peshkov/iStock via Getty Images

Today, REITs (VNQ) present a rare opportunity to buy great companies at heavily discounted prices.

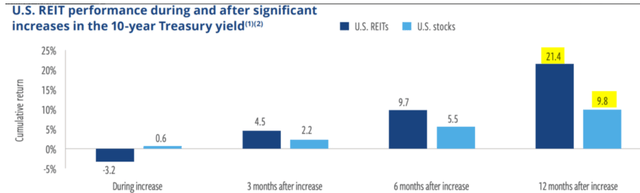

Not only that, but numerous studies have shown that REITs tend to outperform in a high interest environment, returning on average twice as much as regular stocks (SPY) over a 12-month period following peak interest rates.

Our thesis is that the Fed is close to the end of its hiking cycle. We believe this is the case because inflation has already come down to about 3%. Using real-time data for shelter inflation, we estimate that inflation is already deeply below the Fed’s 2% target.

At the same time, the yield curve is the most inverted since 1981, which suggests that the bond market expects the US to soon fall into a recession. And the thing is that the bond market is almost always right.

If we indeed enter a recessionary period, the Fed will most likely resort to cutting interest rates, as it has every single time in modern history, which would likely spark a rally in REITs.

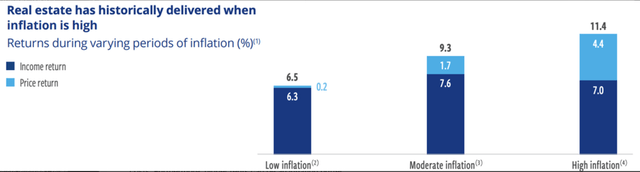

Is this time going to be different? Are interest rates and inflation going to stay higher for longer? We doubt it, but if they are, it’s a good thing that REITs tend to outperform during periods of high inflation as well.

Does that mean that investors should go on a buying spree following the recent correction?

Yes, we believe so.

But one must recognize that while there are many great opportunities, risks are also elevated at this time.

Many office buildings are struggling to survive, overleveraged REITs are cutting their dividend left and right, and it’s getting increasingly difficult to refinance debt.

Now, it is as important as ever to pick the right REITs, which is why today we highlight 5 REITs to avoid.

Tanger Factory Outlet Center (SKT)

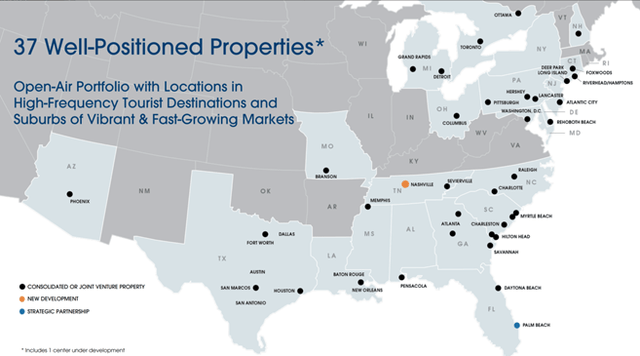

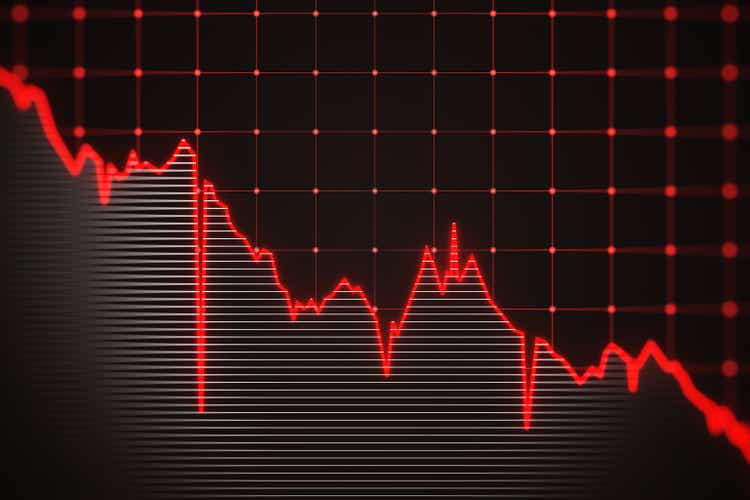

Tanger is the largest owner of outlet centers in the US. The REIT owns 37 centers and leases its space primarily to leading fashion brands such as Nike (NKE), The Gap (GPS) or Under Armour (UA).

