santosha/E+ via Getty Images

Thesis

I rate Adecoagro S.A. (NYSE:AGRO) a Hold with an end-of-year price target of $14.41, which represents a potential 30% upside to its current price of ~$10.80/share.

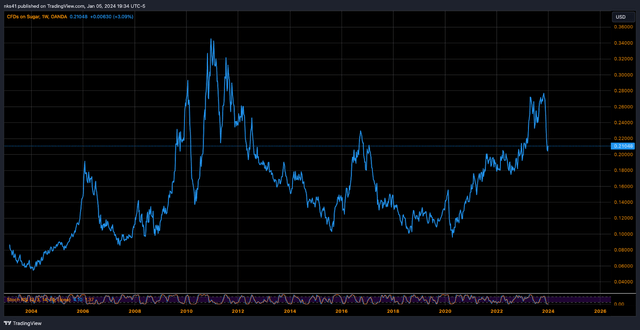

Using an EV/EBIT multiple of 10x and estimating the EBIT across AGRO’s three largest segments, Sugar & Ethanol, Rice, and Dairy, my model suggests AGRO’s share price to be worth upwards of $14.41 by the end of 2024, contingent on sugar prices around or above 20 cents/lb. Compared to years prior, Adecoagro has diversified its income sources away from its sugar and ethanol business, yet, I am unconvinced this will suffice against a heavy downturn in sugar prices.

Business Overview

Adecoagro is an integrated producer of raw and processed agricultural goods in South America. The company is headquartered in Luxembourg, but operates farms in Brazil, Argentina, and Uruguay. In Argentina, the company owns and operates: 18 farms, 4 diary milking facilities, 2 milk processing facilities, 4 rice mills, 1 peanut plant, 1 sunflower plant and 2 grain handling plants. In Brazil, AGRO holds 7 farms and 3 sugar and ethanol processing mills. In Uruguay, AGRO holds one rice farm, and one rice mill. Roughly 45% of AGRO’s assets are located in Argentina, 46% in Brazil and 4% in Uruguay. Adecoagro’s core business is its Sugar and Ethanol division (S&E) which flexibly produces sugar and/or ethanol to maximize profits, and sells excess energy supplies to the Brazilian grid. The company focuses on a circular business model that returns farming byproducts, like sugarcane bagasse and cow manure methane, back into the production process.

Sales

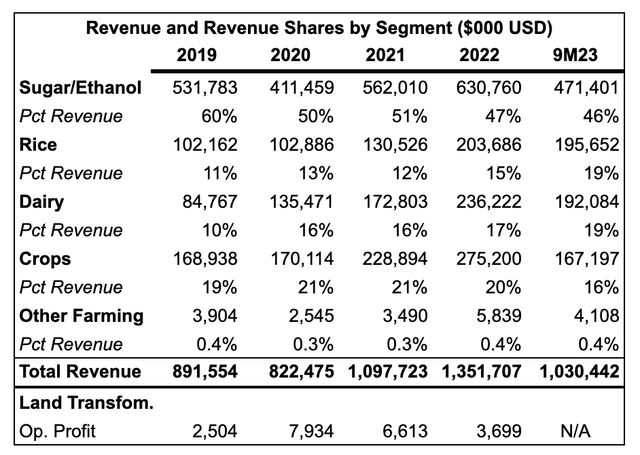

AGRO reports five core segments: Sugar and Ethanol (S&E), Dairy, Rice, Crops, and Land Transformation. The table below summarizes the distribution of sales across these segments.

