Mike Hansen

The Virtus Diversified Income & Convertible Fund (NYSE:ACV) is one of the several closed-end funds offered by Virtus that provide income-focused investors with a way to achieve their goals without the need to sacrifice the potential upside of an equity investment. The fund does this by investing in convertible bonds, which are fixed-income debt securities that can be converted into common equity under certain circumstances. As common equities theoretically have unlimited potential upside, an investor does not necessarily need to sacrifice upside potential in exchange for income by purchasing these securities. In practice, however, these securities do not always deliver the upside that investors may expect due to the fact that these securities are frequently issued by distressed or financially weak companies that may never deliver on their supposed potential. For example, there were numerous companies during the late 1990s technology bubble that ended up going bankrupt. For every Tesla (TSLA), there are at least ten Pets.com. That does not necessarily mean that these securities are bad investments though, and in fact, they may be one of the better things for income-focused investors to hold during periods of low interest rates and high stock valuations. This seems to be the environment that the market expects to exist in a year from now, so there could be an argument for buying some convertible securities today.

Unfortunately, the Virtus Diversified Income & Convertible Fund shares the problem faced by a few of Virtus’s other convertible funds. Its performance over the past several years has been rather disappointing. As we can see here, shares of this fund have gained 7.06% over the past five years. This is substantially less than the 37.43% gain delivered by the iShares Convertible Bond ETF (ICVT) or the 81.27% gain of the S&P 500 Index (SP500) over the same period:

This is disappointing, but we can clearly see that most of this fund’s troubles began in 2022. This goes back to the statements that I made in the previous paragraph. The incredibly low interest rate environment during the post-pandemic period caused a bubble to form in convertible securities. Investors were basically buying everything in sight, including highly risky securities issued by financially stressed companies, in the hopes of achieving some level of return. When the Federal Reserve started raising interest rates, it actually became possible to earn a positive real return by investing in much safer investment-grade bonds and the formerly high-flying risky stocks plummeted. The ones that had issued convertible securities to raise money ended up taking their convertibles down with them. As the Virtus Diversified Income & Convertible Fund employs leverage as a method of boosting its returns, it suffered more damage than the unleveraged index when the convertible bubble burst. With that said though, we can see above that this fund was failing to keep up with the index even during the 2021 convertibles bubble though. That certainly does not reflect very well on it, as its leverage should have been boosting its gains during the 2021 bubble.

As I have pointed out numerous times in past articles, a simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund actually did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets. For example, the Virtus Diversified Income & Convertible Fund yields 9.50% at the current level, which is considerably higher than the 1.84% yield of the iShares Convertible Bond ETF. As such, we should include the distribution that the fund pays in any analysis of its total return due to the simple fact that it does represent a return to the investors. When we do that, we see that the Virtus Diversified Income & Convertible Fund actually managed to beat both the iShares Convertible Bond ETF and the S&P 500 Index over the past five years:

As we can see, investors in this fund received a 100.49% total return over the past five years. This is better than the total returns provided by either index over the period. I will admit that this is a better total return than I expected, especially considering the disappointing total returns that investors in some of Virtus’s other convertible closed-end funds received over the period:

|

Fund |

Trailing 5-Yr. Total Return |

|

Virtus Diversified Income & Convertible Fund |

100.49% |

|

Virtus Equity & Convertible Income Fund (NIE) |

79.99% |

|

Virtus Convertible & Income Fund (NCV) |

-6.65% |

|

Virtus Convertible & Income Fund II (NCZ) |

-6.10% |

Thus, a simple look at the fund’s trailing performance indicates that this fund may not be deserving of the vitriol that investors have leveled on Virtus funds lately. As is always the case though, past performance is no guarantee of future results so we should investigate further in order to determine whether or not this fund could be a reasonable investment today.

