One of the things I’ve tried to work on since middle school is being less judgmental about others. To function efficiently in society, I often have default assumptions about people which can sometimes backfire. I’m also certain that if more people got to know each other there would be less conflict.

As a minority who came to America for high school, I had to constantly fight stereotypes. It was exhausting. The time I spent pushing back could have been spent enjoying life or studying. As a result, I’ve been trying to shine bright lights on my blind spots to be a better person. Maybe you’re trying to do the same.

Before sending our son to private school, I had a preconception that all private school families were well off. Paying for private school is like paying for bottled water when tap water is free. However, after meeting over one hundred private school families over three years, I realize this is not the case at all.

In fact, my thinking was actually backward for many families. Because these families send their kids to private school, they have much tighter cash flow. As a result, they tend to drive cheaper cars and live in modest homes.

In other words, private school was making some parents poorer than if they had sent their kids to public school.

The Prioritization Of A Grade School Education

As a public high school and public college graduate, I’m biased towards public school given things worked out well for me and my wife. However, we send our son to a private Mandarin immersion school so he can grow up bi-lingual.

I grew up speaking Mandarin and English because my parents speak both. In addition, I lived in Taipei, Taiwan for four years when I was in elementary school. Finally, I minored in Mandarin during college and studied abroad in China for six months.

I truly enjoyed learning all I could about the Taiwanese and Chinese cultures. To be able to regularly dream in another language creates an ability to live subconsciously in two worlds.

If there’s one thing I remember about my education, it’s knowing how to speak Mandarin. Roughly 1.3 billion people speak Mandarin and another 1.35 billion speak English. So if you can speak languages spoken by 33% of the world’s population, you might improve your odds of having a better life.

I think many families who send their kids to our Mandarin immersion school feel the same way. As a result, they are willing to pay private school tuition, even if they are not wealthy.

Income Needed To Pay For Private Grade School

Personally, I would not send my kids to private school if I didn’t make more than 7X the net cost of tuition per child or more. In other words, if a school costs $20,000 a year after financial aid, I would need to make over $140,000 a year per child.

I used to think the multiple was 5X income. But, with soaring inflation and the declining return on education, I increased the multiple to 7 in my bestselling book, Buy This, Not That.

I fear too many families stretch to pay private school tuition to the detriment of their long-term finances. For most families, there is a delicate balance between saving for retirement and providing as much as possible for their children.

What I soon realized after meeting many families is that some are clearly not following my recommendation. Why would they? Most have not read my book and I am a nobody.

But here’s the thing. After 14 years of writing on Financial Samurai, I often live in my own bubble where I believe most people think and act like me. This is how blindspots and stereotypes form. Hence, being self-aware is important!

Due to the high priority of grade school education, some families are willing to spend a much larger percentage of their household income on private grade school.

Example Of One Family Paying A Small Fortune For Private School

To protect the privacy of the family, I’ve changed the occupations, estimated income levels, and situation details. But the point is still the same.

One day I was invited over to a family’s home for a playdate. Given my default setting was that every family who sends their children to private school is rich, I was expecting their home to be worth more than the median-priced home in the city.

Instead, I was surprised the family lived in a cozy two-bedroom condo off a busy street. They have two boys, so the parents sleep in one room and the boys bunk in the other. Instead of a large play area for the boys to run around, they utilize a homey nook that’s about four by six feet.

First I was surprised since I had bought a two-bedroom condo twenty years ago in 2003 as a 26-year-old. The parents and I were roughly the same age.

Then I was inspired by how the family made everything work so well in a relatively modest space. The place was efficient and full of love. I also started to feel guilty about my desire to have a larger home with two offices, one for my wife and one for me.

What particularly moved me was how generous and kind the family was. They fed us endless food and beverages and warmly opened their home to us. And the kids all had a great time together.

Dual Income Parents, Never Retiring Early

Eventually, we started talking about occupations as is often the case at get-togethers.

The husband makes about $150,000 a year in marketing and the wife makes roughly $80,000 a year as an administrator. A total of $230,000 is a healthy household income. But they are in their 40s and live in expensive San Francisco with two kids in private school.

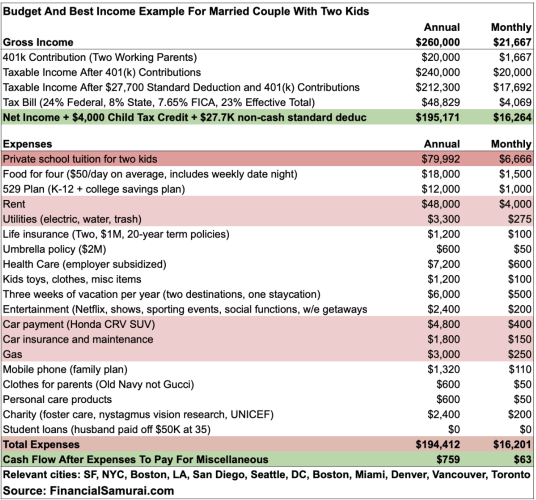

I’ve written about how $300,000 may be needed to live a middle-class life in a big city with children. Here’s a budget I created for a $260,000 household income with two kids in private school. As you can see from the budget, the family is not living it up. They rent and save $20,000 in two 401(k)s and $12,000 a year in two 529 plans.

