PM Images

Rolling into 2024

The question of capital allocation in anticipation of retirement normally straddles the line of being heavily geared toward dividends and income. While I don’t disagree that stocks that produce ample dividends are a wise investment choice, they are not always the right answer all the time and in every market. I had previously produced an article regarding the low-cost S&P 500 Vanguard Index Fund (VOO), It’s Better To Be Roughly Right Than Precisely Wrong, fleshing out indexing strategies for an over-bought market.

As the S&P 500 (SP500)(SPX) acts as a pulley for all stocks, whether they are value-based or not, I prefer to start indexing at the top of the market when we get very close to all-time highs. As I am an investor who likes to buy and hold, not thinking about what a stock will do in the next few years, I need to choose wisely when allocating new capital.

As my value list starts to dry up a bit, and individuals begin to get greedy, I like to get out my surfboard for at least half of my new capital being invested. Below is my 5 pick portfolio to ride the wave up, and protect yourself should the tide go out.

The 5 gradients of growth this total return compounder portfolio

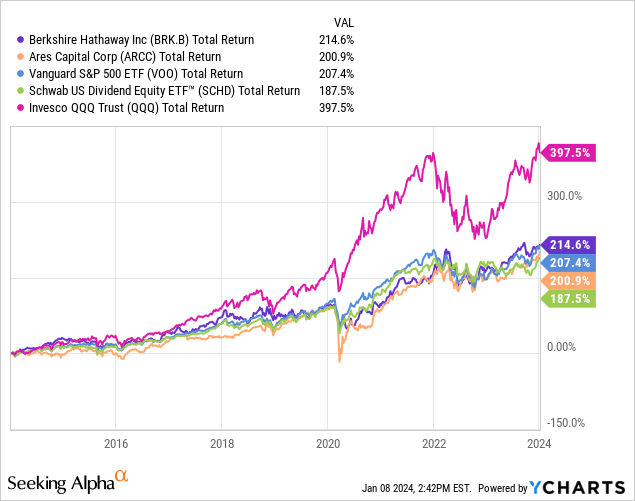

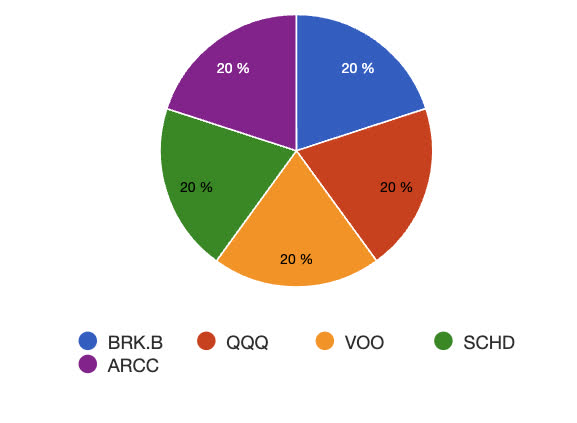

The 5 picks are going to follow a gradient that represent high growth to low growth and higher income. These 5 picks have proven to be superior total return compounders over time. The cycle of logic goes from the first stage of business, which is normally private credit, all the way through the economic life of a company until it becomes privatized once again because it has few places to reinvest its cash. This is an equal weighted portfolio as each have shown to be superior compounders in different parts of the market cycle.

- Diversified private credit markets- Ares Capital (ARCC)

- High growth – Invesco QQQ Trust ETF (QQQ)

- Medium growth- Vanguard S&P 500 ETF (VOO)

- Low growth, high income- Schwab US Dividend Equity ETF (SCHD)

- Cash returners: Diversified private U.S. Business holdings- Berkshire Hathaway (BRK.B)(BRK.A)

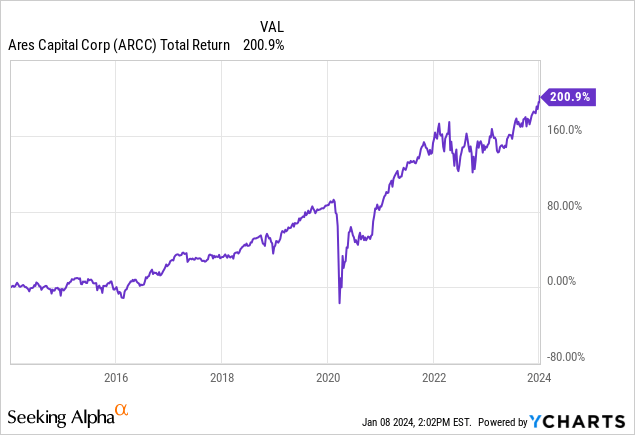

Gradient 1: Ares Capital Corporation

I am going to consider the first gradient of the portfolio to be Ares Capital. Credit is the first element to fuel growth. Without private equity formation, venture capital, and M&A, we would never see a lot of the growth companies in existence that we love today. Helping fund multiple processes from the beginning of a business coming into existence to helping small and medium businesses survive, Business development companies play a vital role in the process of helping a company grow and completing several types of business deals.

