alvaro gonzalez/Moment via Getty Images

Investment thesis

Our current investment thesis is:

- Adecco is a market leader in the recruitment industry, with a wide range of services provided and a strong brand across key geographies.

- The business benefits strongly from the network effect, although technological development is reducing the company’s value from this, eroding its competitive advantages.

- Expanding its consulting capabilities looks to be a good step, but with growth already slowing, we are unsure how material the impact will be from this.

- The business has underwhelming financials, and when compared to peers, Adecco is underperforming.

Company description

Adecco Group AG (OTCPK:AHEXF) is a Swiss multinational human resources (HR) solutions company headquartered in Zurich. The company operates as a global leader in providing various HR services, including temporary staffing, permanent placement, career transition, talent development, and outsourcing.

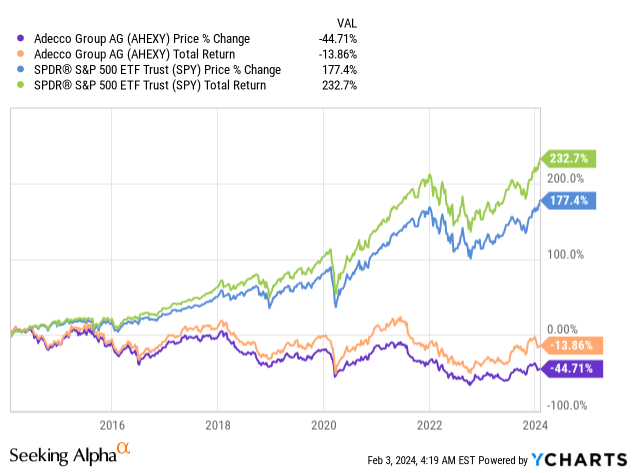

Share price

Adecco’s share price performance has been disappointing, losing over 30% of its value in 10 years while the S&P 500 has made impressive gains. This has been driven by changing industry conditions, in conjunction with mediocre financial results.

Financial analysis

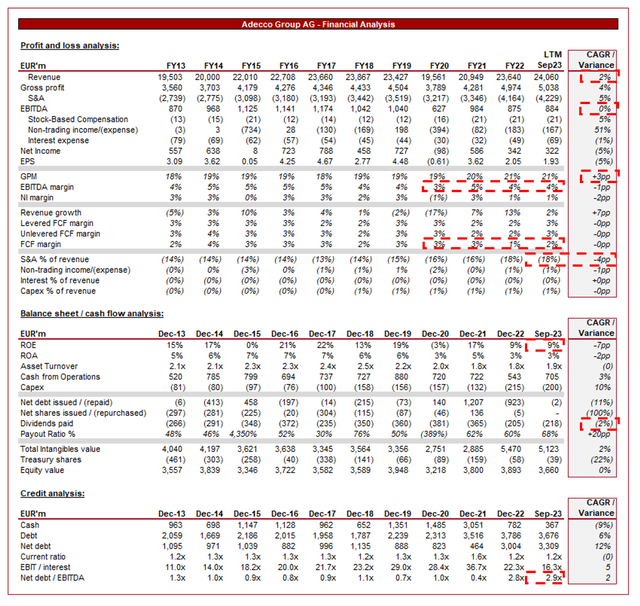

Adecco’s financial results (Capital IQ):

Presented above is Adecco’s financial performance in the last decade.

Revenue & Commercial Factors

Adecco’s revenue growth has been modest, with a 2% CAGR into the LTM period. During this period, the business has generally boasted consistency, although the pandemic was understandably a difficult period for Adecco, wiping out much of the incremental gains it had made over several years. The business is now only marginally above its pre-pandemic levels.

Business Model

Adecco’s business model revolves around connecting job seekers with potential employers through its global network of branches and online platforms. The company offers a wide range of HR solutions to clients across different industries and geographies. Adecco has positioned itself as a partner to its clients, assisting with temporary staffing, as well as finding and hiring full-time employees through its permanent placement services. The company identifies qualified candidates for specific roles, streamlining the recruitment process for its clients.

Adecco is structured as three core businesses, Adecco, Akkodis (Combination of the acquired AKKA and Modis), and LHH.