Tanger Factory Outlet Centers

The company is one of only a handful of REITs that saw its price rise over the past year and a half, returning 24% since the start of 2022, while the broader REIT index (VNQ) declined by 34% and its peer – a major shopping mall operator Simon Property Group (SPG) declined by 31%.

But the thing is that I don’t think the outperformance will last.

Consider this:

- Tanger operates in a sector that is unlikely to see significant growth and if anything may be at risk of a secular decline. The reason is that outlet malls are at a high risk of being replaced by e-commerce. Think about it. The main reason for driving 30-45 minutes to an outlet center vs. going to a nice mall downtown is lower prices. But not even outlet malls can beat e-commerce on price. Tanger’s tenants have been seeing declining sales per sq ft (adjusted for inflation) for quite some time and I don’t expect this trend to change. But it is not just Amazon (AMZN). Now retail discounters like TJ Maxx (TJX) are opening stores for price-conscious consumers all over the nation – typically in more convenient locations.

- Tanger has been able to post a very solid double-digit rent spread over the past two quarters, which has likely been the main reason for the stock going higher. But here’s the thing. Over the next two and a half years, 53% of leases will expire and I worry that if the US falls into a recession and consumer spending slows, the REIT may struggle to renew these leases and/or find new tenants at reasonable rents.

- Finally, the stock is expensive here at 13x FFO, especially compared to SPG which trades at just 9x FFO and offers a significantly safer A-rated balance sheet (SKT’s rating is BBB-).

All things considered, I think it’s best to stay away from SKT for now and invest in companies that are undervalued relative to peers or at the very least operate in a growth sector.

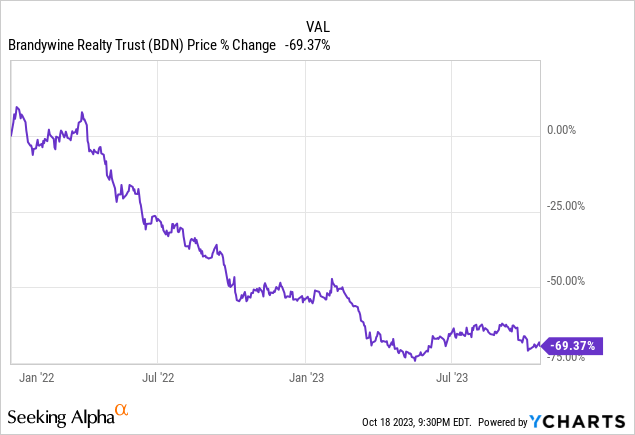

Brandywine Realty Trust (BDN)

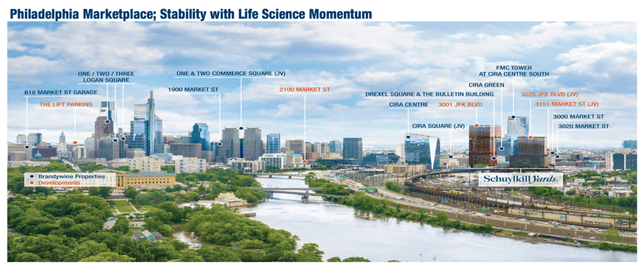

BDN is an office REIT that focuses heavily on the Philadelphia market with a minor 20% exposure to Austin, Texas.

It’s no secret that the office market has been hit hard recently. Between high interest rates, a potential recession, the ongoing threat of work from home, and the difficulties refinancing debt, the risks are as high as ever.

Brandywine has been trying to market itself as Life Science-focused and has announced aggressive plans to increase its presence in this space. But the fact is that Life Sciences account for less than 5% today, which hardly makes the REIT resilient to work from home.

Not only that but the vast majority of Brandywine’s space can be considered traditional office space leased to companies in financial, legal, and business services. These are exactly the sectors that will likely struggle the most in the current environment and consequently, BDN will not have an easy time retaining tenants.

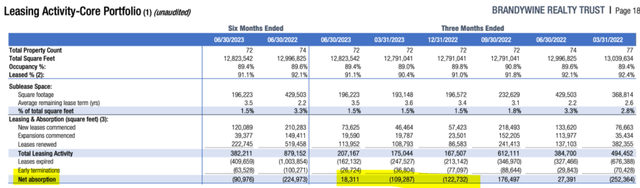

These difficulties have already manifested in negative net absorption over the past three quarters and although the company managed to keep occupancy flat during Q2 2023, I don’t expect them to magically turn things around and increase occupancy.

