metamorworks

Thesis

The iShares MSCI ACWI ex U.S. ETF (NASDAQ:ACWX) is an equities exchange traded fund. The vehicle seeks to track the investment results of an index composed of large- and mid-capitalization non-U.S. equities. On a first glance the fund would seem an interesting diversification tool, offering retail investors exposure to international mid- and large-capitalization equities.

The ETF comes from the iShares / BlackRock family, and charges 0.34% on the outstanding AUM. Its analytics are as follows:

- AUM: $4.6 billion

- Sharpe Ratio: 0.02 (3Y)

- Std. Deviation: 16.9 (3Y)

- Annualized Volatility: 13.2%

- Yield: 3%

- Leverage Ratio: 0%

- Composition: International Equities

- Expense Ratio: 0.34%

The tracked index is the MSCI ACWI ex USA Index, which includes both developed and emerging markets. The index is comprised of non-U.S. stocks from 22 developed markets and 24 emerging markets, and has over 2,000 constituents, which is 85% of the global equity market aside from the U.S. The MSCI ACWI Ex-U.S index is calculated with a methodology that focuses on liquidity, investability and replicability.

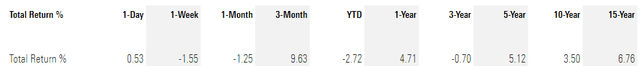

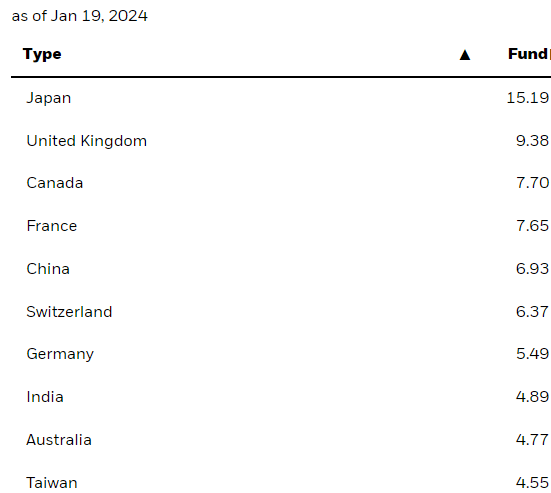

The ETF is overweight Japan at 15% of the collateral, with the rest of the covered jurisdictions composing between 4% and 8% of the fund on average. On a first look it would seem this diversified approach would yield better risk calibrated returns long term. Unfortunately the ETF fails to deliver compelling results. While its standard deviation as measured on a 3-year look-back is lower than the S&P 500 at 16.9, its long term 10-year annualized return comes in at 3.5% only:

The fund has a beta close to 1, meaning it will expose the same directional movement as the S&P 500, yet with lower long-term returns.

The fund has been dragged down by its China exposure in the past three years, despite outperformance in its India and Taiwan assets.

Composition

The fund has a truly diversified geographic approach, with large developed economies getting equal representation in the top-5 geographies:

Countries (Fund Website)

Japan is the top concentration with 15.19% of the portfolio, followed by the U.K at 9.3% and Canada at 7.7%. It is interesting to note that outside of Japan, the rest of the jurisdictions have an almost equal weighting in the collateral pool.

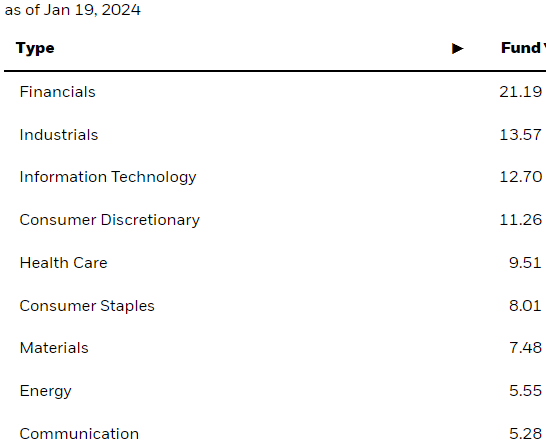

From a sectoral standpoint Financials represent the largest concentration:

Sectors (Fund Website)

Financials are 21.19% of the holdings, followed by Industrials at 13.5% and Information Technology at 12.7%.

