DragonImages

This article was co-produced with Kody Kester of Kody’s Dividends.

—————————————————————————————

Regardless of what happens with the economy, a diversified portfolio of dividend growers is the best bet to build generational wealth for my money.

These three 5.6% to 7.2% yielding blue-chip stocks each pay viable and rising dividends/distributions that average 6.5%.

The companies range from 17% discounted to 30% discounted, each offering investors an attractive margin of safety.

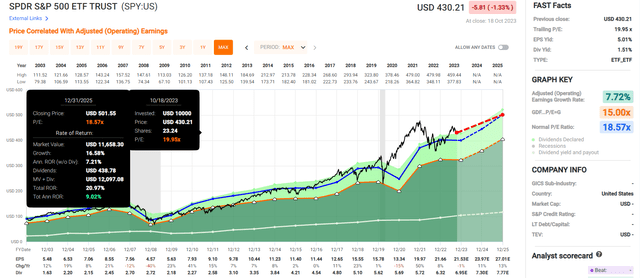

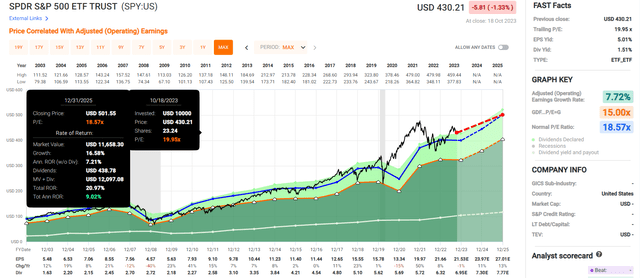

Equally weighted, the stocks could trounce the annual total returns of the S&P 500 (SP500) for the next decade.

These three companies are among the best that investors looking for income, growth, and total returns will find for the next ten years and beyond.

Economics is arguably as much of an art as it is a science. Each week, it seems as though economic indicators are mixed. Whether you are bullish or bearish on the near-term direction of the economy, you can almost always find data to support your stance.

Take, for instance, the data from U.S. retail sales for September. Last month’s $704.9 billion in U.S. retail sales was up 0.7% monthly. This was better than the consensus estimate of 0.3% growth, implying that the American consumer is vital. This seems to defy all expectations in the face of unrelenting inflation and lagging wage growth.

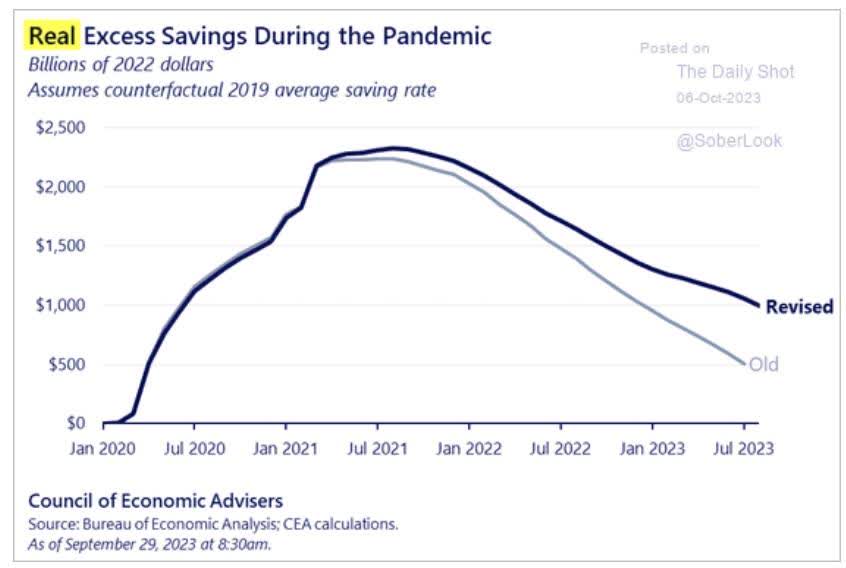

Daily Shot

The blowout data can probably be explained by the fact that Americans overall have roughly $1 trillion in actual excess savings per most recent data, revised upward significantly from the old estimate of $500 billion. However, this is well below the nearly $2.5 trillion peak in late 2021.

Real excess savings are clearly on a downward trend, but it could take a while for them to be completely depleted. That is why a recession is a strong possibility, but the timetable is uncertain. A recession could manifest sometime next year, possibly in 2025 or even later.

Semantics aside, I would advise readers to plan for the worst and hope for the best. As a dividend growth investor, the way that I plan to do this is to buy reliable income stocks at a discount and hold for the long haul.

