triloks

Welcome back to my weekly variety show!

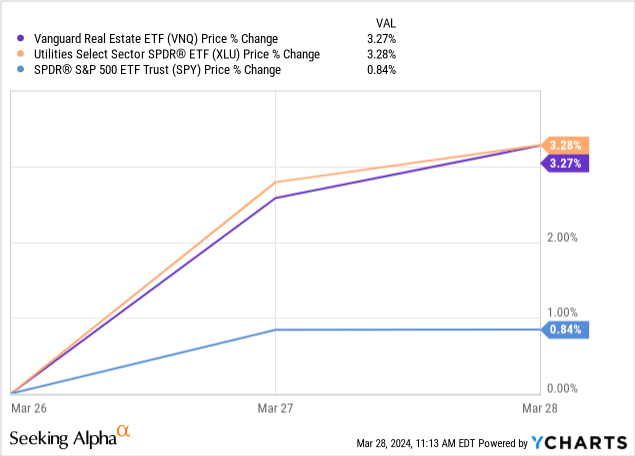

Two of my favorite sectors of the stock market are enjoying a nice rally over the last few days. Those two sectors are Real Estate (VNQ) and Utilities (XLU). (Yes, I know — REITs and utilities. I’m really popular at cocktail parties.)

This mini-rally has coincided with a drop in the 10-year Treasury rate from its recent high of 4.34% to today’s level of 4.2%.

Well-capitalized, investment grade REITs and utilities are definitely able to grow bottom-line earnings when higher interest rates are a headwind. Despite this, the market still treats these sectors as not much more than bond proxies. When rates rise, bond proxy prices fall. When rates fall, bond proxy prices rise.

Why is the market so blockheaded and lacking in nuance here?

Well, as the ever percipient Dane Bowler recently pointed out, REITs have among the highest level of passive ownership via funds like VNQ. And as Jussi Askola and I explained in “$6 Trillion In Dry Powder Waits To Fuel The Rally In REITs,” the historical pattern has been that funds flow out of REITs and into money market funds when the Fed Funds Rate is high, and the reverse happens when the FFR is low. Thus, I would expect all REITs (and utilities, to a lesser degree) to enjoy a sustained tailwind from MMF outflows in the years following Fed rate cuts.

Plus, as I showed in last week’s episode, REITs are trading at GFC levels of cheapness relative to the broader market and are arguably the cheapest sector of the market. (You’ll have to read that article to see the charts.)

Another Echo of the Dot Com Bubble Era

In last week’s article linked above, I continued the discussion of today versus the Dot Com bubble era of 1999-2000, including similarities and differences.

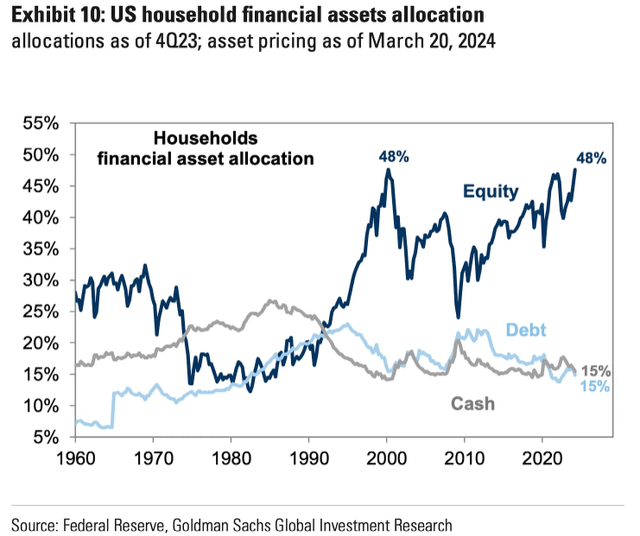

Here’s another similarity: households financial asset allocation to equities is the same today as it was in 2000.

