Since 1957, the S&P 500 index has gone more than a year without making a new all-time high 14 times. Finally reaching new highs in these instances — just as the index did in January — the market proceeded higher over the following year on 13 of these 14 occasions.

This surprising consistency in new bull markets should help ease investors’ minds when buying stocks at these prices, as it suggests that the best is not necessarily behind us. One stock that has also recently reached new all-time highs is less-than-truckload specialist Old Dominion Freight Lines (ODFL 0.41%).

Producing a total return of around 48,400% since the turn of the century, Old Dominion will split its stock 2-for-1 on March 17th — marking its 7th split in the last 21 years.

As we near this upcoming date, here’s why dollar-cost averaging into new company shares over time and holding for the long haul could be prudent for investors.

Image source: Getty Images.

Old Dominion’s upcoming 2-for-1 stock split

The most important thing to remember about stock splits is that nothing fundamentally changes with your investment. A company takes an eight-slice pizza (its shares) and cuts those slices in half, creating 16 new portions. Twice as many slices but ultimately, the same value for everyone. The size of the pizza — or the business’s market capitalization — remains the same.

Despite this negligible effect on shareholders, stock splits increase liquidity on the exchanges while making shares more affordable for employees and outside investors. Though fractional-share trading is now fairly standard, not all brokers offer it.

For example, my Mom has a small E*TRADE account that does not allow fractional-share purchases on the individual stocks she buys. Adding $100 every month or two to her account, Old Dominion’s current price of around $435 would be out of reach for her as she would rather put her cash to work elsewhere than let it accumulate. With the upcoming split, buying some Old Dominion would be much more feasible — especially if she wanted to purchase multiple shares over time.

Better yet for investors, companies splitting their stocks have outperformed the market by 18% in the year following the split, according to a recent Nasdaq and FactSet study.

Multiple market-beating indicators

Home to nearly 11,000 trucks and over 46,000 trailers, Old Dominion is the largest less-than-truckload (LTL) motor carrier in the United States, holding a 12% share of the industry. Unlike traditional long-haul trucking, where a full trailer goes from one city to another, LTL shipping consists of packing numerous partial loads into a common trailer and delivering them to one of Old Dominion’s distribution facilities for delivery. Naturally, the logistical infrastructure technology and know-how needed to make this possible are overwhelming, especially on a countrywide scale.

Despite these challenges, Old Dominion has steadily improved its unique operations and now delivers over 99% of its shipments on time, with only 0.1% of those deliveries containing an error. Generating these top-tier efficiencies while building out its immense grid of 257 service centers, the company has created a wide moat around its business thanks to its specialized network.

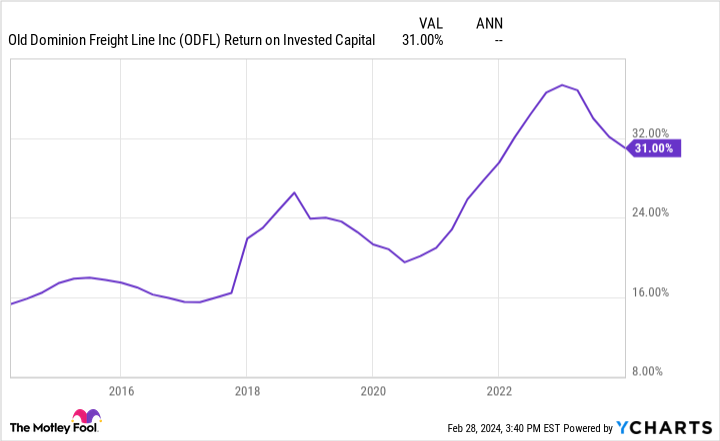

This moat can be somewhat quantified by viewing Old Dominion’s high and rising return on invested capital (ROIC).

ODFL Return on Invested Capital data by YCharts.

A company’s ROIC measures its profitability compared to its debt and equity — the higher, the better. With the 31st-best ROIC in the S&P 500, Old Dominion’s high marks could point to future outperformances. Propelled by this widening moat and rising ROIC, the company has grown revenue and net income by 12% and 25% annually over the last decade.

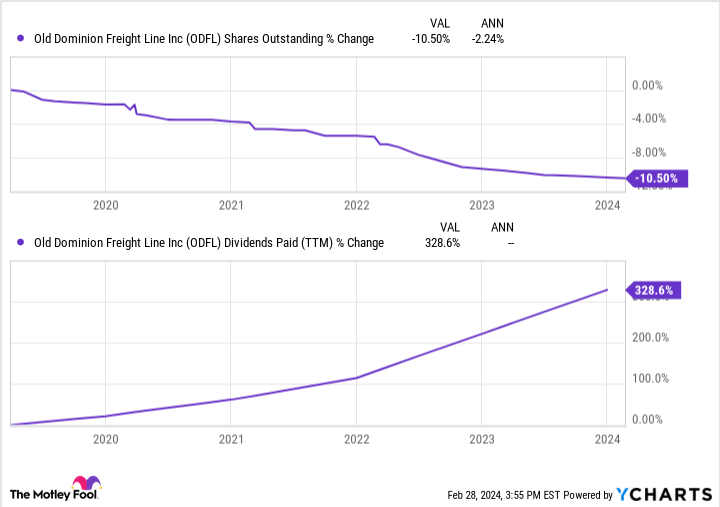

Armed with this burgeoning profitability, Old Dominion has repurchased over 10% of its outstanding shares in just the last five years — all while quadrupling its dividend payments.

ODFL Shares Outstanding data by YCharts.

These shareholder-friendly actions also have a history of market-beating potential. Between 1973 and 2022, dividend-growth stocks like Old Dominion outperformed an equal-weighted S&P 500 index by 2.5 percentage points, according to a Hartford study. Meanwhile, analysis from S&P Global showed that a basket of the 100 most buyback-heavy stocks in the S&P 500 outperformed the broader index in 16 of the 20 years from 2000 to 2019.

Dollar-cost averaging in a cyclical industry

Cyclical in nature, the U.S. trucking industry remains in a temporary downturn, resulting in Old Dominion’s sales declining 6% in 2023. Despite this drop, Chief Executive Officer Marty Freeman explained that the company has continued to take market share over the last few quarters as it absorbed new business from a now-bankrupt peer, Yellow.

Perhaps partially due to these market-share gains, the company’s stock has held onto its premium valuation, trading at 34 times next year’s earnings. Thanks to this combination of lofty valuation versus Old Dominion’s wide moat and market-beating qualities, dollar-cost averaging purchases would be wise for investors. Buying smaller portions of shares over time (at a soon-to-be-lower share price), investors get to put skin in the game right away while also benefiting if a drop arrives amid this trough.

Josh Kohn-Lindquist has positions in Nasdaq and Old Dominion Freight Line. The Motley Fool has positions in and recommends FactSet Research Systems, Old Dominion Freight Line, and S&P Global. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.