Turning the calendar to a new year marks the perfect time for investors to reflect on where their portfolio has been and where they want it to go. Investors who regularly contribute new deposits into their investment accounts are likely on the lookout for quality companies they can count on to deliver in 2024 and beyond.

Sometimes, the best opportunities are hiding in plain sight. And other times, the stocks that were out of favor can reach a valuation that is too cheap to ignore. Here’s why Netflix (NFLX -0.13%), International Business Machines (IBM -1.06%), Brookfield Infrastructure (BIPC 0.14%) (BIP -0.46%), Vertex Pharmaceuticals (VRTX 0.08%), and Starbucks (SBUX -0.60%) stand out as five top stocks to buy this month.

Image source: Getty Images.

1. Netflix: Tune into this stock

Demitri Kalogeropoulos (Netflix): Netflix investors had a good 2023, but the next year could be even better for shareholders. That’s because the streaming video giant is on track to return to double-digit sales growth in the fourth quarter, likely marking a third consecutive quarter of accelerating sales gains.

Netflix will announce its Q4 results on Jan. 23, and most Wall Street pros expect good news in that report. Management in mid-October forecast an 11% sales increase to $8.6 billion. Look for this figure to be lifted by a rising global membership base and steadily increasing average spending.

Wall Street is excited about the new advertising business that should grow into a significant revenue stream over time. That offering has quickly made Netflix’s pricing more competitive with rivals as well. It also helps that competitors like Walt Disney have also been hiking their membership fees. With streaming companies focused on profitability in 2024, Netflix has a clear edge as the industry’s biggest player.

I’ll be watching financial metrics like cash flow and operating profit margin in late January. Both metrics are trending higher and executives hiked their short-term forecasts following Netflix’s strong third-quarter report. Shareholders stand to see improving returns if operating profit margin continues marching toward 20% of sales even as the company generates ample cash flow heading into 2024.

2. IBM belongs on the AI bandwagon

Anders Bylund (IBM): Artificial intelligence (AI) has been the water cooler talk of choice among investors for more than a year now. Many AI experts have seen their share prices soar as investors seek the best investment ideas in this red-hot sector.

But somehow, IBM has missed the train so far.

Big Blue’s stock has only gained 14% over the last year. That return trails AI darlings Nvidia‘s triple and C3.ai‘s double by a long shot, of course. But IBM also lagged behind broad market indexes as the tech-heavy Nasdaq Composite rose by 50% and the more generic S&P 500 tracker added 23% over the same period.

