We’ve all heard the original story of picks and shovels with Samuel Brannan during the Gold Rush in 1849.

Selling picks and shovels to gold miners instead of going for the gold was more profitable. It created a “moat.”

But the key is that Sam sold items to the miners that they couldn’t get themselves. He didn’t sell them clothes… because they already had clothes.

Picks and shovels are borne of necessity – and oftentimes, the companies selling them are mistaken for what I call “middlemen,” the companies whose services can be replaced by the goldminers.

Nvidia (NVDA) is a great example of the former. Just because companies can create chips themselves, Microsoft, Apple, and Amazon, among them – it doesn’t mean they have the technology “moats” to do it. Each one of those companies is working with Nvidia’s technology, not against it.

It would be more expensive for them not to.

And an example of the latter, a middleman, is a company you’ve likely never heard of – Donnelley Financial Solutions (DFIN).

It’s a small-cap firm whose stock is up nearly 20% in the past three months… so its own investors are elated, and I’m sure thousands of others are falling over themselves.

But all the company does is prepare financial documents for other companies – quarterly reports, year-end earnings documents, prospectuses, and more. That’s where 70% of its business comes from – printing papers.

Now, these papers can get costly – it took Arm Holdings (ARM), a recent IPO, $900,000 to put their prospectus together, and I surmise that very few actually read it.

But it’s putting papers together, nonetheless. Donnelley doesn’t have a moat around their technology; there isn’t a myriad of intellectual property under patent; and they aren’t solving world-class problems.

Beyond the theory here, there are two major issues with the company.

The first is located on the company’s own latest earnings filing on November 1…

Technological advancements, regulatory changes, and evolving workflow preferences have led to the Company’s clients managing more of the financial disclosure process themselves, changing the marketplace for the Company’s services and products.

Tech advancements, SEC regulation updates, and the changing workplace means their clients are just doing the work themselves – which is exactly what happens to a middleman company.

The second issue is just a few lines down…

The Company’s Capital Markets segments (CM-SS and CM-CCM), in particular, are subject to market volatility in the United States and world economies, as the success of the transactional and Venue offerings is largely dependent on the global market for initial public offerings (“IPOs”), secondary offerings, mergers and acquisitions (“M&A”), public and private debt offerings, leveraged buyouts, spinouts, special purpose acquisition company (“SPAC”) and de-SPAC transactions and other similar transactions.

Everything they depend on for business is or will soon be smothered.

Interest rates at the level they are increases borrowing costs, and because private companies lack access to public market funding, they need to take on debt to survive. But because costs are higher now, they can’t take on as much and can’t take as many chances as before.

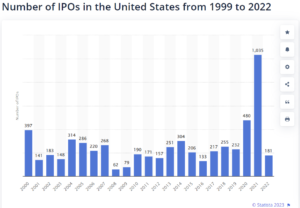

This leads to fewer IPOs – they just don’t have enough money – a trend which is already on the reject.

Note that the outlier in 2021 was due to the SPAC boom – another vehicle for which Donnelley relies – and it’s all but dead.

With fewer papers circulating and less of a need to circulate them, DFIN is in a position for a steep reject.

Avoid the stock.

And if you’re more speculative here, I’d suggest playing put options six to 12 months out to capture a return on a proceed lower.