BDCs also help save companies in need of financing when no other traditional banking institutions come to the rescue. They can also finance a company through the reorganization process as they consolidate their debts.

BDCs offer a higher dividend than most other types of investments as they have to return 90% of earnings to shareholders. Private debt and equity is not cheap and investors in Ares Capital Corporation over time have reaped the benefits of the high cost of capital for middle market, mostly private borrowers.

Ares has been one of the best BDC portfolio managers with a total return profile that nearly matches the S&P 500 over the last decade. The company has nearly 45% of deals in first lien senior secured positions and about 25% of the portfolio is in software and software services. Not only are these returns competitive with equity and boost the yield of the portfolio, but the returns are contractual rather than implied.

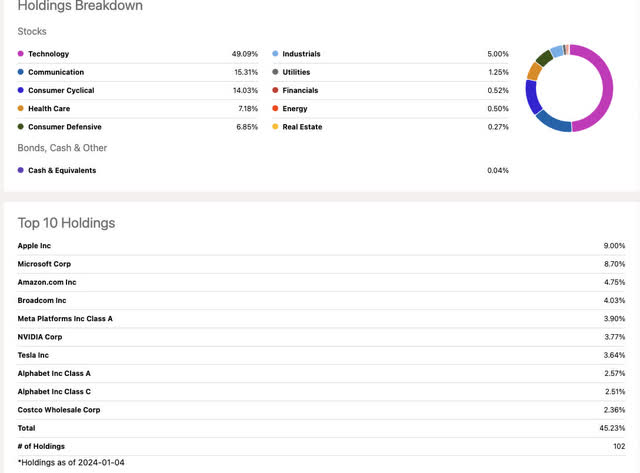

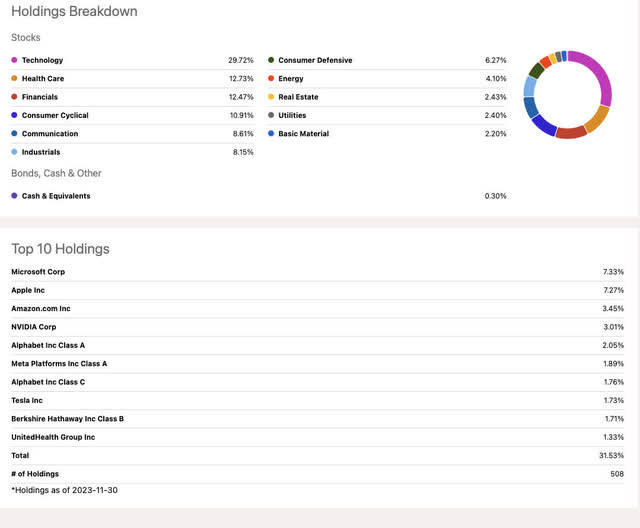

Gradient 2: Invesco QQQ Trust ETF

The Invesco QQQ Trust ETF has been one of the best total return ETFs you’ll find over the previous decade. This is the highest gradient of equity growth stocks amongst the model portfolio. The fund mimics the Nasdaq 100, and the holdings are nearly 50% weighted to mega-cap tech growth companies:

Seeking Alpha

Total return QQQ

This fund is no longer what the index represented circa 1999, where an eyeball or click-to-website ratio was all that could be mustered up for some of these names during that time. Most of these are now the most profitable and fast-growing companies in America.

Yes, we pay much higher multiples for this fund and it will be far more volatile than the others on this list. However, dollar cost averaging into QQQ over time can help to boost the return of the overall portfolio.

