Kativ

Risk and reward are often spoken in the same breath when it comes to investing. However, I would add that the word ‘uncertainty’ is an underappreciated word to think of when it comes to picking the right stock to buy. That’s because uncertainty and risk aren’t the same thing, and while a company can have plenty of uncertainty, it can actually be lower risk than a company with plenty of certainty due to higher valuation.

This brings me to EPR Properties (NYSE:EPR), which I last covered here back in June of last year, noting its sizable liquidity on hand and large market opportunity. The stock has seen its share of ups and downs since then, and at the current price of $47.36, is virtually unchanged since my last piece, all while giving investors a respectable 11.6% total return including dividends. In this piece, I furnish an update and converse why EPR remains attractive at present, so let’s get started.

Why EPR?

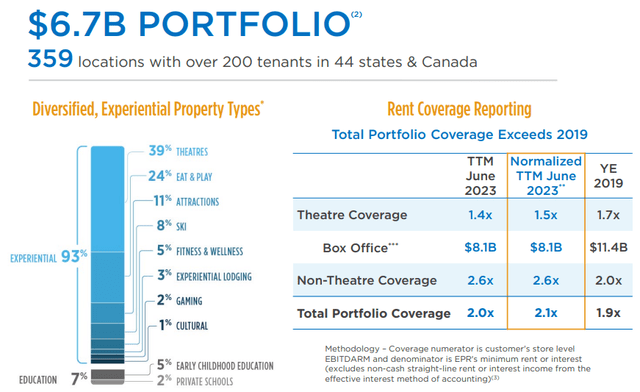

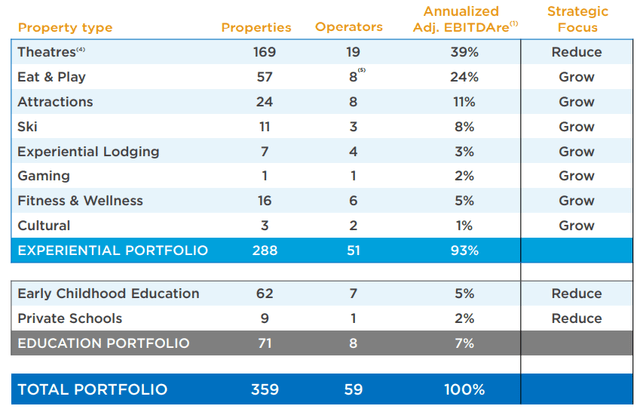

EPR Properties is the second largest REIT that’s focused on experiential real estate, behind gaming landlord VICI Properties (VICI). EPR has a $6.2 billion portfolio, of which 93% experiential and the remaining 7% are in education (5% early childhood education, 2% private schools).

One of the biggest concerns around EPR over the past 5+ years is its exposure to movie theaters, which has seen disruptions from the COVID pandemic and the growth of at-home streaming from the likes of Netflix (NFLX) and Disney+ (DIS). As shown below, the Theater segment remains relatively from a rent coverage perspective compared to where it was 4 years ago and compared to other experiential asset segments in EPR’s portfolio.

Theaters remain weak compared to where they were a decade ago, and this is reflected by the bankruptcy of Regal Cinema, one of EPR’s tenants. However, it appears that a resolution is now on the table. Of the 57 properties that were leased to Regal, 41 will now be anchored by a new master lease agreement, and these are presumed to be stronger properties with better rent coverage than the rest.

A master lease also works to EPR’s advantage, as Regal will be bound to pay rent on all properties regardless of property-level profitability. Of the remaining 16 properties, 5 are to be operated by third parties and 11 were sold off in September. Looking forward, EPR’s strategy is to reduce its exposure to theaters and education while increasing exposure to other experiential segments, as shown below.

Notably, EPR’s overall portfolio is in good shape, with 99% occupancy and rent coverage on the non-theater portion of the portfolio was at a healthy 2.6x during the third quarter. Total revenue grew by 17% YoY during Q3 and importantly, top-line results are translating to bottom line performance, with AFFO per share growing by 20%, implying a higher margin at the total company level. This represents an acceleration in growth, as EPR’s AFFO/share growth in the first nine months of the year (including Q3) was 13%.

EPR’s respectable growth in the last reported quarter and the first nine months was driven by percentage rents, in which EPR collects a percentage of tenants’ revenues on top of base rents. As many moviegoers know, the simultaneous releases of ‘Barbie’ and ‘Oppenheimer’ over the summer were a boon for movie theaters, pulling up total U.S. box office revenue by 26% YoY.

