Dilok Klaisataporn

We believe that the market is currently undergoing a major disruption due to the fact that the economy is rapidly shifting from a period of elevated inflation to a surprising deflationary trend. As a result, we expect that the stocks that got pummeled the most over the past few years will likely be the biggest winners in 2024. In this article, we will look more closely at the major market disruption underway and share our view on why and how best to invest $100,000 for 2024.

Understanding the Major Market Disruption

For the first time in years, the U.S. is witnessing deflation in sectors that were previously inflation hotspots. This trend is most clearly observed in goods such as appliances, furniture, and used cars as recent data from the Commerce Department shows a year-over-year drop in durable goods prices, a clear departure from the high inflation rates that dominated the economic conversation in the past two years.

Moreover, my colleague Austin Rogers recently wrote about the concept of the “Five Horsemen of Deflation” rearing their heads:

- Demographics (aging populations and declining birth rates)

- Technology (with its labor-saving and productivity enhancements)

- Over-indebtedness (high debt levels impeding economic growth)

- Globalization (international trade exerting downward pressure on prices)

- Inequality (reducing aggregate demand due to wealth disparities).

These major societal and macroeconomic trends should exert significant deflationary pressures on the economy in the coming years, adding advance weight to the current deflationary trend as a result of severely restrictive Federal Reserve policies over the past two years. As a result, it is entirely possible that these forces will collectively create sufficiently strong disinflationary pressure to counterbalance the inflationary trends of aggressive government spending (especially if the government can bring its spending under at least reasonable control) and potentially steer the economy into deflation.

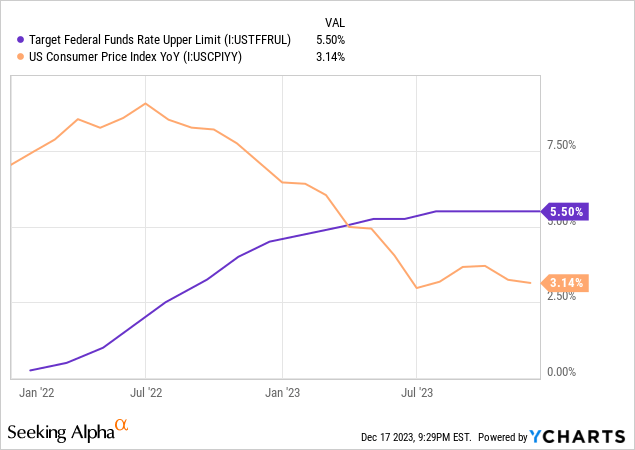

Ultimately, we think that the Federal Reserve is going to be the decisive force in determining how far the economy goes in its swing from four decade-high inflation towards possible deflation. Over the past two years, the Fed has implemented a series of rate hikes at a pace not seen since the 1980s:

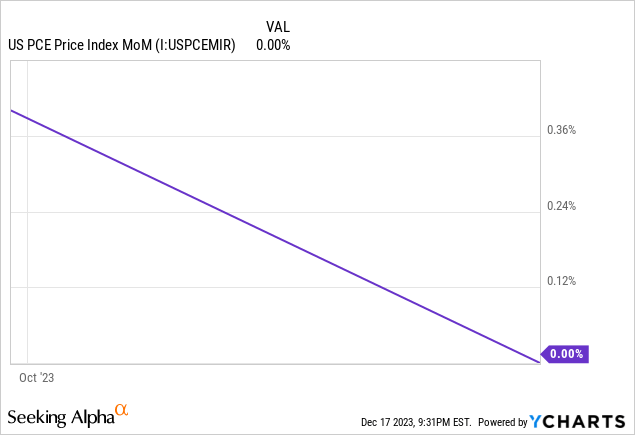

While these measures have successfully reduced inflation, they have also raised concerns about the potential for deflation. For example, the PCE price index – the Fed’s preferred index for measuring inflation – has plummeted over the past three months to 0.00% in its most recent reading. If this trend continues, we will be in a deflationary environment very soon:

Just a few months prior, the markets were fully expecting interest rates to remain higher for longer and leading business leaders – ranging from Jamie Dimon of JPMorgan (JPM) to Ray Dalio of Bridgewater Associates – were calling for long-term interest rates to rise to levels as high as 6-7% potentially. This caused the market to panic, with the S&P 500 (SPY) dipping sharply into correction territory and interest rate sensitive sectors appreciate REITs (VNQ) and utilities (XLU) took an especially hard beating.

However, this rapidly swinging sentiment back towards fears of deflation and the expectation that the Fed will have to scramble to cut interest rates in response is driving a major market disruption.

What is that market disruption? In 2023, while AI-related tech companies, particularly the “Magnificent Seven” (Apple (AAPL), Nvidia (NVDA), Tesla (TSLA), Meta (META), Alphabet (GOOG)(GOOGL), Microsoft (MSFT), and Amazon (AMZN)) along with other major players appreciate Palantir (PLTR), have soared, defensive and interest rate-sensitive stocks appreciate utilities and REITs have lagged.