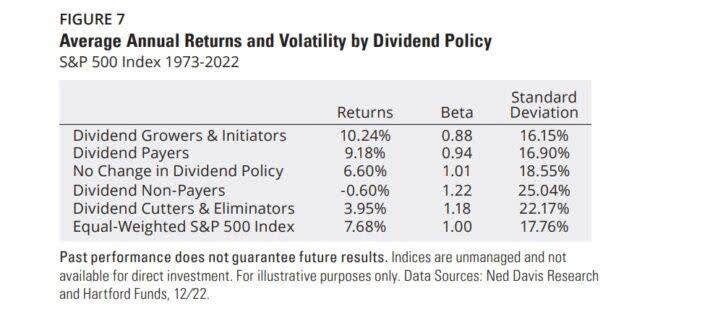

Hartford Funds

That is because over the last 50 years (e.g., an investing lifetime), dividend growth stocks have outperformed all other asset classes with less volatility to boot.

In nominal dollars, for every $1 invested in dividend growers and initiators in 1973, investor A would have had about $131 in wealth with dividends reinvested at the end of 2022. That blows the $40 out of the water that investor B would have ended up with for every dollar invested at the start of that period in the S&P 500 index.

If I weren’t actively padding my emergency fund from three months to a more comfortable six to nine months, here are three high-yielding stocks that would be at the top of my buy list right now.

Enterprise Products Partners L.P. (EPD): One Of The Most Reliable Income Stocks On The Planet

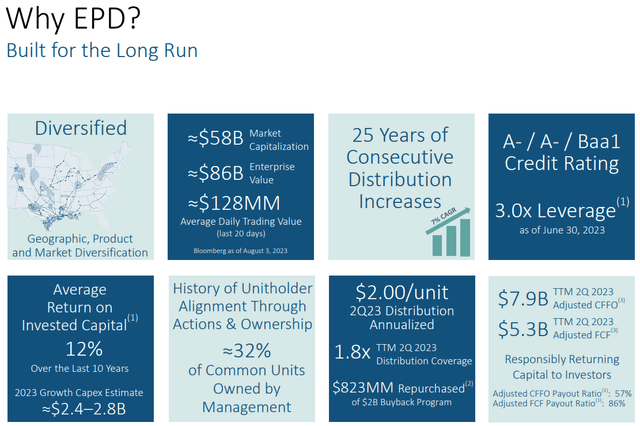

EPD August 2023 Investor Presentation

Enterprise Products Partners is arguably the most proven business in all MLPdom by just about every conceivable characteristic. Please allow me to elaborate.

Care for a management team with interests aligned with unitholders? With 32% of EPD’s outstanding common units owned by management, you can also sleep well at night knowing that management won’t intentionally screw you.

If you want size and scale, EPD has more than 50,000 miles of natural gas liquids, natural gas, refined products, petrochemicals, and crude oil pipelines.

These are also the products that the world couldn’t live without. Everybody in the world, especially in developing economies, wants a great standard of living. Since almost everything we buy or consume uses fossil fuels as an output in some way, the demand for the products that EPD transports and stores won’t just disappear in our lifetime. This is why the long-term growth consensus is a respectable 3.5% annually for EPD.

That is made more attractive when considering that for those comfortable with the tax implications of the K-1 tax form that goes along with it, EPD yields 7.2%. That more than compensates investors relative to the risk-free rate of 4.8%. This distribution is also very safe, covered 1.8 times over in the last four quarters by discounted cash flow (“DCF”). That explains why EPD recently had the confidence to increase its distribution by 2% to $0.50, which was its 25th consecutive year of doing so – – every year since its formation in 1998.

By its leverage ratio of 3 and stable operating fundamentals, EPD also boasts an A- credit rating. This puts the company at a 2.5% risk of going bankrupt in the next 30 years.

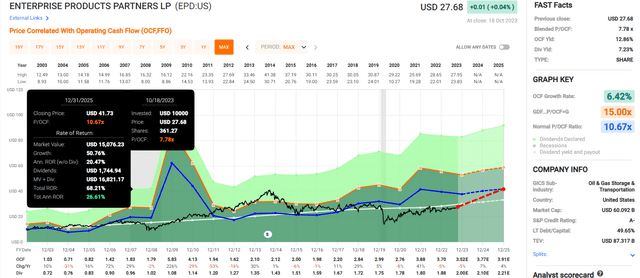

To seal the deal, EPD also trades for $28 a unit (as of October 17, 2023). That is a 23% discount versus its fair value of $36 a unit. That is why the fundamentally justified upside in total return potential for EPD is a staggering 38% for the next 12 months.

