andreswd

Overview

My recommendation for Accolade (NASDAQ:ACCD) is a buy rating, as I remain convicted that ACCD can grow 20% in FY25, driven by a strong core demand, health care plan strategy, GLP-1, and elevated demand for expert medical opinion. Note that I previously rated buy rating for ACCD as I expected ACCD to continue executing as guided and growing the business as I expected. As ACCD executes, valuation should re-rate to historical levels. Indeed, I believe the market recognized that valuation was overly punished previously and that ACCD is still a fundamentally good business, as evident from the strong price rally back to $14 from the low of $6 in October.

Recent results & updates

ACCD 3Q24 revenue performance tracked slightly below my FY24 expectations, but it was a beat vs. consensus estimates. The business reported 3Q24 revenue of $99.4 million, beating consensus estimate of $96.2 million. The same was true for EBITDA, where the loss came in smaller than what consensus expected (-$4.6 million vs. -$6.2 million). I believe the part that drove positive stock price momentum is that management reiterated the expectation of 20% revenue growth and 2 to 4% EBITDA margins in F25.

As far as ACCD’s growth for FY25 is concerned, I think there are obvious tailwinds that should make it possible. First of all, the demand for navigation solutions is strong. According to management, demand is still high, and consumers are making purchases for the same reasons they were before the COVID-19 pandemic. This would indicate that the demand profile has recovered to its pre-pandemic levels. At its core, ACCD helps employers drive down the total cost of providing healthcare benefits, and I think this is a strong growth driver for ACCD as all employers look to reduce costs. This is especially true for high-cost areas like specialty pharmacy, which accounts for about 17% of the average employer’s overall pharmacy cost, and the cost of these drugs is expected to grow by over 10% a year. Employers that use ACCD will be able to better engage with employees, which, ideally, will lead to lower overall costs.

Aside from core demand tailwinds, there are two growth drivers that I remain positive about as well: the health plan channel strategy and the GLP-1 growth catalyst. I am positive about ACCD plans to open up the health plan channel, as it is incremental to the core employer market. While the health plan channel was once a relatively untapped opportunity for ACCD, it has now matured into an integral aspect of the company’s strategy. I view this growing channel as an effective customer acquisition channel for ACCD to address a larger addressable market for all products. As for GLP-1, I see it as an incremental demand driver. The implications of GLP-1s on healthcare outcomes, employee satisfaction, overall costs, and, most importantly, the demand from their workforce have kept them on the minds of employers. In my opinion, ACCD can take advantage of this demand trend by developing more all-encompassing evaluation tools for its members, with an emphasis on long-term care plans that address their nutritional needs, mental health, and access to alternatives to prescription drugs. This should drive more adoption of the ACCD solution, as employers need a comprehensive solution. Both of these growth drivers should lead to strong member expansion for ACCD.

Another tailwind that I like to touch on is the recovery in demand for Expert Merical Opinion [EMO]. To recap, COVID has led to numerous individuals with private and public health insurance not getting the checkups they need because they were afraid of getting infected or because their healthcare facility was closed. As COVID pressure eased, this pent-up demand flooded the system and is still making its way through the healthcare system. Because of this elevated utilization (more procedural and surgical volumes), medical opinion should continue to see elevated demand (i.e., volume should stay elevated for the near term). This pent-up demand is going to be good for ACCD’s EMO business, in my opinion. Let’s also not forget that there is now a larger population of aging people who naturally have a higher percentage of chronic illnesses that need medical attention, which is an organic growth driver for ACCD’s EMO business. Comments from hospitals are also supportive of my view on this demand trend.

It’s both, I mean, it’s both, even the volume recovery, especially, in the acute care business and related services on an elective basis will continue to grow.

The aging of the population, the growing burden of chronic illness, the population shifts into many of our markets, and the continued impacts of service and technology innovation that occur outside of the pharmaceutical sector, provide a significant tailwind for the important role that hospitals and ASCs will continue to play. 3Q23 Tenet Healthcare

Valuation and risk

Author’s valuation model

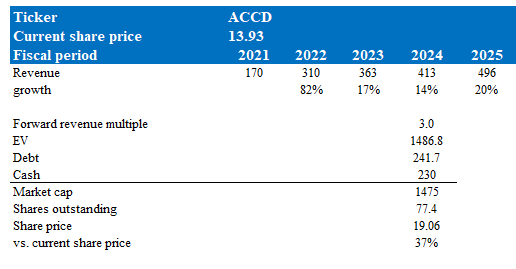

According to my model, ACCD is valued at $19, representing a 37% increase. With management reaffirming their FY25 20% revenue growth guidance and all the growth tailwinds that I have discussed above, I believe ACCD can generate close to $500 million in revenue in FY25. Unlike my previous model, where I had a base and bull case, I believe the market is increasingly recognizing ACCD growth potential as valuation has rerated back to 2x today. If ACCD grows 20% as I expected, I expect the market to 3x forward revenue when I wrote about it back in July 2023. In fact, the re-rate to 3x could happen within 1FH25 if ACCD reported >20% growth, which will convince the market that the risk of missing the 20% guidance is low.

As of today, I think a plausible risk that could delay the adoption of the ACCD solution is if wage costs continue to rise. This could happen if the US economy continues to run hot as the unemployment rate remains near all-time lows. If this happens, employers could be forced to reduce investment in healthcare benefits as the business balance sheet faces more pressure.

Summary

I remain buy rated for ACCD as I expect ACCD to continue growing due to core demand staying strong, health plan strategy, GLP-1 demand trend, and the recovery in EMO volume. Management also reiterated expectations for 20% revenue growth and 2-4% EBITDA margins in FY25, which further bolster my positive outlook. As ACCD continues to execute, I believe valuation multiples will track back to 3x forward revenue.