SEC Filings, AGRO Investor Relations

Sugar and Ethanol

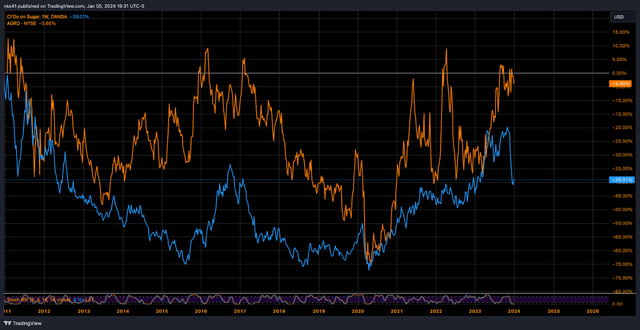

AGRO stock versus sugar spot prices (Tradingview)

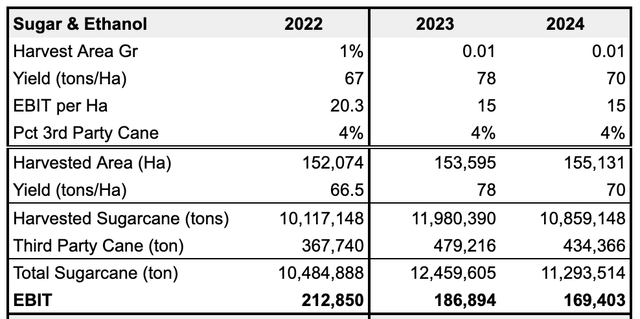

Adecoagro grows sugarcane year round to produce sugar or ethanol. The chart above captures the relationship between sugar prices and AGRO’s stock price. he prices of sugar, ethanol, petroleum and AGRO’s stock are positively correlated, which makes AGRO, in some sense, an energy play. After all, sugarcane is mother nature’s most efficient transformer of solar energy. Brazil, along with the US, is one of the largest producers of ethanol, thanks to national transportation laws. The Brazilian sugar production market is highly competitive and advantages between producers are scarce; AGRO owns only 3 of the approximately 240 sugar mills in Brazil. Part of Adecoagro’s strategy and operating efficiency turns sugar milling byproducts into ethanol to power its mills, trucks and farm equipment. In the first 9 months of 2023, AGRO milled 9.6 million tons of sugarcane, up 30.6% year over year, and increased yields by 28% due to improving weather.

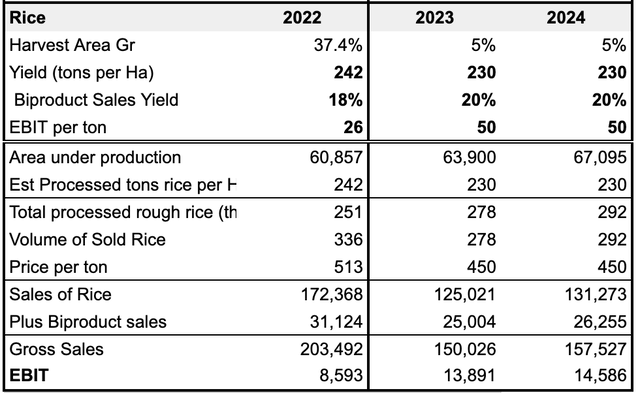

Rice

Adecoagro grows Indian and Japonica rice under four brands: Adecoagro, Molinos Ala, Apostoles, 53 and Monte Alegre. According to the company, Uruguay “is internationally recognized as being of the highest quality standards,” but my palate is too unsophisticated to notice any difference. According to company filings, Adecoagro sells approximately 13% of its rice in the Argentine retail market through three brands, which collectively have a 15.3% market share. Additionally, the company suggested in the Q2 2023 earnings call that they are uniquely positioned to benefit from a, “lack of water in many rice producing countries of the world, which are cutting their rice exports. This means that there will be a very clear need for South American rice”. While this may have been true in 2023, I will leave the weather forecasting as an exercise to the readers. AGRO has been acquiring more rice assets over the last 2 years, and I see this as a net positive, as direct-to-consumer (DTC) products are much ‘stickier’ in pricing than selling sugar on international markets.