Not before they take care of some of the most distressed properties located on the outskirts of Philadelphia with occupancy as low as 50%. That will take significant CAPEX and higher tenant incentives, which will inevitably negatively impact the company’s cash flow.

BDN’s stock has declined by 69% since the Fed started raising interest rates in early 2022 and as a result, the dividend yield has jumped to over 15%.

But the market clearly isn’t giving the company any credit for paying this high dividend. It is pricing in a dividend cut and I agree with the market.

Despite a 70% payout ratio, I expect the dividend to get cut as cash flow declines in efforts to increase occupancy. I think that other companies offer better risk-to-reward at this time.

Granite Point Mortgage Trust (GPMT)

Granite Point is a mortgage REIT (mREIT).

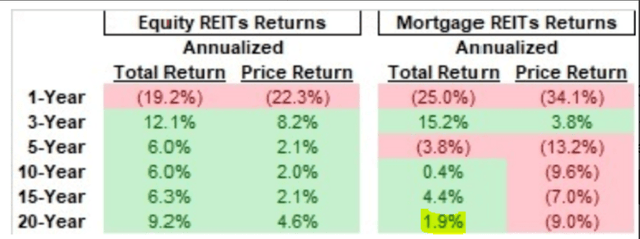

Our view towards mREITs is quite negative for the simple fact that they have largely been value traps, returning just 1.9% annually over the past 20 years.

Of course, that doesn’t necessarily mean that all mortgage REITs will underperform, but I’d rather invest in a sector that tends to outperform.

Wouldn’t you?

That brings me to Granite Point. There are a couple of things that make this mREIT quite risky:

- Out of the $3.6 billion loan book, office loans account for over 40%

- The REIT has a high leverage of 2.7x so shareholders’ losses are multiplied in terms of defaults

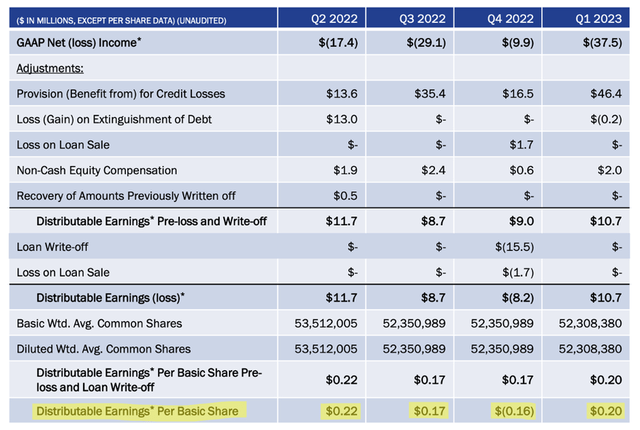

- They have already suffered a major default in Q4 2022 which resulted in a $15.5 million loss

- They have several 4- and 5-rated office loans that could default soon

- Their payout ratio over the past four quarters has been in excess of 200%!

The risk for Granite Point is twofold. Firstly, the dividend is hardly sustainable with such a high payout ratio, and secondly, I really don’t feel comfortable investing in office loans at this time, because any default is likely to result in a major loss.

For these simple reasons, I think it’s best to avoid GPMT for now.

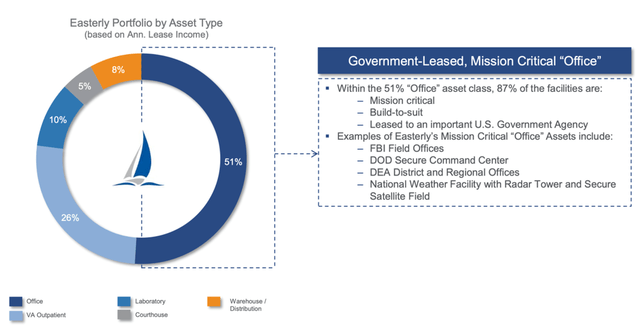

Easterly Government Properties (DEA)

DEA is a REIT that specializes in owning and leasing mission-critical properties to various agencies of the U.S. government such as FBI Field Offices, National Weather Facilities, FDA laboratories, etc.

