Warren Buffett is known for his long-term investing style. Today, Legendary investor — nicknamed the Oracle of Omaha — holds dozens of stocks via his holding company, Berkshire Hathaway.

I’ve gone through Berkshire’s many holdings to determine what makes a stock worth holding forever. After all, forever is a long time! It turns out, though, that there are some clues. For instance, Buffett often tends to favor consumer stocks. You’ll notice that they all:

- Grow for decades (even if they occasionally hit setbacks).

- Sell things consumers buy repeatedly.

- Have colossal market opportunities.

Here are five Buffett stocks you can buy and hold without losing sleep.

1. Apple

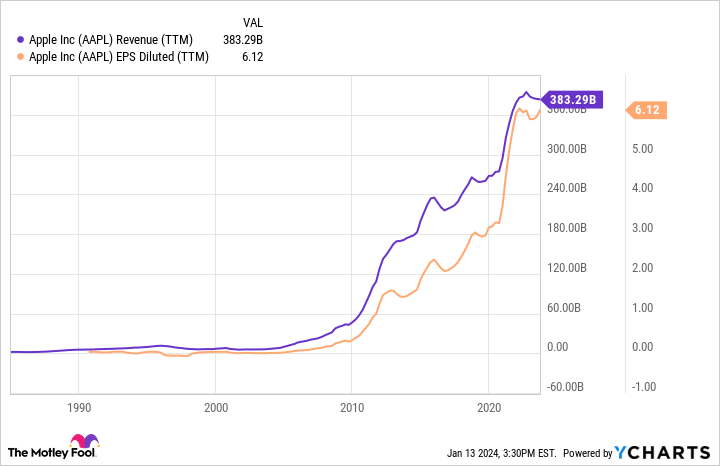

Naturally, Berkshire’s largest holding kicks this list off. Apple (AAPL -1.23%) is 47% of the portfolio. It didn’t start that way, but Apple’s strong performance since 2016 (when Buffett bought) made it that way, and Buffett has held the shares throughout all the success. The iPhone maker is arguably the world’s most prominent company today. Over 2 billion people use iOS devices worldwide.

AAPL Revenue (TTM) data by YCharts

That customer base creates tremendous, though sometimes lumpy, revenue and profits as consumers buy new phones or devices and subscribe to various services, like Apple Music, Cloud, and more. Consumers do so much on their phones that it gives Apple additional growth opportunities in new categories like artificial intelligence, telehealth, and fintech in the future.

2. Amazon

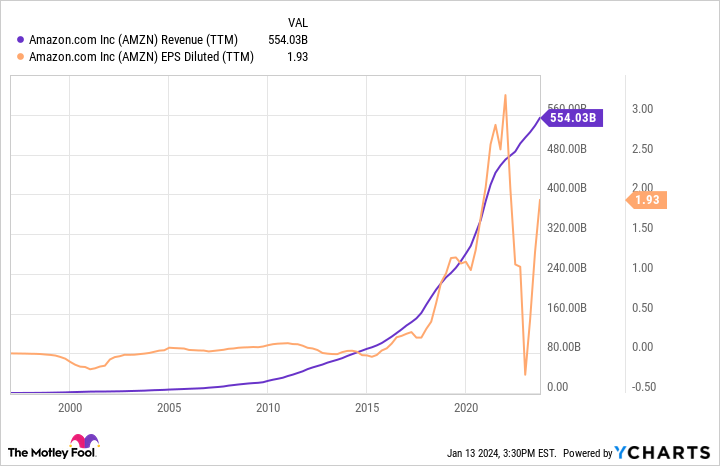

Buffett isn’t always in stocks as early as he should be. After all, nobody is perfect. E-commerce giant Amazon (AMZN -0.94%) is an example of Buffett missing the early upside in a big winner. He bought his first shares in 2019, a position that’s just 0.4% of Berkshire’s holdings.

However, there is still a lot to be excited about with Amazon. It’s the dominant e-commerce business in America, holding a 38% market share. It’s also the world’s leading cloud platform, with 32% of that industry.

AMZN Revenue (TTM) data by YCharts

Not only are e-commerce and cloud computing big markets that can still expand for years, but Amazon is actively setting up new growth opportunities, a mindset instilled by founder Jeff Bezos. Amazon is jumping into media and advertising with both feet. Its Prime membership has over 200 million members and broadcasts entertainment content and live sports via the National Football League on Prime Video. So many irons in the fire make future growth highly likely.