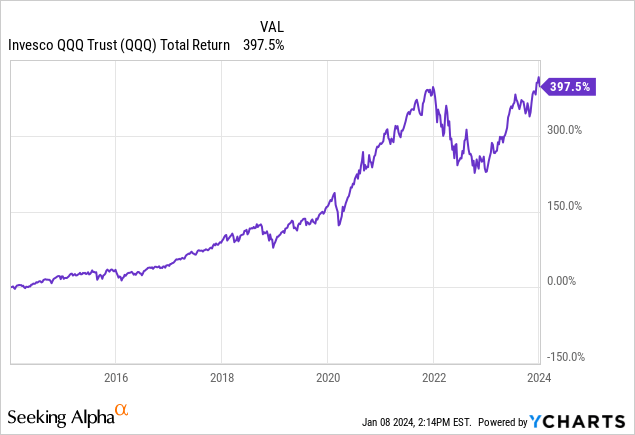

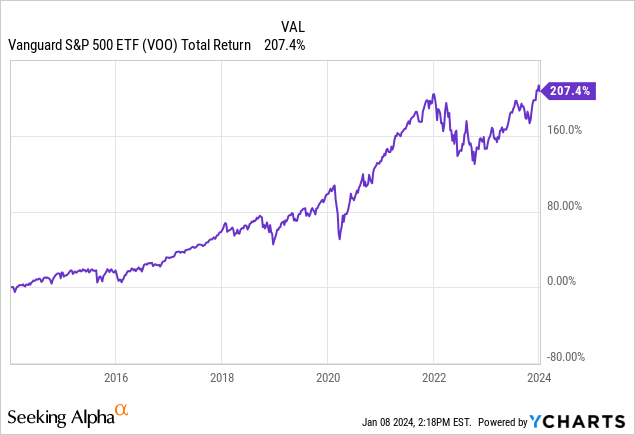

Gradient 3: The Vanguard S&P 500 ETF

The third gradient, medium growth, contains both growth and mature companies, it is the most widely diversified of the lot. The Vanguard S&P 500 ETF is becoming more and more like the QQQ ETF all the time as the market cap weighting becomes larger for big tech. That shows that at this point in history, we are in a massive innovation phase and there is nothing wrong with that. On a total return basis, this fund has beaten almost all other diversified ETFs handily:

Seeking Alpha

Total return

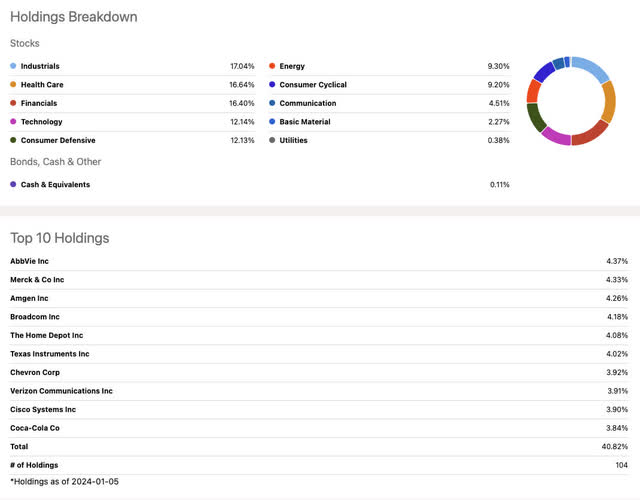

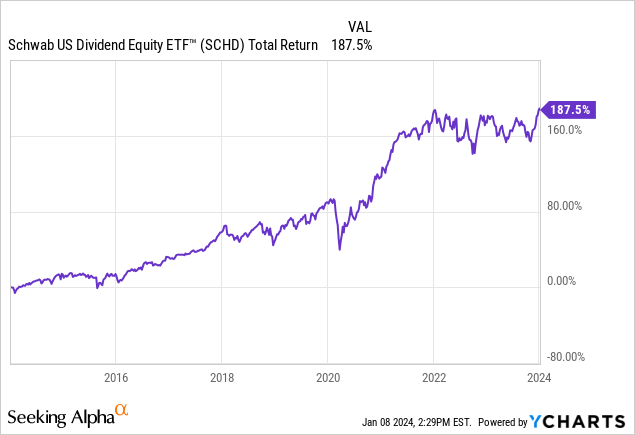

Gradient 4: The Schwab U.S. Dividend Equity ETF

Slowing down in the growth cycle yet still achieving ample free cash flow and return on equity, a company becomes stabilized and starts to increase its return of capital to shareholders. This is well represented by The Schwab U.S. Dividend Equity ETF. After having a substandard 2023, this fund could be poised for a snapback as I see one market theme this year as a return to value from chasing growth. Total return wise over the past decade, this fund is right up there with the rest of them having an excellent total return and high dividend growth rate.

