sullivan/Getty Images News

Adobe (NASDAQ:ADBE) is excelling financially and has had powerful operational initiatives recently related to AI that indicate it will continue to succeed in being a leader in its field. However, there are concerns surrounding the firm’s stock valuation, which could be considered overvalued by some measures. I believe the stock is fairly valued but is relatively priced for perfection.

AI Growth Strategies

Adobe is enhancing personalization across its products with AI, creating customer segments, generating personalized ads, and writing customized email copy. These integrations are crucial for the company to keep up with technology expectations from customers who are going to be naturally attracted to the most advanced capabilities.

The firm is also investing in AI to develop microinteractions in websites and digital products. These subtle design elements enhance user experience and engagement, and using AI to develop these makes the process less resource-intensive and more accessible. Adobe will also be using AI to improve the accessibility of digital content in areas like automatic image description generation and video captioning and to make content accessible for disabled people.

Despite recent changes, including terminating the Figma acquisition, Adobe is committed to generative AI, particularly Firefly, which should become a key growth area. Firefly is the firm’s own generative artificial intelligence model, developed in-house and integrated into its suite of creative tools, including Photoshop. The intelligence has the capability to transform and revolutionize design work. As AI development is at the forefront of the firm’s strategy generally, it should optimize the organization’s margins and drive growth for its top line.

Exceptional Financials

From my perspective, Adobe has amazing financials and could be considered one of the best technology stocks to own in the world. While I am currently seeking stocks outside of the technology sector to diversify my long-term and risk-averse portfolio, Adobe remains too good to pass up, and it looks like it will be added to my holdings soon.

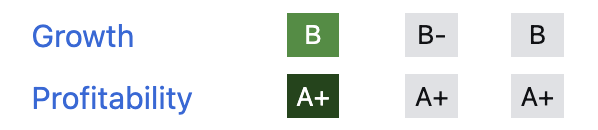

Seeking Alpha’s Quant Factor Grades give the firm a B for Growth and an A+ for profitability, and the reason for this is elucidated in the company’s strong performance relative to peers.

Now, 3M ago, 6M ago (Seeking Alpha)

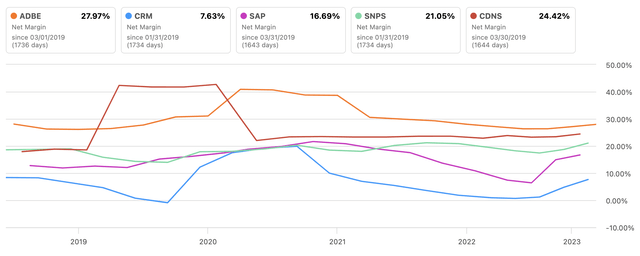

The company has a net income margin that has been reliably at the top of its major industry peers over the last five years, currently at 27.97%:

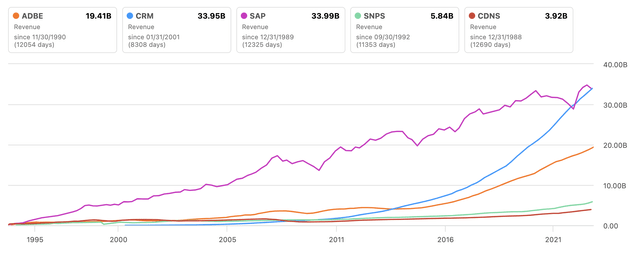

While not the strongest in terms of revenue growth, it still performs well, but a special note has to be made about the incredible results of Salesforce (CRM), a company also worth considering.

Adobe has a highly-regarded suite of products with a customer base that tends to stay with the firm for a long time. The strong quality and maintenance of industry-top tools and software design drive this. As such, the company can reliably maintain industry-best margins after having designed an effective moat in software around some of its main products. I think there is something to be said about the organization’s brand loyalty, allowing it to maintain high sales and subscription prices at lower production and maintenance costs.