Since the mid-1990s, allocations of 35-40% are normal. Less than that usually coincides with a crash or bear market. More than that is usually associated with periods of market euphoria.

Periods of euphoria have similar characteristics but are also unique. Different forces and circumstances drive the euphoria, but the investor reactions in each euphoric period are similar. The euphoria always has a pretty compelling driver.

- 2000: Internet revolution

- 2017: Bitcoin/crypto

- 2021: Pandemic + stimmy checks + lockdowns

- 2023-2024: AI revolution

First, the big boys and hedge funds go heavy into a set of red-hot stocks.

Second, a wave of information washes across the media about the thing driving the growth/euphoria.

Third, regular investors gradually buy into the story and get exposure due to FOMO.

Fourth and finally, people who normally display no interest whatsoever in investing become ecstatic about it and can’t stop proselytizing it.

We’re in Stage 4 Euphoria right now about AI. Everyone is talking about it. Companies that have nothing to do with AI are mentioning it on their conference calls. Like the fabled taxi driver asking passengers about their favorite Internet stocks, I’ve encountered plenty of people who otherwise pay no attention to investing trends talking about AI. Google search trends for “AI” have soared since ChatGPT was released in late 2022.

That does not necessarily mean that all AI stocks are overvalued or poised for poor performance going forward.

It also does not mean the hype cycle is almost over. I don’t know how much longer it will last. I can’t predict that. No one can.

I’m simply observing that the current hype cycle around AI is rhyming with past hype cycles.

Bullish On Energy… All Energy

I’ve expressed my optimism about renewable energy in articles like this one, which explains that renewables remain fundamentally strong even though higher capital costs are acting as a headwind right now.

The comments are a poignant reminder that election year political polarization has taken effect. Renewables are one of those political footballs that cause each side to retreat to their corners and reflexively attack or defend them depending on their politics.

But as I have always maintained, you don’t have to be a left-winger to believe in the investment thesis for renewables, and you don’t have to be a right-winger to believe in the investment thesis for fossil fuels.

Let me show you a few charts.

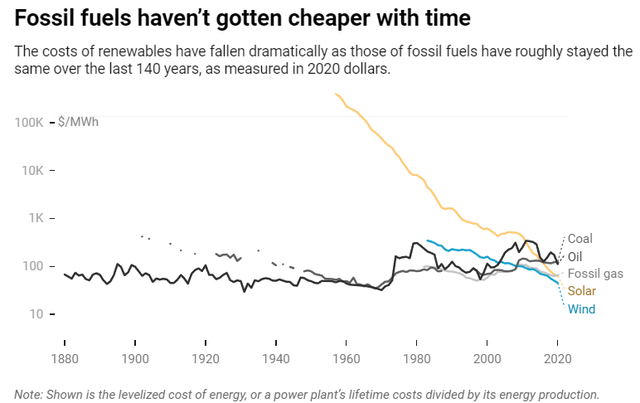

The costs of generating electric power from renewable sources, especially solar, have absolutely plummeted over the last several decades.

Meanwhile, the costs of generating power from fossil fuels in 2020 dollars are basically flat.

One can simultaneously recognize that the falling costs of and lack of pollution from renewables has value and also that the dispatchability and abundance (in the US) of fossil fuels has value.