Easterly Government Properties

Easterly Government Properties

Having the government as a tenant comes with its pros and cons. The pro is of course the fact that the entire revenue of DEA is backed by the full faith and credit of the United States.

The downside is that this is not a growth business model at all.

The problem is that a lot of these buildings are built-to-suit and have very specific characteristics. As leases expire, the government has a lot of bargaining power to keep rent as is and/or to ask for tenant improvement paid by the REIT. Since finding a new tenant for the space would be nearly impossible, DEA has no choice, but to sacrifice growth.

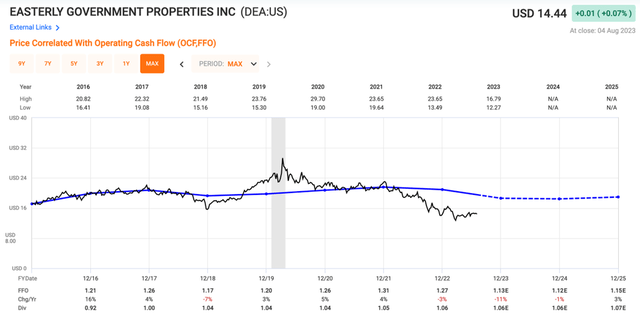

As a result, FFO per share has been flat since 2016 and consequently, investors have made sub-par total returns of 5-7%, coming from dividends alone.

Going forward, there is no reason to think that FFO per share will grow.

Moreover, the quarterly dividend of $0.265 is barely covered by core FFO per share of $0.29 and if maintenance CAPEX is included (as it should), the payout ratio is already in excess of 100%.

We see a potential risk of a dividend cut, which would be particularly devastating for an investment that has relied solely on dividends for its total return over the past 7 years.

For this reason, we are not investing in Easterly Government Properties at this time.

LTC Properties (LTC)

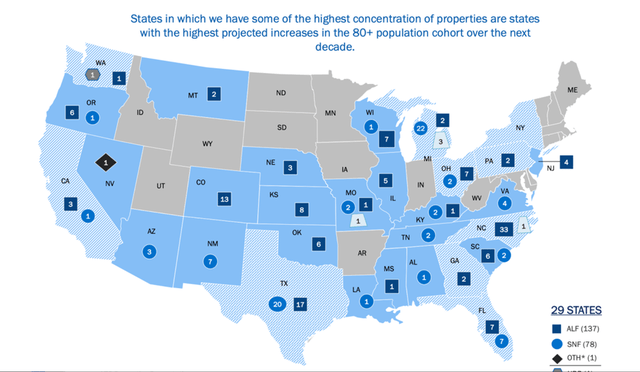

LTC Properties is a healthcare REIT that specializes in assisted living and skilled nursing facilities across the country. The company is basically a combination of an equity REIT and a mortgage REIT as two-thirds of revenue comes from rent while one-third comes from interest on outstanding loans.

LTC investors

The healthcare sector has been hit hard by Covid and faces many problems today. Occupancy has remained stubbornly low with skilled-nursing occupancy as low as 70%, and assisted living is only doing slightly better at 80% occupancy.

The REIT is also heavily concentrated on just a few large tenants. The largest tenant Prestige Healthcare accounts for 14% of total rent, followed by ALG Senior at 10.5% and Brookdale Senior Living (BKD) at 9%.

This wouldn’t be problematic if these were large investment-grade companies, but in many cases, they are relatively small privately held companies that only operate a couple dozen properties. To make things worse, the average operator rent coverage is below 1.5x.

All things considered, I don’t think management has what it takes to turn things around. The stock has underperformed historically, returning just 4% annually over the past 10 years (on a total return basis).

The payout ratio is also becoming quite stretched at 89% which could pose a threat to the 6.8% dividend. Similarly to DEA, a dividend cut would be devastating for LTC Properties, which has relied on the dividend to generate positive returns over the past 10 years.

With so many great opportunities in the market today, there is no reason to invest in LTC Properties, which is why we’re avoiding this REIT for now.

Bottom Line

We presented five REITs that we’re avoiding because they suffer declining cash flows, poor growth prospects, and/or excessive valuations.

But these are actually exceptions.

REITs are today the most opportunistic they have been in over a decade. The key is to be selective to sort out of the good from the bad ones.