About The Fund

According to the fund’s website, the primary objective of the Virtus Diversified Income & Convertible Fund is to provide its investors with a very high level of total return. This makes a lot of sense for a fund like this, as convertible securities are by their nature a total return vehicle. Investors typically buy them in order to receive an income from the coupon payments that they pay out. However, there is also the possibility of capital gains from the conversion feature, as common stock can theoretically go to infinity. Thus, an investor in a convertible security may be able to earn far more capital gains than would ordinarily be available from a fixed-income investment. Total return, by definition, consists of both income and capital gains so any fund that invests in convertible securities will almost certainly have this as its primary objective.

The description that is provided on the webpage strongly implies that this fund will be invested primarily in convertible securities. Here is the text from the page:

The Fund seeks to provide total return through a combination of current income and capital appreciation, while seeking to mitigate the risk of capital loss. The Fund strives to dynamically allocate across convertibles, equities, and income-producing securities.

The Fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified portfolio of convertible securities, income-producing equity securities and income-producing debt and other instruments of varying maturities, of which at least 50% of total managed assets are invested in convertibles. The Fund has the latitude to write covered call options on the stocks held in the equity position.

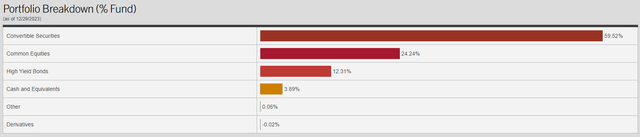

As the above description states, the Virtus Diversified Income & Convertible Fund typically invests at least 50% of its assets into convertible securities. It is fulfilling this requirement currently, as 59.52% of the fund’s assets are invested in convertibles:

Interestingly, we see that common equities comprise the fund’s second-largest position at 24.24% of its total assets. The remainder of the fund’s portfolio is mostly invested in junk bonds, although it does have a small allocation to cash and money market assets. The stock allocation is a bit surprising, as we might ordinarily expect that a fund like this would be invested in a combination of convertible securities and bonds. After all, bonds are better at producing income in today’s environment as the yield available from bonds is much higher than the yield available from common stocks. However, this fund’s equity allocation appears to be the biggest factor that sets it apart from Virtus’s other convertible bond funds. The Virtus Convertible & Income Fund and the Virtus Convertible & Income Fund II are both invested in a combination of convertible and junk bonds without an equity allocation. Those two funds were the ones that delivered very disappointing performances over the past five years. Thus, it may be this fund’s balance between bonds and common equities that resulted in its outperformance versus the market. This is something that could continue to benefit the fund over the long term, especially given the very real possibility that inflation will be a permanent fixture in the American economy (see here). Common equities, and to a lesser extent convertible bonds, tend to do a bit better than ordinary bonds in an inflationary environment.

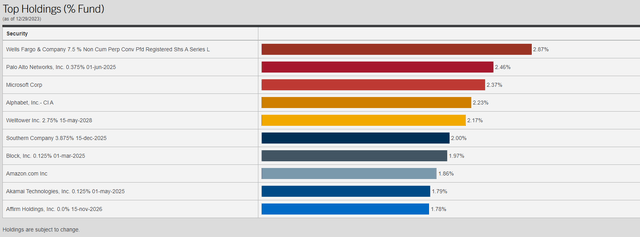

Earlier in this article, I pointed out that convertible securities are frequently issued by start-up companies or companies that are experiencing some level of financial stress. This is because the promise of equity upside might be the only way that these companies can acquire financing at a reasonable price. For example, Wells Fargo (WFC) issued convertible securities back during the 2007-2009 financial crisis when nobody wanted to provide banks with financing without demanding very high interest rates. The promise of an equity upside once the sector recovered allowed the bank to sell the securities with a lower coupon rate than it would have been able to obtain without the equity kicker. Tesla also issued convertible securities in its earlier years when it was unable to earn a consistent profit. As such, we might expect that many of the fund’s largest positions will be in younger companies or in companies that experienced some degree of financial struggles in their history. This is, in fact, what we see in the fund’s top ten positions. Here they are:

Admittedly, we do not see nearly the same level of potentially financially struggling companies here that we do among many of Virtus’s other funds. The Wells Fargo Series L preferreds are convertibles that were issued when it was having difficulty during the financial crisis. Block, Inc. (SQ) and Affirm Holdings (AFRM) are both relatively young companies, even though both have been around for more than ten years now. Even Palo Alto Networks (PANW) is relatively young, as it was founded in 2005. These securities may not be recent issues, so they could have been issued back when these companies were in worse financial shape than they are now. Thus, for the most part, we do see the thesis that convertibles are frequently issued by companies that need to offer an equity upside in order to obtain financing from the market playing out in many of the fund’s positions.