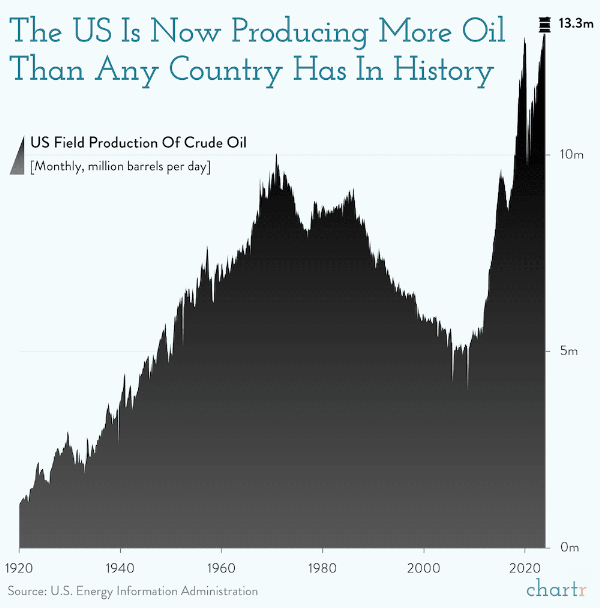

Speaking of abundant fossil fuels, note that the US is now pulling record amounts of oil out of the ground — more than any country ever has in history.

Chartr

It’s okay (and, dare I say, rational) to be bullish on all forms of energy — not just renewables, and not just fossil fuels. Coal is a notable exception, because it doesn’t seem to have a bright future, but demand for everything else looks like it will be strong as far as the eye can see into the future.

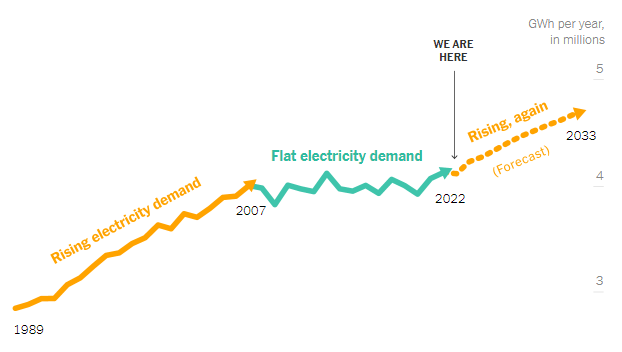

AI and data centers, electric vehicles, US manufacturing, and population growth make it highly likely that electricity demand will steady rise in the coming decades.

New York Times

The proverbial “pie” is growing. Both renewables and fossil fuels can (and probably will) win in the world of tomorrow.

Power Producers Riding The AI Wave

Not only is the pie growing, we will likely soon suffer an electricity shortage as power-hungry data centers fueling the AI revolution create more demand than supply can deliver. Elon Musk recently predicted that in a year or so, “you will see that they just can’t find enough electricity to run all the chips.”

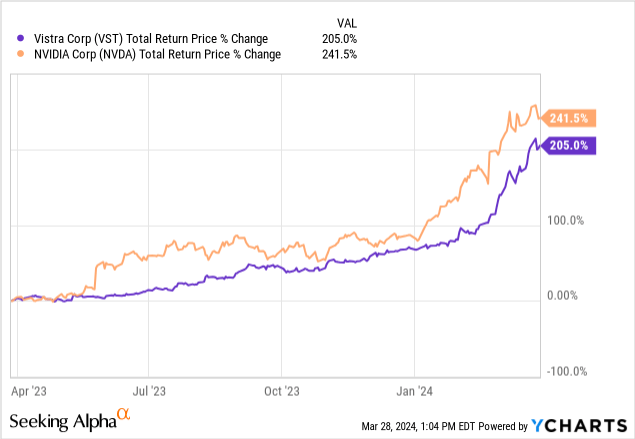

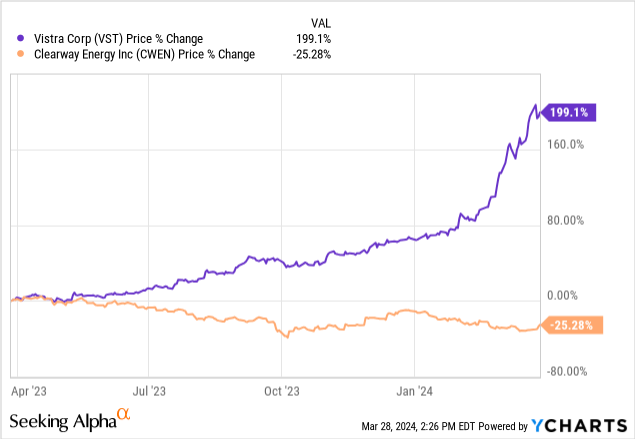

That’s why an independent power producer like Vistra Corp (VST) that owns unregulated power generation facilities is trading like an AI stock itself.