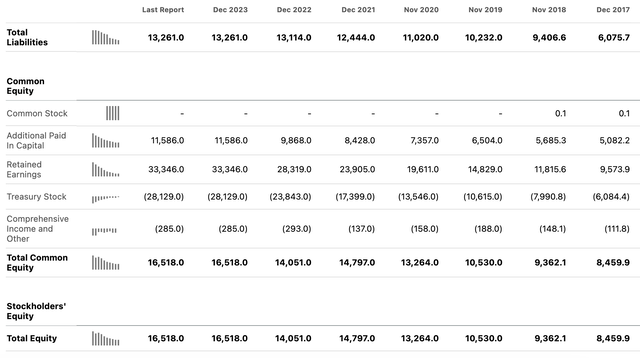

Crucial to maintaining this success is the company’s strong balance sheet, with total equity higher than total liabilities reliably over the last ten years:

Dan Durn is the CFO of Adobe; he was appointed effective October 18, 2021, assuming the role from the previous executive vice president and CFO, John Murphy. The long-term financial management of Adobe seems shrewd to me, and I always look at a company’s balance sheet as a crucial indicator of the foundations of a company’s significant growth and profitability success. I’m pleased to notice Adobe has strong management of its liabilities over a long timeframe.

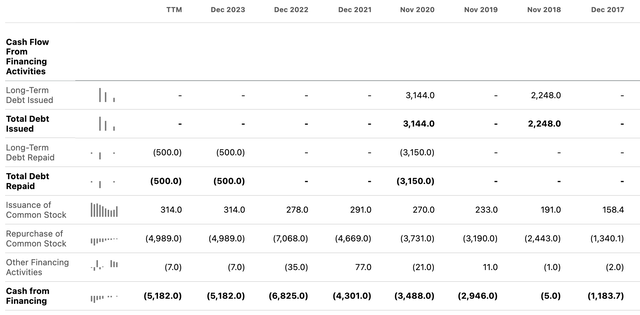

The management has also decided to repurchase common stock consistently historically, which is further good news for shareholders, and has not been issuing debt on a regular basis:

Valuation Concerns

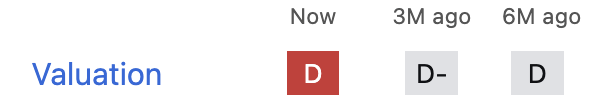

Given the company’s exceptional financials, it seems unlikely that the stock would be undervalued. Instead, its present value seems fair to me, even if it may be slightly higher relative to a full group of its industry peers. Indeed, SA’s Quant Factor Grades give the stock a D for valuation.

Seeking Alpha

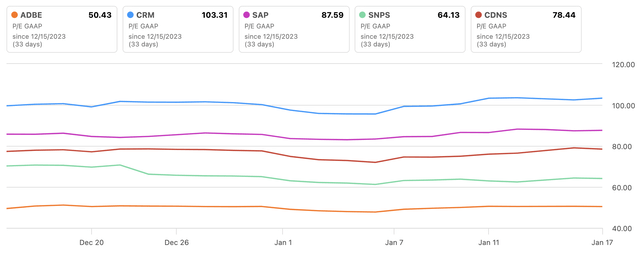

However, compared to its top industry peers used for charting in this analysis, Adobe is actually the lowest-valued firm of the five:

The company’s forward ratio based on GAAP is an even more promising 43.