We also see some common equities among the fund’s largest positions. For example, the fund’s Microsoft (MSFT), Alphabet (GOOGL), and Amazon.com (AMZN) positions are all common equity positions as opposed to something. I will admit that I have levied criticism at some funds for having these among their largest holdings in previous articles. This is mostly because every fund seems to be holding these positions, so investors have a hard time diversifying away from them. This is important because all three of these companies have very high valuations and are in the same economic sector. That naturally presents a great deal of risk, and most people who invest in closed-end funds are not particularly interested in taking on large amounts of risk. In this case, though, I am willing to let the fund’s positions in these three companies slide as they do not account for very much of the fund’s overall portfolio. In addition, a convertible fund by its very nature will have a certain degree of exposure to the technology sector as companies in this industry are a bit more likely to issue convertible securities than a blue-chip manufacturer. As such, anyone who buys this fund goes in knowing that they will have significant exposure to the technology sector and will make sure that their portfolio is properly configured to ensure proper diversification across sectors.

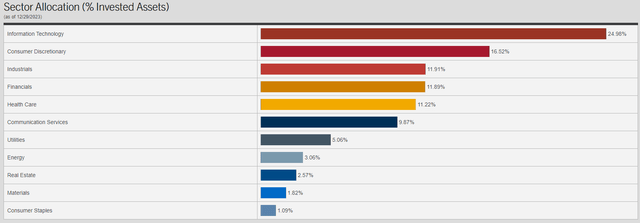

We do see that this fund is very heavily exposed to the information technology sector:

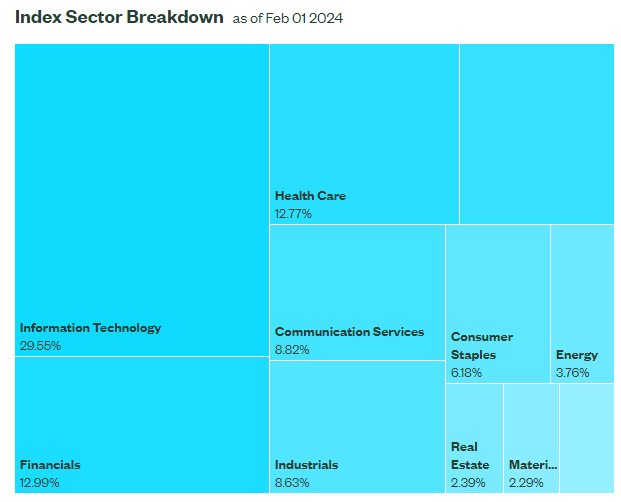

As we can clearly see, 24.98% of the fund’s assets are invested in the information technology sector. This weighting exceeds every other individual sector in the portfolio by quite a lot. Perhaps surprisingly though, this fund is actually a bit better than the S&P 500 Index in terms of diversification. Here are the weightings for the S&P 500 Index:

State Street

As shown here, the S&P 500 Index has a 29.55% weighting to information technology. The fact that this fund is a bit less could therefore be somewhat attractive to an individual investor who wants to reduce their overall exposure to the sector, but as we just saw the fund is still very heavily invested in it. Of course, convertible securities are theoretically safer than the common equities that one would get by investing in the S&P 500 Index due to the fact that they are senior to common stock in the event of bankruptcy or liquidation. That may be attractive to a risk-averse investor.