While its easy to write off movie theaters as being a ‘problem child’ for EPR properties. The reality is that many studios that have experimented with streaming have found that it simply doesn’t make financial sense to skip theaters and go direct-to-streaming. This is probably best exemplified by the following comment by David Zaslav, CEO of Warner Brothers Discovery (WBD), in a recent interview with Deadline as follows:

We believe there is a real opportunity to do things differently, to deliver the content consumers want and will pay for while getting the full value of our offering. Profitability, not purely subscriber count, is our benchmark for success.

And We learned what doesn’t work. And this is what doesn’t work for us based on everything that we’ve seen: direct-to-streaming movies. So spending a billion dollars or collapsing a motion picture window into a streaming service. The movies that we launch in theater do significantly better, and launching a 2-hour, 40-minute movie direct to streaming has done nothing for HBO Max in terms of viewership, retention or love of the service.

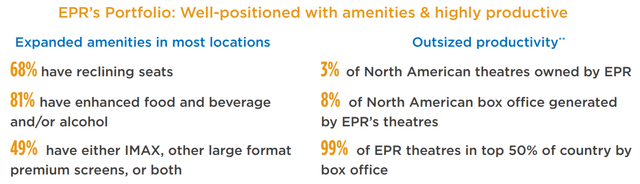

Meanwhile, EPR’s theaters offer a compelling value proposition to consumers and movie studios alike. This is considering that EPR’s theaters comprise 3% of total theaters in North America but create 8% of North American box office revenues. As shown below, a substantial portion of EPR’s theaters have modern day amenities admire reclining seats, enhanced beverage choices, and IMAX.

Meanwhile, EPR maintains a strong liquidity profile, with $137 million in cash on hand and $1.0 billion available liquidity on its revolving credit line with a zero balance at present. It also 99% unsecured debt at 100% fixed rates and has no remaining maturities this year and just $136.6 million of maturing debt next year, which it can easily handle with cash on hand. EPR also carries a safe amount of leverage with a net debt to EBITDAre ratio of 4.4x and a BBB- investment grade credit rating from S&P.

Risks to EPR include potential for low box office results in 2024 should studios falter to come up with movie blockbusters that draw audiences to theaters. Also, the potential for a recession could result in less travel to EPR’s ski and other attraction destinations. Lastly, while the Federal Reserve indicated rate cuts next year, they would still be higher than what interest rates were over the past decade, which may result in higher interest expenses down the line.

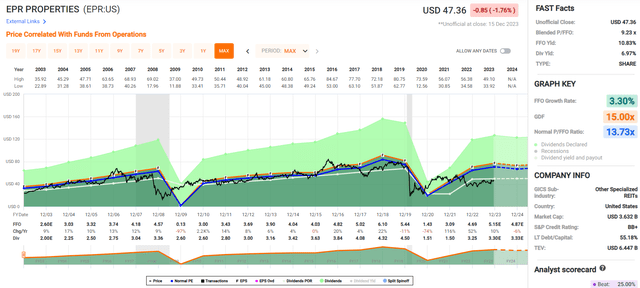

Importantly for income investors, EPR pays a monthly dividend that currently yields 7% annually. The dividend is also well-covered by a 64% payout ratio, based on full-year 2023 FFO/share of $5.16 expected by analysts. I also see value in the stock at the current price of $47.36 with a forward P/FFO of 9.2, sitting below its normal P/FFO of 13.7. While not a full apples-to-apples comparison, EPR does trade at a substantial discount to experiential REIT peer VICI Properties, which carries a forward P/FFO of 13.1 at present.

Investors searching for higher yield may want to consider the Preferred Series E stock (NYSE:EPR.PR.E), which currently yields 8.1%. It’s cumulative, which means that missed payments must be made up lest EPR goes bankrupt. However, it’s worth noting that this preferred issue trades at an 11.6% premium to the $25 par value and currently trades past its call date of 4/20/2013. Given its premium to par and the current high interest environment, it seems that the market does not believe that it will be called anytime soon, but this is a risk worth considering.

Investor Takeaway

With the common shares yielding 7%, sitting close to the 8% yield of the Preferred Series E stock, I view the common as being a better buy considering the long-term upside potential and the call risk as it relates to the preferred stock. As such, I preserve a ‘Buy’ rating on EPR stock and a ‘Hold’ rating on the Preferred Series E.