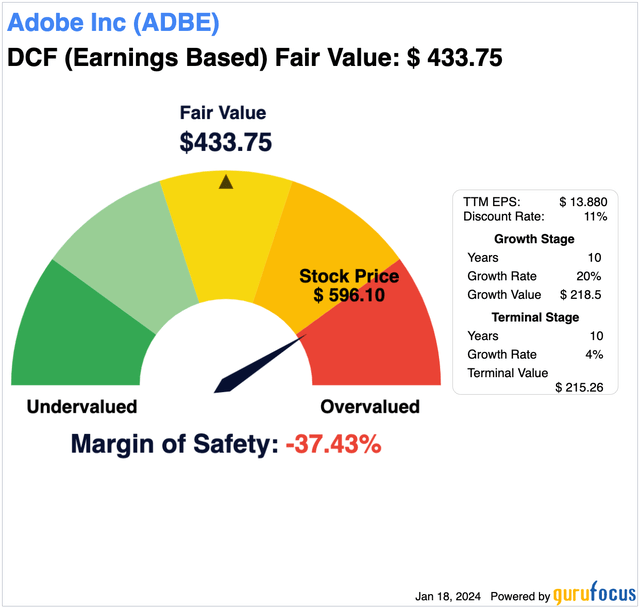

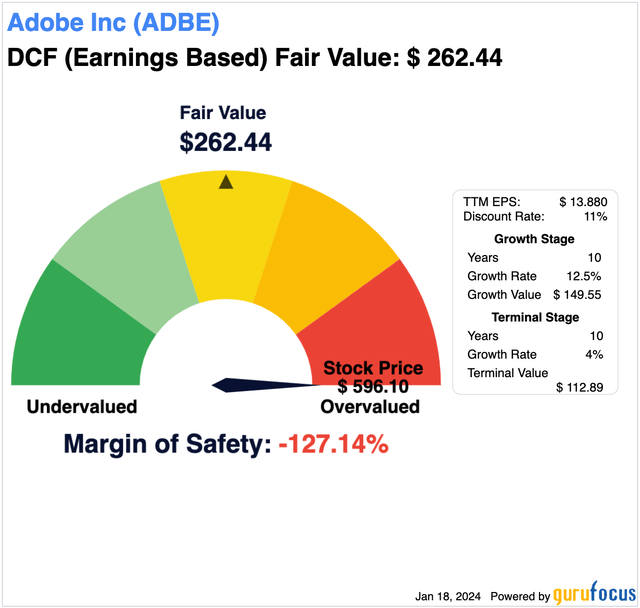

However, it may be fair to view the company as overvalued from a discounted cash flow analysis, as even a very optimistic 20% EPS average annual growth rate for the next ten years gives a result where the stock looks around 35% overvalued with a fair value estimate of around $430. Taking a much more conservative approach of a 12.5% EPS average annual growth rate over the next ten years, the stock looks very overvalued indeed—around 125% or so, with a fair value estimate of around $260.

Seeking Alpha Author, Using GuruFocus Author, Using GuruFocus

However, I think this traditional valuation approach is simply too limited, and I have noticed that there can sometimes be exceptions to DCF analysis rules. What may be a good indicator for some stocks may, in fact, not be such a good indicator for others. In areas such as technology, which are often driven by momentum and are overvalued on consensus, a DCF analysis looks too pessimistic. It seems more reasonable, given the financials and future outlook for the stock, that the shares are presently fairly valued.

Risks

While the company is heavily investing in AI, including the Firefly model, it’s important to recognize that the success of these approaches is not guaranteed over the long term. In addition, the considerable investment required to fund the development and integration of advanced technologies can reduce returns in the short term. If there are regulatory pressures on the use of AI, the firm’s stock price could be affected. With what seems like a fair or overvaluation at present, there is little room for mistakes.

There are considerable geopolitical risks in the world at the moment. I, for one, am not betting on these escalating, am not investing in defense stocks, and am hopeful for peaceful resolutions to present conflicts. However, given the current uncertainty, too heavy an allocation to technology stocks based in the US could be considered unwise. There is a possibility of severe volatility, although unlikely, which could be mitigated through careful allocation to other countries and industries as a precaution.

Conclusion

Adobe seems like an exceptional company to me. I would consider it a Strong Buy if it weren’t for its potential overvaluation. I think the organization has built a powerful brand that protects it from competition well and allows for high margins, and I believe in the firm’s financial management and approaches to this. My analyst rating for Adobe stock is a Buy.