Jr Korpa/iStock via Getty Images

A very busy week lies ahead for the market, especially following a weak ISM manufacturing report, which showed that stagflation may be becoming entrenched, as the continuing claims show that the unemployment rate may be on the rise.

If this week’s data disappoints, it will likely direct to advocate yield curve steepening as the 2-year rate falls to the 10-year.

Important Week For Data

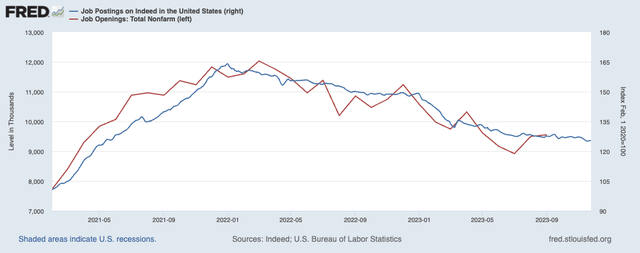

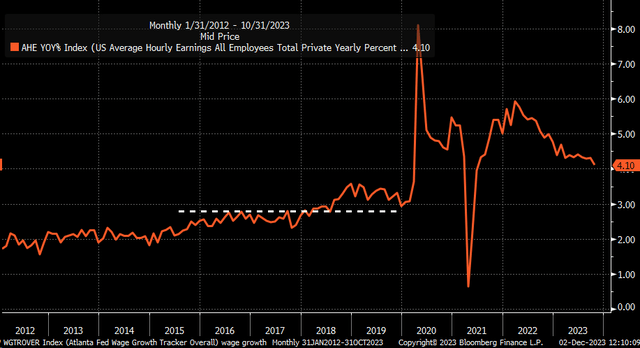

The JOLTS data on Tuesday is expected to show that the number of job openings in October fell to 9.3 million from 9.5 million. Meanwhile, analysts see the ISM services index rising to 52.3 from 51.8 in October. More employment data from ADP on Wednesday is expected to show that hiring increased to 120,000 in November from 113,000 in October. Finally, the BLS job report is expected to show that new jobs increased by 160,000 from 99,000 in October, while the unemployment rate remained unchanged at 3.9%. Average hourly earnings rose by 0.3% in November and 4.0% y/y versus an enhance of 0.2% versus 4.1% in October.

The Indeed job posting data suggest that the JOLTS data is likely to show that the number of job openings continues to fall, but at what appears to be a slower pace. It will likely take a advocate economic slowdown to get employers to reduce their job openings.

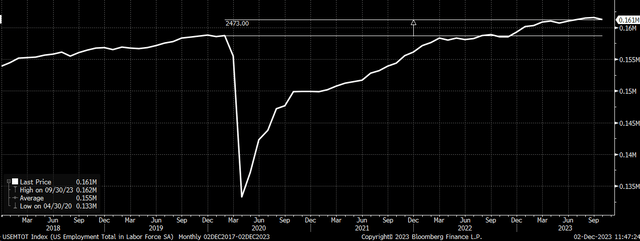

The reason why jobs are probably fairly slow to fill is because the number of workers in the labor force has only modestly risen since its peak in February 2020, climbing to just 161 million from around 159 million.

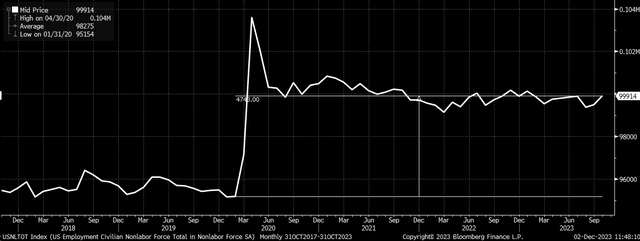

Additionally, the number of people not in the labor force has climbed dramatically to roughly 99.9 million from 95.1 million pre-pandemic. The combination of demand for workers, as demonstrated through high JOLTS readings, and the rising number of workers not in the labor force suggests that the supply of workers isn’t ample enough to meet the demand.

This is possibly one reason there has been a rather large enhance in wage growth, which has appeared to have gotten sticky around the 4.0% level over the past few months. Average hourly earnings before the pandemic averaged just below 3%.

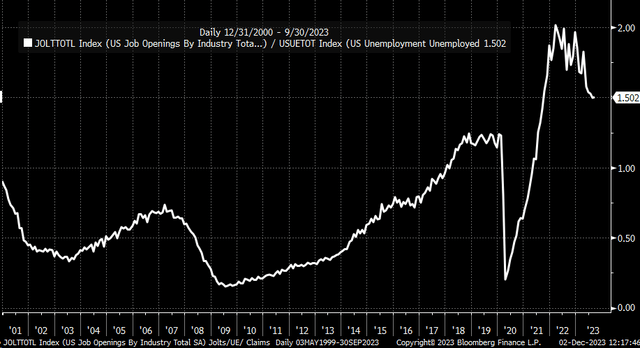

The Fed, however, has been trying to extinguish the demand side of the economy in the hopes that the number of job openings will fall to bring economic growth back to a level that is more in line with the number of workers. This is illustrated by the obsession they have with the Jolts To Unemployment ratio, which remains at 1.5, and well above the pre-pandemic peak of about 1.2