Private school for one child costs $39,600 a year, which means almost $80,000 a year after-tax in private school tuition. Using a 27% effective tax rate, the family would need to make $114,285 in gross income to pay for two children at their private school.

After paying for private school, the family has roughly $115,715 in gross income ($84,472 net) to save, spend, pay more taxes, and invest. In a city with a median home price of $1.6 million, this family does not own, but rents.

Maybe they contribute the maximum to each of their 401(k) plans. If they did contribute the max, this family would not have much disposable income leftover to build a taxable investment portfolio. In other words, both parents will most likely have to work until past 60.

Hard To Retire Early Living In A Big City With Kids

Working past 60 is normal. But paying 30% of your gross household income toward private grade school tuition is outside the norm. It is a risk this family chooses to take because they greatly emphasize the value of education.

Using my 5X-7X formula, the family would need to earn between $400,000 to $560,000 at a minimum to comfortably send both of their children to private school and save enough money for retirement.

My blind spot was realizing that a family with two kids is normal, but earning $400,000 – $560,000 is not. After updating my Top 1% Net Worth By Age post, I realized a top 1% income now starts at about $650,000. Therefore, a $400,000 – $560,000 income is a top 3% income.

Clearly, the private school is not only accepting families with top 3% household incomes. From a school fundraiser I attended, roughly 20% of families receive financial aid.

At the same time, the Financial Samurai in me cannot recommend earning only 3X more than the cost of tuition for each kid to justify sending a kid to private school. Too many financial calamities happen during the course of our lives to spend so much private school.

For most families, retiring early with kids is nearly impossible if you send them to private school.

We May Be Living In A Personal Finance Bubble

I’m glad to be socializing more with other families. It enables me to realize my blind spots and understand that not everyone is an obsessed personal finance maniac.

For example, many families I’ve spoken to do not contribute much to their 401(k)s, nor do they have 529 plans. Whereas many of us on Financial Samurai try to take full advantage of all tax-advantaged retirement accounts. It is a default setting!

Instead of letting personal finance guidelines dictate how to spend their money (e.g. 1/10th rule for car buying, 5-7X income rule for private school, 30/30/3 rule for home buying), many families spend money on what they value most. Only after they spend do they deal with the consequences, if any.

I prefer to follow a rules-based approach to spending money because it’s too easy for me to waste money. I look at my growing belly as proof I lack the self-discipline needed to stay in shape without some help. My personal finance guidelines keep my family out of financial trouble. They also motivate me to work harder if I want to buy something.

For example, if I really want to buy an $80,000 car, I need to find a way to make $800,000 that year. Otherwise, I’m not buying it!

I know my guidelines are not for everybody. After meeting so many families, my blind spot is realizing not everybody is as obsessed as we are about achieving financial independence sooner.

Prioritizing Between A House, A Car, Education, And Financial Independence

Since 2009, my default setting has been that most families prioritize achieving financial independence sooner above all else. After all, who wants to work at the same boring job for decades? It would be so much better to save and invest aggressively in order to retire sooner!

But another blind spot is that not every parent wants to retire early! There are plenty of parents who have found meaningful jobs to do until after their kids graduate college. I erroneously assumed from one Gallup poll that 70 percent of workers feeling “disengaged” meant 100 percent of workers would rather do something else.

Alas, I was clouded by my situation. In 2009, when this site launched, I was beginning to get bored of the finance world. I was also scared of losing all my money during the global financial crisis. So of course I wanted to figure a way out of the grind ASAP with my finances intact.

What I didn’t realize was that not every parent my age was as shaken by the Global Financial Crisis as me. In addition, given we had children late, many parents are younger and simply haven’t had as much time to build as much wealth.

We all can afford many things, but it’s hard to afford everything. As a result, we will logically prioritize spending money on things we value most. For some families, that priority is a private grade school education.

To Summarize The Blind Spots Of Private School Familes

- Not all private school familes are rich

- A certain percentage of families receive tuition assistance (~20% at my school)

- If you’re reading this site and listen to personal finance podcasts, you are a minority.

- Some families highly value education and are willing to spend more on education and less on accommodation, transportation, and other items as a result

- Not everybody wants to FIRE ASAP

If you are holding onto stereotypes about private school families, kids, or graduates, I hope you will reconsider as I now have. The stronger your negative emotions about a particular group of people, the more you’ve got to dig within to find the root of the problem. Keep an open mind and get to know them. You must be pleasantly surprised by what you discover!

Reader Questions And Suggestions

Did you realize there are plenty of families who send their kids to private school who are not wealthy? Were you aware that some families prioritize private grade school at the expense of saving for retirement or buying a home? What are some other blind spots we might not realize about private school families?

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.