Looking out further, the stock could deliver great returns as well:

-

7.2% yield + 3.5% consensus annual growth + 2.7% annual valuation multiple expansion = 13.4% annual total returns against roughly 10% annual total returns for the S&P 500

- 252% 10-year return potential vs 160% S&P.

But it doesn’t take ten years to make impressive returns in EPD.

FAST Graphs, FactSet FAST Graphs, FactSet

Main Street Capital (MAIN): A Best-Of-Breed BDC

Main Street Capital Q2 2023 Investor Presentation

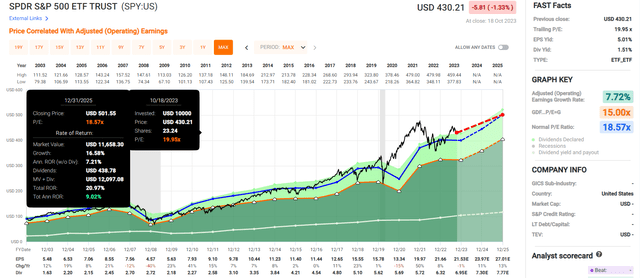

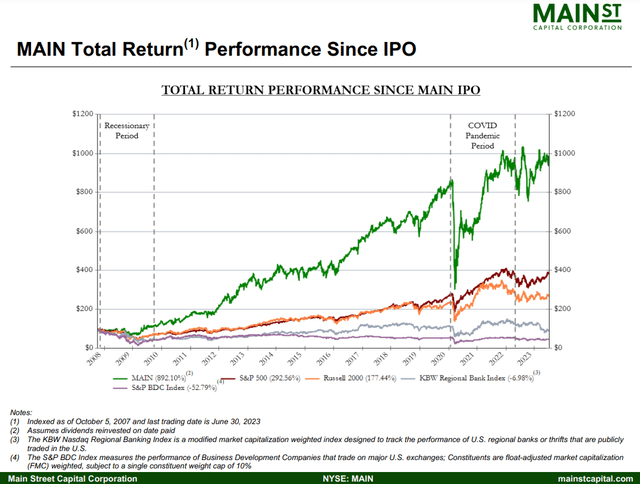

Main Street Capital stands head and shoulders above the rest in the business development company (“BDC”) world. Since its 2007 IPO, the company has delivered amazing returns to its shareholders: A mere $10,000 investment in the BDC in 2007 would have been valued at $99,000, with dividends reinvested as of June 30. That is far superior to the measly $5,000 that the same investment in the S&P BDC index would have been worth as of June 30. It even leaves the $39,000 that the S&P 500 Index (SP500) would have grown to in the dust.

As a BDC, MAIN lends to lower middle market or LMM businesses and receives equity and/or debt stakes in exchange for capital. These are commonly defined as businesses with annual revenue of $10 million and $150 million and annual EBITDA between $3 million and $20 million. These companies have had a more challenging time securing funding from banks in recent years. That explains how MAIN has grown its investment portfolio to nearly $7 billion as of June 30, including externally managed funds.

The BDC has done a great job of spreading its investments to minimize the concentration risk, with 195 investments throughout dozens of industries. Considering that the U.S. LMM industry comprises approximately 200,000 businesses, MAIN should have no problem continuing to grow for many years. That is the basis for FactSet Research’s annual growth consensus of 8% for the BDC.

Like EPD, MAIN’s management and Board of Directors have every reason to give everything they have to create value for shareholders. That is because the management team and BoD owned $140 million-plus of MAIN stock, throwing off roughly $10 million in regular dividends alone annually as of June 30. Excellent fundamentals aside, this is part of why the company’s monthly dividends per share have soared by 114% in the last 16 years.

The company also enjoys a BBB- investment-grade credit rating from S&P. That puts it at a modest 11% risk of not being around by 2053.

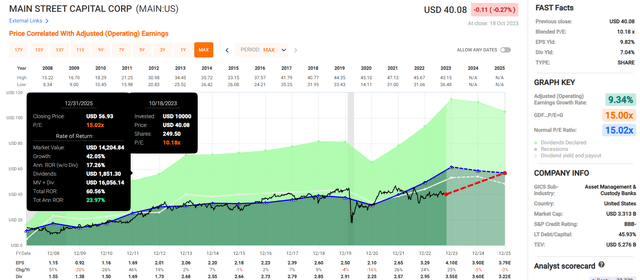

Investors can also scoop up MAIN’s 7% regular dividend yield at an enticing valuation. From the current $40 share price, the BDC looks 30% below its fair value of $57. This could translate into a blistering 51% upside total return potential in the next 12 months, supported by its fundamentals.

