aapsky

AAR Corp. (NYSE:AIR) reported third quarter earnings on the 21st of March after the closing bell. At the time of writing the stock is trading more than 6% lower. In this report, I will be discussing the results and review my rating and price target for the stock.

AAR Corporation Stock Trails The Market After Acquisition News

I initiated coverage for AAR Corporation in September 2023 with a buy rating and the stock initially performed very well, gaining more than 23%. However, following the news that the company would acquire the Product Support business from Triumph Group (TGI) for $645 million, adding 13% in sales and 38% in adjusted operating profit, AAR Corp. stock has retreated from its highs. On the same day, AAR Corporation announced second quarter results which showed revenue growth translating favorably to operating income expansion but unfavorable translation to the net income level. Revenues missed by $13.15 million but beat on EPS by $0.01.

AAR Corp.

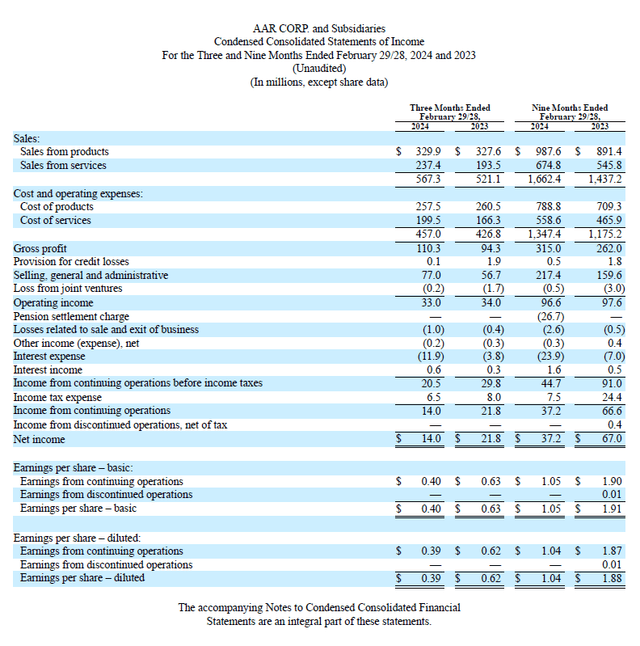

AAR Corporation posted revenues of $567.3 million, marking nearly 9% growth in revenues, falling behind significantly compared to the 15.6% growth rate observed for the nine months ended as the comp becomes more challenging to post high growth rates. Furthermore, availability of feedstock airplanes for used serviceable parts or USM remains tight as OEMs are struggling to meet demand and the situation seems to be getting worse before it will get better as engine maintenance shops are fully booked.

Sales to commercial customers grew 18% as the aforementioned challenge for OEMs to meet demand translates favorably to demand for the products and services offered by AAR Corporation as older aircraft have to remain in service longer. Sales to government customers fell 7%, but that was because the comparable quarter last year was extremely strong. Sales grew 5% sequentially and bookings are picking up. So, there’s some good momentum for Government sales to recover.

Gross margins increased from 18.1% to 19.4% due to strong performance in the Parts Supply business with strong margins for the commercial and government customer groups.

The reality, however, is that reported sales growth did not translate favorably to all levels. The sales growth of 9% translated to 17% growth in gross profit but net income fell by 36%. That was driven by an increase of $8.1 million in interest expenses as well as higher transaction costs in the amount of $12.2 million of which $9.4 million was related to the acquisition of Triumph Product Services and $2.8 million was related to the acquisition of Trax. If we were to adjust for that, operating earnings would have been $45.2 million, indicating 33% growth year-on-year. So, from an operational perspective we do see strength.

AAR Corporation Guides For Higher Interest Expenses And Margin Expansion

For the fourth quarter, AAR Corporation expects mid to high teens growth in revenues which includes $65 million to $70 million in sales from the business acquired from Triumph Group and adjusted margins of 9%. Based on continued integration costs as well as elevated interest expenses, guided at $18.5 million for the fourth quarter, I do expect continued pressure on actual reported operating income and net income.

The combination of higher interest expenses, integration costs and the lower year-on-year organic growth rates could very well explain why the market is valuing AIR stock around 6.5% less at the time of writing.

Is AAR Corporation Stock Still A Buy?

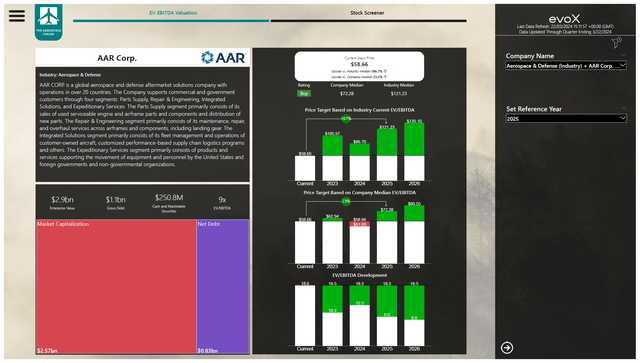

The Aerospace Forum

While there’s clear pressure on net income as we also saw in Q3, it’s important to assess whether the elevated interest expenses driven by addition of debt to finance acquisition will result in higher value for shareholders. I believe that will be the case since the demand environment remains robust and the business acquisitions drive margin expansion. However, the big question is how much already is incorporated in the stock price. That’s why I have added the balance sheet data and forward projections in my stock screener to calculate a price target and rating. With the forward projections in mind, I believe that the stock remains a buy with 23% upside and a price target north of $72 per share.

Conclusion: AAR Corporation Stock Remains A Buy

AAR Corporation booked results that showed margin expansion but impact from transaction related costs as well as higher interest expenses and that is likely to continue. However, on an adjusted basis the results were solid and we see continued strength in the commercial customer market while government customer bookings are picking up pace. As a result, I do believe that AAR Corporation stock remains a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.