VST’s gas, nuclear, and battery storage facilities sell electricity at spot prices, and demand from data centers gives VST upside from both volume and price — more electricity sold at higher prices.

Theoretically, the more chips Nvidia (NVDA) sells, the more power will have to be generated by the likes of VST.

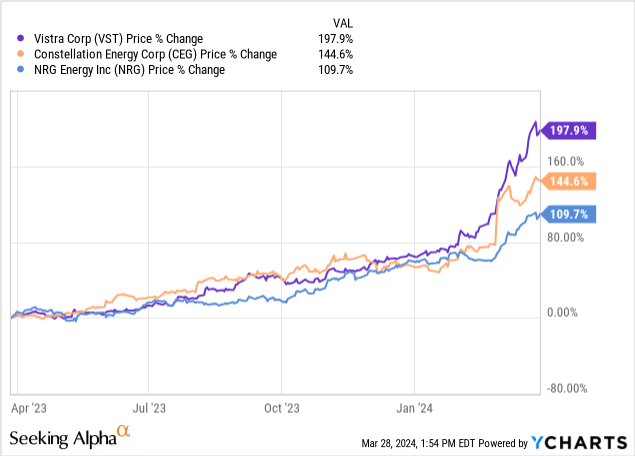

The same goes for fellow independent power producers Constellation Energy (CEG) and NRG Energy (NRG), but the market seems to believe VST is best positioned to benefit from AI-fueled power demand.

I missed the boat on VST. I sold my large position in it about a year ago at prices between $25 and $30. I’ve been kicking myself ever since, not just because the price has soared since then, but more so because I violated one of my own rules by selling it.

I have a rule to never sell shares in a high-quality business just because they have appreciated in price. Even if the stock looks overvalued, that’s the market’s problem, not mine.

I foolishly looked at VST, a non-investment grade company, as low cost source of funds (sub-3% dividend yield) with which to reinvest in higher-yielding, investment grade companies. I didn’t understand why VST was rising, so I sold it and asked questions later. The market seemed to be getting it, or at least was starting to.

This leads to the creation of another rule:

When a high-quality stock is rising rapidly in price and you don’t know why, figure out what the market sees before you even *think* about selling.

If I had this rule in mind last year, I’d still own VST and would be annoying everyone willing to listen with my boasting about it.

I hope that if I rub my own nose in this mistake enough, I won’t make it again.

On the other side of the spectrum, consider that 1/3rd of Clearway Energy Inc.’s (CWEN, CWEN.A) cash flows are generated by unregulated conventional (gas-fired) power plants in California and Connecticut. The PPA contracts start to expire as early as 2026, opening the possibility of re-contracting the power produced by these facilities at better pricing.

And yet CWEN has enjoyed none of the favor that VST has:

Truthfully, I don’t know if CWEN will be able to take advantage of the swell in electricity demand with better pricing and utilization of its gas-fired plants.

But I also don’t know if VST will benefit from AI as much as the market is currently pricing in.

Whether or not the rally in VST is overdone, I do think the selloff in CWEN is overdone, which is why I’m buying more.