Over a longer time, MAIN’s annual total return potential is equally impressive:

-

7% yield + 8% annual growth + 3.6% annual valuation multiple upside = 18.6% annual total return potential.

- 451% 10-year total return potential vs. 160% S&P

FAST Graphs, FactSet FAST Graphs, FactSet

Philip Morris International Inc. (PM): The King Of Today And Tomorrow’s Tobacco Industry

PMI Q2 2023 Investor Presentation

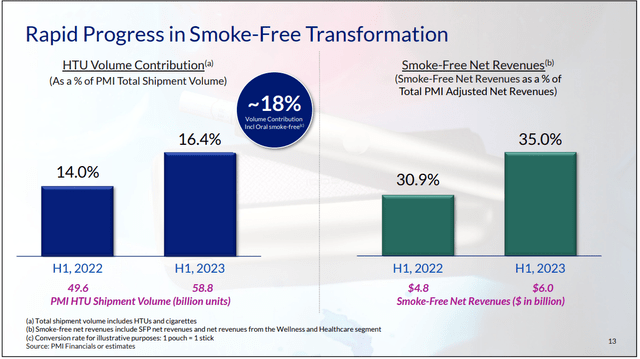

Everybody probably knows Philip Morris International best for its top-selling Marlboro brand, which is mainly responsible for its worldwide customer base of 150 million. Since most consumers desire tobacco products that are potentially less harmful than cigarettes, PM made a move to launch its heat-not-burn IQOS product in 2014. In doing so, PM has established itself as the odds-on favorite of winning the tobacco industry’s future. IQOS alone had 27.2 million users as of June 30 – – up nearly 15% over the year-ago period.

Besides IQOS, the tobacco giant owns the top nicotine pouch brand in Zyn. This product posted 50%-plus volume growth in the U.S. in the second quarter. PM derived 35% of its first-half revenue in 2023 from smoke-free products thanks to these two tremendous reduced-risk product brands. That is up meaningfully from 30.9% in the first half of 2022.

As global cigarette volumes continue to decline, PM should have exceptional growth prospects due to its best-in-class smoke-free business. Along with greater gross margins on said products than cigarettes, that is why PM’s FactSet Research earnings growth consensus is 9.1% annually.

The company also possesses an A- credit rating. Thus, its 30-year bankruptcy risk is also just 2.5%, offering superb capital preservation.

Put all these factors together, and it’s not surprising that PM’s 5.6% dividend yield is also quite secure. The company’s payout has nearly tripled since becoming a public company in 2008. This should lead to an EPS payout ratio of around 84% for 2023, which leaves a small buffer compared to the 85% rating agencies like to see from the tobacco industry.

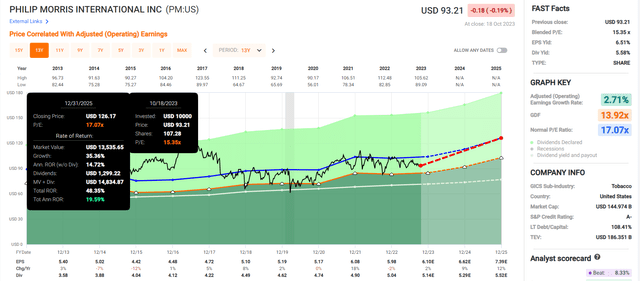

Best of all, PM’s $97 share price is trading 17% below its average fair value of $112. Along with growing earnings and its dividend, the 12-month justified upside is 27%.

Beyond the near term, PM stock offers robust total return potential:

-

5.6% yield + 9.1% annual earnings growth + 1.8% annual valuation multiple upside = 16.5% annual total return potential

- 360% 10-year total return potential vs. 160% S&P.

FAST Graphs, FactSet FAST Graphs, FactSet

Summary: Secure And Outsized Income That Can Crush The Market

Zen Research Terminal

EPD, MAIN, and PM are each remarkable businesses with investment-grade balance sheets, sustainable and generous dividends, and healthy growth potential.

Assuming steady valuation multiples, average annual total returns would be 13.5% for these three stocks. But because the stocks are collectively deeply undervalued, investors can look forward to a 2.8% boost to annual total returns over the next decade with a reversion to fair value.

This trio can deliver above-average income (6.6% yield) and 16%-plus annual total returns in the next ten years. That stacks up quite favorably to the S&P’s measly 1.6% yield and 10% annual total returns for that period. For these reasons, EPD, MAIN, and PM are no-brainer buys for income, growth, and capital appreciation.