First quarter earnings season will soon get underway with the banks, as always, kicking things off in earnest before market open on 12th April.

As usual, market participants will be paying close attention not only to individual results, and to aggregate performance, but also to any potential macroeconomic implications of earnings, and their accompanying commentary, particularly as the first Fed cut this cycle continues to loom.

Per FactSet, overall S&P 500 earnings growth is seen at 3.6% YoY in the first quarter, marking the third consecutive quarter of YoY growth for the index, if reports fall in line with expectations.

Positive revenue growth is also expected, for the 14th consecutive quarter, with consensus seeing YoY revenue growth at around 3.5% for the index at large.

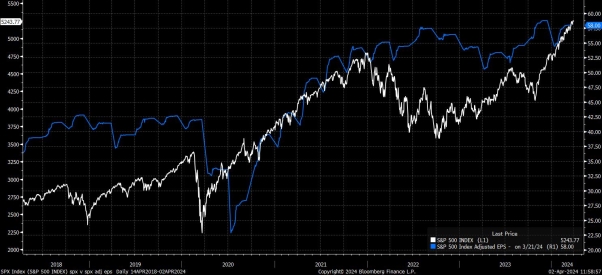

Nevertheless, on many valuation metrics the S&P continues to look ‘expensive’, with the forward 12-month P/E ratio just shy of 21, above both the 5- and 10-year averages.

Furthermore, the index has continued to rally despite something of an ‘earnings gap’ emerging, as the chart below displays.

As is always the case, major Wall St banks kick proceedings off, with Citi (C), JPMorgan (JPM) and Wells Fargo (WFC) all reporting before market open on 12th April, followed by Goldman (GS) on 15th, and Bank of America (BAC) and Morgan Stanley (MS) on 16th.

Early indications bode relatively well for bank earnings season, particularly after Jefferies – whose fiscal quarter ends a month before the calendar quarter used by most competitors – notched a jump in both trading and investment banking revenues. Other banks, including BofA, have also recently pointed to capital markets revenue having continued to trend higher over the course of Q1. A resurgence in the IPO market, sparked by Reddit’s recent listing, may also point to a relatively constructive outlook in the quarters ahead.

Of course, broader macro commentary from bank CEOs will also be watched closely, particularly as the beginning of the Fed’s policy normalisation process continues to loom, and as the debate over whether the economy will experience a ‘soft’, a ‘hard’, or no landing at all rumbles on. The health of consumer balance sheets, and spending trends, will be a particular focus here.

These earnings come as the KBW bank index trades, as near as makes no difference, at its highest level in 13 months, albeit continuing to trade around 10% below the highs seen just before the collapse of Silicon Valley Bank (SVB) last March.

Besides banks, there are a range of other stocks, and narratives, that will be in focus this reporting season; though, on the whole, the theme of firms massaging analyst expectations lower, only to then beat these downbeat forecasts, is likely to ring as true as ever.

While the so-called ‘magnificent seven’ haven’t proved anywhere near as dominant this year, with AAPL and TSLA in fact trading in negative territory on a YTD basis, reports from these behemoths will still be in sharp focus, not least owing to their significant weight at an index level. Together, the ‘Mag 7’ comprise around 28.8% of the S&P 500, and around 40% of the Nasdaq 100; hence, post-earnings reaction in these stocks, most of whom report towards the end of April, should prove a significant driver of broader sentiment and price action.

Meanwhile, at a sector level, seven of the eleven GICS sectors in the S&P are set to report YoY earnings growth, likely being led by communication services, information technology, and utilities, all of which trade in the green on a YTD basis. On the other hand, the remaining four are seen reporting a YoY earnings decline, with energy and materials set to lag most significantly.

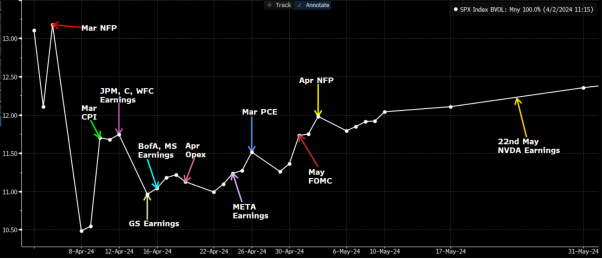

Returning to a broader index level, the below annotated implied vol curve for the S&P 500 helps to envisage how markets view the key event risk that looms on the horizon – not only from an earnings, but also from a data and policy standpoint.

Clearly, derivatives price corporate reports as one of the most obvious near-term risks, while pricing around ‘big tech’ earnings later in the month is likely to move higher as reports near, and once the stocks in question confirm reporting dates.

As earnings season progresses, and the aforementioned dates are confirmed, Pepperstone’s coverage of corporate reports will continue in earnest.