6 Stocks I’m Buying This Week

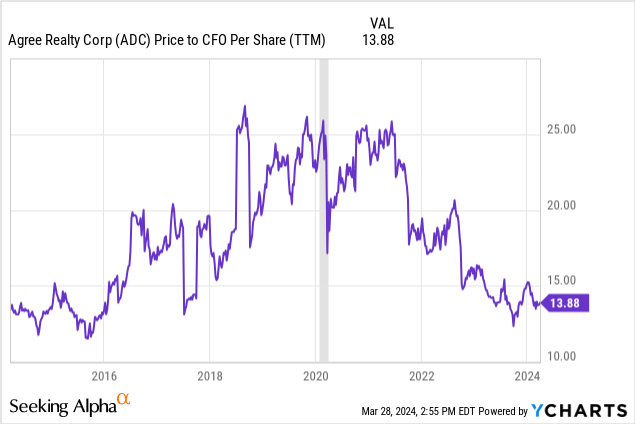

1. Agree Realty (ADC)

I pitched ADC last week, and all of that pitch obviously still applies, so I’ll focus on some things I did not in last week’s article.

First, ADC is cheap. By both price to AFFO and price to operating cash flow, ADC hasn’t been this cheap since about 2015.

In late 2015 and 2016, ADC’s valuation took a meaningful step up as the market came to realize the quality of its portfolio, balance sheet, and investment philosophy. That quality persists today.

Second, the quality and foresight of ADC’s investment philosophy is an important point to which the market ascribes seemingly no value today. This is a mistake.

ADC’s focus on high-quality and industry-leading retailers has led it to identify trends as they are beginning to unfold rather than after everybody already knows about them. This forethought led ADC to reduce exposure to Walgreens (WBA) from 30% in 2012 to 1% in 2023 while simultaneously growing exposure to leading retailers like Tractor Supply (TSCO), TJ Maxx (TJX), and Sunbelt Rentals over the last decade.

ADC also pioneered the use of forward equity offerings that help to smooth out the REIT’s cost of capital rather than relying solely on the fluctuations of the stock price.

Third, perhaps the most difficult characteristic of a company to quantify and value is the quality of management. But the skill, foresight, and passion of top management does have value — perhaps not in the short-term, but definitely in the long run. Passion goes a long way in minimizing downside while maximizing upside.

Joey Agree, the second generation Agree to lead the eponymous company, has done just that, turning ADC into a consistent compounding machine.

2. American Tower (AMT)

I opened a position in AMT this past week, and I plan to buy more in the first week of April.

I recently trimmed my large position in Crown Castle (CCI), because I fear the change in CEO, strategic review of the fiber segment, and lack of full dividend coverage (based on FCF) this year makes a dividend cut likely.

Unfortunately, though CCI’s small cell investments had promise, they simply did not deliver the kinds of returns I (or management) thought they would. It turns out that small cells have virtually no moat. They’re relatively easy to build, so adding multiple tenants onto these assets isn’t happening as much or as quickly as was initially thought. The entire thesis behind such a heavy investment in small cells was that they’d eventually stack multiple tenants onto each asset and generate tower-like yields on invested capital. That simply hasn’t happened.

AMT never invested heavily in small cells. They recognized all along that the economics weren’t that good. Instead, they invested in towers outside the US in both developed and emerging markets. And in late 2021, AMT acquired data center REIT CoreSite, which broadens the spectrum of AMT’s investment opportunities.

AMT’s superior capital allocation track record, cost of capital, and range of assets make it the vastly better REIT than CCI for long-term buy-and-hold investors, in my opinion.

CCI’s tower assets are great, but its impaired cost of capital will make accretive growth difficult going forward. That makes AMT the much more reliable compounder.

AMT’s 19x AFFO multiple is about 25% higher than CCI’s 15.2x multiple, but I would argue that the fundamental value of AMT is more than 25% greater than CCI’s, which makes it the better buy today.

3. Clearway Energy Inc. (CWEN, CWEN.A)

I already mentioned CWEN both last week and above, so I’ll make this part brief.

CWEN is much better positioned than the market is giving it credit for. Almost 100% (99% to be exact) of debt has effectively fixed interest rates. No unsecured corporate debt matures until 2028, and the secured, project-level debt is all fully self-amortizing over the lifespan of the asset.