Leverage

As is the case with most closed-end funds, the Virtus Diversified Income & Convertible Fund employs leverage as a method of boosting the effective yield of the assets in its portfolio. I explained how this works in numerous previous articles. To paraphrase myself:

Basically, the fund borrows money and then uses that borrowed money to purchase convertible securities, common stock, and other publicly traded securities. As long as the total return that the fund received from the borrowed money is greater than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive level of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its total assets for this reason.

As of the time of writing, the Virtus Diversified Income & Convertible Fund has leveraged assets comprising 32.43% of its portfolio. This is not out of line with the leverage employed by many other closed-end funds, and it is not above the one-third maximum that I typically prefer to see. As such, the balance between the risk and the reward appears to be acceptable here.

Here is how this fund compares to the other Virtus convertible funds in terms of leverage:

|

Fund |

Current Leverage As A % Of Assets |

|

Virtus Diversified Income & Convertible Fund |

32.43% |

|

Virtus Equity & Convertible Income Fund |

N/A |

|

Virtus Convertible & Income Fund |

37.28% |

|

Virtus Convertible & Income Fund II |

38.27% |

Thus, the Virtus Diversified Income & Convertible Fund is currently employing a lower level of leverage than its peers. This should result in the fund having somewhat lower volatility and lower overall risk. This strengthens the investment case for risk-averse investors.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Virtus Diversified Income & Convertible Fund is to provide its investors with a very high level of total return. In pursuance of this objective, it invests in a portfolio that consists of convertible securities, common equity, and junk bonds. Convertible securities and junk bonds both generally deliver their investment return in the form of direct payments to their owners, although convertible securities can also deliver substantial capital gains in certain situations. Common equities provide most of their investment return in the form of capital gains, but the fund can always realize capital gains to get money for its shareholders. The fund collects all of the money that it receives from these sources and pools it together. It then distributes the money in the pool to its shareholders, net of its expenses. We might expect that this would result in the fund’s shares having a fairly high yield.

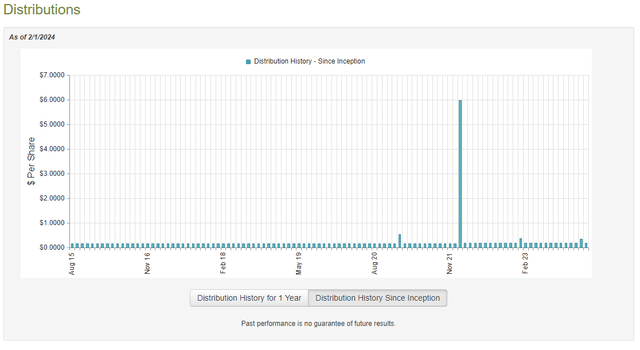

This is indeed the case as the Virtus Diversified Income & Convertible Fund pays a monthly distribution of $0.18 per share ($2.16 per share annually), which gives it a 9.50% yield at the current price. The fund also makes special distributions around the start of each year, as it did in January. This results in investors frequently realizing a higher yield than what is calculated just from the regular distribution. This fund has been remarkably consistent with its distribution over its history as it has never cut the payout:

The fund did raise its distribution once, but otherwise, it has been remarkably consistent. This fund’s strategy apparently is to pay out an amount that it is fairly confident that it can get from the portfolio and then just pay out any surplus in a special distribution. This works pretty well overall and income-focused investors will probably find a lot to like here. After all, this fund looks like a good way to obtain a regular monthly income that can be used to pay your bills and finance your lifestyle and it has the advantage of possibly paying a special distribution at the start of the year. It is almost like a job with bonus potential, which is attractive to many retirees.

As is always the case, we want to ensure that the fund can actually afford the distribution that it pays to the shareholders. After all, we do not want the fund to be regularly paying out more than it actually earns from its portfolio and destroying its net asset value in the process. That is unsustainable over any sort of extended period of time.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on July 31, 2023. As such, it will not include any information about the fund’s performance over the past six months. This is quite unfortunate as there were a number of events that occurred during that period. In particular, the market’s seeming euphoria during the latter two months of 2023 almost certainly provided this fund with the opportunity to earn some profits. In contrast, the summer months were characterized by rising interest rates as well as falling stock and bond prices that probably had an adverse impact on the assets in the fund’s portfolio. The most recent financial report will not provide any information about how well the fund negotiated either of these environments. We will have to wait until the fund releases its full-year report (probably in March) to have such information. As such, we have to go with what we have for now.