The holdings are widely different than either QQQ or VOO and offer quite a bit of extra, non-overlapping diversification:

Seeking Alpha

The index referenced in SCHD is the Dow Dividend 100 index:

The Dow Jones U.S. Dividend 100 Index is designed to measure the performance of high-dividend-yielding stocks in the U.S. with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios.

This methodology takes into consideration dividend growth over several consecutive years combined with return on equity requirements and free cash flow to total debt ratios. The methodology is a close one to some of the benchmarks of Benjamin Graham. The total return is evidence of the sound logic:

Gradient 5: Berkshire Hathaway

Berkshire Hathaway is a diversified holdings company split almost down the middle between its diversified private business holdings and its publicly listed stock holdings segment. The amount of cash that Berkshire has been able to generate and stuff away in a now relatively high-yielding sack, along with the low amount of debt, makes Berkshire the company with one of the highest net worths of any out there.

As amazing cash-flowing/dividend-paying companies get tired of playing the stock market game, many often make their way to the private holdings list of Berkshire Hathaway. Knowing that your money is invested in great businesses without market volatility themselves is unique.

The types of companies Berkshire takes private are usually in the most mature phase of the cash-flowing cycle and don’t often need the reassurance of raising new equity any longer.

Warren Buffett loves such companies that have few options of where to invest excess cash or “owner earnings”, the proxy term Buffett uses for free cash flow. Sending lots of cash back to Berkshire allows the managers to either deploy it into the publicly traded holdings portfolio or build the interest bearing cash position even further. The companies are usually highly regulated and often times require substantial CAPEX, but retaining earnings for growth purposes is on the lowest end of these spectrums.

The private businesses that Berkshire Hathaway gives you access to include:

- Insurance

- Railroads

- Utilities

- Manufacturing

- Consumer Products

- Service

- Retail

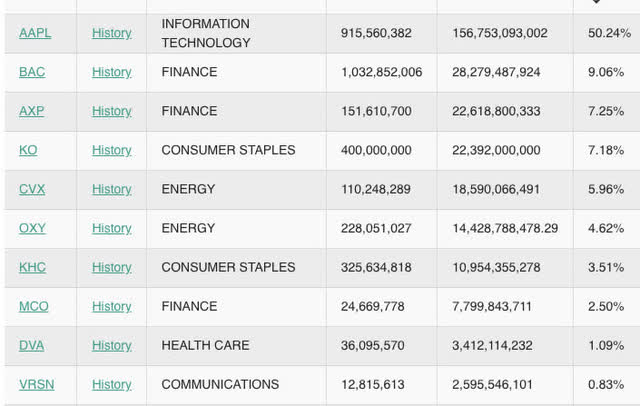

The holdings company is the other, non-income generating segment except for dividends and capital gains which are rarely realized. These companies themselves have amazing earnings but are not reportable unless Berkshire owns a controlling stake. Here are the top 10 holdings:

Whalewisdom

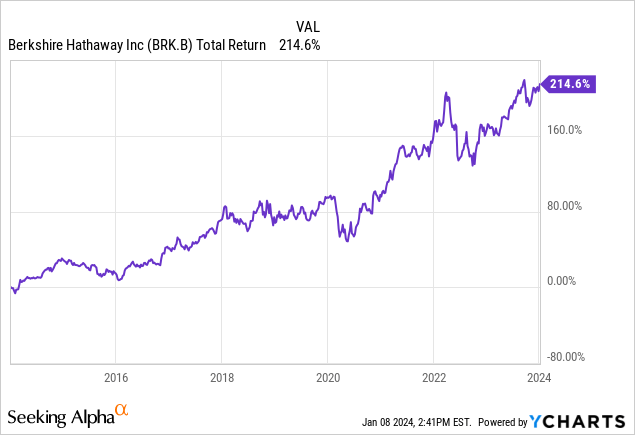

The total return has held up with the best of them. Buffett has said as they grow, they expect to outperform in bad years for the market and underperform in good years for the market. Overall, this is an element I am very happy to own:

