Ingenious Buddy/iStock via Getty Images

Fixed income: The case for active management

In today’s fast-paced financial world, retail investors are constantly bombarded with advice, much of it echoing the short-term, trend-driven narratives of the 24-hour news cycle. We’ve previously pointed out the disconnect between this type of advice and Oakmark’s commitment to a long-term, fundamentals-based approach. Recently, our chairman, in his usual perceptive manner, highlighted an emerging trend he’d noticed across various media and financial pundit outlets: a push for individuals to invest in individual bonds amid rising interest rates. (Retail investors hold ~20% of all U.S. corporate bonds, already a significant enough portion that can’t be ignored.) It’s a compelling narrative, but like a mystery novel that skips the last chapter, many of these recommendations leave out a critical piece-the nuances of the fixed income asset class and associated risks involved in buying individual securities. In this commentary, hopefully free from any bond manager bias, we seek to shed light on these risks and explore why bond funds, including mutual funds and ETFs, might just be the smarter play for most investors.

Higher rates look appealing

The appeal of individual bond investment, especially when interest rates are much higher than what we have become accustomed to over the past 15 years, is undeniable. Individual bonds promise higher semi-annual payments and a sense of direct control over investments. Plus, almost all investment-grade corporate and government-issued bonds hold up their end of the bargain and pay off their coupons and full principal at maturity. (Note: this isn’t necessarily the case for high-yield, or “junk,” securities.) However, this apparent simplicity masks a range of complexities and risks to fixed income investing that requires a deeper understanding.

Warren Buffett astutely pointed out, “Reaching for yield is really stupid. But it is very human.” What Buffett was referring to is a well-known, but often underestimated, danger in fixed income investing: bankruptcy (or default) risk and how the allure of high yields can inadvertently lead investors to bonds with the highest bankruptcy risk. Bonds have a guaranteed income stream until a default occurs, and for individual investors, this can be irresistibly attractive.

Credit analysis and diversification help manage risk

The importance of thorough credit analysis cannot be overstated-a task often beyond the scope of most individuals due to its complexity and the time investment required. At Oakmark, our foundational approach for more than three decades has been to delve deeply into the specific details of a company’s capital allocation profile and its cash flow streams, both historical and projected. Our emphasis on a bottom-up rather than a macro perspective means we rigorously examine the default risk at each company we invest in. This approach not only reduces our dependence on broad economic cycle predictions but also, we believe, better positions us to avoid significant permanent losses for our investors. By focusing on individual company analysis, we aim to provide a more nuanced and effective risk assessment, ensuring better outcomes for those who entrust us with their investments.

These risks of default also intensify with concentration. Whether it’s a securitization tranche or a corporation, if an issuer defaults or the underlying assets default en masse, the losses can be profound. Consider this: the average recovery on defaulted corporate bonds since 1990 was 40%, according to Standard & Poor’s. In a diversified portfolio of 100+ securities, such a loss might be manageable. But in a concentrated portfolio, the impact of even a single default can destroy years of yield.

And just because you are buying an individual bond doesn’t mean you get to ignore the big picture stuff. Inflation, an issue that’s particularly relevant in the current economic climate, can significantly erode the real value of bond returns. For retail investors who might not fully grasp (or have no inclination to; it’s boring!) the implications of real versus inflation-adjusted returns, deferring to a manager with the necessary tools to adjust exposures based on market rates makes sense. This is true more generally with interest rate risk management as well. We’re in an era of unusually high interest rate volatility, leading to greater price fluctuations in the short and medium term. As rates rise, the value of existing bonds typically falls, posing a substantial risk, especially if selling before maturity becomes necessary.

For those in a position to buy and hold, focusing on investment-grade, high-quality securities (those with a rating of BBB- or better) can act as a buffer against some of these basic risks. This strategy suits retail investors who aren’t pressed for immediate liquidity and feel confident steering through the twists and turns of the current interest rate landscape.

Institutional access to bonds

Now, this might sound like standard fare from the bond investing 101 handbook. The familiar refrains of bankruptcy, concentration and interest rate risks are important to highlight, but they are fairly well covered in the current discourse. However, quieter, less-discussed risks also merit our attention. These less conspicuous challenges, often lurking in the shadows of the bond market, are equally crucial for individual investors to understand and navigate.