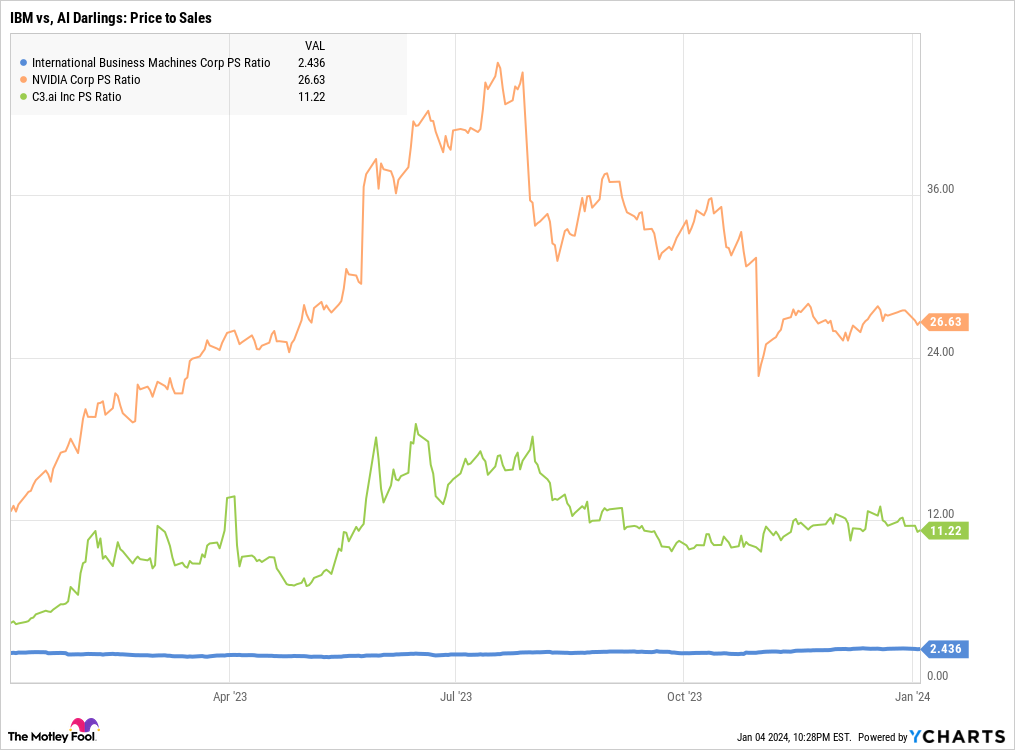

IBM’s stock carries a price tag with a deep-discount valuation of 21 times earnings, 12 times free cash flows, and 2.4 times sales. Meanwhile, the likes of Nvidia and C3.ai soared to nosebleed-inducing valuations. For example, here’s how these three AI experts compared in terms of price-to-sales ratios over the last year. IBM is the flat blue line at the bottom:

IBM PS Ratio data by YCharts

Why am I so offended by IBM’s low valuation and modest price gains in the AI era? Well, this company started doubling down on what it calls “strategic imperatives” more than a decade ago, shedding slow and unprofitable operations in order to focus on a handful of key markets.

AI was always one of these target sectors.

And IBM has been researching and commercializing AI technologies for many decades. Remember when the first chess computer beat the human world champion? That was IBM’s Deep Blue system, making history against Garry Kasparov in 1997. This company has been making consumer-facing history in AI for a long, long time.

Yes, the AI sector is teeming with prospective winners. However, very few of them come with bargain-bin stock prices and generous dividend policies. IBM comes with both of these advantages, alongside an unmatched history of AI excellence.

I can’t wait to see IBM’s Watson.AI platform for business-oriented AI services making a name for itself as the AI mania evolves. And if you buy shares at this modest price level, that savvy investment should serve you well in the long run.

3. Brookfield Infrastructure: Start your year with this rock-solid dividend stock

Neha Chamaria (Brookfield Infrastructure): Brookfield Infrastructure owns and operates a diversified portfolio of infrastructure assets across utilities, transportation like rail and toll roads, midstream energy, and data infrastructure. There’s one common link between all — they’re the kind of assets that are essential to an economy and are, therefore, fairly insulated from economic downturns. Also, that means the bulk of these assets — almost 90% — generate income for Brookfield Infrastructure under long-term or regulated contracts. That alone offers a lot of stability to the company.

It makes sense to expect shares of a company with such a rock-solid business profile to rise steadily over time. 2024 could be one such year for Brookfield Infrastructure stock, especially after its dud performance in 2023 when fears of rising interest rates weighing on the company’s growth plans gripped the markets.

Brookfield Infrastructure, however, has displayed great resilience so far, having grown its funds from operations (FFO) per unit by 8.5% year over year during the nine months that ended Sept. 30, 2023, driven by higher tariffs and investments of more than $1 billion. A notable acquisition includes that of global intermodal shipping company Triton International for $1.2 billion.

What this essentially means is that Brookfield Infrastructure is stepping into 2024 with a strong cash-flow profile and should be able to meet its annual dividend growth goal of 5% to 9%. Put another way, you can expect a dividend raise of at least 5% from Brookfield Infrastructure stock this year while you enjoy a high dividend yield of 4.5% or more whether you buy units of the partnership or corporate shares. It’s a lucrative deal, and with the Federal Reserve also expected to cut interest rates this year, I’d pick Brookfield Infrastructure as a top stock to buy now.

4. Vertex Pharma: Starting the new year off with more than one bang

Keith Speights (Vertex Pharmaceuticals): Like many stocks, Vertex Pharmaceuticals is coming off a great performance in 2023. Shares of the big biotech soared nearly 41%. I think that Vertex is in store for another strong year in 2024 — and probably a solid performance in January.

The company is starting the new year off with more than one bang. Vertex expects to announce results in early 2024 from six late-stage clinical studies. Three of them focus on its vanzacaftor triple-drug combo targeting cystic fibrosis (CF). The other three studies are for VX-548 in treating acute pain. I expect good news on all fronts.

Vertex knows CF inside and out. It markets the only therapies approved to treat the underlying cause of the rare genetic disease. I predict that the vanzacaftor triple will be the company’s biggest CF success so far. The therapy requires only once-daily dosing compared to twice-daily dosing for Vertex’s top-selling CF drug Trikafta. Vertex will also have much lower royalty payments for the vanzacaftor triple, assuming it wins regulatory approval.