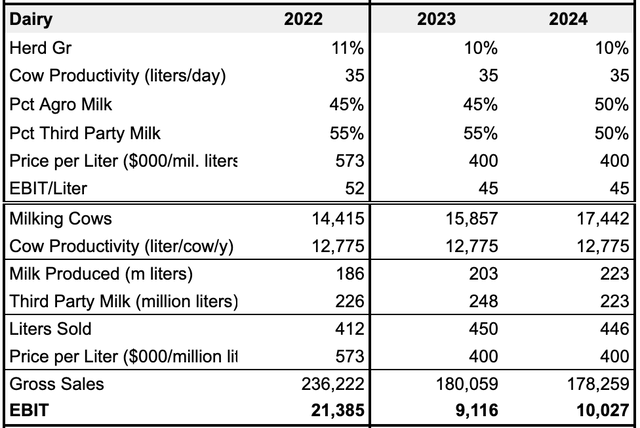

Dairy

Supplementing the rice products, Adeco also sells milk DTC. AGRO was the first company in South America to implement free-stall milking, and in 2019 the company purchased two milk processing plants in Argentina from SanCor, the largest producer of dairy products in South America. Through the Las Tres Ninas and Agelita brands, AGRO offers a selection of milks, creams and cheeses. Of these products, powdered milk and UHT fluid milk comprise 80% the dairy unit’s revenues. Roughly 40-50% of AGRO’s total milk sales originate from the company’s herd while the remaining portion is purchased from local producers and processed in AGRO’s facilities.

Crops, Land Transformation and Other

All other farm product revenues are consolidated in AGRO’s Crops division, grown mostly in Argentina. This includes soybean, corn, wheat, peanut, sunflower and cotton. Of these products, corn, soybean, and peanuts make up the bulk of the unit’s sales. As mentioned in its annual report, “Argentina is positioned among the most important players in the production and export of peanuts, with high technological levels both in terms of production as well as processing. Argentina exports more than 90% of the peanuts it produces and its main market is the E.U.”

In addition to farming, AGRO manages a “Land Transformation” division that buys and develops property for agricultural use. The company’s three transformation strategies/targets are: Undeveloped land (savannahs and natural grasslands), Undermanaged or underutilized farmland (cultivated pastures and poorly managed agriculture), and Ongoing transformation of arable land. In September 2023, the company sold its 6,302 hectare “El Meridiano” farm for $48 million USD, or $7,681/hectare, 30% above the assessed value carried on its books. In total, AGRO owns 233,941 hectares assessed at a value of $745,301 USD, or $3,186/Ha.

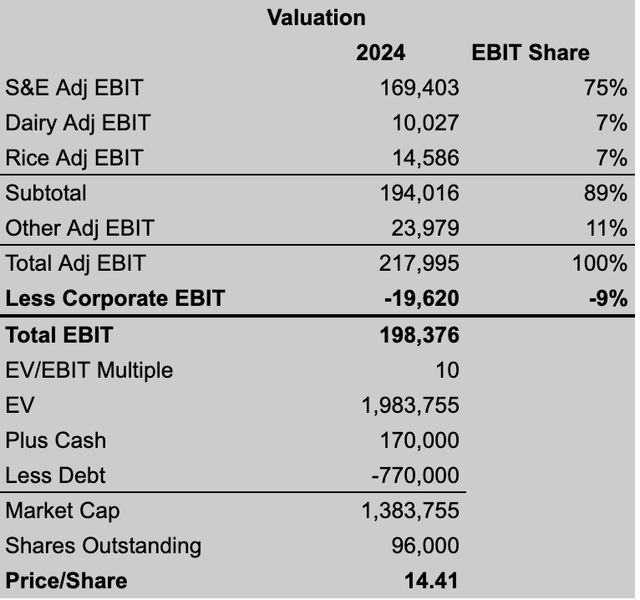

Valuation – Adecoagro

To value AGRO, I use a SOTP analysis to estimate 2024 EBIT numbers from the three largest and fastest growing segments, Sugar & Ethanol, Dairy, and Rice. From there, I deduce the remaining share of EBIT from the other segments, Crops, and Land Transformation, to reach my full 2024 estimation.