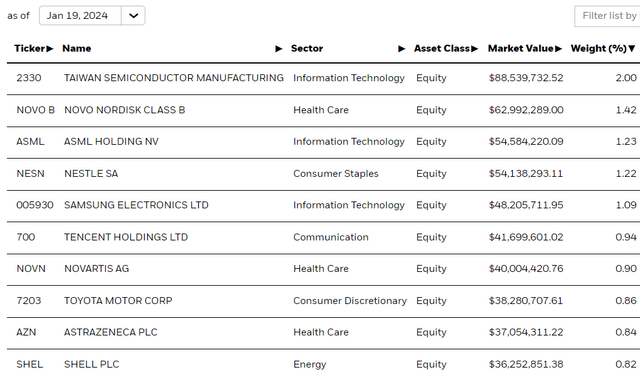

From an individual name perspective, we can find a handful of semiconductor companies in the top-10 names in the portfolio:

Individual Equities (Fund Website)

We can see Taiwan Semiconductors at 2% of the collateral, followed by ASML Holdings at 1.23%.

Long-term performance is disappointing

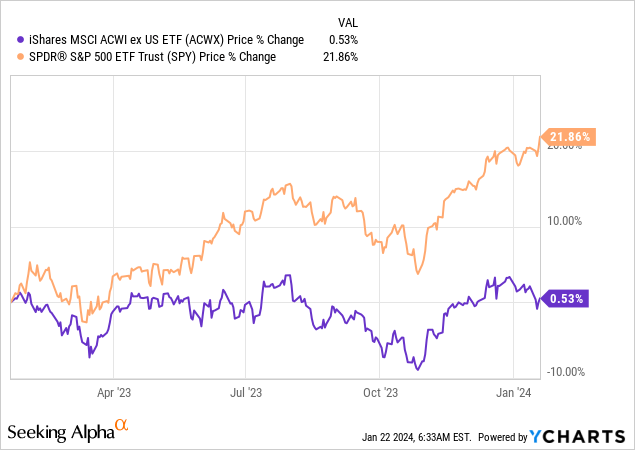

The fund is almost flat on a 1-year look-back while the S&P 500 has soared:

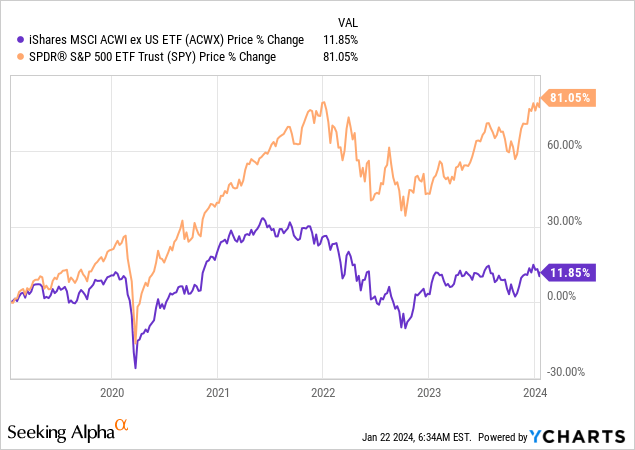

On a 5-year lookback the story is fairly similar:

The funds fails to deliver long term, despite its diversified geographic approach, with ACWX up only 11.85% on that time-frame, while the SPY was up 81%.

Which jurisdictions have worked lately?

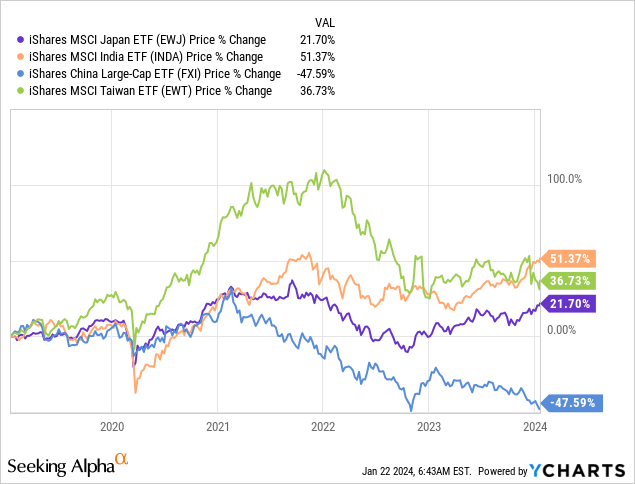

One of the strengths of portfolio construction is constituted by diversification. Unfortunately for ACWX, diversification works against it. In the past five years, we see a clear bifurcation among jurisdictions which have performed, and the ones which have not:

From the chosen cohort the iShares MSCI India ETF (INDA) is the top performer on a 5-year look-back, followed by the iShares MSCI Taiwan ETF (EWT). The one glaring underperformer that is heavily represented in the ACWX ETF is China. The iShares China Large-Cap ETF (FXI) is down -47% on a 5-year look-back. Think about it this way – the net gap between India and China as exposed by INDA and FXI is almost 100% on an absolute basis.