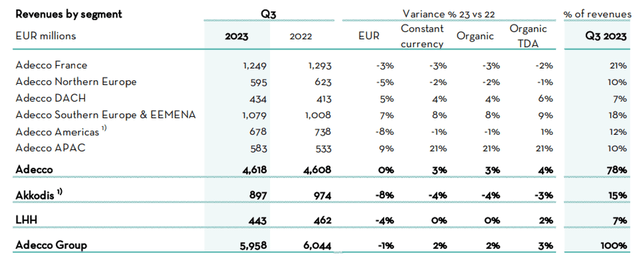

These businesses provide a range of HR services as reflected below, with the vast majority of its revenue coming from recruitment services (Adecco).

Entry barriers to this industry are low, as even single individuals can support businesses to staff them. The competitive position of Adecco is layered based on its characteristics. Firstly, the business is global, with an extensive network of users, allowing multinational clients to streamline their recruitment globally through one provider. Additionally, the business is able to access a wider pool of labor. From an investment perspective, this international presence expands its total addressable market, increasing the growth potential of the business. Further, the company’s scale has allowed it to expand its services offering, allowing Adecco to develop deep expertise across the HR spectrum (Temps, FTEs, Outsourcing, Managed services, RPO, etc.) and in specific industries. Finally, the company has created a strong network effect. With more clients come potential applicants who use Adecco’s services to find jobs. This further encourages new clients to post their roles on its services. This is truly the unique value proposition with Adecco, as its substantial scale globally gives it a strong position in the industry.

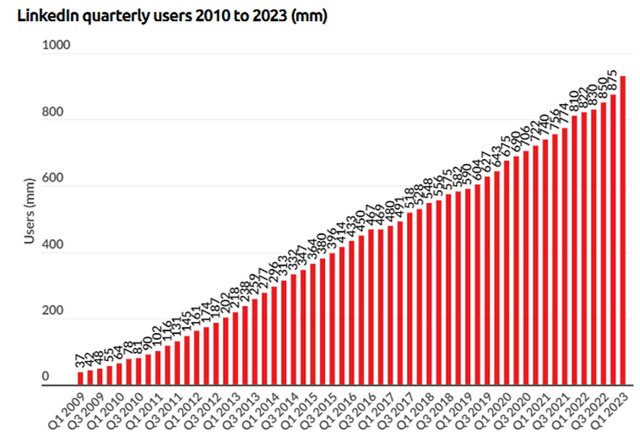

The HR industry is highly competitive, with numerous players vying for clients and talent. The industry has seen a fair degree of disruption in recent years, as new entrants and digital platforms enter the market, impacting the market and contributing to higher competition. One of the primary examples of this is LinkedIn, which acts as a recruitment app and social media offering. As the following illustrates, its growth in users has been growing at an exponential rate, creating a strong network effect of its own. Adecco is currently posting its own roles on the site, essentially cannibalizing its own digital offering.

Our expectation is for technology to continually disrupt the HR industry, further compounding the pressures of the likes of Adecco. Importantly, this competition is breaking down its key inherent competitive advantages.

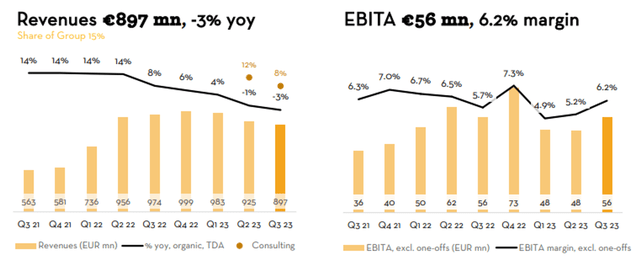

Adecco’s response to the growing threat has also come through the diversification of its offerings. Through the acquisition of AKKA and the creation of Akkodis, the business has bolstered its consulting offering. The business is a leading engineering and digital solutions business in the Smart Industry market. This industry is growing well, with this combination positioning the new business to be a leader in this space.

HR Industry

Adecco operates in a highly competitive HR solutions industry and faces competition from various firms, including: Randstad N.V. (OTCPK:RANJF), ManpowerGroup Inc. (MAN), Kelly Services, Inc. (KELYA), and LinkedIn (MSFT), as well as a range of local recruitment firms.

With technological and economic development across the West, there has been strong demand for specific skills and expertise, such as STEM education, contributing to challenges in talent acquisition. This should contribute to inherent growth in the recruitment segment, as demand remains strong.

The rise of remote work and virtual teams is currently impacting the traditional staffing models, with an increased number of employees looking to move roles to find a better work-life balance. This has been a tailwind for the industry but the expectation is for this to slow as those who want to move, have.