AGRO Investor Relations, Author’s Work AGRO Investor Relations, Author’s Work

AGRO Investor Relations, Author’s Work

AGRO Investor Relations, Author’s Work

Under these assumptions I calculate an intrinsic value of $14.41. Of course, this is just a near-term view. Shares could trade higher if commodity prices move in a favorable direction (up), AGRO makes more accretive acquisitions in the Dairy and Rice spaces, or the company buys back shares more aggressively.

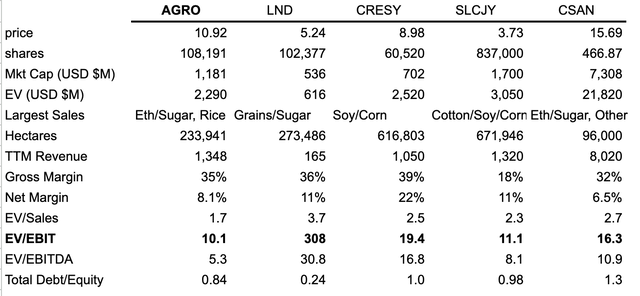

Comparables

Seeking Alpha, Tradingview, AGRO Investor Relations

The Brazilian sugar and ethanol industry is fragmented and competitive. Food production in South America is highly industrialized and only a few companies are traded on American exchanges. The most comparable business models to Adecoagro are: BrasilAgro (LND), Cresud (CRESY), SLC Agricola (OTCPK:SLCJY), and Cosan (CSAN). Of the companies in the table above, AGRO competes most directly with CSAN’s Raizen subsidiary, a joint venture between Shell and Cosan, the leading individual exporter of sugar in the world. Raizen typically mills 4 to 5 times the volume of sugar of AGRO. However, where AGRO lacks in size, it makes up for in crop flexibility and product diversity. Additionally, AGRO has higher current margins, less leverage and is cheaper on all of the provided metrics.

Another point of interest is the relationship between AGRO, LND and CRESY. Soros’ Quantum fund was an initial investor in AGRO and managed the firm’s IPO in 2011. In 2017, Quantum exited the position at the top, and the stock declined from its high of $12 to $3.30 by March of 2020. Similarly, LND IPO’d in 2011, too, but as a spinoff to consolidate Cresud’s agriculture assets in Brazil. Cresud’s founder, Argentine real estate mogul Eduardo S. Elsztain, is a former protege of Soros, who personally seeded Cresud with a $10 million dollar investment over three decades ago. At the same time Quantum exited AGRO, Cresud’s subsidiary LND stock was exiting a painful bottom. Since Quantum’s divestment in 2017, AGRO’s share price has barely made a round trip back to $12 while LND has returned nearly 140%. I do not know why Quantum divested from AGRO in 2017, but I find this series of events curious and relevant in considering where the ‘big money’ is positioned. Still, Alan Leland Boyce, former portfolio manager at Quantum, remains on AGRO’s board and holds a 1.1% share of the company.

Risks

Model Weakness

My valuation relies heavily on EBIT margins, or the EBIT per ton I assign to each segment. This is less a weakness of the model, and more a weakness of the business. Much of Adecoagro’s costs are fixed, so in the short term, margins are determined more by downstream prices than technical innovations. Perhaps the growth of the Dairy and Rice businesses can supplement AGRO’s other crops to the point where the probability of a uniform decline in prices across several agricultural commodities is less likely. Still, miscalculated hedging could result in significant losses. In the 3Q conference call, “82% of [AGRO’s] sugar position remains open”. Since then, sugar prices have declined precipitously, and the company has communicated that they have hedged 31% of production at 24.1 ct/lb. Similarly, managing 4 foreign currencies presents separate hedging risks.