And like I said above, CWEN enjoys the strength of having a handful of gas-fired power plants in its portfolio. The value of these gas plants is surely increasing in the age of AI. Plus, its sponsor’s ability to develop paired solar/storage facilities makes it a contender to become a provider of dedicated power generation for data centers.

CWEN.A yields 7.5% as of this writing.

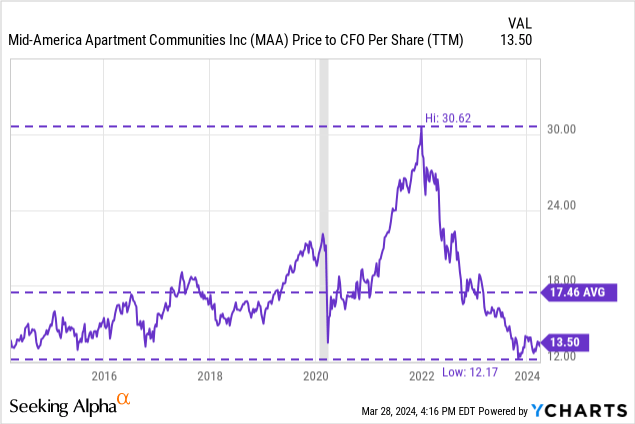

4. Mid-America Apartment Communities (MAA)

Like other REITs, MAA is the cheapest it has been in a long time. In fact, MAA is near its cheapest valuation since the GFC era:

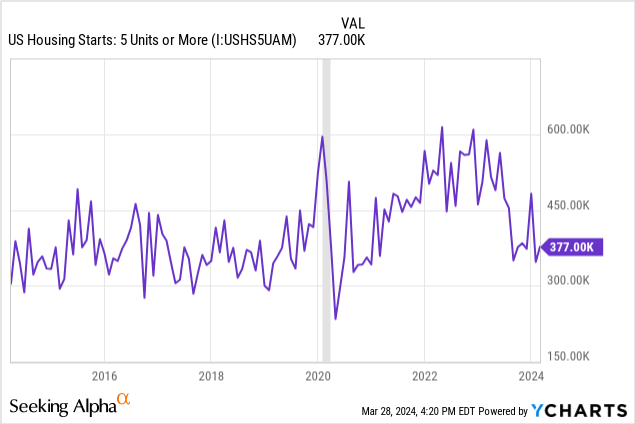

The market seems very short-sighted by pricing MAA this cheap. Yes, there is a substantial wave of supply hitting MAA’s Sunbelt markets right now. That will cause rents to be flat to slightly down this year as the new supply gets absorbed.

But construction starts for apartments have collapsed back down to around the midpoint of the 2010s range, falling even further in many oversupplied Sunbelt markets.

But the Sunbelt is still projected to capture the most population and job growth in the coming years.

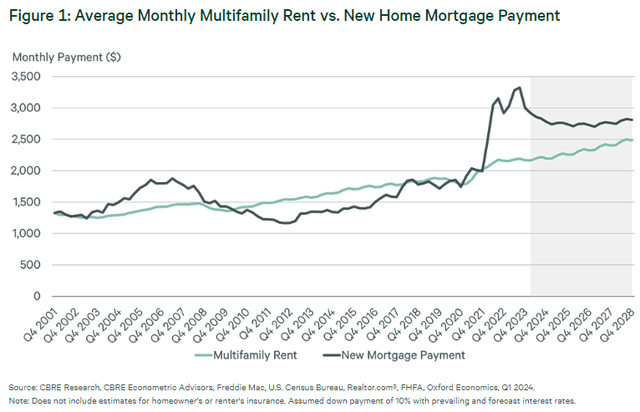

Plus, even assuming steady rent growth, the monthly cost of homebuying with a mortgage is projected to remain higher than the cost of renting through at least 2028.

That should severely limit the number of apartment move-outs for homebuying over the next several years, which also benefits MAA, because the REIT should still be able to bump up rent rates for lease renewals.