What looks good for institutions is not necessarily appropriate for a retail investor

While institutional investors might clamor international equities to show ‘diversification’, retail investors should actually care about returns. ACWX displays a long term annual return of close to 5% (during multiple economic cycles) with a very low Sharpe ratio. When U.S. equities provide for 8% plus, there is little to see in terms of improving a retail portfolio via ACWX. Given its high correlation to the SPY, the fund will also move in the same direction as the market, rather than provide for any type of ‘hedge’.

We would be more inclined here to build diversification to international equities via a few jurisdictional ETFs that can be chosen after some fundamental analysis is done. As seen above, China has been a massive drag for ACWX in the past 5 years, while other Asian jurisdictions have delivered. Choosing India, Taiwan and Japan via their respective ETFs would have generated net superior results to utilizing ACWX. We are therefore of the opinion that a retail investor is best served to pick and choose a number of well-researched jurisdictions rather than buy-and-hold via ACWX.

Institutional investors on the other hand like the deep liquidity that ACWX provides and the diversification offered by the fund, despite its low annualized total returns. For such investors a ‘one-stop-shop’ like ACWX might be the answer, even though the returns are not there.

Political risk is not priced correctly

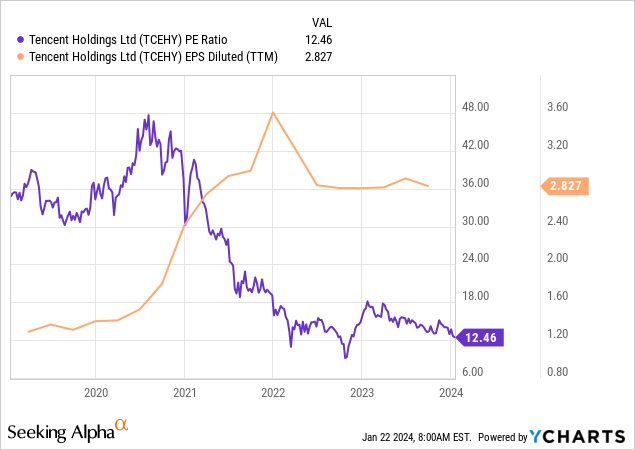

One of the main take-aways from looking at ACWX is that political risk is not priced appropriately by global equity markets. The fund covers global jurisdictions, including emerging markets. One of the largest drags in performance for the fund is constituted by China. While fundamentally extremely sound, Chinese equities have suffered heavy P/E de-ratings due to political factors. Let us look at Tencent (OTCPK:TCEHY), one of the main Chinese stocks in the portfolio:

This is a global company with a market cap in excess of $300 billion, which has seen its EPS almost triple in the past 5 years, yet its P/E ratio has been ravaged, moving from over 30x to merely 12x now. Why? Political risk and jurisdictional risk. When the market perceives the political factor to have a constraining effect on the future earnings power of a company, it then proceeds to assign a lower P/E ratio.

Expect more of the same here. With China – Taiwan tensions running high, expect a severe underperformance in ACWX if China ever decides to invade. Significant political risk is present in any EM jurisdiction, and it can strike without any warning, with severe consequences. Just look at what happened to Russian equities after the country invaded Ukraine, or how the Israel stock market did after its military actions.

Conclusion

ACWX is an equities ETF. The fund tracks the MSCI ACWI ex USA Index, which includes non-U.S. stocks from 22 developed markets and 24 emerging markets. While ACWX is perceived as a diversification tool for institutional investors, retail investors should look past its theoretical aspects and be practical. The fund has failed to deliver robust returns long term, mainly due to the underpricing of political risk, especially in EM jurisdictions. A glaring example of such risk is embodied by Chinese equities which are down almost -50% in the past five years, despite improving fundamentals and earnings. Retail investors are best served by picking specific jurisdiction ETFs such as EWJ or INDA after doing country specific research, rather than choose a large aggregator such as ACWX. Conversely institutional investors will continue to hold the name due to its liquidity and ability to check boxes in terms of non-US equity exposure.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.