Sugar is one of the most volatile ‘soft’ commodities. (Tradingview)

But let’s take another look at 2017-when Soros & co exited their position at the top. In 2016, southern India had one of its worst droughts in 140 years, decimating crops and removing Indian sugar from Global markets (India faced another drought in 2023, again driving up sugar prices). This monsoon-drought pattern occurs roughly every 7 years, and is a large force in the sugar price cycle. Prices peaked above 23.50 c/lb in the Fall of 2016, and began 2017 at 20 c/lb, only to decline to a low of 12.50 c/lb that summer. Along with the price of sugar, AGRO’s shares fell from $12 in January 2017, to $5 in September of 2019.

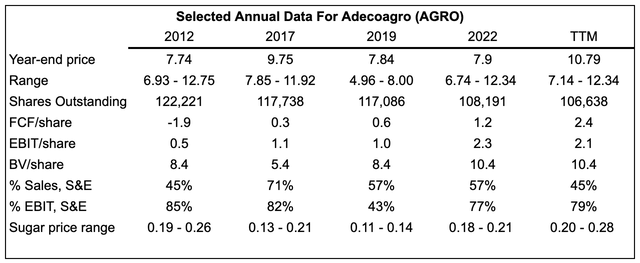

A snapshot of AGRO’s performance during various years across the sugar cycle. 2019 was one of the weakest years for shares since the IPO. (Author’s work, SEC filings)

In 2017 AGRO’s Sugar and Ethanol division accounted for 82% of EBIT and 71% of sales. In 2022, S&E accounted for 77% of EBIT and 57% of sales. In the trailing twelve month period, Sugar and Ethanol accounted for 79% of EBIT and 45% of sales. Despite sugar’s majority influence on the bottom line, since 2017 the company has reduced share count by 9%, initiated an annual dividend of $0.33 per share, and steadily increased FCF per share.

Argentina

New president Javier Milei’s free-market philosophy bodes well for AGRO, where the company sells its popular consumer milk, sugar and rice brands and pays >30% corporate income tax. Milei’s presidency could usher in an economic boom for Argentina-or another economic disaster-but it’s still too soon to tell. I suspect Milei’s first year to be the bellwether for the following three years, so economic improvements would translate to AGRO’s bottom line no sooner than Q4 2024.

Brazil, Ethanol Blending, and Electric Vehicles

Many developed countries supplement gasoline with ethanol to reduce emissions and to support domestic sugar industries. In Brazil, the CIMA Resolution No. 1, passed in 2015, established an ethanol blend in regular gasoline of 25% to 27% percent, the highest in the world. For context, other countries’ gas blend requirements are: UK 10%, US 10%, Argentina 12%, Canada 5%. India has targeted a 20% requirement by 2025, and more countries are considering such policies. Although this adoption of flex-fuel is a tailwind for AGRO, if EVs are the terminal solution for clean transportation, the sugar industry might be in for a rude awakening. In the near future, though, Brazil seems set on quietly supporting ethanol fuel over EV adoption.

Final Thoughts

My analysis here outlines Adecoagro’s position in the South American industrial agriculture space, and provides a 12-month price target. Looking beyond the next year or two, I would slot AGRO in Charlie Munger’s infamous ‘too hard’ pile. For many of the top-down justifications of AGRO, there are simpler plays. Bullish on sugar? Just buy sugar futures. Think the Age of Argentina is upon us? MELI has you covered. Excited about Selic rate cuts? The IBZL ETF will do. There are a lot of inherent risks for an Argentine industrial farmer, at least looking in from the United States. Ultimately, what makes me nervous about Adecoagro’s business is its position as a price-taker selling to a global market. Of course, there are many industrial farmers who have become very wealthy, so I (probably) fundamentally misunderstand the business.

My model suggests that, based on 2024 revenues, the stock should be worth around $14 or $15 dollars a share. This issue is, I have very little knowledge of the sugar markets, and cannot recommend buying this late in the sugar cycle. Bulls will say that AGRO is a fundamentally better business than when it IPO’d in 2011. AGRO certainly is more advanced than it was over a decade ago when comparing crop yields, that’s true. So, was Adecoagro a different company in 2017? I’ll leave the answer up to you.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.