The company reported highly encouraging results in December from a phase 2 study of VX-548 in treating painful diabetic peripheral neuropathy. That could bode well for the upcoming late-stage results of the non-opioid drug in treating acute pain.

Vertex should have more positive news on the way later in the first quarter. The U.S. Food and Drug Administration (FDA) set a PDUFA date of March 30 to make an approval decision on Casgevy in treating transfusion-dependent beta thalassemia. A thumbs-up seems likely considering that the FDA approved the gene-editing therapy for treating sickle cell disease in December.

No stock is guaranteed winner. However, I think that few stocks are in a better position than Vertex to deliver market-beating gains in 2024 and over the next several years.

5. Starbucks is entering a new stage of growth

Daniel Foelber (Starbucks): Over the last three years, Starbucks stock is down over 9% compared to a 26.7% gain in the S&P 500. I think a big reason for that underperformance is due to setbacks from the COVID-19 pandemic and a refusal by the market to accept that Starbucks is entering a new period of transformational growth. Underappreciated and out of favor, Starbucks has the perfect setup for 2024. And I think the stock looks like a steal at the current price of around $94 a share.

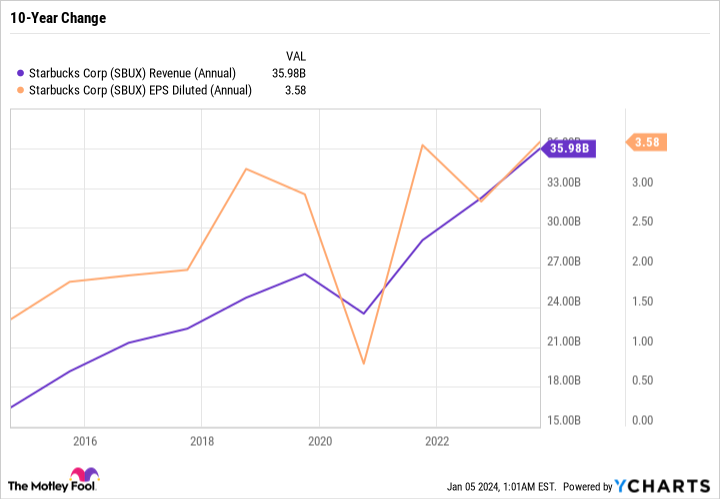

Starbucks quietly put up a monster fiscal 2023 — including record revenue and earnings.

SBUX Revenue (Annual) data by YCharts

The coffee kingpin is guiding for 10% to 12% revenue growth in fiscal 2024 and 15% to 20% earnings growth thanks to margin expansions. Yet there seems to be little confidence that Starbucks can actually hit these targets given the stock gave up many of its initial post-earnings gains and is hovering within 5% of a 52-week low.

Starbucks’ growth used to mainly depend on opening more stores. But today, the company’s growth plan is far more sophisticated. Digital engagement through the Starbucks app, which works hand in hand with mobile order and pay and the Starbucks Rewards program are driving same-store growth and encouraging more frequent visits and higher sales per transaction both domestically and internationally. In Q4 of fiscal 2023, 90-day active U.S. rewards members reached 33 million and over 21 million in China.

What’s interesting about this stat is that Starbucks has 16,352 U.S. stores and 6,806 stores in China. So as a ratio of stores to rewards members, China has 3,085 rewards members per store while the U.S. has just 2,018 rewards members per store — which goes to show that Starbucks’ emphasis on its loyalty program and digital offerings could prove more successful in China despite the brand being much more established in the U.S.

This trend bodes well in the long term, as Starbucks is investing heavily in China with plans to boost the store count by 13% in fiscal 2024 alone. I’d be curious to see if China can continue growing rewards members at a faster rate than the U.S. in the years to come.

Starbucks is leaning big into the pickup concept, focusing on stores with drive-thrus and pickup locations, reducing store footprint, and abandoning the traditional coffee house model in urban areas. It’s a strategy that focuses on convenience rather than atmosphere, which bodes well for Starbucks’ growth while differentiating it from smaller, often cooler coffee houses.

Overall, Starbucks stands out as a stock that has languished for too long. And once the market wakes up to Starbucks’ master plan, the stock could soar. In the meantime, investors can collect a 2.5% dividend yield from simply holding the stock.