Charted against one another

Allocation pie chart

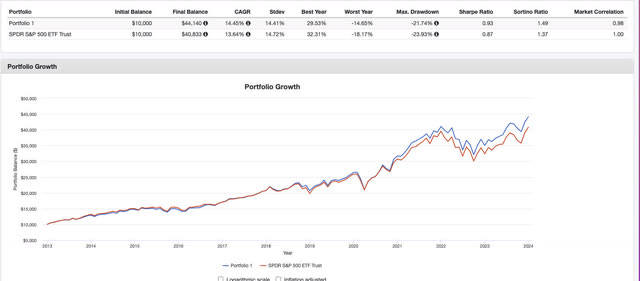

portfoliovisualizer.com

The backtested results

portfoliovisualizer.com

10 year results:

| PORTFOLIO | INITIAL BALANCE | CAGR | MAX DRAWDOWN | FINAL BALANCE |

| Portfolio 1 | $10,000 | 14.45% | -21.74% | $44,140 |

| SPDR S&P 500 ETF Trust | $10,000 | 13.64% | -23.93% | $40,833 |

Here we can see that this diversified fund portfolio was able to beat the compound annual growth rate of the market by almost 1% per year. Doesn’t sound like a ton, but over time, the buy-and-hold investor would reap massive rewards with just an extra percent of Alpha over decades. The max drawdown was also two percentage points lower indicative of lower volatility.

A better dividend than the market to boot

This portfolio also entails a greater dividend yield than broad based S&P 500 index funds due to the inclusion of private credit in Ares and the high yield dividend trust SCHD. This yield is based on an equal weight allocation:

| STOCK | YIELD | 5 Year DIVIDEND GROWTH RATE |

| BRK.B | 0.00% | 0% |

| VOO | 1.48% | 6.06% |

| QQQ | 0.58% | 10.55% |

| SCHD | 3.48% | 13.05% |

| ARCC | 9.41% | 4.51% |

| AVERAGE | 2.99% | 7% |

With this fund allocation yielding near 3% yet still giving you a strong possibility of a market beating return, this allocation can whet the appetite of the growth and income investor alike.

Risks

Howard Marks has said that private credit, namely companies like Ares Capital, Oaktree (OCSL), Main Street (MAIN), Blue Owl Capital Corporation (OBDC), and others, should do well as long as the FED rate is in the 2-4% range versus 0-2%. I believe he’s right and 0-2% levels should only be reserved for true emergencies. That being said, a tidal wave of commercial real estate and U.S. Treasuries maturing could be a factor that would put the rate under 2%. That being said, Ares has still been able to keep up with the total return of the S&P 500 index despite very unfavorable rate environments during the past 10 years.

If we hit a prolonged recession at some point, many analysts have opined that this relatively new publicly traded asset, private credit, will take a hit larger than most. If the manager has sufficiently prepared for the risk, they may even do better in that type of environment under the surface regardless of what the price action entails. Reinvesting the dividend on large-yielding BDCs could buy you low-cost shares with yields near 20% should the market get rough. The large yield on cost of those shares could make up for any regression in total return further down the line if the share price recovers.

Berkshire Hathaway faces questions about leadership and what might happen should his successor, Gregory Abel take over the company. I believe Warren Buffett has arranged the company for long-term success regardless of whether Buffett is the face of the organization or not. Others would disagree, but I am very comfortable accumulating Berkshire for the long haul. Out of the 5 picks, these are the two that have the greatest risks over general market Beta risk.

Ride the wave

Value investors have no idea how long the elevated market multiple will last. The forward P/E ratio of the S&P 500 is now a tad above 20 X. In my opinion, a 10-15% correction would put the market back in line with historical averages as long as earnings continue to grow as expected. While I have a long list of value stocks that I nibble at, I realize that a market correction will take those down a peg as well.

I also realize that I have no control over the market sentiment and the market can stay hot longer than the short-seller can remain solvent. With over $6 trillion in cash and money markets on the sideline in a declining rate environment [although the FED hasn’t cut we are already seeing organic rate declines in our money market funds], I have no way to predict the madness of men.

Some would argue that buying deep value would protect an investor in a market correction. Possibly so in the past. Now that everything has been consolidated into market segment mutual funds and ETFs, the ships usually sink together and single equities have more price variability than diversified funds and diversified fund proxies like Berkshire Hathaway and Ares. If the market corrects hard, the great deals will get even better.

In this instance, I am going back to riding the wave and protecting my downside. These 5 picks are ones I am confident, I will never regret. Only when the tide goes out during a correction or a crash do I enjoy looking for blue chips on the ocean floor. If I were deploying $10,000 to $1 million in cash that has been idle on the sidelines, this portfolio would help me sleep well at night. These 5 gradients serve different purposes at different times and cycles of the market, but all will contribute to the circle of commerce that binds it.