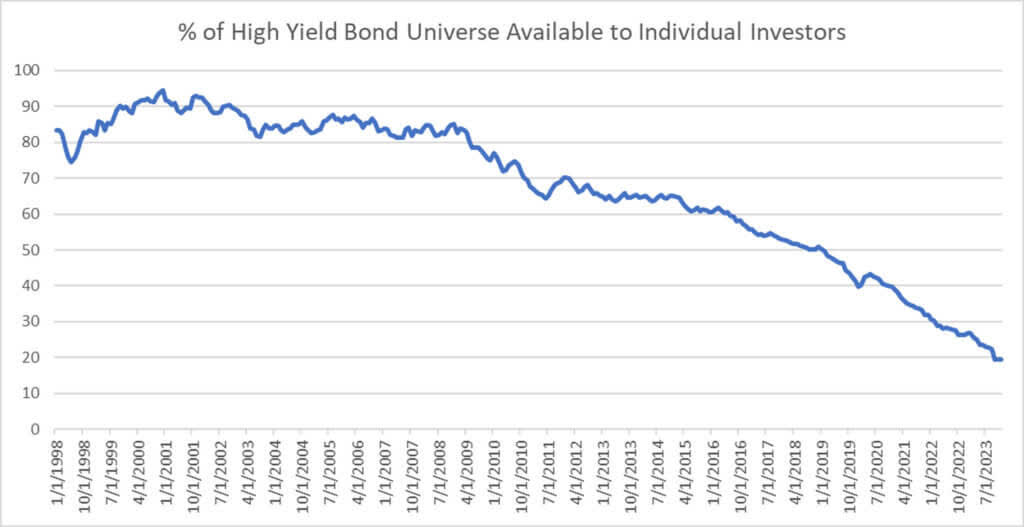

One such issue is limited access to securities. Imagine the bond market as a vast library. Most individual investors have a library card that only grants them access to a few shelves in the corner. In contrast, institutional managers have an all-access pass, allowing them to roam through the extensive stacks of rare and valuable volumes. (At Oakmark, it’s worth noting we spend a lot of time in these sections and it’s where we generally find the most attractive value. Today, in fact, we are finding the most opportunities in leveraged loans, non-guaranteed securitized, and specific high-yield issues. Most of which are not available to individual investors). This disparity is largely due to what the SEC labels 144A restrictions. These rules confine certain bonds to “qualified institutional buyers” only, making them as inaccessible to the average retail investor as a restricted section in a private archive is to the public. This limitation is stark: consider that about 81% of high-yield bond issuances, 100% of leveraged loan and 40-60% of non-guaranteed securitized in 2023 were 144A restricted, effectively off limits to most individual investors.

Source: Bloomberg L.P. as of 12/29/23.

Even within the accessible bond inventory, however, challenges persist, like poorer liquidity and higher transaction costs. In the scattered landscape of the bond market, a contrast to the more straightforward equity market, the issue of pricing for retail investors often lacks clarity. The absence of a central system for pricing means that individual investors are frequently met with prices that can destroy a large proportion of the value in the security. This is especially true when compared to institutional investors, who, thanks to their substantial trade volume and frequency, are in a better position to negotiate more favorable pricing and secure early access to new offerings.

The case for professionally managed bond portfolios

This is where I aim to be as unbiased as possible. Despite the fees associated with bond funds, the value of a seasoned manager’s expertise and the potential for implicit savings shouldn’t be underestimated. For most individual investors, professionally managed bond funds are often the better route for achieving superior risk-adjusted returns over the long haul. Whether you choose an actively managed fund or a passive ETF depends on your personal investment goals and preferences. If outperformance in fixed income is your aim, select a manager with a solid track record of beating benchmarks after fees. For those who simply want broad exposure to the bond asset class while minimizing fees, passive funds are the logical choice.

Direct investment in individual bonds, while increasingly attractive in this higher interest rate world, also brings significant risks, some of which are easier to understand than others. At Oakmark, our ethos is rooted in active management and the relentless pursuit of excess return generation through a fundamentals-first approach to security selection. Our track record in the Oakmark Bond Fund is hopefully a testament to our ability to consistently achieve that goal.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate.

Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.

Yield is the annual rate of return of an investment paid in dividends or interest, expressed as a percentage. A snapshot of a fund’s interest and dividend income, yield is expressed as a percentage of a fund’s net asset value, is based on income earned over a certain time period and is annualized, or projected, for the coming year.

Maturity is the weighted average of the stated time to maturity for the securities held in the portfolio.

The Oakmark Bond Fund invests primarily in a diversified portfolio of bonds and other fixed-income securities. These include, but are not limited to, investment grade corporate bonds; U.S. or non-U.S.-government and government-related obligations (such as, U.S. Treasury securities); below investment-grade corporate bonds; agency mortgage backed-securities; commercial mortgage- and asset-backed securities; senior loans (such as, leveraged loans, bank loans, covenant lite loans, and/or floating rate loans); assignments; restricted securities (e.g., Rule 144A securities); and other fixed and floating rate instruments. The Fund may invest up to 20% of its assets in equity securities, such as common stocks and preferred stocks. The Fund may also hold cash or short-term debt securities from time to time and for temporary defensive purposes.

Under normal market conditions, the Fund invests at least 25% of its assets in investment-grade fixed-income securities and may invest up to 35% of its assets in below investment-grade fixed-income securities (commonly known as “high-yield” or “junk bonds”).

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

Bond values fluctuate in price so the value of your investment can go down depending on market conditions.

All information provided is as of 12/31/2023 unless otherwise specified.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.