During the six-month period, the Virtus Diversified Income & Convertible Fund received $3.286 million in interest and $1.213 million in dividends from the assets in its portfolio. We have to subtract out a very small amount of foreign withholding taxes that the fund paid to arrive at a total investment income of $4.498 million over the six-month period. The fund paid its expenses out of this amount, which left it with $352,000 available for the shareholders. This was obviously not enough to cover the $11.194 million that the fund paid out in distributions to its shareholders over the period. At first glance, this may be concerning as the fund is clearly not generating sufficient investment income to cover its distribution.

However, there are other methods that the fund can employ in order to earn the money that it requires to cover the distribution. For example, it might be able to realize capital gains from price movements of various securities. Realized capital gains are not considered to be investment income for tax or accounting purposes, but they clearly represent money coming into a fund that can be distributed to investors.

Unfortunately, the fund had mixed results in obtaining money from alternative sources. It reported net realized losses of $5.673 million but was able to offset this with a whopping $23.957 million in net unrealized gains. The fund’s net assets increased by $7.489 million over the period after accounting for all inflows and outflows. Thus, the fund technically managed to cover all of its distributions during the period.

However, we can see that the fund only managed to cover its distributions due to the strength of its unrealized capital gains. As we all know, unrealized capital gains can easily be erased by a market correction or similar event. Thus, there is no guarantee that these gains will become permanent and the fund did not have sufficient net investment income and realized gains to cover the distribution.

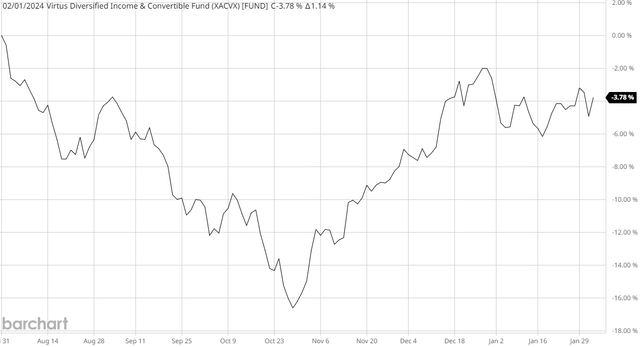

Unfortunately, in this case, there may be a reason to be concerned. This chart shows the fund’s net asset value per share from July 31, 2023, to February 1, 2024:

As we can see, the fund’s net asset value has declined since the closing date of the most recent financial report. This suggests that it has failed to cover all of the distributions that it has paid out since that period. It was, however, up slightly around the start of this year. That explains the special distribution that the fund paid out last month. However, as of right now, the fund has not fully covered its distributions since the closing date of the most recent financial statement. It will need to correct this problem going forward. That should not be too hard if the market continues to remain strong, but there is no guarantee that this will be the case.

Valuation

As of February 1, 2024 (the most recent date for which data is available as of the time of writing), the Virtus Diversified Income & Convertible Fund has a net asset value of $21.10 per share but the shares currently trade for $22.63 each. This gives the fund’s shares a 7.25% premium at the current price. That is a very large premium that is substantially above the 1.78% discount that the shares have had on average over the past month. As such, the fund’s shares look far too expensive to purchase today. Investors would be advised to wait for a better entry point before purchasing shares.

Conclusion

In conclusion, the Virtus Diversified Income & Convertible Fund appears to be one of the better convertible funds in the market today. It has a history of outperforming both the convertible bond index and the S&P 500 Index as well as a pretty consistent distribution history. The fund also appears to be more diversified than the S&P 500 Index so it might appeal to investors who are becoming increasingly disillusioned with how concentrated that particular market index has become. The fund’s biggest failing right now is that its share price is incredibly high relative to the actual value of its assets so it may be best to wait for the premium to decline before buying in.