In the meantime, MAA’s best-in-class balance sheet, A- credit rating, and net debt to EBITDA ratio of 3.6x positions the REIT very well to pounce on attractive deals that will likely come available over the next year or so.

5. Rexford Industrial (REXR)

REXR was on my buy list last week as well, so I’ll be brief.

Lots of investment theses are based on projections, but projections can be (and often are) overly optimistic. You don’t have to make projections with REXR. Just look at its track record.

Its average annual NOI growth of 32% over the last five years is roughly double the 17% of its peer average. Likewise, its 5-year average annual dividend growth of 18% is 80% higher than the peer average of 10%.

Over the next three years, REXR expects its NOI growth to average 14% per year — slower than the past, perhaps, but still impressive.

Even better, in the last week of March, REXR raised $1 billion of exchangeable notes at a weighted average interest rate of 4.25%, but it wasn’t immediately obvious for what. Then, on Thursday afternoon, REXR announced the acquisition of $1 billion of infill industrial properties in Southern California from Blackstone (BX) for an initial cash yield of 4.7%. Even better, REXR expects the stabilized yield to rise to 5.6%.

I like the deal. The initial yield isn’t quite as high as I’d like, but there is clearly some embedded upside to NOI in it.

6. Essential Utilities (WTRG)

The former Aqua America is primarily a water utility that also became a gas utility in 2020 with a transformative acquisition that led it to become “Essential Utilities.”

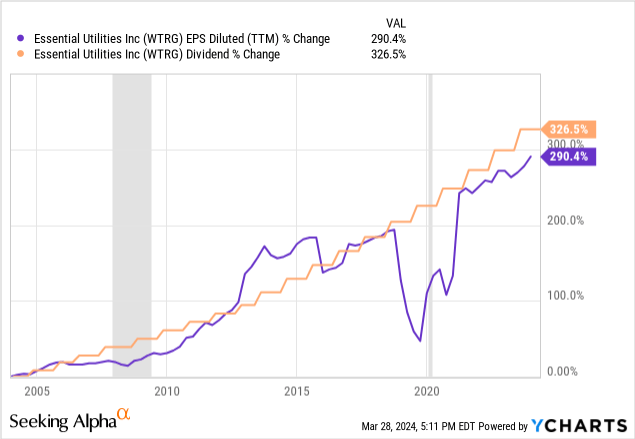

Regulated water and gas utilities provide a steady, reliable level of organic growth, and WTRG supplements that with acquisitions of local water utilities across the country. This simple formula has led to remarkably stable and repeatable returns over the last few decades:

That 7% annual dividend growth per year is like clockwork. The dividend has been raised every year for the past 32 years, and I don’t see that record ceasing to grow anytime soon.

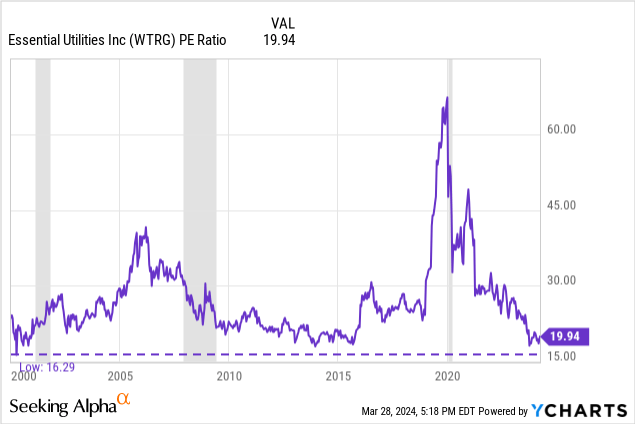

WTRG is currently valued near its lowest level in decades.

That also means its 3.3% dividend yield is near its highest level in decades.

It may be boring to many, but I like the stability and reliability of the annual dividend growth on top of WTRG’s respectable 3.2% yield.