Investors are celebrating new all-time highs for the S&P 500. The index is a popular stand-in for the broader stock market, making its new record a signal that Wall Street is officially in a new bull market.

But that’s a loaded expression with more meaning than news headlines tell you. Don’t get me wrong, investors have seen bull markets before, and history says there could be more fun in the coming years.

Still, keeping expectations realistic is crucial to avoiding the frenzied market behavior from 2021 that ultimately set up investors for a big letdown.

Here is what you need to know about this bull market and what could be coming.

1. The bull market is already well underway

The stock market can be tricky. Every bull or bear market has several ups and downs. It’s essential to be careful when declaring the broader state of Wall Street. Generally speaking, the best way to be sure about a new bull market is to look for two milestones.

First, the market should rise at least 20% from its low. The S&P 500 hit its lowest point on Oct. 12, 2022. Since then, the index has risen over 36%. Sometimes, the market can rally (even quite far) but ultimately lose momentum and revert toward its lows. This is often called a bear market rally. Second, the market should hit a new all-time high. That additional milestone adds more substance to the idea that the market has shifted to a new growth phase.

Therefore, the bull market technically started back in October 2022. Investors avoiding the market would have missed a tremendous rally from the lows. But getting too excited too soon would have been a disaster if it was ultimately a bear market rally.

This conundrum is why trying to time the market’s broader moves is virtually impossible. Nobody has a crystal ball to know these things, so steadily investing over time is best. Remember, time in the market is better than trying to time the market.

2. Investors might have already seen the brightest fireworks

Alright, so the market is bullish. What’s next? Keeping your expectations grounded is very important. Historically speaking, bull markets tend to start with a bang. According to Forbes, bull markets since 1957 have averaged a 41.8% gain in the first year following the market’s lows.

This bull market returned just over 21% in 12 months from the low but is now up to over 36%, approximately 15 months out from lows. That’s close to the historical average; it just took a few more months.

Remember that the S&P 500’s average annual return from 1972 to 2021 is 9.4%. Such significant returns in such little time are outliers in the historical data. In other words, while a bull market can go on for years, it likely won’t be a straight line. Yes, the market could fall as much as 20% from its high and still retain its bull market label.

3. Yes, the market is at all-time highs. Yes, it could continue going higher.

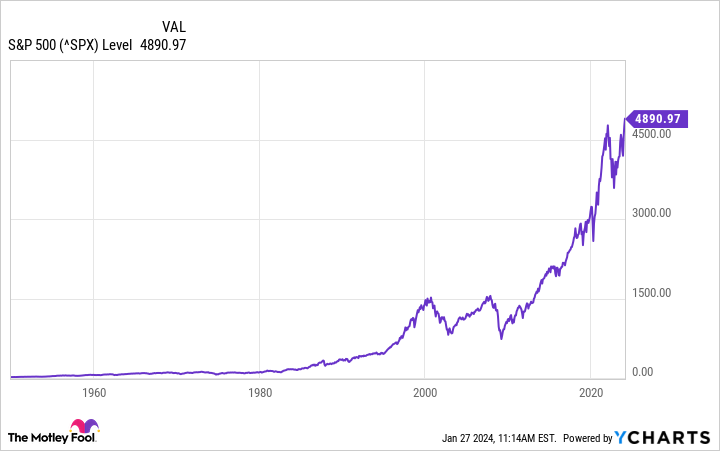

Market volatility is part of the game, the price of admission for building wealth, so don’t get discouraged. The previous 10 bull markets averaged nearly 2,000 days in length and over 180% cumulative gains. There’s a good chance that a stock market at an all-time high will continue making new highs. If you zoom out, you’ll see that it’s paid to stay in the market over time:

The point is to keep your expectations realistic and stay on an investment plan that works in all markets. Add new funds slowly, hold for the long term, and you’ll have a great chance of making money investing.

The new bull market is exciting, and those who went through the lows of 2022 are probably breathing a sigh of relief. Enjoy it! Just don’t let your emotions turn optimism into greed, which didn’t end well when the last bull market peaked in 2021.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.