Furthermore, the labor market is evolving rapidly, driven by factors such as the gig economy, remote work, and changing worker preferences. These shifts in labor market dynamics have contributed to changing recruitment strategies by businesses. As an example, many of the food delivery apps (and wider gig economy employers), such as DoorDash (DASH), will recruit drivers through their website, cutting out the need for a recruiter.

Economic & External Consideration

Current economic conditions are defined by high inflation and elevated rates. This is acting as a drag on many economies, with growth slowing and consumers hesitant to spend, seeking to protect finances.

For this reason, we have seen job growth beginning to slow and could be reversing, with the US unemployment rate at 3.9% in July. Similar cases are observed in other countries, with the UK seeing unemployment creeping higher to 4.3% (although wage inflation remains high), and Germany seeing its unemployment only marginally increasing to 5.7%.

A slowing jobs market (and wider economy) will directly negatively impact Adecco, suggesting the business may face a tough back-end to the year.

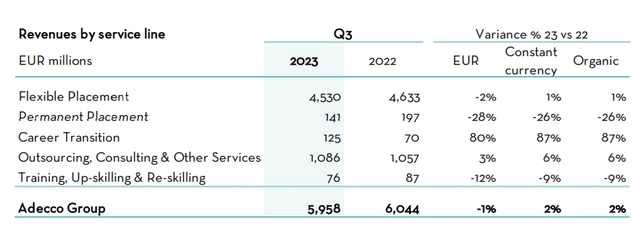

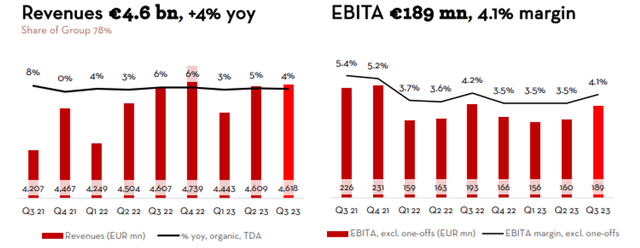

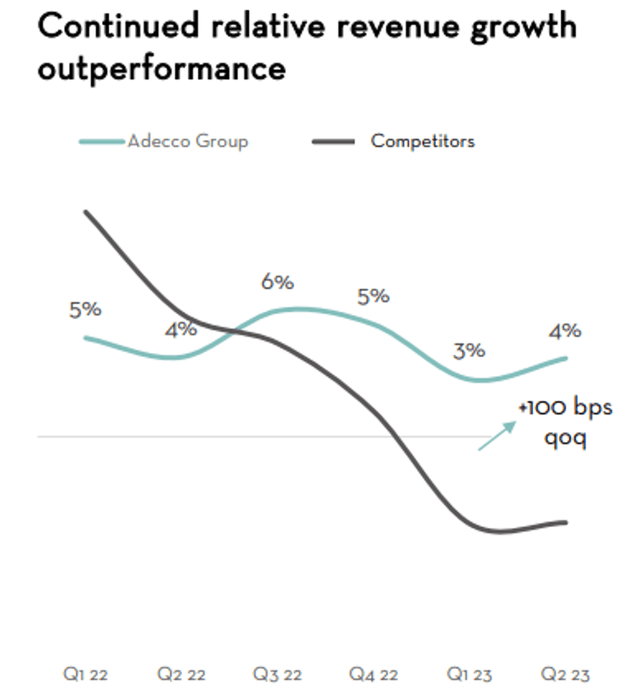

Thus far, however, Adecco has performed exceptionally well. The Group has grown organically by 2% YoY, driven by growth across Flex (+1%), Outsourcing (+6%) and Career Transition (+87%), offset by a decline in Permanent placements (-26%). The business has observed strong resilience in most key industries.

Akkodis has seen its growth rate consistently decline in recent quarters, falling to negatives in Q2 and Q3 23. This is likely a reflection of its slowing trajectory following a strong period of high growth, as well as a slowdown in activity in the tech sector, primarily in staffing (Staffing -19%, Consulting +8%).

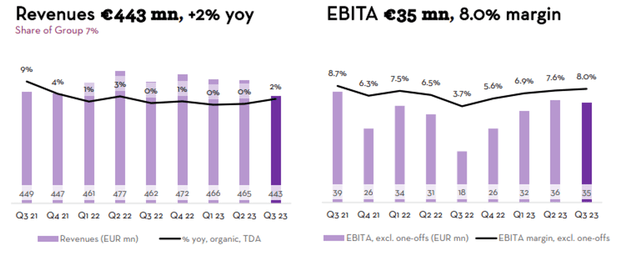

LHH (Talent advisory business), has also seen growth decline, flatlining for several quarters.