However, with the economy showing signs of cooling and potential shifts in the interest rates on the horizon, a reversal in this trend is clearly underway. In a deflationary environment, certain asset classes are favored over others. For instance, sectors with stable, contractual cash flows, such as certain REITs and utilities, could become more attractive. The potential for a market correction also suggests that investments in overvalued sectors, appreciate certain tech stocks, might need to be reassessed. Moreover, a deflationary period could also see a shift in consumer behavior, affecting sectors reliant on discretionary spending, including some of the high-flying mega-cap stocks appreciate AAPL, TSLA, and AMZN.

We will dedicate the rest of this article to discussing some specific ways that we are preparing our portfolio to profit in 2024.

How To Invest $100,000 For 2024

As we have discussed in the past, the late Charlie Munger believed that the first major step to achieving financial independence was amassing an investment portfolio of at least $100,000 (granted, he said this a while ago, so accounting for inflation may mean that his sum would be meaningfully higher today), stating:

The first $100,000 is a *****, but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000.

This milestone is important to achieve because – while you won’t earn much passive income from your investments early on – once your savings achieve a certain size, the passive income you earn becomes quite large and your nest egg begins to compound rapidly.

With this principle as well as the ongoing market disruption in mind, how do we set up our compounding machine for success in 2024? We are positioning our portfolio increasingly towards value-oriented, dividend-paying stocks in sectors that are resilient to economic downturns and likely to outperform in a disinflationary or even deflationary environment. The defensive investments that we appreciate the most are those offering stable cash flows, as we expect these to not only outperform other asset classes through a deflationary recession but also continue to pay and even grow dividends on a very reliable basis.

Specifically, we appreciate utilities appreciate beaten-down high yield and investment grade Algonquin Power & Utilities (AQN), investment grade yield cos appreciate Brookfield Infrastructure Partners (BIP)(BIPC) and Brookfield Renewable Partners (BEP)(BEPC), REITs appreciate Realty Income (O) and Crown Castle (CCI), financials appreciate New York Community Bancorp (NYCB) and some other undervalued community banks, blue chip midstream infrastructure stocks appreciate Enbridge (ENB) and Enterprise Products Partners (EPD), and gold (GLD) and silver (SLV) related investments.

Meanwhile, investments that profit from elevated short-term interest rates such as BDCs (BIZD) appreciate Main Street Capital (MAIN) and Ares Capital (ARCC), as well as mega-cap technology stocks that have soared this year on the backs of the A.I. boom such as Apple and Microsoft that have begun to lag the market in recent weeks, are likely to continue doing so as the focus on falling interest rates and recession risk grows, in our view.

What would a $100,000 investment look appreciate in a sample portfolio following this approach? Here is a sample 15-stock portfolio that offers a balance between income (a significant 5.85% yield), total return, and safety, though you should tweak these picks based on your risk tolerance and long-term investment goals:

| Security | Amount Invested | Dividend Yield |

| AQN | $2,500 | 6.71% |

| Brookfield Infrastructure Preferred (BIP.PR.A) | $7,500 | 7.90% |

| BIP | $2,500 | 5.08% |

| BEP | $2,500 | 5.04% |

| EPD | $7,500 | 7.61% |

| ENB | $7,500 | 7.43% |

| O | $7,500 | 5.37% |

| CCI | $2,500 | 5.55% |

| NYCB | $2,500 | 6.20% |

| Arbor Realty Trust (ABR.PR.F) | $7,500 | 8.38% |

| GLD (sell options as needed to produce income) | $5,000 | 0% |

| SLV (sell options as needed to produce income) | $5,000 | 0% |

| Schwab U.S. Dividend Equity ETF (SCHD) | $10,000 | 3.52% |

| Vanguard High Dividend Yield ETF (VYM) | $10,000 | 3.01% |

| JPMorgan Equity Premium Income ETF (JEPI) | $20,000 | 8.65% |

| Total | $100,000 |

5.85% |

Investor Takeaway

As we transition from an inflationary environment to a potentially deflationary one, it is likely to cause significant disruption in financial markets, presenting a unique opportunity for investors to position their portfolios to profit as we head into 2024.

For investors looking to invest $100,000 in 2024, our recommended approach emphasizes a pivot towards value-oriented, dividend-paying stocks in sectors that are resilient to economic downturns. These sectors include utilities, REITs, financials, blue-chip midstream infrastructure stocks, and precious metals. These sectors are expected to outperform in a recessionary and falling interest rate environment due to their stable cash flows and reliable dividend growth.

In this article, we provided a sample 15-stock portfolio that yields 5.85%, balancing income, total return, and safety. That being said, keep in mind that this is just a sample portfolio, and it is crucial for investors to tailor these recommendations to their individual risk tolerance and long-term investment goals.