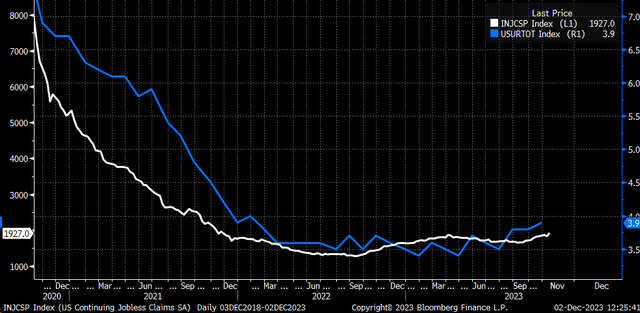

But continuing claims show that the unemployment rate is likely to rise from current levels, as it has been steadily rising now for some time, and that could be a problem because while the Fed expects the unemployment rate to rise, in hopes wage growth and spending will slow, it has to bring inflation back to and preserve its 2% objective.

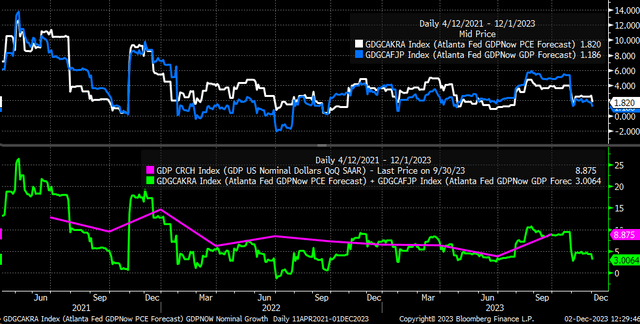

But we now see a meaningful slowdown in real and nominal GDP growth in the fourth quarter. As the unemployment rate rises, it will advocate entrench the US economy into a period of stagflation. Currently, the Atlanta Fed GDPNow model projects real GDP growth of just 1.2% in the fourth quarter with a PCE of just 1.8%, which comes to nominal growth of just 3%. That is down sharply from the roughly 9% nominal growth in the third quarter.

Steeper Curve

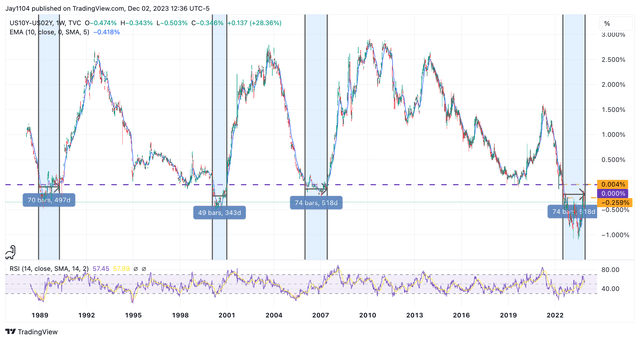

This seemingly appears to be the bond market’s message and the market rates plunge at the front of the yield curve, despite Powell pushing back against rate cuts. The bond market saw the ISM manufacturing data, with employment down, prices rising at a neutral pace to last month, and a sector that remains in contract. If the data from this week confirms the data points of the ISM manufacturing sector, then it is likely to direct to advocate yield curve steepening, as the front of the curve now begins to fall to the back of the curve.

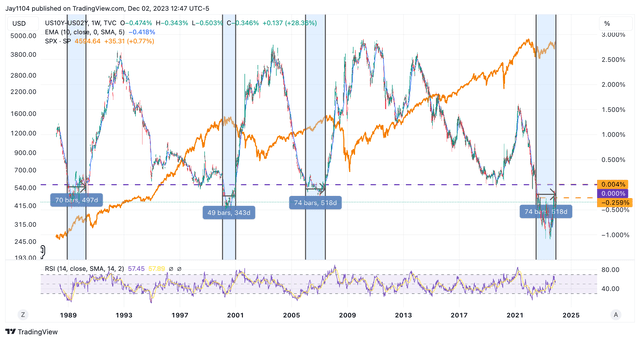

What is also clear is the yield curve doesn’t stay inverted forever, and typically, by around 500 days, the steepening process gets going. That steepening process has already begun, and we are at a point where it should turn positive again.

In 1990, when the yield curve rose after inversion, the S&P 500 fell by more than 20%. In 2000, when the yield curve steepened, the S&P 500 fell by more than 40%; in 2008, when the yield curve steepened, the S&P 500 fell by more than 50%.

That makes this week all the more important because the jobs data, specifically the unemployment rate, really dictates when the Fed pivot will begin and, more importantly, when the yield curve steepening will begin to drive higher. If the data this week shows that a slowing economy is picking up steam, with the unemployment rate creeping above 4% and average hourly wages staying elevated. At the same time, if the number of job openings remains high, it could direct to a yield curve steepening much faster than usual and may take on the form of a 2-year fall and 10-year rise. If that happens, it will be a very strong signal that bond markets are worried about stagflation and a steeper yield curve is coming, which is when the real fun will begin.