This strong growth is unexpected, with the following graph supporting this view. Adecco has gained market share well during this period, significantly outgrowing its peers.

Margins

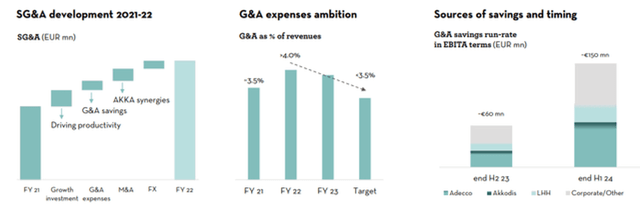

Adecco’s margins are fairly underwhelming, with an EBITDA-M of 4% and a NIM of 1%. During the historical period, margins have remained flat, with GPM improvement but S&A dilution.

The inability to achieve scale economies is disappointing, but a reflection of the competitive nature of the industry, restricting the company’s ability to expand margins.

Further, Adecco’s business mix, with a focus on temporary staffing, can lead to margin pressures, as these services tend to have lower profit margins compared to permanent placement services or higher-value HR solutions. Akkodis has the potential to lift the average, but with its growth rate now below Adecco, this should be a medium-term goal.

In conjunction with operational improvement to minimize costs, we could see margin improvement in the coming 5 years. We are always hesitant, however, when Management seek to cut costs when growth is low, as this usually compounds the risk of stagnation.

Industry analysis

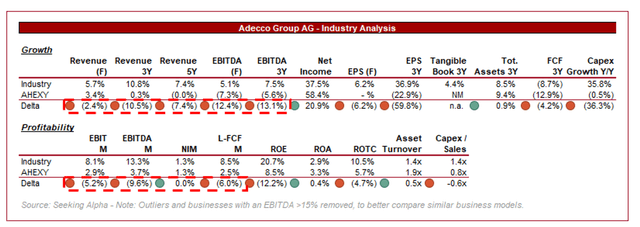

Presented above is a comparison of Adecco’s growth and profitability to the average of its industry, as defined by Seeking Alpha (19 companies).

Adecco’s performance is poor relative to this peer group. With low margins, the expectation is for growth to somewhat offset this, but that is not the case. Adecco is materially lacking in growth, despite the acquisition of AKKA.

The lack of growth is likely a reflection of its size but also its mature business model relative to its peers, many of whom are younger tech businesses on an improved trajectory.

Based on this, we believe Adecco should be trading at a steep discount to this group, adequately reflecting its mediocre financial performance.

Valuation

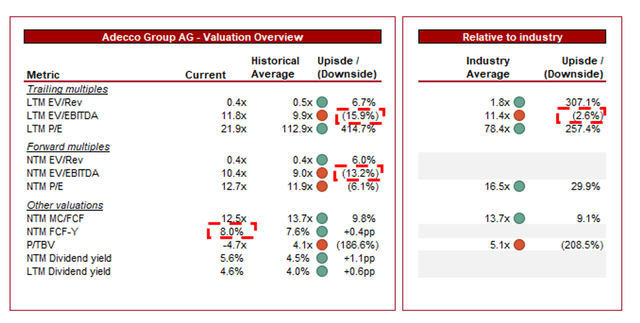

Adecco is currently trading at 12x LTM EBITDA and 10x NTM EBITDA. This is a premium to its historical average.

A premium to its historical average is not clearly justifiable. We like the acquisition of AKKA and seeing how this progresses in the coming years will be interesting. This said, the business faces increased competition and has shown an inability to achieve consistent margin improvement. Its growth rate is essentially in line with its historical average, as are margins.

Further, the business is trading at a discount to its peer group, as we would expect given the financial weakness, although we believe the level is not sufficient. At an EBITDA level, this discount is only ~3%. We would suggest a discount closer to 15% is more reasonable, as this would adequately reflect both a margin and growth deficit.

Based on this analysis, Adecco is likely slightly overvalued, but within the range of fair value. Analysis concurs with this view, with a target downside of 1.1% and a majority hold recommendation (Source: Capital IQ).

Final thoughts

Adecco is a solid business. The company has a substantial presence in the recruitment industry, while also having a wide range of services that improve the quality of its revenue profile. We are slightly concerned that its business model is under threat, as technological development increasing access to employers and employees.

The company’s financial performance is modest to say the least, but every company has a price. This issue is that it underperforms its peers while not trading at a discount sufficient to reflect this.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.