3. Coca-Cola

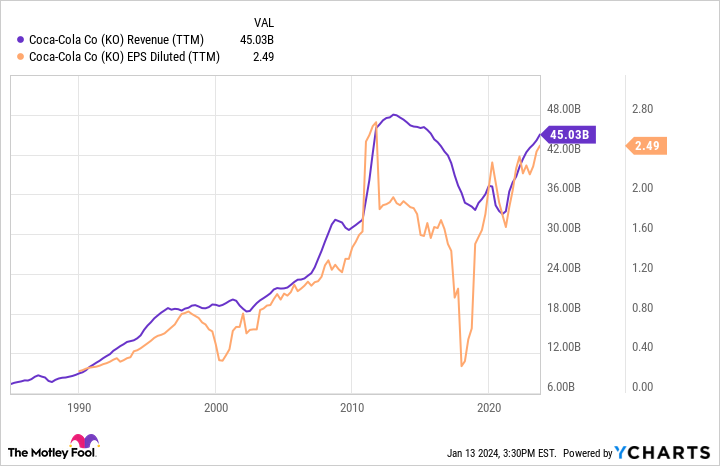

Beverage giant Coca-Cola (KO -0.66%) needs little introduction. It’s one of the world’s most widely recognized brands and has been a core holding in Berkshire’s portfolio since the late 1980s. Today, the stock is Berkshire’s fourth-largest holding at 6.7%. It’s also a testament to dividend stocks. Berkshire receives a whopping $736 million in dividends from Coca-Cola each year.

KO Revenue (TTM) data by YCharts

Coca-Cola isn’t a growth stock, but the business is growing. It’s a simple recipe. Take a product portfolio with hundreds of beverage brands sold in virtually every country on Earth. Coca-Cola’s products are in stores, vending machines, restaurants — virtually everywhere they can be.

Factor in slow population growth, new product launches and acquisitions, and price increases, and you get decades of growth and investment returns. It’s as simple as that.

4. Diageo

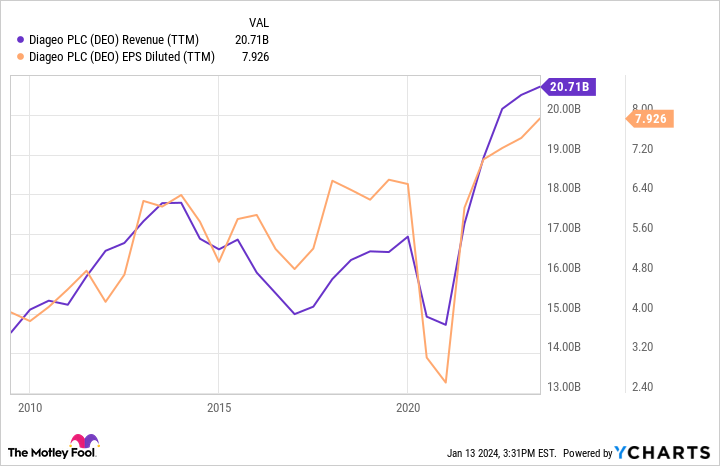

Sticking with the beverage industry, Buffett also went to the other side of the aisle, to the alcohol business. Diageo (DEO -0.96%) is a conglomerate that owns several household alcohol brands, including Guinness, Johnnie Walker, Captain Morgan, Baileys, Smirnoff, and more. In all, Diageo is doing over $20 billion in annual sales.

Alcohol falls into a category often called sin stocks. It’s not good for you, but people have been drinking to alleviate stress and have a good time for thousands of years.

DEO Revenue (TTM) data by YCharts

It’s not a massive investment by Buffett’s standards. Berkshire allocates just $32 million to Diageo stock, making it a rounding error in Berkshire’s portfolio. But if you’re looking for a company that’s as certain to be around in 100 years as any, Diageo is an outstanding stock to take a look at today.

5. American Express

Lastly, Buffett has benefited from how much Americans love spending money. Credit card company American Express (AXP -0.59%) has resided in Berkshire’s portfolio since the early 1990s, and it’s grown to 7.6%, the portfolio’s third-largest holding. Credit cards are a bedrock in consumers’ household finances. Credit card debt across America totals more than $1 trillion today.

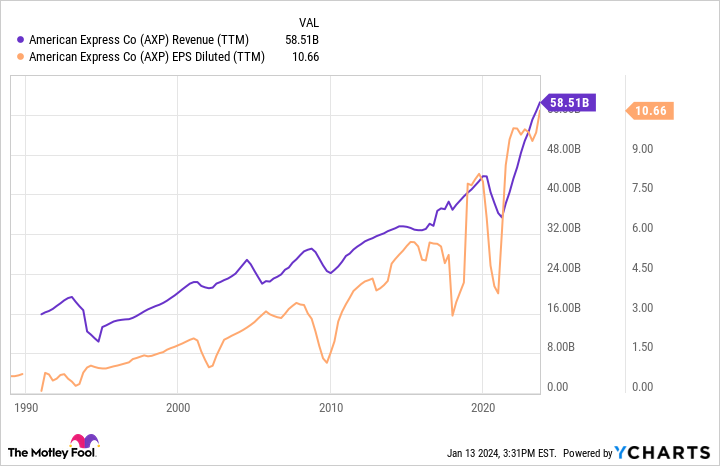

AXP Revenue (TTM) data by YCharts

That will not change anytime soon, and American Express should remain a household brand name. During recent earnings calls, the company’s management noted that younger generations, like Millennials and Gen Z, are its fastest-growing demographic. As these consumers mature and become the primary spenders in the economy, American Express should continue delivering for shareholders.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. American Express is an advertising partner of The Ascent, a Motley Fool company. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Berkshire Hathaway. The Motley Fool recommends Diageo Plc and recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.